Keep 'em rollin, rollin, rollin, though their disapproven, keep them sheeple movin', rawhide.....

Give me a high interest rate and a low priced home over a record low interest rate and a home with an inflated price any time.

It is hard to say how many understand this concept and why this is so important. When I bring this up to potential buyers they just do not understand why this would make financial sense. It seems counter-intuitive in a world driven by interest rates. For these potential buyers the interest rate is merely a method of squeezing out the maximum monthly payment from their strained income. (the mortgage interest deduction allowance is another misunderstood "benefit" to homeowners, to be taken up at another time)

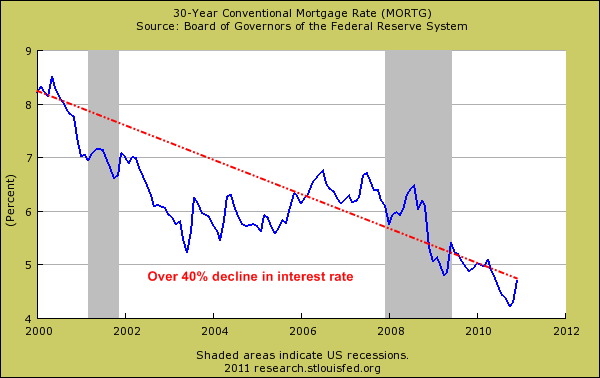

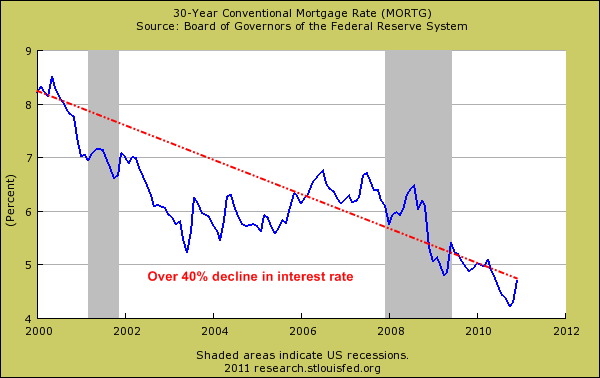

People forget that in 1981 the 30 year fixed mortgage rate peaked at over 18 percent. Today while many talk about “rising” interest rates the 30 year fixed is still hovering around 5 percent. The four decade average is closer to 9 percent but the Federal Reserve has meddled to keep the lid on interest rates low for the time being. The only reason the Federal Reserve is following this path is because it needs to keep home values inflated or face another deep banking correction. Keeping rates low allows Americans to purchase as much home as possible with maximum face value while allowing banks to keep the pretend game going regarding real estate values. This is a bad move for potential buyers and we will examine why.

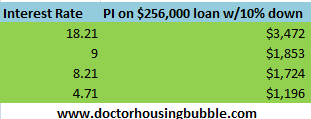

Over the last 10 years interest rates have gone from 8.21 percent on January of 2000 to the current 4.71 percent. The 30 year fixed mortgage was like trying to bring a Beach Boys CD to a swank Hollywood club. However today the 30 year fixed mortgage does matter because it is biggest game in town. To demonstrate how big of a difference these various rates are let us run four scenarios: the peak 1981 rate, the historical average 9 percent, the January 2000 rate of 8.21, and the current rate. We’ll run the numbers for the median priced California home of $256,000:Keep in mind the above does not include insurance and taxes. Why is the above important? First, it highlights how stretched many home buyers have become merely to purchase a home even after the substantial correction. A large reason for this has been the lost wages for many and stagnant income growth for most middle class families.

A lowering of the interest rate gives a perceived feeling that people have more buying power because in a way they do.

This is Federal Reserve alchemy. It comes at a large cost of bailouts, Quantitative Easing, and a general bubble environment where hot money chases whatever is the flavor of the day. Ultimately a low interest rate gives the potential buyer a very expensive asset that seems inexpensive because of an artificially low interest rate. Just look at the historical average of 9 percent. If the 30 year fixed mortgage reaches this level a typical buyer will need to pay a stunning 54 percent more each month on principal and interest. Is this even doable in this economy with virtually no wage growth? Of course this is not a sustainable path and that is why we are seeing home prices come down since mortgage rates are scraping the bottom of the barrel.

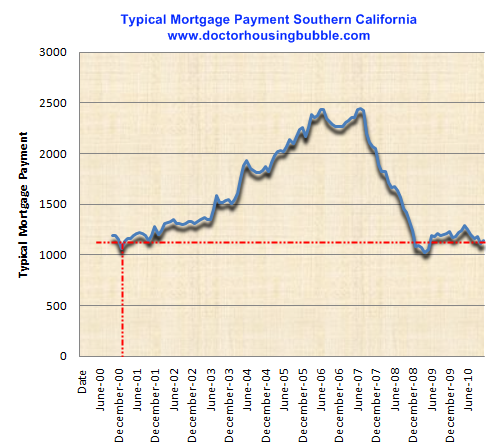

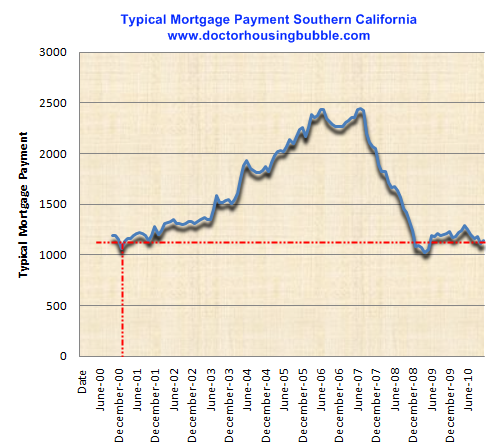

A lost decade is already seen in Southern California mortgage payments:

Source: DataQuick

For all the talk about hot money flowing into Southern California and giant bank accounts the typical mortgage payment stood at $1,136 for the latest month. This is where the “hot” money is since families now have to document income and go with 30 year fixed mortgage products. When the bubble burst it exposed the inflated asset values but it also unraveled an entire decade of lost income covered with the trappings of a debt lifestyle.

What we had for the large part of the decade an entire mortgage market that cared not about documented income but about a willingness to buy into the cult-like mentality that somehow real estate values never went down. It was a hot money bubble.

A lower priced home is much more valuable than a low interest rate. As a buyer you're paying off more of the house and less to the bank. It also provides you a variety of options:

http://www.doctorhousingbubble.com/i...-rates-decade/

Give me a high interest rate and a low priced home over a record low interest rate and a home with an inflated price any time.

It is hard to say how many understand this concept and why this is so important. When I bring this up to potential buyers they just do not understand why this would make financial sense. It seems counter-intuitive in a world driven by interest rates. For these potential buyers the interest rate is merely a method of squeezing out the maximum monthly payment from their strained income. (the mortgage interest deduction allowance is another misunderstood "benefit" to homeowners, to be taken up at another time)

People forget that in 1981 the 30 year fixed mortgage rate peaked at over 18 percent. Today while many talk about “rising” interest rates the 30 year fixed is still hovering around 5 percent. The four decade average is closer to 9 percent but the Federal Reserve has meddled to keep the lid on interest rates low for the time being. The only reason the Federal Reserve is following this path is because it needs to keep home values inflated or face another deep banking correction. Keeping rates low allows Americans to purchase as much home as possible with maximum face value while allowing banks to keep the pretend game going regarding real estate values. This is a bad move for potential buyers and we will examine why.

Over the last 10 years interest rates have gone from 8.21 percent on January of 2000 to the current 4.71 percent. The 30 year fixed mortgage was like trying to bring a Beach Boys CD to a swank Hollywood club. However today the 30 year fixed mortgage does matter because it is biggest game in town. To demonstrate how big of a difference these various rates are let us run four scenarios: the peak 1981 rate, the historical average 9 percent, the January 2000 rate of 8.21, and the current rate. We’ll run the numbers for the median priced California home of $256,000:Keep in mind the above does not include insurance and taxes. Why is the above important? First, it highlights how stretched many home buyers have become merely to purchase a home even after the substantial correction. A large reason for this has been the lost wages for many and stagnant income growth for most middle class families.

A lowering of the interest rate gives a perceived feeling that people have more buying power because in a way they do.

This is Federal Reserve alchemy. It comes at a large cost of bailouts, Quantitative Easing, and a general bubble environment where hot money chases whatever is the flavor of the day. Ultimately a low interest rate gives the potential buyer a very expensive asset that seems inexpensive because of an artificially low interest rate. Just look at the historical average of 9 percent. If the 30 year fixed mortgage reaches this level a typical buyer will need to pay a stunning 54 percent more each month on principal and interest. Is this even doable in this economy with virtually no wage growth? Of course this is not a sustainable path and that is why we are seeing home prices come down since mortgage rates are scraping the bottom of the barrel.

A lost decade is already seen in Southern California mortgage payments:

Source: DataQuick

For all the talk about hot money flowing into Southern California and giant bank accounts the typical mortgage payment stood at $1,136 for the latest month. This is where the “hot” money is since families now have to document income and go with 30 year fixed mortgage products. When the bubble burst it exposed the inflated asset values but it also unraveled an entire decade of lost income covered with the trappings of a debt lifestyle.

What we had for the large part of the decade an entire mortgage market that cared not about documented income but about a willingness to buy into the cult-like mentality that somehow real estate values never went down. It was a hot money bubble.

A lower priced home is much more valuable than a low interest rate. As a buyer you're paying off more of the house and less to the bank. It also provides you a variety of options:

-You can pay down the debt quicker with extra payments. Since you paid less, each extra dollar you send will eat away the principal quicker. Believe it or not mortgage burning parties did exist.

-Flexibility. If rates are high, it is likely they will stay that way or move lower. If they move lower, future potential buyers have more flexibility in buying your home so the pool of buyers increases. Today is as low as we go.

-Price. People seem to have forgotten that value comes from price, not the interest rate. The banking industry has made a living off economic rents and interest rates have become so crucial that our central bank is now obsessed with keeping rates low only to keep housing values inflated.

The market is demanding a higher interest rate. Only artificial intervention is keeping the rate low. How long can this go on? We’ve already passed the $14 trillion mark with national debt and it is likely our Congress will need to raise the debt ceiling yet again. And for what? To keep housing values inflated while Americans struggle to find work? To keep rates low so banks can chase easy money around the globe and inflate the stock market? The entire economy is being held together with the duct tape that is known as Federal Reserve sponsored low interest.-Flexibility. If rates are high, it is likely they will stay that way or move lower. If they move lower, future potential buyers have more flexibility in buying your home so the pool of buyers increases. Today is as low as we go.

-Price. People seem to have forgotten that value comes from price, not the interest rate. The banking industry has made a living off economic rents and interest rates have become so crucial that our central bank is now obsessed with keeping rates low only to keep housing values inflated.

http://www.doctorhousingbubble.com/i...-rates-decade/

Comment