I was listening to a fascinating lecture regarding the Los Angeles real estate market by Dr. Robert Shiller, the creator of the often used Case-Shiller S&P Index that tracks the real estate market. The lecture was given back in 2008 at Yale and pertained to real estate finance. In one of his historical studies, he examined housing in Los Angeles back in the 1880s. What he found through various news clippings and other sources of information was a belief that Los Angeles was somehow the “promised land” because of the nice weather and general belief that it was somehow booming. Of course, prices peaked in 1886 and then crashed. In more modern times, he was able to survey people in 1988 in Los Angeles during another boom and once again, the typical Southern California sun induced delusion reared its head. The data is fascinating and we’ll tie this in with the Orange County real estate market as well.

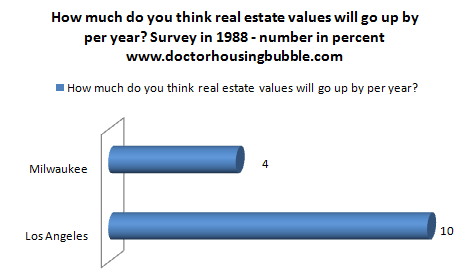

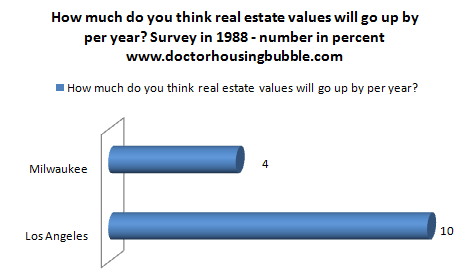

What he found in 1988 was that those surveyed in Los Angeles thought that real estate prices would go up by 10 percent each year into the indefinite future:

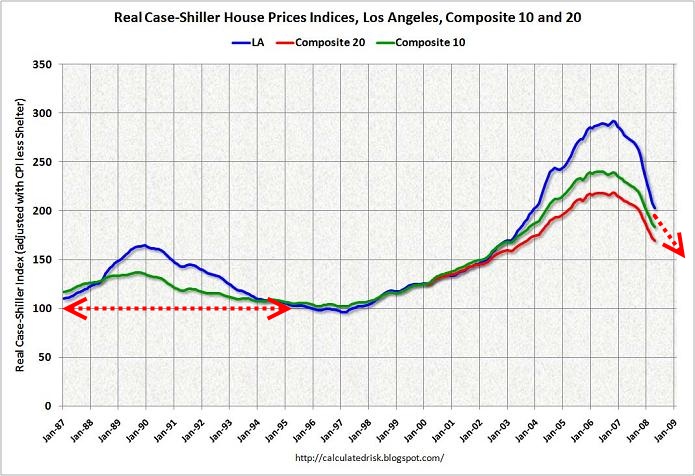

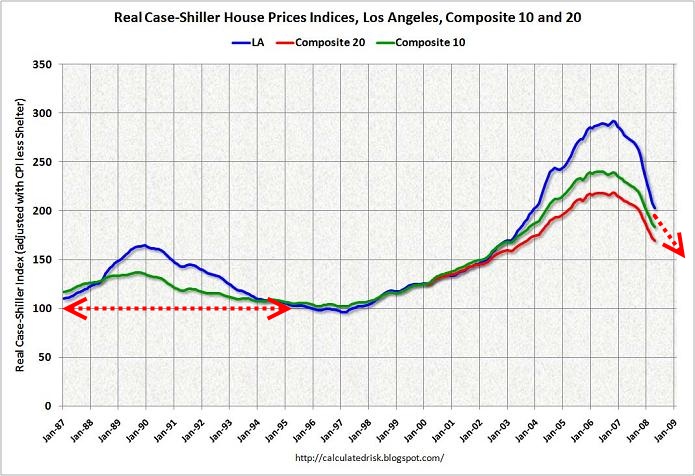

So for many in Los Angeles at the time, the belief was that housing prices would double in 7 years versus 18 in Milwaukee (the 4 percent perception was closer to the overall inflation rate). Also, what was found in the survey was that 80 percent of those in Los Angeles feared being left out of the housing market if they didn’t buy today. This was very common in our last bubble and much more so since prices were going up sometimes 20 percent a year. There was also a sense of gambling with Los Angeles; 54 percent had a sense of excitement surrounding the real estate market versus 21 percent in Milwaukee according to Shiller’s research. Here is how the 1980s boom looked like:

Source: Calculated Risk

Now of course the 1980s boom looks like a walk in the park compared to the latest boom. But the seeds of delusion that were in place in the 1880s, 1980s, and 2000s all seem to carry the same tone. Los Angeles and Southern California carries a sense of glamour and is prone to major housing bubbles. You would think that after this insane bust that people would learn to curb their enthusiasm. Not so. In fact, the UCLA Anderson forecast on Orange County is a fascinating example of how enthusiastic people can be on a regional market. Let us look at the data.

UCLA Anderson forecast for Orange County

Now before we look at the 2010 forecast, we should say that their long-term forecasting hasn’t always been exactly on point:

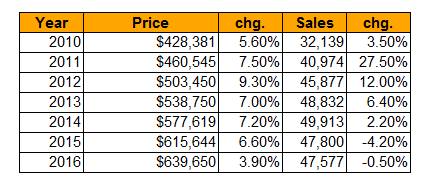

Source: OC Register, UCLA forecast

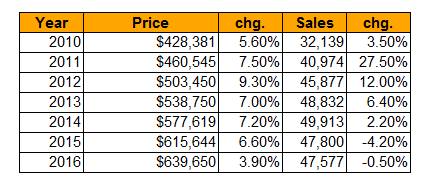

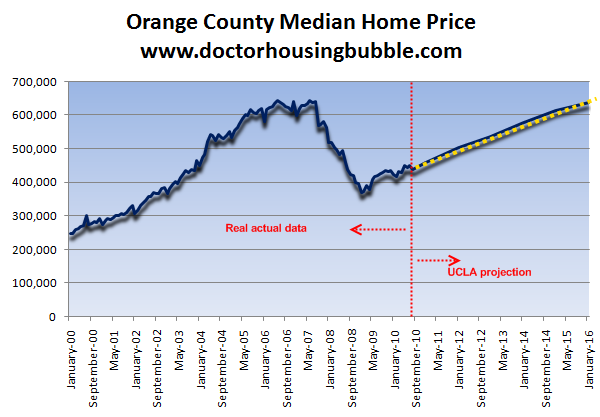

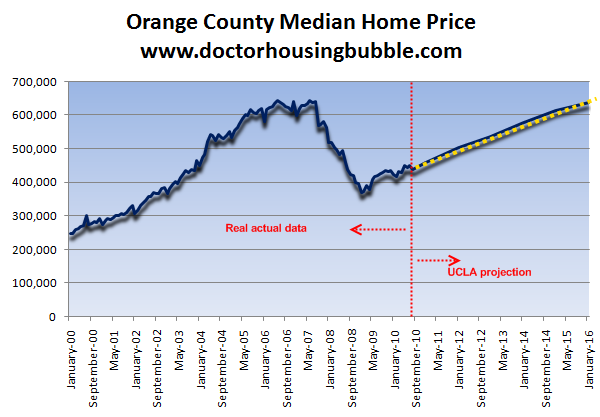

Now this is just stunning. It reminds me of the 1988 survey of Los Angeles residents saying they expect to see 10 percent annual appreciation in real estate prices. In the next six years according to this survey, prices should go up by 49 percent for the entire county. So that million dollar Seal Beach home should then be worth $1,490,000 in 2016. Not only does this forecast seem unlikely, when we chart it out it seems preposterous:

The red line shows were reality ends and to the right, fantasy begins. Given the great state budget we have right now and unemployment situation, why are they predicting home price hikes that are reminiscent to the heyday of the housing bubble? This is their reason:

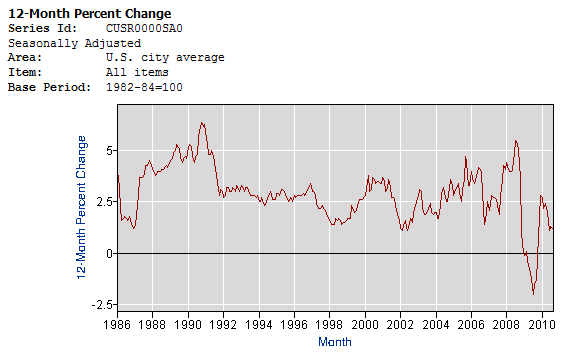

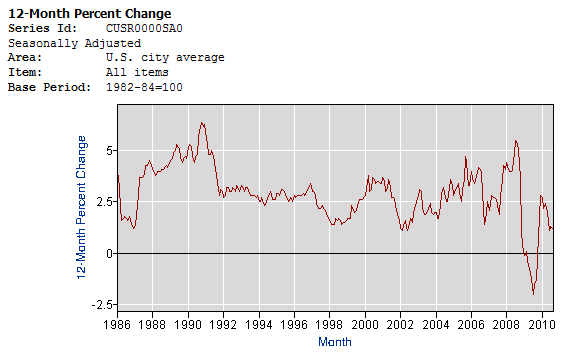

The forecast also doesn’t talk about the biggest cost in real estate building and that is labor. As we know with the squeezing out of the working and middle class, labor is abundant and cheap especially in the state because of the bust in the construction industry. Incomes are stagnant. So why would home prices soar 49 percent in 6 years? Even inflation is weak at the moment:

Source: BLS

In the last couple of years, inflation has oscillated from a negative rate to 2.5 percent annually. That does not translate to a 49 percent increase in six years. Every county in Southern California seems to be chasing past returns and expects the days of the bubble to come back. Maybe it is the sun that causes all these booms and busts.

http://www.doctorhousingbubble.com/o...-come-to-pass/

What he found in 1988 was that those surveyed in Los Angeles thought that real estate prices would go up by 10 percent each year into the indefinite future:

So for many in Los Angeles at the time, the belief was that housing prices would double in 7 years versus 18 in Milwaukee (the 4 percent perception was closer to the overall inflation rate). Also, what was found in the survey was that 80 percent of those in Los Angeles feared being left out of the housing market if they didn’t buy today. This was very common in our last bubble and much more so since prices were going up sometimes 20 percent a year. There was also a sense of gambling with Los Angeles; 54 percent had a sense of excitement surrounding the real estate market versus 21 percent in Milwaukee according to Shiller’s research. Here is how the 1980s boom looked like:

Source: Calculated Risk

Now of course the 1980s boom looks like a walk in the park compared to the latest boom. But the seeds of delusion that were in place in the 1880s, 1980s, and 2000s all seem to carry the same tone. Los Angeles and Southern California carries a sense of glamour and is prone to major housing bubbles. You would think that after this insane bust that people would learn to curb their enthusiasm. Not so. In fact, the UCLA Anderson forecast on Orange County is a fascinating example of how enthusiastic people can be on a regional market. Let us look at the data.

UCLA Anderson forecast for Orange County

Now before we look at the 2010 forecast, we should say that their long-term forecasting hasn’t always been exactly on point:

“(December 2006) Despite the housing downturn, the California and U.S. economies are headed for a “soft landing” because trouble in one sector alone is not enough to trigger a recession, UCLA economists said in a quarterly forecast to be released today.

California could have a soft landing — slowing growth but without recession — as long as its economic woes are limited to the housing sector, economist Ryan Ratcliff said in the UCLA Anderson Forecast outlook.

In his California forecast, Ratcliff expressed concern about two aspects of the economy: consumer spending and the state budget. If problems develop in either area in conjunction with the housing slump, then the state could slide into recession, he said. But Ratcliffe concluded that neither of those scenarios was likely.”

I think it safe to say that we had anything but a soft landing but wanted to give you a sense before we present the pie in the sky numbers for Orange County:California could have a soft landing — slowing growth but without recession — as long as its economic woes are limited to the housing sector, economist Ryan Ratcliff said in the UCLA Anderson Forecast outlook.

In his California forecast, Ratcliff expressed concern about two aspects of the economy: consumer spending and the state budget. If problems develop in either area in conjunction with the housing slump, then the state could slide into recession, he said. But Ratcliffe concluded that neither of those scenarios was likely.”

Source: OC Register, UCLA forecast

Now this is just stunning. It reminds me of the 1988 survey of Los Angeles residents saying they expect to see 10 percent annual appreciation in real estate prices. In the next six years according to this survey, prices should go up by 49 percent for the entire county. So that million dollar Seal Beach home should then be worth $1,490,000 in 2016. Not only does this forecast seem unlikely, when we chart it out it seems preposterous:

The red line shows were reality ends and to the right, fantasy begins. Given the great state budget we have right now and unemployment situation, why are they predicting home price hikes that are reminiscent to the heyday of the housing bubble? This is their reason:

“(OC Register) Expect a sluggish housing market for the remainder of this year and into next spring,” the forecast states. “At that time, pent up demand, rising affordability, and dissipating fear of a faltering economy should push sales higher.”

In other words, they are just speculating. This is like betting on red coming up on Roulette. First, rising home prices mean home prices become less affordable as they go up unless income also goes up (we don’t see how this is the case in the forecast). The only reason the bubble occurred in the first place was that toxic mortgages gave the illusion of affordability with teaser rates and artificially low interest rates. Next, this “fear” is actually tethered to reality. The state budget is in a mess. The employment market is incredibly weak. And this notion of pent up demand is bunk. Mortgage rates are at historically low levels. There is inventory on the market and it is pent up supply (shadow inventory) that is keeping prices inflated at the moment but that can’t last forever.The forecast also doesn’t talk about the biggest cost in real estate building and that is labor. As we know with the squeezing out of the working and middle class, labor is abundant and cheap especially in the state because of the bust in the construction industry. Incomes are stagnant. So why would home prices soar 49 percent in 6 years? Even inflation is weak at the moment:

Source: BLS

In the last couple of years, inflation has oscillated from a negative rate to 2.5 percent annually. That does not translate to a 49 percent increase in six years. Every county in Southern California seems to be chasing past returns and expects the days of the bubble to come back. Maybe it is the sun that causes all these booms and busts.

http://www.doctorhousingbubble.com/o...-come-to-pass/

Comment