The banks have an effective way of laundering money. First, they proclaim that they are turning a ďprofitĒ with TARP funds but fail to mention the trillions of dollars of leverage they garner through the Federal Reserve. The cost is indirect through inflation and the debasing of the U.S. dollar. Next, Fannie Mae and Freddie Mac just announced that they might cost U.S. taxpayers $368 billion. Maybe I learned finance incorrectly, but a $368 billion loss is not a profit in my book. Fannie Mae and Freddie Mac donít make loans directly to the public but allow banks, the same robo-signing variety, to issue loans on their behalf. These losses are merely a reflection of their horrible lending practices and a sophisticated method of laundering money into the economy by debasing the value of the U.S. dollar. That is why today, when people ask me what is at the root of the housing problem I tell them that home prices are simply too expensive because incomes are weak.

The reason people bit into the toxic mortgage apple was because they were falling behind on household income and felt they needed to use financially destructive products that allowed them to have too much leverage for their actual household balance sheet. It is a matter of what you can safely payback. If banks and individuals were allowed to fail for these bad bets, so be it. The end results arenít even that bad; millions will now need to rent and we will have fewer bank solicitations in the mail). Yet the majority of prudent Americans are financing this casino and housing mess. How about loan modifications for the vast majority that do pay their mortgages on time or tax breaks for renters that do pay their bills on time? With new Census data leaking out it is obvious that multiple income households and deep debt have masked how far we are from finding a balance in the economy.

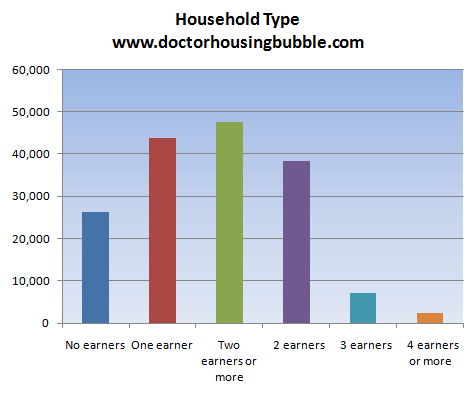

Two incomes not enough for middle class lifeSource: Census, thousands

I was digging through the new Census data and broke out households by earners. Ultimately people have to pay for their mortgage and other bills with an income. Presumably this income comes from a job (no-doc loans provided a way to avoid this tiny issues when purchasing a home). But even now the biggest group that we have is households with two earners. This is definitely a reversal from previous times in our history. Yet it has gotten progressively more difficult to have a middle class lifestyle in the U.S. I think housing is the ultimate symbol of the American Dream. This isnít to say that this is good but this has been a heavily ingrained belief for the last couple of generations. I think the generation that grew up in the Great Depression might have something to say about housing being a fantastic investment but that population is largely not with us. The collective psychology has purged those terrible memories but we are recreating our own today.

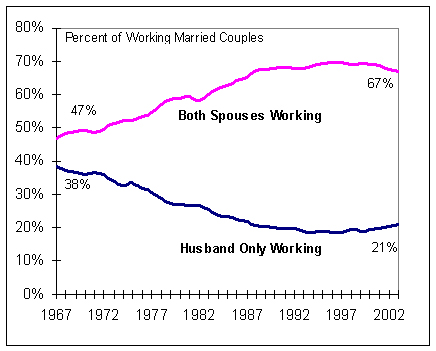

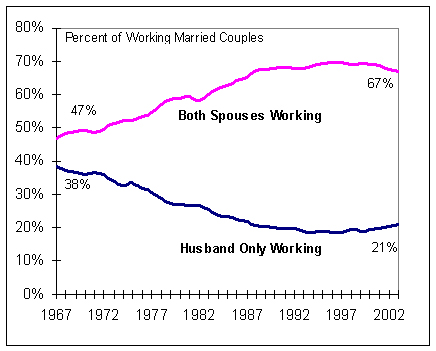

Much of the costs of middle class life have been buffered by women entering the workforce:

Source: Tax Foundation

In 1967 47 percent of working married couples had both spouses working. In 2003 that number is up to 67 percent. This number is now lower because the data above only goes out to 2003 before the depths of our current recession. So you have two incomes now flowing into one household but individually, these incomes are lower on a per capita inflation adjusted basis. Did people actually become wealthier over this time? The numbers seem to suggest a different trajectory.

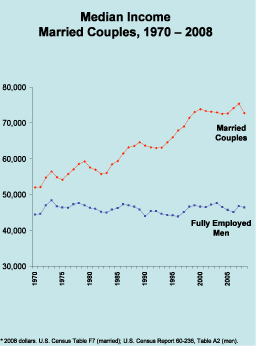

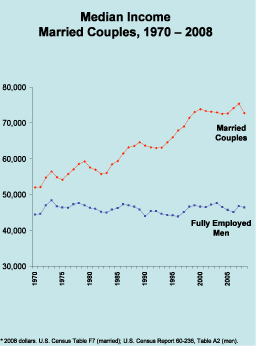

Wages stagnant for individual workers

It should be no surprise that two incomes are better than one. But if we separate it out for the individual worker incomes have been stagnant. And recently, even married couples have seen their incomes falter as many households are seeing one spouse without work and trying to adjust to a one income household. A one income household in 1970 might have provided for a middle class lifestyle but today that is largely becoming a distant dream.

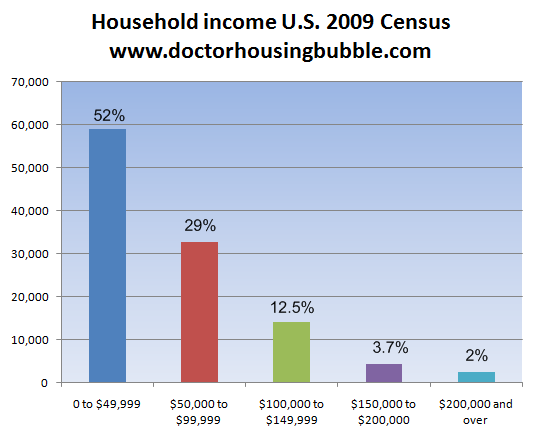

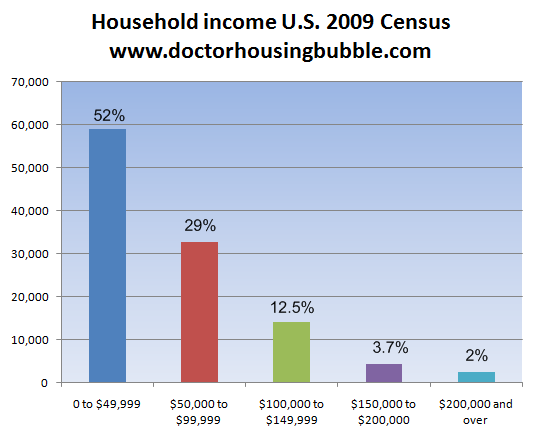

The current median home price in the U.S. is $178,600. The median household income is $50,000. Overall, housing prices are too expensive based on the income of U.S. households. Take a look at this data:

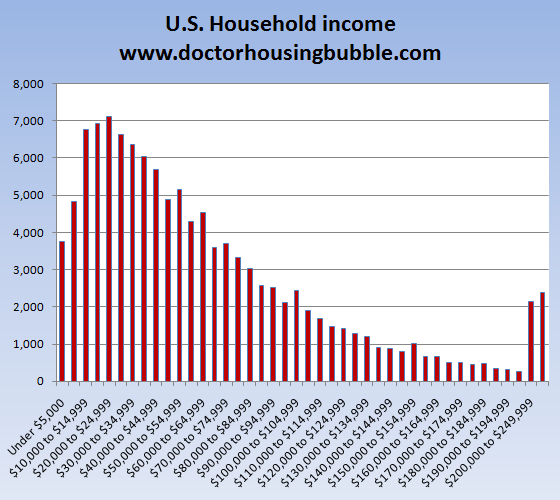

Income distribution shows a shrinking middle class

Source: Census

The ugly secret that the media wants to ignore is the erosion of buying power for the middle class. Take a look at the above chart. Even at the median home price of $178,600 over half of the households in the U.S. are ruled out from being potential buyers. No household making $49,999 or less can afford a median priced home. Even the next group of those earning $50,000 to $99,999 will have a stretch depending on where they buy and on which side of range they fall on. We can break the data out further:

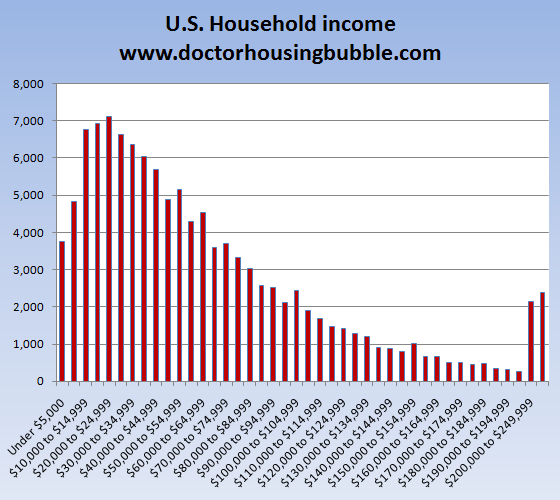

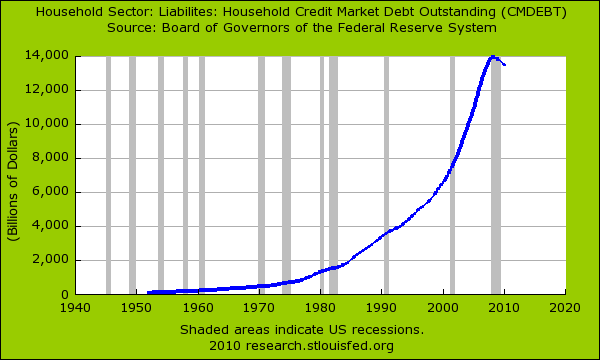

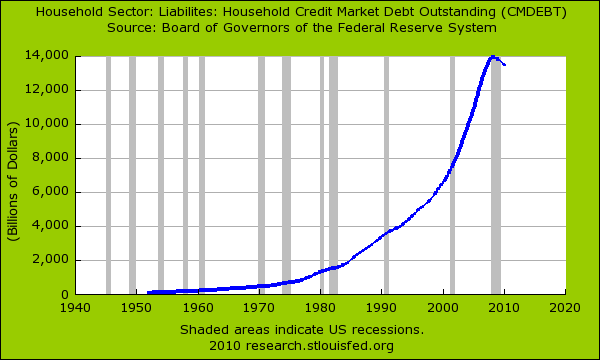

Even more troubling is the number of households that live on $25,000 or less each year. It is important for this group to have affordable rents. So why are we pursuing policies that purposely keep home prices inflated? It is no surprise that all this middle class living has been accomplished merely by going into massive amounts of debt:

Our economy since the 1970s has started making up for the stagnation of buying power by supplementing purchasing power with debt. Now, we have students routinely leaving school with $50,000 to $100,000 in student loan debt. This was virtually unheard of in the past. Will this group be able to buy a home? Or what about all the people with incredible amounts of credit card debt? Never has the U.S. had so many people encumbered with so much debt. When you purchase with debt you are promising future income for current consumption. With the housing bubble, we have committed 5 to 10 years of future income to current home prices. Yet the economy did not grow and wages certainly did not. So now, a correction must occur and is occurring. All these stop gap measures are simply covering up what no politician wants to admit. Many banks must fail because they were on the wrong side of the bet. Instead, we are allowing banks to launder their mistakes to taxpayers through Fannie Mae, Freddie Mac, the FHA, the Federal Reserve, and other gimmicks that allow banks to siphon off more capital from the actual real economy to pay for their multi-decade embezzlement. This is a zero-sum game here and banks are raiding the publicís wallet.

Things today have turned into a circus. How are banks turning profits when 26 million Americans are unemployed or underemployed, are seeing their incomes slashed, and are seeing their home values decline? Even multiple incomes canít cover up this mess anymore. Iím not sure if the public overall really understands the complex laundering system setup by the banks and how they have sucked away productive capital out of the economy. This mess happened for a reason. This wasnít an accident. How else did Wall Street hedge funds start placing bets on the housing market imploding starting back in 2006 when home prices were still at their peak? Some people clearly saw this happening and in many cases these were the same people putting together the mortgage backed securities that would later implode the banking system.

While banks announce wicked profits keep looking at the income data for actual working Americans. There is a direct connection here. Those losses of Fannie Mae and Freddie Mac originated from these same dubious banks and will be paid by the taxpayers. You donít hear them bragging about TARP in this scenario.

http://www.doctorhousingbubble.com/a...ousing-market/

The reason people bit into the toxic mortgage apple was because they were falling behind on household income and felt they needed to use financially destructive products that allowed them to have too much leverage for their actual household balance sheet. It is a matter of what you can safely payback. If banks and individuals were allowed to fail for these bad bets, so be it. The end results arenít even that bad; millions will now need to rent and we will have fewer bank solicitations in the mail). Yet the majority of prudent Americans are financing this casino and housing mess. How about loan modifications for the vast majority that do pay their mortgages on time or tax breaks for renters that do pay their bills on time? With new Census data leaking out it is obvious that multiple income households and deep debt have masked how far we are from finding a balance in the economy.

Two incomes not enough for middle class lifeSource: Census, thousands

I was digging through the new Census data and broke out households by earners. Ultimately people have to pay for their mortgage and other bills with an income. Presumably this income comes from a job (no-doc loans provided a way to avoid this tiny issues when purchasing a home). But even now the biggest group that we have is households with two earners. This is definitely a reversal from previous times in our history. Yet it has gotten progressively more difficult to have a middle class lifestyle in the U.S. I think housing is the ultimate symbol of the American Dream. This isnít to say that this is good but this has been a heavily ingrained belief for the last couple of generations. I think the generation that grew up in the Great Depression might have something to say about housing being a fantastic investment but that population is largely not with us. The collective psychology has purged those terrible memories but we are recreating our own today.

Much of the costs of middle class life have been buffered by women entering the workforce:

Source: Tax Foundation

In 1967 47 percent of working married couples had both spouses working. In 2003 that number is up to 67 percent. This number is now lower because the data above only goes out to 2003 before the depths of our current recession. So you have two incomes now flowing into one household but individually, these incomes are lower on a per capita inflation adjusted basis. Did people actually become wealthier over this time? The numbers seem to suggest a different trajectory.

Wages stagnant for individual workers

It should be no surprise that two incomes are better than one. But if we separate it out for the individual worker incomes have been stagnant. And recently, even married couples have seen their incomes falter as many households are seeing one spouse without work and trying to adjust to a one income household. A one income household in 1970 might have provided for a middle class lifestyle but today that is largely becoming a distant dream.

The current median home price in the U.S. is $178,600. The median household income is $50,000. Overall, housing prices are too expensive based on the income of U.S. households. Take a look at this data:

1970

Median U.S. home price: $17,000

Median household income: $9,300

2009

Median U.S. home price: $178,600

Median household income: $50,200

Even today, with the majority of households having two incomes home prices eat up more of a householdís income than back in 1970. The only reason the Federal Reserve is pushing interest rates lower is because this is the only way they can hide the shrinking buying power of the American middle class. Just look at the data above. In 1970 it took about 2 years of an annual household income to buy a home while today it takes over 3. Even on face value, buying a home is too expensive overall for the nation (let us not even dig into specific cities in California that are largely in housing bubbles even today).Median U.S. home price: $17,000

Median household income: $9,300

2009

Median U.S. home price: $178,600

Median household income: $50,200

Income distribution shows a shrinking middle class

Source: Census

The ugly secret that the media wants to ignore is the erosion of buying power for the middle class. Take a look at the above chart. Even at the median home price of $178,600 over half of the households in the U.S. are ruled out from being potential buyers. No household making $49,999 or less can afford a median priced home. Even the next group of those earning $50,000 to $99,999 will have a stretch depending on where they buy and on which side of range they fall on. We can break the data out further:

Even more troubling is the number of households that live on $25,000 or less each year. It is important for this group to have affordable rents. So why are we pursuing policies that purposely keep home prices inflated? It is no surprise that all this middle class living has been accomplished merely by going into massive amounts of debt:

Our economy since the 1970s has started making up for the stagnation of buying power by supplementing purchasing power with debt. Now, we have students routinely leaving school with $50,000 to $100,000 in student loan debt. This was virtually unheard of in the past. Will this group be able to buy a home? Or what about all the people with incredible amounts of credit card debt? Never has the U.S. had so many people encumbered with so much debt. When you purchase with debt you are promising future income for current consumption. With the housing bubble, we have committed 5 to 10 years of future income to current home prices. Yet the economy did not grow and wages certainly did not. So now, a correction must occur and is occurring. All these stop gap measures are simply covering up what no politician wants to admit. Many banks must fail because they were on the wrong side of the bet. Instead, we are allowing banks to launder their mistakes to taxpayers through Fannie Mae, Freddie Mac, the FHA, the Federal Reserve, and other gimmicks that allow banks to siphon off more capital from the actual real economy to pay for their multi-decade embezzlement. This is a zero-sum game here and banks are raiding the publicís wallet.

Things today have turned into a circus. How are banks turning profits when 26 million Americans are unemployed or underemployed, are seeing their incomes slashed, and are seeing their home values decline? Even multiple incomes canít cover up this mess anymore. Iím not sure if the public overall really understands the complex laundering system setup by the banks and how they have sucked away productive capital out of the economy. This mess happened for a reason. This wasnít an accident. How else did Wall Street hedge funds start placing bets on the housing market imploding starting back in 2006 when home prices were still at their peak? Some people clearly saw this happening and in many cases these were the same people putting together the mortgage backed securities that would later implode the banking system.

While banks announce wicked profits keep looking at the income data for actual working Americans. There is a direct connection here. Those losses of Fannie Mae and Freddie Mac originated from these same dubious banks and will be paid by the taxpayers. You donít hear them bragging about TARP in this scenario.

http://www.doctorhousingbubble.com/a...ousing-market/

Comment