Announcement

Collapse

No announcement yet.

House Price Declines: Buy the Numbers

Collapse

X

-

Re: House Price Declines: Buy the Numbers

In Atlanta (and I'm sure other areas) these drops are very neighborhood sensitive. The areas that were only just being developed because prices were too high in better areas, those have been hit the worst. Most of the higher priced homes are hit hard as well. Those homes that come with big tax, utility, and upkeep bills. Nobody wants em now. At least not anywhere near full price. But 2200-3000 sq ft homes in good areas, they have done okay. So averages like Case Shiller don't really tell the whole story.

Comment

-

Re: House Price Declines: Buy the Numbers

Financially California is starring into a dark and deep economic abyss. Even if we start adding jobs at a fast pace it is likely to do very little for the housing market simply because the jobs being added do not have the income potential of the real estate heavy jobs during the housing bubble. Inflated home prices equaled inflated paychecks for many. It is hard to see a sudden surge in real estate values based on recent job growth trends. What is troubling is that even if the nationwide economy picks up California is likely to face structural problems because of looming liabilities. California needs to figure out a way to grow even faster merely to pay for stated expenses. The upper crust of the housing market is seeing large foreclosures hitting the market. Today we will take a look at another Beverly Hills foreclosure that is the biggest foreclosure we have covered on the blog.

Beverly Hills and the $16,950,000 foreclosure

2600 BOWMONT DR, Beverly Hills, CA 90210Let me start off by saying this is a great looking place by any measure. A large Beverly Hills home with all the amenities a buyer can ask for. Yet this home is part of the grim foreclosure statistics. It is interesting that the upper range of the housing market has stalled out with an intense ferocity. FHA insured loans or non-jumbo mortgages do not provide any support here. In our current housing market to purchase a home like this will require substantial document income. No aspiring actor making $1 million a year and loading up on an option ARM here. It was amazing that back in the bubble days we were seeing multi-million dollar loans from lenders like Washington Mutual going with nearly zero down. No wonder why these lenders went extinct.

2600 BOWMONT DR, Beverly Hills, CA 90210Let me start off by saying this is a great looking place by any measure. A large Beverly Hills home with all the amenities a buyer can ask for. Yet this home is part of the grim foreclosure statistics. It is interesting that the upper range of the housing market has stalled out with an intense ferocity. FHA insured loans or non-jumbo mortgages do not provide any support here. In our current housing market to purchase a home like this will require substantial document income. No aspiring actor making $1 million a year and loading up on an option ARM here. It was amazing that back in the bubble days we were seeing multi-million dollar loans from lenders like Washington Mutual going with nearly zero down. No wonder why these lenders went extinct.

Beds: 7

Baths: 8/1

Square feet: 10,000

Lot size: 1 acre

Let us marvel at this home before moving on to the details:

“Nice rug.”

“Nice rug.”

“Nice view.”

This is definitely what you would consider a prime Southern California home. But apparently things are not moving so quickly. Let us look at the description:“Lender Owned~Sequestered in a sml gated community resides this 10,000+ SF Contemporary Medit masterpiece. Features 7 bds, 8.5 ba~s + guest apt behind prvt gates w/ stunning city, canyon & valley views. Superior craftsmanship & sophisticated design in every corner of this well appointed homage to modern living. Grand vol & scale throughout. Stately columns, hand painted ceil & 2 stry entry lead to lrg LR, DR & FR w/ soaring ceilings, fplc & wall of windows. Lrg center isle eat in kit w/ Arclinea cabinets, 2 Elkay sinks, granite cntrs, side by side Subzero freezer & fridge, Miele oven & fpl. Spectac mstr suite w/ hrd wd flrs, fplc, prvt terr & huge walk-in closets. Top of the line amenities turn spacious his & her mstr baths into sophisticated personal spas. Covered loggia, rolling green lawns, well-designed pool & spa, outdoor kit w/ BBQ. Guest apt w/ full ba, walk in closet, prvt terr & sep entry. Motor crt & 5 car garage, Crestron Advantage System & CAT5 wiring. Orig listed at $16,950,000.”This place was originally listed at $16,950,000 so I know many of you are already getting your checkbooks ready. How much action has taken place with the listing price? Let us take a look:

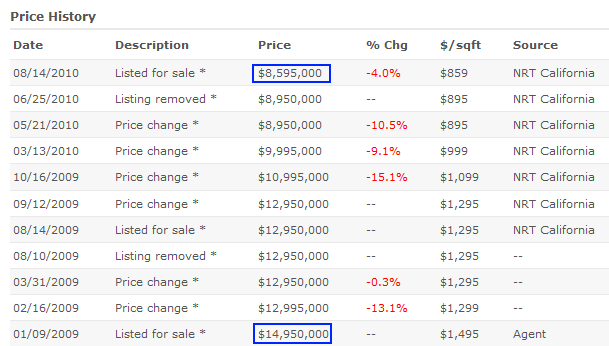

Little by little the price has come down. From a listing price of $16.95 million to $8.59 million. This is a 50 percent price drop in Beverly Hills! As we all know the upper end of the housing market is still largely in a housing bubble. If this home was perceived as being worth $16 million it would have sold to someone that would be in the market for a $16 million home. Of course the pool of buyers for this home is extremely small.

Let us look at some older sales history:

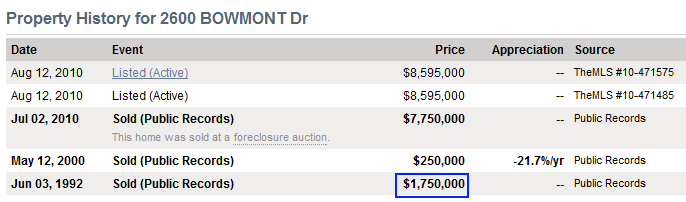

Source: Redfin

The place sold at a foreclosure auction in July of 2010 for $7.75 million. The current list price is still $845,000 over the foreclosure auction price. Assuming a six percent commission any profits on the second go around are getting slimmer.

Anyone in the market for a $16 million home for $8 million?

Beverly Hills, We Salute You!

http://www.doctorhousingbubble.com/b...0-percent-off/

Comment

-

Re: House Price Declines: Buy the Numbers

I live right down the road from this monstrosity.

http://projects.ajchomefinder.com/ga...s/0319mansion/

Not a foreclosure yet, but how soon before it goes that route? This is hardly Southern California. Who wants a $45 million home in bumpkinville GA?

Comment

-

Re: House Price Declines: Buy the Numbers

I see the same thing here. Along with the Case-Shiller numbers I keep track of the local MLS reports every month from the realtors. The reports don't break down by individual neighborhoods, but they do separate major areas of the city, and individual suburbs and exurbs. While the Case-Shiller index for Portland is down about 24% and the overall average and median are down about 22%, some suburbs have dropped over 30%, and some far-flung counties have dropped over 40%. Nothing like the numbers shown in the original post, but still quite a difference. Anecdotes and drive-bys suggest certain neighborhoods in the city, and of course some individual houses, have fallen much more than the aggregate numbers. On the other hand, other neighborhoods have held up relatively well.Originally posted by flintlock View PostIn Atlanta (and I'm sure other areas) these drops are very neighborhood sensitive. The areas that were only just being developed because prices were too high in better areas, those have been hit the worst. Most of the higher priced homes are hit hard as well. Those homes that come with big tax, utility, and upkeep bills. Nobody wants em now. At least not anywhere near full price. But 2200-3000 sq ft homes in good areas, they have done okay. So averages like Case Shiller don't really tell the whole story.

On your other post about the mansion for sale:

What are they going to downsize to, a 20,000-square-foot home?The grand staircase. Owners Hubert and Norma Humphrey -- who are not related to the late vice president -- are looking to downsize from the 82-room, 47,000-square-foot home on the property.

Comment

-

Re: House Price Declines: Buy the Numbers

from: A Study of RE Markets in Declining Cities, by James Follain (Research Institute for Housing America)

Another type of declining city may also be emerging — places that grew substantially during the housing boom and are now experiencing unprecedented declines in house prices and increases in foreclosures. In a recent web-based conference hosted by Jesse Abraham of the National Association of Business Economists, Celia Chen of Moody gave a presentation entitled “2010: Housing Recuperates.” A key part of her analysis focused on the length of time before a full housing recovery can be expected. One particularly striking graphic highlighted a number of places in California, Nevada, Arizona and Florida where full recovery of the housing market is not expected until 2030.

Her forecast is based upon the various and negative consequences for the housing markets in these areas stemming from the recent bursting of the house price bubble.

Areas in portions of central and eastern California such as Riverside County and Stockton are good examples. These areas were predicated on residents commuting for jobs to Los Angeles or the San Francisco Bay area and overly optimistic views about future house price growth. Sharply higher gas prices and unemployment rates coupled with the crash of their housing markets may threaten the long-term viability of these areas.

Lastly, another type of declining city may also be emerging — places that grew substantially during the housing boom and are now experiencing unprecedented declines in house prices and increases in foreclosures. In a recent web-based conference hosted by Jesse Abraham of the National Association of Business Economists, Celia Chen of Moody gave a presentation entitled “2010: Housing Recuperates.”

A key part of her analysis focused on the length of time before a full housing recovery can be expected. One particularly striking graphic highlighted a number of places in California, Nevada, Arizona and Florida where full recovery of the housing market is not expected until 2030.12 Her forecast is based upon the various and negative consequences for the housing markets in these areas stemming from the recent bursting of the house price bubble. Areas in portions of central and eastern California such as Riverside County and Stockton are good examples.

These areas were predicated on residents commuting for jobs to Los Angeles or the San Francisco Bay area and overly optimistic views about future house price growth. Sharply higher gas prices and unemployment rates coupled with the crash of their housing markets may threaten the long-term viability of these areas.

The full report, in PDF, is here: http://www.housingamerica.org/RIHA/R...ies_Report.pdf

Comment

-

Re: House Price Declines: Buy the Numbers

Don's 2600 Bowmont Dr example annoys me

Whoever purchased it for $ 7.75m fell into the same trap that caused this mess in the first place.

The Land value = $2.0m

The construction costs to build it would run at $2.8m ($280/sqft for that style)

but houses depreciate at 2% /year.(if you spend no money- updating /painting/ replacing worn out appliances on a home in fifty years it will be zoned D7) - D7 = Catapillar Dozer.

If you paid more than $4.5m you paid for fluff.

Your market still has some exuberance in it.

Don't believe me ask a builder how much to build a 20,000sq/ft home with all the bells and whistles then mutiply by 4 then add land

The larger the space the less the cost. Bathrooms/Kitchens are expensive but garages/ bedrooms cheap. Pools and tennis courts expensive but land/gardens cheap. Lets not forget the opportunity costs that $7.75m would allow you. You have to live somewhere but remember to live while your doing it.

And OH God the cost to maintain that house in a gated Hell hole with HOA nazi's would be impoverishing.

Fly to 27 Deg 52' 52.94" S 153Deg 20' 31.51"E - Built by me 2005 as a spec - Land cost $380,000 70,000 sq/ft 5 bed +huge study.5 bath. Home theatre, pool, 3 car. Balinese design inc koi pond and temple entrance over bridge. $680,000. Annual upkeep $15,000/year Sold $1.6m on international golf course. The buyer paid for fluff.

Always run the numbers.Last edited by thunderdownunder; January 08, 2011, 05:57 PM.

Comment

-

Re: House Price Declines: Buy the Numbers

What's funny is comparing the Georgia and the Beverly Hills Super mcMansions with real mansions:

http://www.charente-immobilier.com/r...ngs/l1157.html

This 15th century Feudal Mansion is available for around 1.6M euros = about $2M.

Sure, it ain't Beverly Hills, but then again it is proven to hold off angry peasants with flaming pitchforks...

And it even has 3 cottages for the 'help'

Comment

-

Re: House Price Declines: Buy the Numbers

For some of us, this bubble took a lot more than what it gave. A friend's home in #13th place on that map, direct AIA, across from ocean, perfectly maintained building, gorgeous unit which owns the protected deepwater dock. Paid $150k in 1978 for a then newly constructed townhouse. Supposedly peaked at about $900k according to zillow. Now would be lucky to fetch $400k. The CPI-adjusted 1978 price? $503k in 2010 $s. This thing is 20% under its inflation-adjusted price of 33 years ago.

Another old friend, paid $135k for an inland condo in 2002 in area #11 of that map, beginning to worry that she wouldn't be able to afford anything if she waited to buy. That home is now worth maybe $115k. The person she bought from paid $94,500 in 1998 so maybe my friend overpaid but not by all that much, particularly considering the population growth there at that time. In any case, even that 1998 price cpi-adjusts to $126,800 in 2010 $s. So this thing is 10% under its cpi-adjusted price of 13 years ago.

Comment

-

Re: House Price Declines: Buy the Numbers

I'm also quite confused.......Originally posted by housingcrashsurvivor View PostFor some of us, this bubble took a lot more than what it gave. A friend's home in #13th place on that map, direct AIA, across from ocean, perfectly maintained building, gorgeous unit which owns the protected deepwater dock. Paid $150k in 1978 for a then newly constructed townhouse. Supposedly peaked at about $900k according to zillow. Now would be lucky to fetch $400k. The CPI-adjusted 1978 price? $503k in 2010 $s. This thing is 20% under its inflation-adjusted price of 33 years ago.

Another old friend, paid $135k for an inland condo in 2002 in area #11 of that map, beginning to worry that she wouldn't be able to afford anything if she waited to buy. That home is now worth maybe $115k. The person she bought from paid $94,500 in 1998 so maybe my friend overpaid but not by all that much, particularly considering the population growth there at that time. In any case, even that 1998 price cpi-adjusts to $126,800 in 2010 $s. So this thing is 10% under its cpi-adjusted price of 13 years ago.

But if I had to bet my health/wealth on which way RE prices are going moving forward......I'd say down further.....in both nominal and real(for now) terms.

I can't help but think about that hyper inflation chart from Germany which showed what % of the average wage spent on housing, food, etc.

While I agree with EJ and Co who think high inflation, NOT hyperinflation is in the cards for us.....wouldn't a similar, but less lopsided, result in high inflation?

Meaning, with essential food/energy costs rising quite significantly in the next bunch of years(with energy analogous to oxygen for all intents and purposes).....couldn't there be scope for RE to continue to drop as a % of the average wage as more and more of the paycheck goes towards food/energy?

I would be interested in comparing the average wage, average housing cost, average food cost, average energy cost, etc for 1978 with 2010 for those two areas....maybe it might paint a picture.

Hell, just out of interest I'd be keen to see it for every year from 1946-2010...we might get some indication of where we are going to roughly extrapolate where housing is going.

My thought is along the lines of answering the following question:

Where will wages be on average over the next 1-5 years?

My GUESS is that they will be flat to negative for many, and anemic increases for most of the remainder, and strong increases for the rare minority.

IF wages are roughly flat and largely fail to stay above the rising tide of inflation.....we will not only see the complete destruction of discretionary income for many, but it may result in a further downward spiral for real estate.

People HAVE to eat and currently rely on energy like oxygen....real estate is a distant, distant third isn't it?

Comment

-

Re: House Price Declines: Buy the Numbers

Where are people going to live: outside in Winnipeg in winter, to enjoy the bitter-cold temperature, with ice-fog and with wind-chill as an added-bonus?

Remember: in Canada, wind-chill is an added-bonus and NEVER counts as a temperature. Try minus-40F (-40C) in Winnipeg, under the ice-fog, and northern-lights dancing above that. And you are proposing to sleep outside?

Living-through this Great Recession is about survival.

Shelter is an absolute necessity, just like food, warm clothes, medical-care, light, heat, and water....... And now you know why my tolerance for environmental-elitists and government-elitists is now exhausted.

So, what is shelter worth, especially when interest rates are zero, or even less than zero? When governments are intent upon destroying their currencies, what are necessities of life worth?Last edited by Starving Steve; January 09, 2011, 10:44 PM.

Comment

-

Re: House Price Declines: Buy the Numbers

I am NOT proposing that people should(or will) live outside....bar the unfortunate increase in folks who will be truly homeless going thru this.Originally posted by Starving Steve View PostWhere are people going to live: outside in Winnipeg in winter, to enjoy the bitter-cold temperature, with ice-fog and with wind-chill as an added-bonus?

Remember: in Canada, wind-chill is an added-bonus and NEVER counts as a temperature. Try minus-40F (-40C) in Winnipeg, under the ice-fog, and northern-lights dancing above that. And you are proposing to sleep outside?

Living-through this Great Recession is about survival.

Shelter is an absolute necessity, just like food, warm clothes, medical-care, light, heat, and water....... And now you know why my tolerance for environmental-elitists and government-elitists is now exhausted.

So, what is shelter worth, especially when interest rates are zero, or even less than zero? When governments are intent upon destroying their currencies, what are necessities of life worth?

The question I have in response to you Steve is:

Where did the folks live in Germany during the 20's/30's when the % of wages needed to be allocated to food and shelter inverted, then lopsided towards food?

Again, I do not expect to see hyperinflation.......but high inflation as covered by EJ and Co......

So while I don't think we will see such extremes....I don't think we need to in order to get results heading in a similar(but less severe and less lopsided) direction.

What % of our income is made up of housing, food, energy?

Isn't it possible we could see the % allocated to food and energy double over the next 5-7 years at the EXPENSE of everything else?

And when the previous spending on "everything else" drops further or collapses could that not contribute to another leg down in property prices?

I'm not trying to be cheeky, but the last time I chekced our needs are prioritized as follows:

Air, water, food, shelter

AIR, their not charging us for AIR yet...so let's exchange that for ENERGY since we are as addicted at the moment to energy as we are to oxygen.

WATER...sorry to hear about your local water issues.......

FOOD....

SHELTER....

To my simple way of thinking...Shelter is pretty far down the list of essential priorities...and would certainly feel that way IF energy/food prices increase substantially.

Maybe an oversimplistic way of me looking at it, but I reckon housing prices still have room to drop further PARTLY due to costs of energy/food going higher...at least in our parts of the world.

Just my 0.02c.....feel free to correct any errors

Comment

Comment