Poverty is an anomaly to rich people: it is very difficult to make out why people who want dinner do not ring the bell. –Walter Bagehot

Over the weekend it was leaked that US authorities were gearing up to bring insider trading charges against investment banks, consultants, and a wide net of Wall Street players. We’ve gone down this road a few times since the crisis started and many of the crony banking institutions merely settled out of court paying the government off with taxpayer money. It’ll be interesting to see that going on our fourth year of the crisis whether anyone will be charged criminally for what has become the biggest Ponzi apparatus known to humankind. Wall Street simply doesn’t understand how so many people can be angry about their record profits as they push people out of their homes through rocket dockets like those in Florida. If you are poor or middle class then not paying your bills is sufficient for you to be “thrown out on the street with prejudice” but for the big banking system it merely means more generous bailouts. And those being thrown out are also selected with bias; for example how is it that many non-payers in expensive California homes have more leeway to ignore paying their mortgage while a person in Florida with a $90,000 loan is ushered out in a McDonalds like court system? If you can rewind to 2007 when the proverbial debt hit the fan, most of the bailouts were pushed with the pretext of “saving” the housing market. If that was the mission, it has been an abject failure.

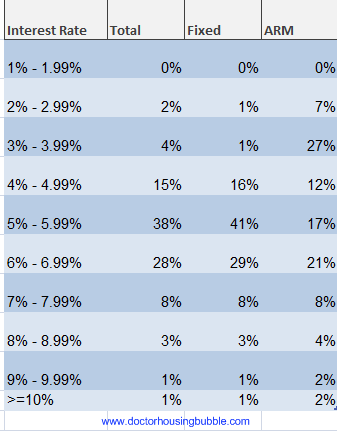

I bring this up under the context of the problems now facing Ireland. This weekend rumors were making the rounds of the price tag to bailout the nation. From $100 to $164 billion dollars. For the size of the country and GDP, this would be like the US getting a $9 to $10 trillion bailout. Why do this? Because many of the big banks from Germany, Spain, and the US have hundreds of billions of dollars connected to Irish debt. We’ve seen this story play out because we are living a similar bailout shell game. The extremely high price tag is being floated in the media so when the lower incredibly expensive price tag comes out, they can play psychological mind games with the public (“see, it wasn’t that bad.”) The Federal Reserve is claiming that QE2 is to save the US consumer but really it is only a method of allowing banks to gamble with cheap funds while they figure out where to stash the nuclear debt waste. The reason many people can’t benefit from the lower funds is because so many homeowners are underwater and can’t refinance. Also, you have 17 percent of the nation unemployed or underemployed so they are out of the game to purchase housing. This is how the numbers break down regarding mortgage rates:

Source: JP Morgan

While banks keep salivating and screaming about low interest rates they simply don’t care that the American consumer is in a position unable to capitalize. They don’t understand why the poor don’t ring a bell for food. Yet at the same time, banks are borrowing at the Fed for record low rates and speculating in the global stock market casino. Now you might ask how is it that 40 percent of Americans have mortgages with rates higher than 6 percent when the current 30 year fixed rate is in the 4 percent range? Because many can’t refinance and many are underwater. Plus, banks have no incentive to automatically lower the rate when they can skewer paying customers to subsidize the many who are now living payment free in their distressed homes. The housing industry is one giant corrupt shell game at the moment.

Southern California housing implodes

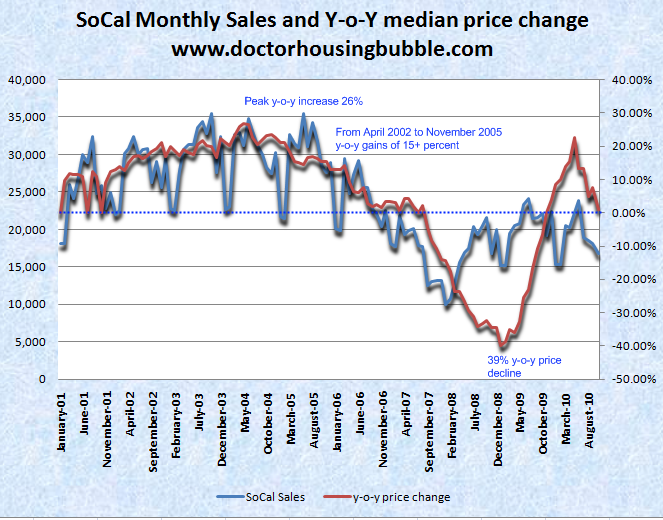

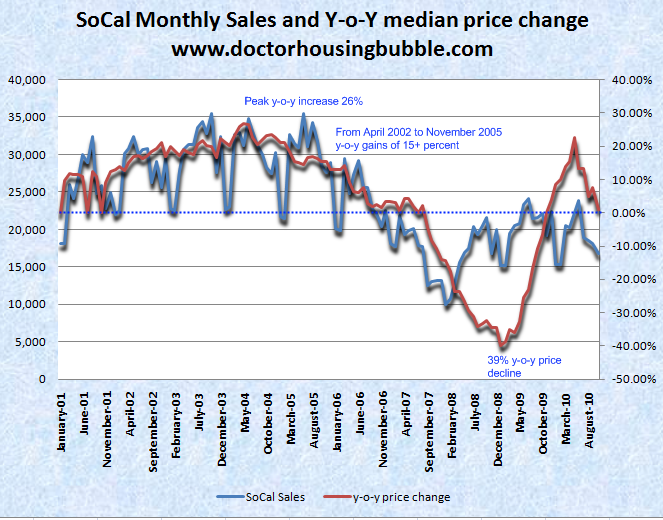

The Southern California housing market is imploding as we speak. You need to know where to look for this severe correction but many are unable to see beyond one month of data. So I decided to analyze and chart out year-over-year median price changes versus home sales to highlight the current trend:

This is a fascinating look at the SoCal housing market which covers over 22 million people and is incredibly diverse. From 2000 to early 2007 there was no y-o-y decline even during seasonally weak periods of winter. In fact, from April of 2002 to November of 2005 y-o-y median price gains never fell below 15 percent and many times hit the 20 percent range (peaking at 26 percent). Yet you can see that the correction in prices came with the collapse in sales. The collapse of 2006 sales was reflected in home prices in 2007. If you follow the current trend, y-o-y price increases are virtually done and sales are heading lower in the beginning of the seasonally weak period. In other words, 2011 will see price corrections. The question of course is whether it will be tepid (5 to 10 percent) or more significant (>10 percent).

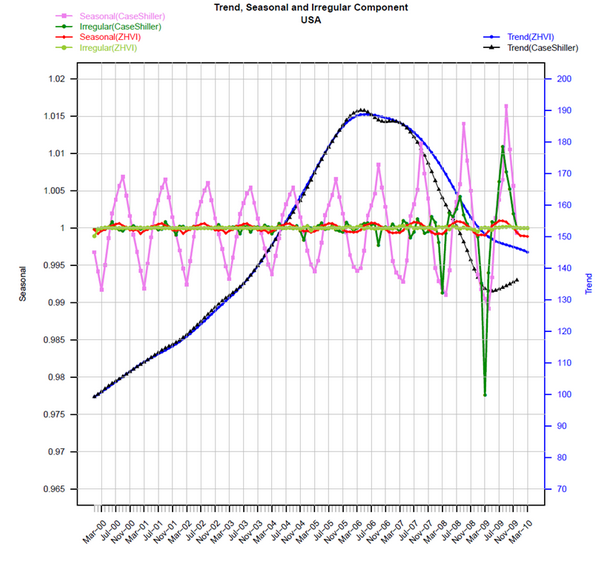

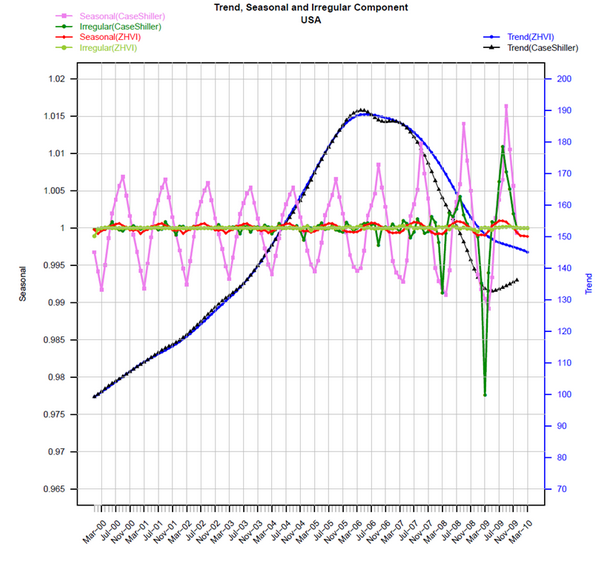

There is a fascinating analysis by Zillow regarding seasonal home sales and price fluctuations:

Source: Zillow

What Zillow found was that given the massive number of foreclosure re-sales, the Case-Shiller Index has been prone to more dramatic fluctuations because in the weak fall and winter months, when normal home sales are pulled from the market, the distressed inventory is still selling and with much lower prices depresses the overall market. Given the size of foreclosure re-sales, this has shifted the makeup of prices. That is why in one month we saw the median SoCal home price drop by over 4 percent. You can expect this kind of behavior throughout March of 2011.

You can see this on the current MLS and looking at shadow inventory for Southern California:

http://www.doctorhousingbubble.com/w...han-6-percent/

Over the weekend it was leaked that US authorities were gearing up to bring insider trading charges against investment banks, consultants, and a wide net of Wall Street players. We’ve gone down this road a few times since the crisis started and many of the crony banking institutions merely settled out of court paying the government off with taxpayer money. It’ll be interesting to see that going on our fourth year of the crisis whether anyone will be charged criminally for what has become the biggest Ponzi apparatus known to humankind. Wall Street simply doesn’t understand how so many people can be angry about their record profits as they push people out of their homes through rocket dockets like those in Florida. If you are poor or middle class then not paying your bills is sufficient for you to be “thrown out on the street with prejudice” but for the big banking system it merely means more generous bailouts. And those being thrown out are also selected with bias; for example how is it that many non-payers in expensive California homes have more leeway to ignore paying their mortgage while a person in Florida with a $90,000 loan is ushered out in a McDonalds like court system? If you can rewind to 2007 when the proverbial debt hit the fan, most of the bailouts were pushed with the pretext of “saving” the housing market. If that was the mission, it has been an abject failure.

I bring this up under the context of the problems now facing Ireland. This weekend rumors were making the rounds of the price tag to bailout the nation. From $100 to $164 billion dollars. For the size of the country and GDP, this would be like the US getting a $9 to $10 trillion bailout. Why do this? Because many of the big banks from Germany, Spain, and the US have hundreds of billions of dollars connected to Irish debt. We’ve seen this story play out because we are living a similar bailout shell game. The extremely high price tag is being floated in the media so when the lower incredibly expensive price tag comes out, they can play psychological mind games with the public (“see, it wasn’t that bad.”) The Federal Reserve is claiming that QE2 is to save the US consumer but really it is only a method of allowing banks to gamble with cheap funds while they figure out where to stash the nuclear debt waste. The reason many people can’t benefit from the lower funds is because so many homeowners are underwater and can’t refinance. Also, you have 17 percent of the nation unemployed or underemployed so they are out of the game to purchase housing. This is how the numbers break down regarding mortgage rates:

Source: JP Morgan

While banks keep salivating and screaming about low interest rates they simply don’t care that the American consumer is in a position unable to capitalize. They don’t understand why the poor don’t ring a bell for food. Yet at the same time, banks are borrowing at the Fed for record low rates and speculating in the global stock market casino. Now you might ask how is it that 40 percent of Americans have mortgages with rates higher than 6 percent when the current 30 year fixed rate is in the 4 percent range? Because many can’t refinance and many are underwater. Plus, banks have no incentive to automatically lower the rate when they can skewer paying customers to subsidize the many who are now living payment free in their distressed homes. The housing industry is one giant corrupt shell game at the moment.

Southern California housing implodes

The Southern California housing market is imploding as we speak. You need to know where to look for this severe correction but many are unable to see beyond one month of data. So I decided to analyze and chart out year-over-year median price changes versus home sales to highlight the current trend:

This is a fascinating look at the SoCal housing market which covers over 22 million people and is incredibly diverse. From 2000 to early 2007 there was no y-o-y decline even during seasonally weak periods of winter. In fact, from April of 2002 to November of 2005 y-o-y median price gains never fell below 15 percent and many times hit the 20 percent range (peaking at 26 percent). Yet you can see that the correction in prices came with the collapse in sales. The collapse of 2006 sales was reflected in home prices in 2007. If you follow the current trend, y-o-y price increases are virtually done and sales are heading lower in the beginning of the seasonally weak period. In other words, 2011 will see price corrections. The question of course is whether it will be tepid (5 to 10 percent) or more significant (>10 percent).

There is a fascinating analysis by Zillow regarding seasonal home sales and price fluctuations:

Source: Zillow

What Zillow found was that given the massive number of foreclosure re-sales, the Case-Shiller Index has been prone to more dramatic fluctuations because in the weak fall and winter months, when normal home sales are pulled from the market, the distressed inventory is still selling and with much lower prices depresses the overall market. Given the size of foreclosure re-sales, this has shifted the makeup of prices. That is why in one month we saw the median SoCal home price drop by over 4 percent. You can expect this kind of behavior throughout March of 2011.

You can see this on the current MLS and looking at shadow inventory for Southern California:

November 2010 data

Current MLS homes: 95,095

MLS + distressed homes: 257,824

So what does this data say about the next few months? Home prices will be coming down. The implications for the larger economy are yet to be seen. Yet public outrage against the banks and bailouts is boiling over and the public is ringing the bell against the massive fraud that is going on. 4 years into this crisis and no one has stepped up which tells you how cozy Wall Street and Washington are at the moment.Current MLS homes: 95,095

MLS + distressed homes: 257,824

http://www.doctorhousingbubble.com/w...han-6-percent/

Comment