Re: 1997 ?!

Finster, others,

My question has to do with the dollar depreciation situation.

It appears you have the belief that stocks will maintain relative growth vs. inflation while bonds will benefit from 'flight to safety' once the brown stuff hits the air circulator.

However, if there is a dollar collapse would not both (or actually ALL dollar denominated assets) fall equally?

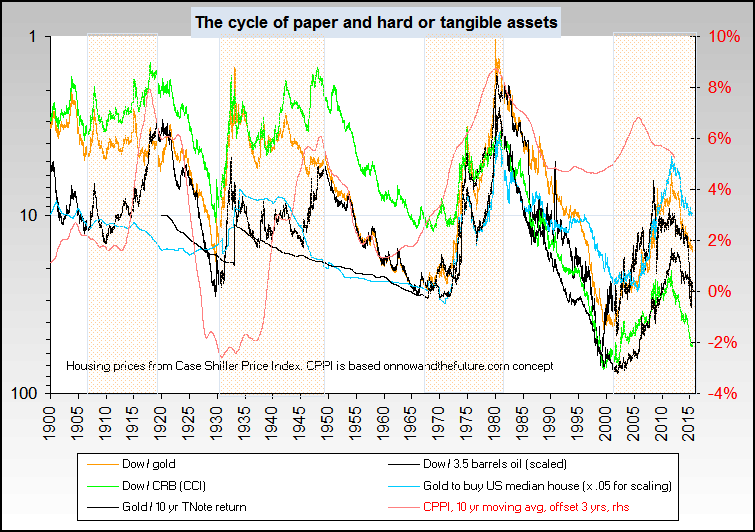

In this case, I will exclude PMs and commodities as these will retain purchasing power value in the face of actual demand.

This has been my primary fear and the reason why I am pushing money into businesses abroad.

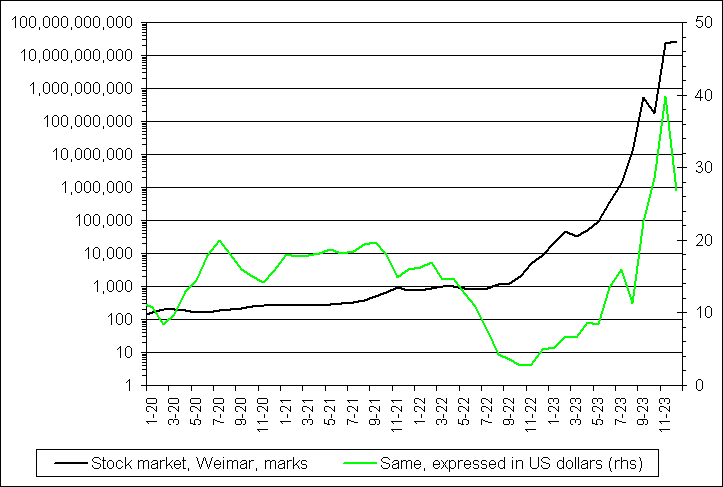

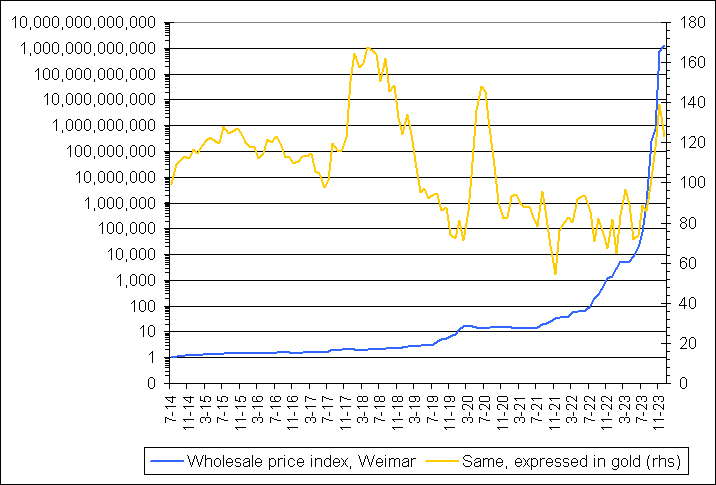

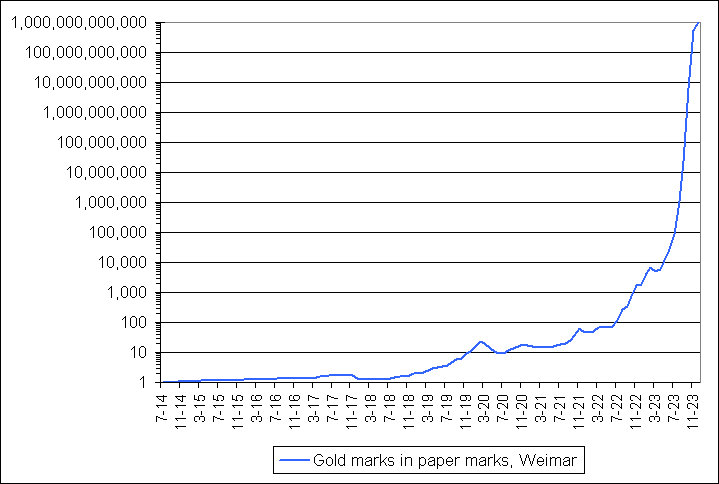

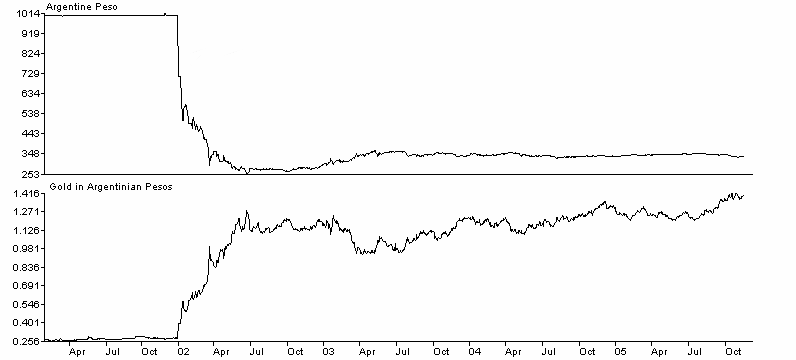

Weimar and Argentina are the examples I fear; while certainly I don't see 1000% inflation in the US, on the other hand a dollar index of 65 is entirely possible.

Finster, others,

My question has to do with the dollar depreciation situation.

It appears you have the belief that stocks will maintain relative growth vs. inflation while bonds will benefit from 'flight to safety' once the brown stuff hits the air circulator.

However, if there is a dollar collapse would not both (or actually ALL dollar denominated assets) fall equally?

In this case, I will exclude PMs and commodities as these will retain purchasing power value in the face of actual demand.

This has been my primary fear and the reason why I am pushing money into businesses abroad.

Weimar and Argentina are the examples I fear; while certainly I don't see 1000% inflation in the US, on the other hand a dollar index of 65 is entirely possible.

Comment