The elaborate gold plated fairytale for 2010 is that somehow housing recovered. Sure data was fudged and we swept a few million dubious loan modifications under the Ikea rug but this is certainly not a recovery. Zillow announced that in 2010 US homeowners lost $1.7 trillion in housing value. This brings the grand total of US residential real estate wealth to evaporate into the ether to $9 trillion. There are many pressing issues that remain with the housing market but one that stuck out to me was how modified loans are being laundered into the system as “re-performing loans” even if borrowers haven’t made a payment on the loan or deeply examining their debt-to-loan ratios. The reason this is an issue is that for most of the year, media sources have been quoting the “non-performing” percent figure and in fact this has gone down. Yet this is a blatant deception because of course this will drop when you take millions of loans and suddenly “mod” them and they are miraculously performing as if Houdini reappeared through a puff of smoke. Yet the vast majority re-default only a short while later for obvious reasons (i.e., lack of income, loan balance still too high, etc). Let us look at this daunting phenomenon.

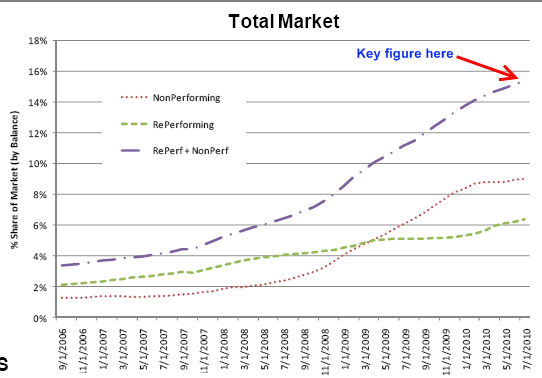

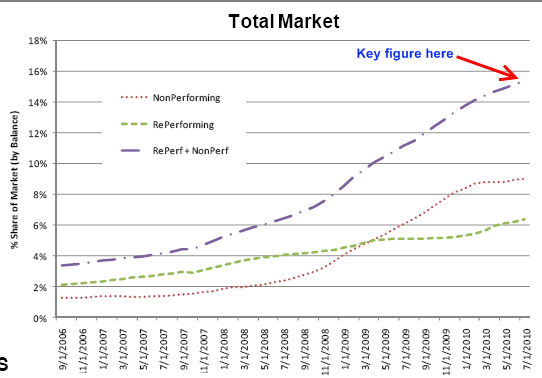

The most important thing is to combine the non-performing loans (foreclosures and those 60+ days late with no payment) with the recycled inventory:

Source: Amherst Securities

When we examine this figure we see that over 14 percent of all loans (55 million in total) are either non-performing or part of this recycled figure. Why haven’t we seen massive stories in the media about people that have had their loans modified through say HAMP early on and are now thriving? Why you may ask? Because these are diamonds in the rough and the bulk of these loans end up back in the foreclosure sewage pipeline process a few months later. Loan modifications have helped in some cases but it is naïve to assume that this has significantly helped the market like current quoted data reveals. The fact that another $1.7 trillion was shed in residential real estate values should tell you something.

Keep in mind this $1.7 trillion collapse (essentially the size of California’s annual GDP) in housing values for 2010 happened virtually unnoticed by many. I think folks are psychologically getting numb to these figures. When the crisis started a few billion dollar loss was enough to rock the markets. Today, an announcement that home values fell by $1.7 trillion doesn’t even get noticed by financial markets. Keep in mind that most Americans that own any wealth have it stored in real estate. This is going to be yet another hit to the net worth bottom line of most and mentally a roundhouse kick in the cajones of wealth effect.

The report by Amherst Securities even brought out Nouriel Roubini saying that US banks will face another $1 trillion in losses. According to the report the current mortgage market looks like this. 20 first mortgages out of 100 are impaired because of:

Source: Amherst Securities

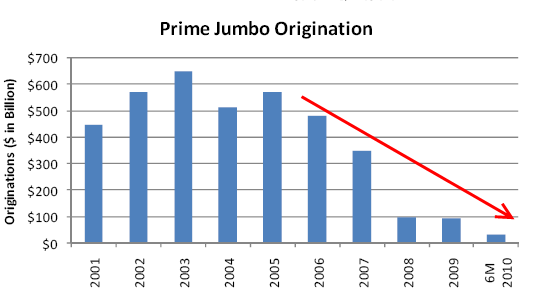

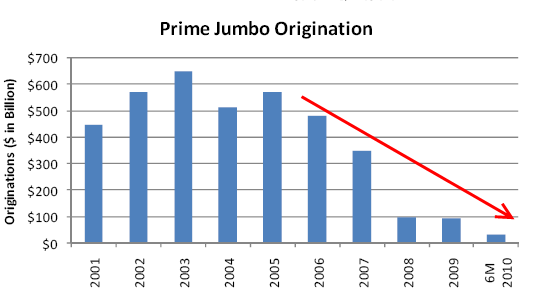

The jumbo loan market is virtually non-existent showing that many homeowners in these “prime” areas used subprime tactics in buying their homes by over leveraging and buying something they could not afford. As we have shown, many million dollar home buyers in key areas like Beverly Hills or Newport Coast were only able to buy because of the mania of the housing bubble and debt fuel that allowed people to over spend and leverage. Since these loans can’t be funneled to the government, banks are not putting their money on the line in these markets. After all, you would think that if banks had faith in their “wealthy” customers they would be making large numbers of jumbo loans. Does the above chart look like that?

The vast majority of Americans never even have to contemplate a jumbo mortgage. The conforming loan limits are already high enough as they are. Plus, the median price of a US home now stands at $170,500 and this is down from $172,000 from last year. In other words, we have gone negative year over year yet again. Keep in mind this happened even in the face of tax gimmicks, the Federal Reserve artificially pushing mortgage rates lower through their actions, giant Wall Street bailouts, and banks basically stalling on foreclosing on homes. With a mixed Congress next year, it is hard to bet what exactly is going to happen. But one thing is clear; common sense minded Independents, Republicans, and Democrats now realize that their representatives do not listen or vote for items that are significantly meaningful to them. The 435 House members and 100 Senators answer to their larger interests.

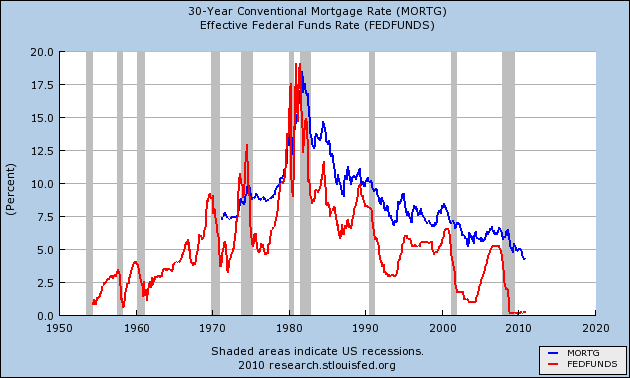

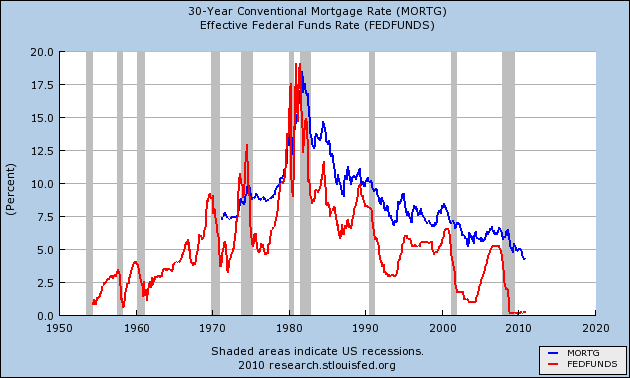

The troubling thing about all this is that mortgage rates are at all-time historical lows:

The Fed must be scratching its head wondering why people aren’t borrowing more money. After all, they were so willing to do it for the past three decades! Last night I was looking at comments from various blogs and mainstream media sources regarding the across the board tax deal in D.C. A large number of comments centered around, “that is great that everyone is getting a cut but it would be nice if I had a paycheck to cut in the first place.” For those that will get a cut many reflected on the $15, $20, or $25 per week they would be getting and how the cost of other items like energy and healthcare have gone up. In the end it is peanuts and is merely a Band-Aid just like the loan modification issue.

Years ago, I tossed out the notion of nationalizing the US banking system. Why? The system was so rife with corruption and fraud that it would take only a true internal assessment to get us out of the mess. Many objected about the cost and believed what the banking industry fed them (or politicized the entire event). Well guess what? We are now entering the fourth year of the crisis, $9 trillion in housing wealth gone, and banks now back to their speculative ways again so what has really changed? We now back Fannie Mae and Freddie Mac completely and banks are the gatekeepers in terms of what mortgages they shuffle off to these agencies. What we have now is the worst part of nationalization (the cost) without the major benefit (complete control to reform). The battle isn’t between Democrats or Republicans. The battle right now is between the people and Wall Street investment banks. The media doesn’t frame it this way but most Americans now finally get it. Not all, but definitely a larger number.

So what is next for us? Expect home values to drop even lower. Keep in mind that if mortgage rates go up (a very likely scenario given global market debt concerns) home prices will become much more unaffordable. The only thing keeping home prices affordable right now is an artificially low mortgage rate manufactured by the Federal Reserve. This is not a normal market by any stretch of the imagination and the longer home problems drag out, the more people of a new generation will think twice about buying a home. This was another important reason to confront the issue head on and deal with it squarely by breaking up banks into commercial and investing units and clearing out the inventory in a steady and predictable way. Now, it is a patch work of insanity and the price tag is up in the trillions of dollars even though we keep hearing about the few billions of dollars being paid back to TARP as some sort of win.

$1.7 trillion lost in residential real estate values, unemployment edging back up to peak levels, and banking profits back to record levels. Guess which group is benefiting the most because of the bailouts?

http://www.doctorhousingbubble.com/l...r-jumbo-loans/

The most important thing is to combine the non-performing loans (foreclosures and those 60+ days late with no payment) with the recycled inventory:

Source: Amherst Securities

When we examine this figure we see that over 14 percent of all loans (55 million in total) are either non-performing or part of this recycled figure. Why haven’t we seen massive stories in the media about people that have had their loans modified through say HAMP early on and are now thriving? Why you may ask? Because these are diamonds in the rough and the bulk of these loans end up back in the foreclosure sewage pipeline process a few months later. Loan modifications have helped in some cases but it is naïve to assume that this has significantly helped the market like current quoted data reveals. The fact that another $1.7 trillion was shed in residential real estate values should tell you something.

Keep in mind this $1.7 trillion collapse (essentially the size of California’s annual GDP) in housing values for 2010 happened virtually unnoticed by many. I think folks are psychologically getting numb to these figures. When the crisis started a few billion dollar loss was enough to rock the markets. Today, an announcement that home values fell by $1.7 trillion doesn’t even get noticed by financial markets. Keep in mind that most Americans that own any wealth have it stored in real estate. This is going to be yet another hit to the net worth bottom line of most and mentally a roundhouse kick in the cajones of wealth effect.

The report by Amherst Securities even brought out Nouriel Roubini saying that US banks will face another $1 trillion in losses. According to the report the current mortgage market looks like this. 20 first mortgages out of 100 are impaired because of:

-9 are behind on their payments at a serious level (60+ days, foreclosure)

-6 of the loans are what they call “dirty current” meaning they were modified but re-default at rates above 50% per annum.

-5 are underwater with negative equity by more than 20% of current market value and these are defaulting at a 20% annum pace (I would imagine this is a large pool of the strategic defaulters).

In other words, 1 out of every 5 first mortgages in the US are in seriously bad shape today. As in right now. Many toxic mortgages still permeate the market especially in places like sunny California. This report is for nationwide data so you can imagine what it looks like for a state like California where home prices are still in a bubble. And for all those California inflated price home owners that think the jumbo loan market is going to make a roaring come back, think again:-6 of the loans are what they call “dirty current” meaning they were modified but re-default at rates above 50% per annum.

-5 are underwater with negative equity by more than 20% of current market value and these are defaulting at a 20% annum pace (I would imagine this is a large pool of the strategic defaulters).

Source: Amherst Securities

The jumbo loan market is virtually non-existent showing that many homeowners in these “prime” areas used subprime tactics in buying their homes by over leveraging and buying something they could not afford. As we have shown, many million dollar home buyers in key areas like Beverly Hills or Newport Coast were only able to buy because of the mania of the housing bubble and debt fuel that allowed people to over spend and leverage. Since these loans can’t be funneled to the government, banks are not putting their money on the line in these markets. After all, you would think that if banks had faith in their “wealthy” customers they would be making large numbers of jumbo loans. Does the above chart look like that?

The vast majority of Americans never even have to contemplate a jumbo mortgage. The conforming loan limits are already high enough as they are. Plus, the median price of a US home now stands at $170,500 and this is down from $172,000 from last year. In other words, we have gone negative year over year yet again. Keep in mind this happened even in the face of tax gimmicks, the Federal Reserve artificially pushing mortgage rates lower through their actions, giant Wall Street bailouts, and banks basically stalling on foreclosing on homes. With a mixed Congress next year, it is hard to bet what exactly is going to happen. But one thing is clear; common sense minded Independents, Republicans, and Democrats now realize that their representatives do not listen or vote for items that are significantly meaningful to them. The 435 House members and 100 Senators answer to their larger interests.

The troubling thing about all this is that mortgage rates are at all-time historical lows:

The Fed must be scratching its head wondering why people aren’t borrowing more money. After all, they were so willing to do it for the past three decades! Last night I was looking at comments from various blogs and mainstream media sources regarding the across the board tax deal in D.C. A large number of comments centered around, “that is great that everyone is getting a cut but it would be nice if I had a paycheck to cut in the first place.” For those that will get a cut many reflected on the $15, $20, or $25 per week they would be getting and how the cost of other items like energy and healthcare have gone up. In the end it is peanuts and is merely a Band-Aid just like the loan modification issue.

Years ago, I tossed out the notion of nationalizing the US banking system. Why? The system was so rife with corruption and fraud that it would take only a true internal assessment to get us out of the mess. Many objected about the cost and believed what the banking industry fed them (or politicized the entire event). Well guess what? We are now entering the fourth year of the crisis, $9 trillion in housing wealth gone, and banks now back to their speculative ways again so what has really changed? We now back Fannie Mae and Freddie Mac completely and banks are the gatekeepers in terms of what mortgages they shuffle off to these agencies. What we have now is the worst part of nationalization (the cost) without the major benefit (complete control to reform). The battle isn’t between Democrats or Republicans. The battle right now is between the people and Wall Street investment banks. The media doesn’t frame it this way but most Americans now finally get it. Not all, but definitely a larger number.

So what is next for us? Expect home values to drop even lower. Keep in mind that if mortgage rates go up (a very likely scenario given global market debt concerns) home prices will become much more unaffordable. The only thing keeping home prices affordable right now is an artificially low mortgage rate manufactured by the Federal Reserve. This is not a normal market by any stretch of the imagination and the longer home problems drag out, the more people of a new generation will think twice about buying a home. This was another important reason to confront the issue head on and deal with it squarely by breaking up banks into commercial and investing units and clearing out the inventory in a steady and predictable way. Now, it is a patch work of insanity and the price tag is up in the trillions of dollars even though we keep hearing about the few billions of dollars being paid back to TARP as some sort of win.

$1.7 trillion lost in residential real estate values, unemployment edging back up to peak levels, and banking profits back to record levels. Guess which group is benefiting the most because of the bailouts?

http://www.doctorhousingbubble.com/l...r-jumbo-loans/

Comment