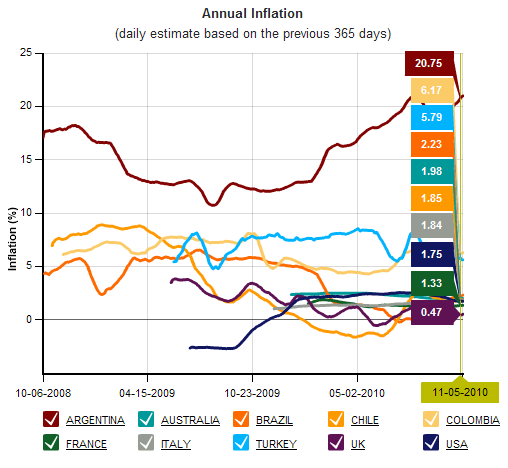

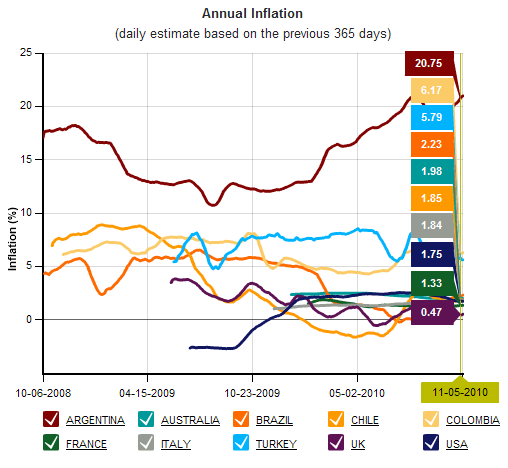

Pretty interesting. Verdict: no inflation.

http://bpp.mit.edu/

The Billion Prices Project is an academic initiative that collects prices from hundreds of online retailers around the world on a daily basis to conduct economic research. We currently monitor daily price fluctuations of ~5 million items sold by ~300 online retailers in more than 70 countries.

This webpage showcases examples of average inflation indexes that we created to illustrate the type of statistical work that can be done with this data. Our team is currently working on developing econometric models that leverage the data to forecast future trends and conduct economic research.

This webpage showcases examples of average inflation indexes that we created to illustrate the type of statistical work that can be done with this data. Our team is currently working on developing econometric models that leverage the data to forecast future trends and conduct economic research.

Comment