The Next Housing Bubble - Is This the Perfect Storm?

Wednesday, 15 December 2010 10:40

In surfing the tubes that make up the internet (my apologies to the late Senator from Alaska), I happened upon this article from the Journal of the American Planning Association. The article is entitled "Aging Baby Boomers and the Generational Housing Bubble". It is a fascinating analysis of what could bring a fatal blow to the idea that our houses will form the bulk of our assets as those of us that are baby boomers enter our retirement years. Unlike the short-term "temporary" meltdown in house prices created by the subprime mortgage issue of the past two years, this long-term demographic price correction could have a permanent impact on the housing market.

Traditionally, the generation that parented baby boomers has watched house prices rise, at times seemingly exponentially, and have sold their homes at prices that are often orders of magnitude more than what they paid for them decades earlier. In large part, the sale of these assets has provided funds for their retirement years. As baby boomers, we have learned this lesson (perhaps a bit too well) and have patterned much of our financial planning with a similar target in mind. Sure saving money from our weekly paycheques is a good idea but it's hard work and requires discipline and, after all, we can count on using the equity we have in our homes to make up the difference between what we save and what we need to retire with very little effort on our part. After all, house prices have nowhere to go but up....eventually.

This study by Dowell Myers, a professor at the Univeristy of Southern California School of Policy, Planning and Development and co-authored by SungHo Ryu studied the relationship between the 78 million baby boomers and the housing market and what effects aging baby boomers will have on the housing market in the United States as they retire, relocate, downsize and eventually leave the housing market. The large numbers of this cohort has largely driven the real estate market since they first entered it in the early 1970s; burgeoning demand for homes drove prices and inventories ever higher seemingly unendingly, especially if one listens to real estate associations.

According to the study, sales of existing homes make up 85 percent of the homes sold today. Senior citizens are by and large the suppliers to the housing market as they downsize, move into senior's residences or pass away. Those over 65 years are proportionately more likely to own their own homes in comparison to younger adults so they are more likely to have houses to sell. The first baby boomers are slated to reach their retirement years at the age of 65 in 2011 and the last will pass through the "gate" to seniorhood in 2029 so it seems likely that the effects of this demographic change on the real estate market will be seen sooner rather than later. As well, a decrease in the number of younger, first-time home buyers means that the housing market will feel additional stress from shrinking demand at the same time as it faces rapidly growing supply. This does not bode well for prices since the supply of available housing will be increasing at the same time as the demand for that housing is decreasing.

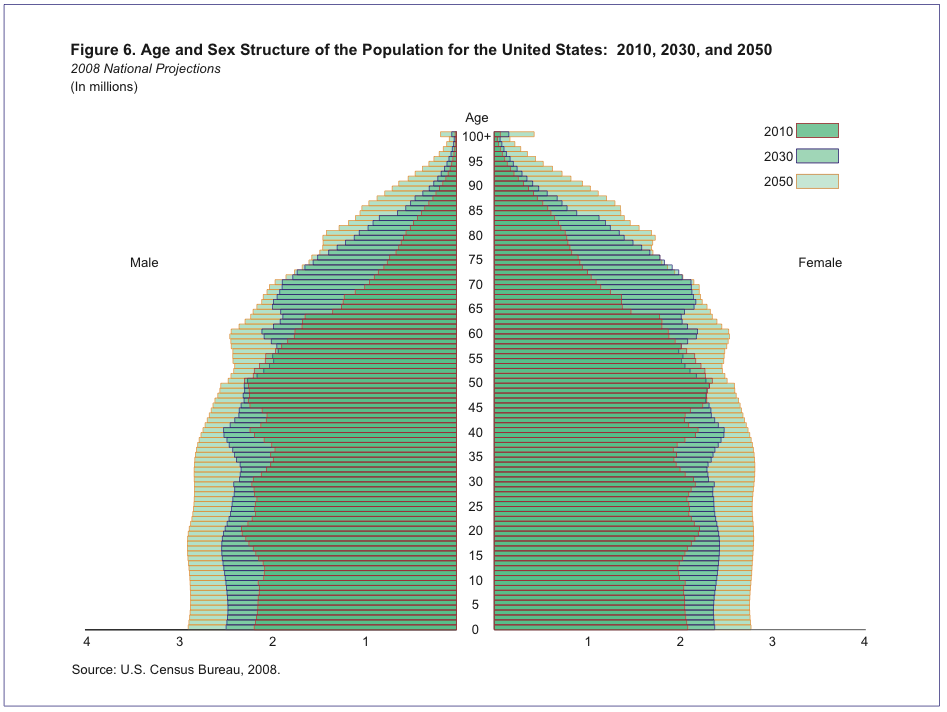

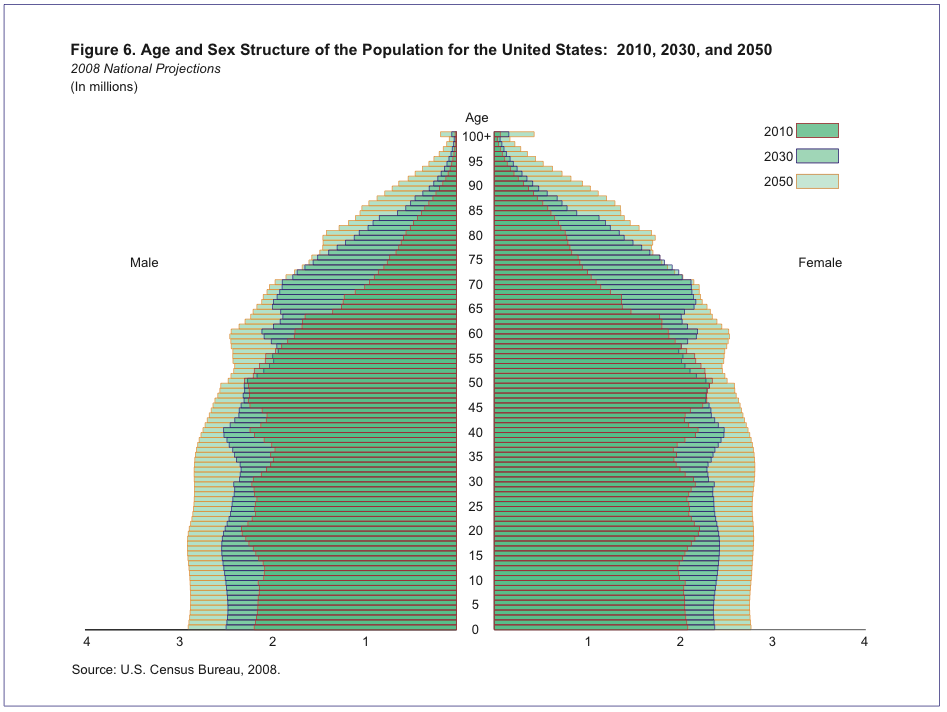

Here is a chart from the United States Census Bureau showing the projected changes to the demography of the United States over time for the years 2010, 2030 and 2050:

Wednesday, 15 December 2010 10:40

In surfing the tubes that make up the internet (my apologies to the late Senator from Alaska), I happened upon this article from the Journal of the American Planning Association. The article is entitled "Aging Baby Boomers and the Generational Housing Bubble". It is a fascinating analysis of what could bring a fatal blow to the idea that our houses will form the bulk of our assets as those of us that are baby boomers enter our retirement years. Unlike the short-term "temporary" meltdown in house prices created by the subprime mortgage issue of the past two years, this long-term demographic price correction could have a permanent impact on the housing market.

Traditionally, the generation that parented baby boomers has watched house prices rise, at times seemingly exponentially, and have sold their homes at prices that are often orders of magnitude more than what they paid for them decades earlier. In large part, the sale of these assets has provided funds for their retirement years. As baby boomers, we have learned this lesson (perhaps a bit too well) and have patterned much of our financial planning with a similar target in mind. Sure saving money from our weekly paycheques is a good idea but it's hard work and requires discipline and, after all, we can count on using the equity we have in our homes to make up the difference between what we save and what we need to retire with very little effort on our part. After all, house prices have nowhere to go but up....eventually.

This study by Dowell Myers, a professor at the Univeristy of Southern California School of Policy, Planning and Development and co-authored by SungHo Ryu studied the relationship between the 78 million baby boomers and the housing market and what effects aging baby boomers will have on the housing market in the United States as they retire, relocate, downsize and eventually leave the housing market. The large numbers of this cohort has largely driven the real estate market since they first entered it in the early 1970s; burgeoning demand for homes drove prices and inventories ever higher seemingly unendingly, especially if one listens to real estate associations.

According to the study, sales of existing homes make up 85 percent of the homes sold today. Senior citizens are by and large the suppliers to the housing market as they downsize, move into senior's residences or pass away. Those over 65 years are proportionately more likely to own their own homes in comparison to younger adults so they are more likely to have houses to sell. The first baby boomers are slated to reach their retirement years at the age of 65 in 2011 and the last will pass through the "gate" to seniorhood in 2029 so it seems likely that the effects of this demographic change on the real estate market will be seen sooner rather than later. As well, a decrease in the number of younger, first-time home buyers means that the housing market will feel additional stress from shrinking demand at the same time as it faces rapidly growing supply. This does not bode well for prices since the supply of available housing will be increasing at the same time as the demand for that housing is decreasing.

Here is a chart from the United States Census Bureau showing the projected changes to the demography of the United States over time for the years 2010, 2030 and 2050:

Notice how the bulge in the population age pyramid travels upwards particularly in the 2030 projection? This indicates an overall aging of the population as the baby boomers reach their senior years. Also note that for the 2030 projection, the number of people in the age groups under 45 years of age increases much less in proportion to those who are over 65. From a housing perspective, that means that there are fewer people that will be entering the housing market than those who will be leaving.

Here's another chart showing what percentage of the population will be over 65 by state comparing the year 2000 to projections for the year 2010 and 2030:

Here's another chart showing what percentage of the population will be over 65 by state comparing the year 2000 to projections for the year 2010 and 2030:

Notice that the overall nationwide over 65 population only increases from 12.4 percent to 13 percent in 2010 because the baby boomers have not yet reached that age bracket. The big change occurs after 2010 and the U.S. Census Bureau projects that the percentage of those over 65 will rise to 19.7 percent of the total population. Some states will be more affected than others; Florida, Maine, Wyoming, New Mexico, Montana and North Dakota will each have more than one quarter of their populations being aged 65 and over. That will have a major impact on their local housing markets. Data from the Centres for Disease Control puts life expectancy at birth at 77.9 years in their latest study that examines all deaths in the United States for the year 2007. This tells us that it is most likely that the baby boomers that reach the age of 65 in 2011 will most likely not be around by 2029 when the last of the boomers reach 65 years of age. Those senior boomers who own houses in 2011 will in all likelihood not own homes by 2029 which is part of the supply problem.

Another factor that is affecting home ownership by the generation following the boomer generation is the lack of affordability especially when one compares median house prices to median income level. Dr. Myers gives the example of house prices in New Jersey where the median house price to median household income multiple rose from 2.89 in 2000 to 5.00 times the income of young adult households by the year 2005. Some states showed much greater ratios of median home values to median incomes of household heads between the ages of 30 and 34, California, Hawaii, Nevada, New Jersey, Rhode Island and Massachusetts being particularly problematic in 2005. There is no doubt that the recent decline in housing prices has improved affordability in these markets but houses are still unaffordable for many families that are in their prime home purchasing years. For further information on housing affordability, I highly recommend the 6th Annual Demographia International Housing Affordability Study 2010 which shows which parts of the United States have the least affordable housing as measured by a multiple of median price to median income.

What is rather critical to Dr. Myers' thesis is the crossover point where selling of homes exceeds buying. The problem will be most severe in states where the older population is large and sells their homes at a young age and where the population of young buyers is growing slowly or is stagnant. From the study, it appears that the northeastern states are the ones where older homeowners sell in greater numbers than younger homeowners buy as shown in this chart:

Another factor that is affecting home ownership by the generation following the boomer generation is the lack of affordability especially when one compares median house prices to median income level. Dr. Myers gives the example of house prices in New Jersey where the median house price to median household income multiple rose from 2.89 in 2000 to 5.00 times the income of young adult households by the year 2005. Some states showed much greater ratios of median home values to median incomes of household heads between the ages of 30 and 34, California, Hawaii, Nevada, New Jersey, Rhode Island and Massachusetts being particularly problematic in 2005. There is no doubt that the recent decline in housing prices has improved affordability in these markets but houses are still unaffordable for many families that are in their prime home purchasing years. For further information on housing affordability, I highly recommend the 6th Annual Demographia International Housing Affordability Study 2010 which shows which parts of the United States have the least affordable housing as measured by a multiple of median price to median income.

What is rather critical to Dr. Myers' thesis is the crossover point where selling of homes exceeds buying. The problem will be most severe in states where the older population is large and sells their homes at a young age and where the population of young buyers is growing slowly or is stagnant. From the study, it appears that the northeastern states are the ones where older homeowners sell in greater numbers than younger homeowners buy as shown in this chart:

Baby boomers were born over an 18 year period of time; it is likely that the housing sell-off (and accompanying price declines) that takes place will take far longer than a normal correction in the housing market, most particularly when compared to the price decline seen in the past 2 to 3 years. The baby boomers born in the late 1950s and early 1960s are likely to suffer the greatest price drops since, by the time they are ready to sell their homes, the supply of real estate for sale will be approaching its peak.

Home equity forms a very important part in the retirement savings of many American households and real estate is more widely held as an financial asset by Americans than other asset.

While it is comforting to think that the equity that we have built up in our homes is the key to a secure retirement, shifts in the demography of nations in Europe, the South Pacific and North America may prove that paradigm to be a fallacy.

http://www.oyetimes.com/views/column...-perfect-storm

Home equity forms a very important part in the retirement savings of many American households and real estate is more widely held as an financial asset by Americans than other asset.

While it is comforting to think that the equity that we have built up in our homes is the key to a secure retirement, shifts in the demography of nations in Europe, the South Pacific and North America may prove that paradigm to be a fallacy.

http://www.oyetimes.com/views/column...-perfect-storm

Comment