The current tax debate reveals something deeply troubling about our current economy and psychology of current leaders. They want it all but don’t want to pay for it. At least pay for it today since it seems that current leaders are very eager to saddle future generations with massive amounts of back breaking debt instead of confronting the grim reality of a nation fueled by incredibly large amounts of debt. One aspect of the housing market not discussed in the media is the extraordinary amount of student loan debt out in our country and how this will impact future buyers. As I noted in a previous article student loan debt has now surpassed all outstanding credit card debt in our nation which is an incredible milestone in itself.

Even this week, we heard head Fed honcho Ben Bernanke give one solution to the economic crisis on 60 Minutes where he discussed that “education” was the key to improving our economy. Like anything in life there is an ultimate cost to everything. At what point does formal education become overpriced? How much debt is too much? Many younger Americans are saddling themselves with so much debt that they will not be able to borrow enough to buy a home (at least not at current prices). In California, a college degree isn’t exactly a path into this “employment” miracle Bernanke talked about. Let us look at employment utilization for Californians by degree level.

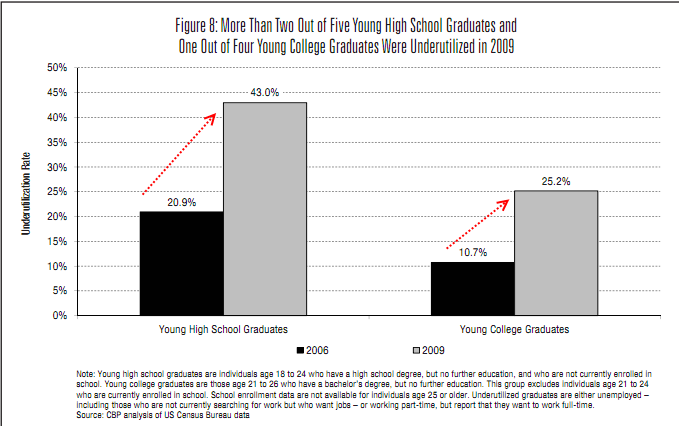

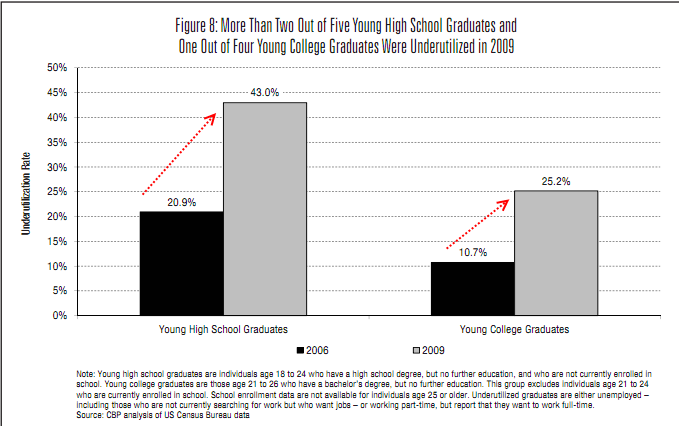

This chart is rather startling:

Source: California Budget Project

The current headline unemployment rate in California is 12.4 percent. Yet the underemployment rate is over 23 percent. It is without a doubt that those with more education do better in the economy. But how much better are they doing if they come out of school with $20,000, $50,000, or even $100,000 in debt? In fact, there is a student with $200,000 in debt that started her own website to help her pay it down:

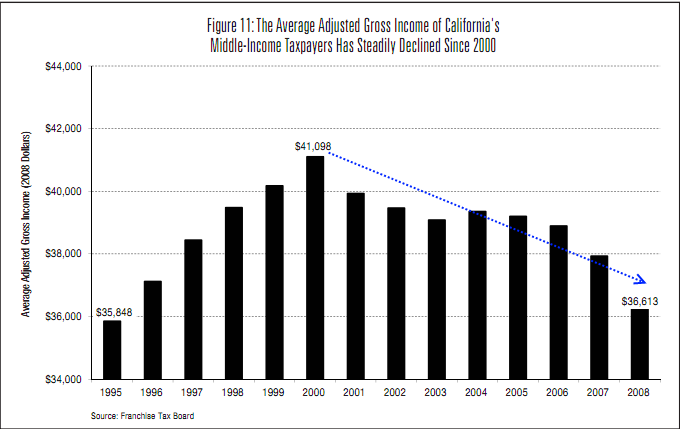

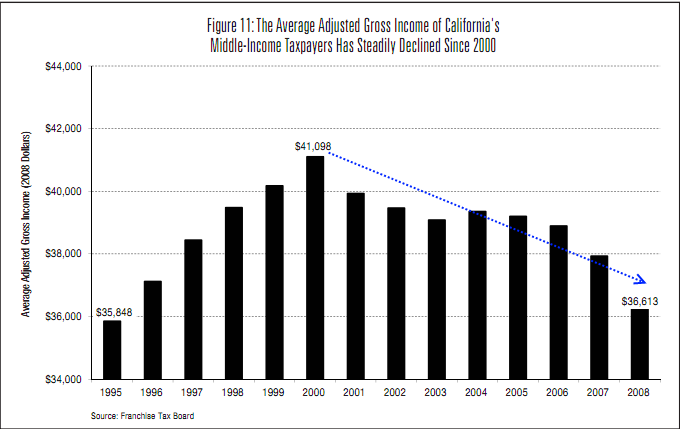

The average wage for California tax payers have also fallen steadily for over a decade:

Keep in mind the above is for individuals and not households. You might be asking yourself how is it that home prices surged to dizzying heights all the while average income was steadily dropping? Good question. Of course when you don’t check for income and offer maximum leverage loans anyone and everyone can borrow and inflate a bubble. This is what happened yet now that the air is being let out, we are confronting a decade of falling wages and a market that simply has more workers than jobs.

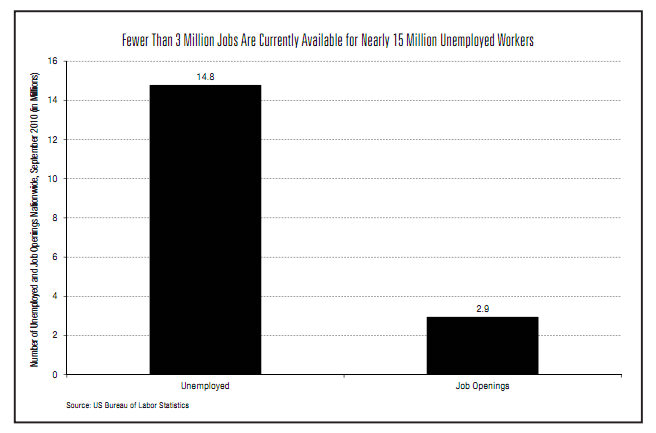

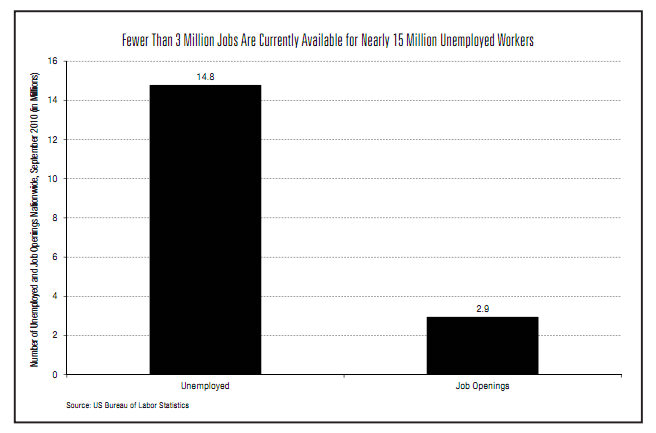

Take a look at this rather simple but very telling chart:

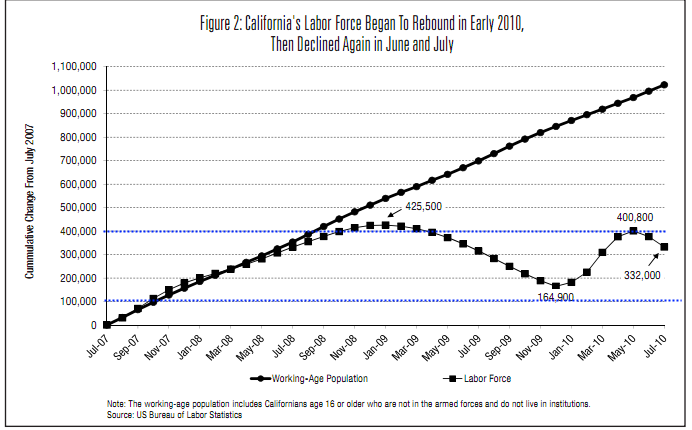

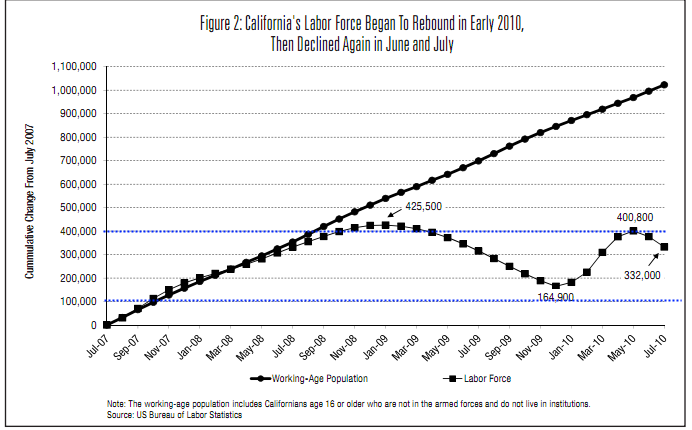

We have 15 million unemployed Americans but only have 3 million job openings. You don’t need a doctorate to realize that is a recipe for disaster. The California employment market is trending lower yet again:

We saw an early jump this year but once all the gimmicks, home buyer tax credits, delays, smoke screens, and other shenanigans disappeared we were left with an economy that is flooded with debt in mortgages, auto loans, credit card debt, and student loan debt. I look at the California housing market closely and when I talk with recent college graduates, they have little desire to buy a home because many enter a sticker shock scenario when their student loan debt payments begin. As you know, students start paying their student loan debt 6 months after they graduate typically. Just imagine entering a market with few jobs and incredible amounts of debt. Why would this generation want to add an additional layer of debt with mortgages? They don’t and the longer this crisis goes on the more this generation will avoid paying high prices for housing. Not because they don’t want to own but because their debt burden is already high before they start their professional career.

This is another issue missed by analysis on the housing market. Many bought homes before the bubble hit. They bought at a time when home prices were more reasonable. It was also the case that many locked in jobs during these good times.

So I can understand why many in this group will believe that prices will go up but who are they going to sell to? The only real viable pool if they want prices to remain high is those that bought at the right time and got jobs during better days. But guess what? That pool is diminishing because of the ticking of time and each month that goes forward we have a new younger generation of Californians with starkly different expectations. They will buy only what they can afford and with a tough labor market and larger student loan debt levels, they won’t be paying top price for many homes in the Golden State. I’ve seen a few delusional folks usually tied to the housing industry calling for the reemergence of toxic loans to goose the housing market again but that game is over.

I am the first to agree that an education is absolutely vital moving forward. But not all degrees are created equal. Also, the public education system should charge based on potential earnings. For example, there is demand for nursing and many community colleges offer these programs. But many times these programs have waitlists that span years because of the demand but also the cost to run these programs. Many nurses earn a good income. So why not charge a higher fee and increase the number of students? The state generates revenue and also puts students into jobs that are in demand. On the flip side, why would the government back student loans for those pursuing degrees in online gaming at for-profit schools? There is a giant bubble in education but more because of how loans are structured and the government seal of approval. Some will argue that students should go to public school. Well guess what? Prices are shooting up:

From 2003 the cost to attend the University of California has gone up by over 100 percent. This at a time when the average income has fallen. Given the notion that education is vital, is it any wonder why students will go into debt to gain a four year degree? And the above price is cheap relative to private school tuition and for-profit paper mills.

Future young Californians are having a very different mindset from those that lived their lives in two decades of bubbles. Those that remember the 1970s will recall that there can be prolonged levels of slumps. Will these future generations be hungry to over leverage and buy over priced housing? I doubt it. And even if they wanted to the labor market and their current debt will put a ceiling on what they can buy.

http://www.doctorhousingbubble.com/a...mount-of-debt/

Even this week, we heard head Fed honcho Ben Bernanke give one solution to the economic crisis on 60 Minutes where he discussed that “education” was the key to improving our economy. Like anything in life there is an ultimate cost to everything. At what point does formal education become overpriced? How much debt is too much? Many younger Americans are saddling themselves with so much debt that they will not be able to borrow enough to buy a home (at least not at current prices). In California, a college degree isn’t exactly a path into this “employment” miracle Bernanke talked about. Let us look at employment utilization for Californians by degree level.

This chart is rather startling:

Source: California Budget Project

The current headline unemployment rate in California is 12.4 percent. Yet the underemployment rate is over 23 percent. It is without a doubt that those with more education do better in the economy. But how much better are they doing if they come out of school with $20,000, $50,000, or even $100,000 in debt? In fact, there is a student with $200,000 in debt that started her own website to help her pay it down:

“(DailyNews) A recent college graduate has come up with a student loan debt solution: Pleading for help online.

Northeastern University grad Kelli Space, 23, owes $200,000. The New Jersey resident has set up a website entitled TwoHundredThou.com on which she tells her story and asks visitors to make a payment, any payment, to help bail her out.

“Monthly payments just for the private loans are currently $891 until Nov 2011 when they increase to $1600 per month for the following 20 years,” she wrote in an effort to elicit funds.

But the response has been lukewarm, to say the least.

To date, she’s received $1,811.28 in donations and still owes $198,188.72, according to her website.”

That amount of debt is more than the median U.S. home price! Just like housing, we have made it all too easy to borrow incredible amounts of money for students to go to college. But unlike a toxic mortgage, students cannot walk away from their massive student loan payments. This is actually creating a generation of Americans that will work to pay for their large amounts of college debt and have little left over for anything else except buying a Subway sub and a bottle of Coke. Examining the above chart, we see that young high school graduates are entering a very unforgiving economy. 43 percent are underutilized in the employment force versus 20 percent in 2006. Yet the rate for young college graduates is even more startling. In 2009 young college graduates were underutilized in the work force by over 25 percent! These are the potential future buyers of California homes yet we somehow expect prices to remain inflated?Northeastern University grad Kelli Space, 23, owes $200,000. The New Jersey resident has set up a website entitled TwoHundredThou.com on which she tells her story and asks visitors to make a payment, any payment, to help bail her out.

“Monthly payments just for the private loans are currently $891 until Nov 2011 when they increase to $1600 per month for the following 20 years,” she wrote in an effort to elicit funds.

But the response has been lukewarm, to say the least.

To date, she’s received $1,811.28 in donations and still owes $198,188.72, according to her website.”

The average wage for California tax payers have also fallen steadily for over a decade:

Keep in mind the above is for individuals and not households. You might be asking yourself how is it that home prices surged to dizzying heights all the while average income was steadily dropping? Good question. Of course when you don’t check for income and offer maximum leverage loans anyone and everyone can borrow and inflate a bubble. This is what happened yet now that the air is being let out, we are confronting a decade of falling wages and a market that simply has more workers than jobs.

Take a look at this rather simple but very telling chart:

We have 15 million unemployed Americans but only have 3 million job openings. You don’t need a doctorate to realize that is a recipe for disaster. The California employment market is trending lower yet again:

We saw an early jump this year but once all the gimmicks, home buyer tax credits, delays, smoke screens, and other shenanigans disappeared we were left with an economy that is flooded with debt in mortgages, auto loans, credit card debt, and student loan debt. I look at the California housing market closely and when I talk with recent college graduates, they have little desire to buy a home because many enter a sticker shock scenario when their student loan debt payments begin. As you know, students start paying their student loan debt 6 months after they graduate typically. Just imagine entering a market with few jobs and incredible amounts of debt. Why would this generation want to add an additional layer of debt with mortgages? They don’t and the longer this crisis goes on the more this generation will avoid paying high prices for housing. Not because they don’t want to own but because their debt burden is already high before they start their professional career.

This is another issue missed by analysis on the housing market. Many bought homes before the bubble hit. They bought at a time when home prices were more reasonable. It was also the case that many locked in jobs during these good times.

So I can understand why many in this group will believe that prices will go up but who are they going to sell to? The only real viable pool if they want prices to remain high is those that bought at the right time and got jobs during better days. But guess what? That pool is diminishing because of the ticking of time and each month that goes forward we have a new younger generation of Californians with starkly different expectations. They will buy only what they can afford and with a tough labor market and larger student loan debt levels, they won’t be paying top price for many homes in the Golden State. I’ve seen a few delusional folks usually tied to the housing industry calling for the reemergence of toxic loans to goose the housing market again but that game is over.

I am the first to agree that an education is absolutely vital moving forward. But not all degrees are created equal. Also, the public education system should charge based on potential earnings. For example, there is demand for nursing and many community colleges offer these programs. But many times these programs have waitlists that span years because of the demand but also the cost to run these programs. Many nurses earn a good income. So why not charge a higher fee and increase the number of students? The state generates revenue and also puts students into jobs that are in demand. On the flip side, why would the government back student loans for those pursuing degrees in online gaming at for-profit schools? There is a giant bubble in education but more because of how loans are structured and the government seal of approval. Some will argue that students should go to public school. Well guess what? Prices are shooting up:

From 2003 the cost to attend the University of California has gone up by over 100 percent. This at a time when the average income has fallen. Given the notion that education is vital, is it any wonder why students will go into debt to gain a four year degree? And the above price is cheap relative to private school tuition and for-profit paper mills.

Future young Californians are having a very different mindset from those that lived their lives in two decades of bubbles. Those that remember the 1970s will recall that there can be prolonged levels of slumps. Will these future generations be hungry to over leverage and buy over priced housing? I doubt it. And even if they wanted to the labor market and their current debt will put a ceiling on what they can buy.

http://www.doctorhousingbubble.com/a...mount-of-debt/

Comment