1987? 1999? 1929? no - 1997!

first a brief summary of a skeptical and bearish view from bill cara:

http://www.billcara.com/archives/200..._pre.html#more

[abbreviated, and emphases added] July 14, 2007

As the global economy appears to continue its rapid growth based on expansion of the BRIC economies (Brazil, Russia, India and China), and the US economy staves off recession due to continued growth of the money supply, the conditions are now right for a final blow-off and commencement of a secular Bear, possibly September-October....

The Fed has been taking action because the yield on three-month T-Bills has rallied in three weeks from +4.56 pct to +4.82 pct. As the cost of money increases, there will be some more credit bubbles popping....

Clearly there is a crisis of confidence in the USD. It was just mid-June (less than 4 weeks ago) when the $USD traded at 83.27, whereas the price today is 80.58. Even the 200-day (40-week) Moving average of the $USD is 83.77....

Yes, the monetary conditions are ripe for higher equity prices, but don’t miss note of the fact that commodity prices are rising faster. This week, for instance, traders were agog over the S&P 500 lifting +1.52 pct in a single week, but oil (1.81 pct), gold (+1.91 pct), silver (+2.77 pct) and gold stocks ($XAU +4.19 pct) far out-performed.....

The point I am making here is that, like other things, this equity market is being pulled up by inflation, but the true inflation beneficiaries are beating the paper-backed equities and currencies hands-down....

If you don’t believe that, look at the worst two sectors this week: consumer cyclicals (where XLY is the major ETF) [economy] and Financials (where XLF is the major ETF) [interest-sensitive].

And where the seams are coming apart, and which is the area of interest to seek the driver that will take down this roaring Bull, look at the Financials over the past month. They are the worst of the ten sectors of the market, with XLF being down -2.2 pct. Ugly. Yet, most traders think this market is on a screaming run higher....

I think we are quickly reaching – over the next eight to twelve weeks – the cycle peak for stocks. We, some time ago, reached the peak for bonds. What is left is for commodity prices to spike to their final cycle high. That will complete the cycle.....

Rising interest rates will kill (and have been killing) many home-owners, small banks, and fund managers who are loaded up with debt...

Traders can still protect their assets by eliminating debt, buying puts, writing calls or just plain selling the stocks, and as an absolute minimum raising their protective stops across the equity portfolio.

++++++++++++++++++++++++++++++++++++++++++++++++++ +++++++++++

now, my own thoughts:

the market seems to be suffering from mood swings: 1 day the dji is down 148 because of worries about credit, then, 2 days later, it's up over 200 on the euphoric news that some retailers aren't doing as badly as feared.

bill cara's week in review, extracted above, suggests an 8-12 week blow-off before a smash up in the fall. it seems plausible to me, but i remember having exactly the same expectation a year ago at this time.

i think there's a chance that richard russell is right when he says that this is the beginning of a speculative blowout that won't end until the public is pulled back in. if so,we've got not weeks but years to go before the top.

but i've got trouble reconciling that with the subprime/alt-a/overleveraged-prime credit problems, which seem to be undermining the u.s. economy in several ways: by killing house prices and so closing the housing ATM; by blowing up over-leveraged hedge funds and forcing a repricing on assets held in cdo's and mbs's, which in turn may force investment funds to sell other kinds of holdings in order to meet margin calls and reduce over-all risk exposure. meanwhile the hit to consumption by cutting off HELOC's [home equity lines of credit] is reinforced by increasing food and energy prices which drain consumer buying power. add to this the massive numbers of mortgages in the process of resetting and it's hard to avoid the idea of a consumer-led recession. or at least a consumer-led banana. [Alfred Kahn, one of Jimmy Carter’s economic advisers, was once rebuked by the president for scaring people by talking of looming recession. Mr Kahn, in his next speech, substituted the word banana for recession. here i mean a slowdown, call-it-what-you-will.]

so if russell is right we could have a correction but not a bear market, and that means that somehow the game keeps going. how?

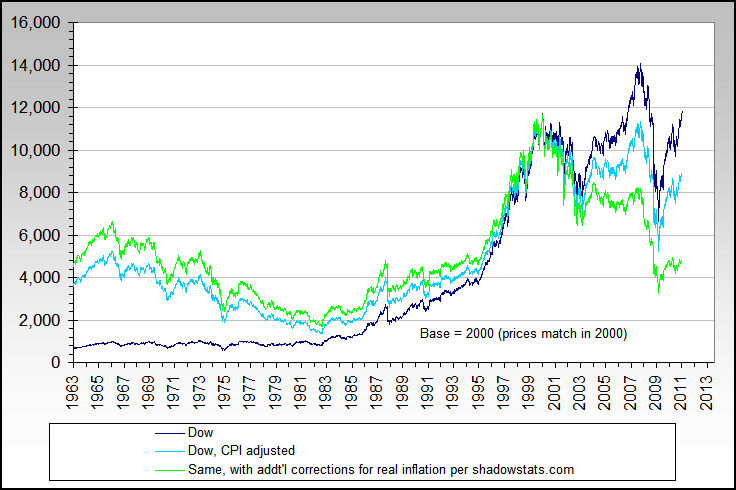

if the fed lowers rates, it would support housing and consumption by lowering the rates on arm's and other floating rate credit, but i think that must mean the dollar plunges, and the cost of oil and food goes higher. i can imagine the stock market rising in this scenario, as u.s. assets will look very cheap compared to overseas assets. note that in euro terms the dow is still 40% below its peak in '01. as finster likes to point out, rising stocks can instead be viewed as cheaper dollars.

as i think about it, this scenario looks a lot like the present. the fed hasn't lowered rates, but credit has been plentiful, the dollar is dropping, oil and food are rising and the stock market is rising as an alternative to cash.

on the other hand, if the fed raises rates, it can support the dollar but at the cost of driving a stake through the now irregularly beating heart of the housing market. long rates might come down some, and fixed rate mortgages get a bit cheaper, but still tighter lending standards are likely to accompany higher short rates.

if the present looks like a fed-lowers-rates scenario, that appears to be changing at the margin. the key is the availability of credit. in housing we see not only the disappearance of "affordability products" like liar loans and neg-am option arms, but we also hear that financing for lbo's/pe-deals is becoming a little tighter. covenant-lite is harder to come by, and buyers are turning to banks for bridge loans that they hadn't needed to use in the recent past. this is all the spawn of the slow motion subprime-etc-etc debacle.

i can imagine the fed holding rates just where they are until they are absolutely forced to make a shift. it's your choice whether you want to see this as deer-in-the-headlights, frozen with fear non-functioning, or as stalwart, hold-the-course courage that they've got it right. either way, we'd see the credit markets slowly turning off the flow of pe buyouts and removing this prop from equities. on the other hand, you've got the sovereign investment funds and other potential foreign buyers who can move into u.s. assets, and if the market can just keep going a while, at some point you've got individual investors who swore off the market in 2002 eventually being sucked, or suckered, back in, say in 2008 or '09.

avoiding a serious recession and avoiding more than a "correction" in equities depends on the economy becoming somewhat less dependent on consumption and somewhat more successful in exporting, while [especially asian] other economies pick up the pace of their own consumption. can this handoff be made without severe disruption in the interim?

i think the answer depends on your definition of "severe."

were the events of 1997-98 -- the "asian contagion," the russian default and the ltcm episode -- "severe"? they certainly seemed severe at the time, and the fed thought the global financial structure could topple if ltcm wasn't "handled" carefully.

but in retrospect the equity sell-off in 1998 was just "the pause that refreshes" for the 1990's bull market. the dji dropped from just over 9000 to just under 8000, about 11%. the s&p dropped from about 1200 to about 1000, about 17%. i.e. we had "a correction" of over 10% and under 20%. the nasdaq dropped harder, about 25% from 2000 to 1500. but of course the naz went on to star in the last act.

commentators have been comparing our current circumstances to 1987 and 1999. stock market analysts are driven, i have noticed, to find historical parallels. and in detail: is it the "spring of '87" or the "summer of 1999"? or, god forbid, the summer of 1929? we look to the past for guidance and stuggle to find the right historical epoch as a repository for our fears and hopes.

i'd like to nominate 1997, but upside-down, inside-out and in slow motion.

if you recall, the 1997 "asian contagion" started with a speculative attack against the over-valued thai baht.

[from a paper on the thai crisis @ http://www.columbia.edu/cu/thai/html...cial97_98.html ]

Thailand had had persistent current account deficit ranging from -5.08 to -8.10 % of GDP [from 1990-96] lowest among the other nations for most of the time in the sample [of asian countries]. This negative sum largely came from the country’s balance of trade deficit. The value of its imports had widely exceeded its export value.

does this high current account deficit arising from a high trade deficit remind you of the recent multi-year experience of another country you know?

from the paper on thailand:

"This high volume of imports could be expected as the country had had a high GDP growth rate [5.52 to 8.94% in the years 1990-96]."

that sure doesn't fit.

from the paper on thailand:

"However, the number could look better if Thai people had been more prudent in spending and could be more competitive exporters. During the boom period, the economy was in a bubble. Thai people had had an expectation of a long run economic growth of their country; thus, their consumption had become quite excessive especially in imported commodities and luxuries."

thais had been the recipients of a lot of foreign credit, much of which had been invested in real estate- commercial buildings, luxury condos, golf courses and the like. i.e. the credit was invested in things that didn't generate foreign income. that's starting to sound familiar again, isn't it? we've got the real estate boom, the consumption boom and, in addition, a black hole for money in the form of the war[s] in the middle east.

but the baht was pegged to the dollar, and the foreign debt was denominated in dollars. speculators saw that the baht was overvalued and began selling it. eventually, thailand was forced to devalue.

of course, the u.s. isn't thailand. as owner of the world's reserve currency, the u.s. gets to take on its debt in u.s. dollars. thailand couldn't print dollars to pay back its debts. we can. big difference.

and russia defaulted around the same time because oil was so cheap. oil is no longer cheap. another big difference.

and ltcm could threaten the world's financial system because it had huge leverage supporting huge positions which, although usually uncorrelated, became correlated in a crisis. no difference. there's now huge leverage supporting huge positions, and just about everything still gets correlated in a crisis. so big similarity.

nobody outside thailand cared all that much about the fate of the baht, at least at first. the baht's problems were contained to thailand, it was thought. [like the problems in the credit system are "contained" to a sliver of subprime - right.] the baht represented a little problem on the financial system's "periphery."

central banks all around the world care about the fate of the u.s. dollar: the dollar is at the center of the financial system. they all know that a dollar crisis will be contained only to the immediate planet.

so how about 1997-98 inside-out, upside-down and in slo-mo? i don't think it's coming, i think it's here.

we already have a dollar crisis, but it's playing out in slow motion and no one wants to talk about it too loudly for fear of frightening the flock. overwhelming foreign debt caused a quick devaluation of the baht. overwhelming foreign debt is causing a slow devaluation of the u.s. dollar.

russia was pressured by cheap oil killing its income stream. the u.s. is pressured by expensive oil killing it on the expense side of the ledger.

ltcm was hit by its leveraged bets suddenly becoming correlated as they all went south together. this is what is in the process of playing out in the credit markets right now. but slowly, slowly.

so how about a 1998 sized crisis? a consumer banana severe enough to drop markets and scare a lot of people and bust a lot of bonds. but as with ltcm, there will be a rescue. we already see pieces of it in various state funds to help exploited subprime liar buyers, and we'll see more, and on a bigger scale from the feds. and somehow, when the derivatives explode, the fed will remember its role as lender of last resort, and it will liquify the markets. there will be casualties, sure. but then, after the sell-off, the correction, comes the exciting 3rd stage of the bull market, propelled on a tide of liquidity that, compared to today, will be as a tsunami to a ripple. ka-poom indeed.

first a brief summary of a skeptical and bearish view from bill cara:

http://www.billcara.com/archives/200..._pre.html#more

[abbreviated, and emphases added] July 14, 2007

As the global economy appears to continue its rapid growth based on expansion of the BRIC economies (Brazil, Russia, India and China), and the US economy staves off recession due to continued growth of the money supply, the conditions are now right for a final blow-off and commencement of a secular Bear, possibly September-October....

The Fed has been taking action because the yield on three-month T-Bills has rallied in three weeks from +4.56 pct to +4.82 pct. As the cost of money increases, there will be some more credit bubbles popping....

Clearly there is a crisis of confidence in the USD. It was just mid-June (less than 4 weeks ago) when the $USD traded at 83.27, whereas the price today is 80.58. Even the 200-day (40-week) Moving average of the $USD is 83.77....

Yes, the monetary conditions are ripe for higher equity prices, but don’t miss note of the fact that commodity prices are rising faster. This week, for instance, traders were agog over the S&P 500 lifting +1.52 pct in a single week, but oil (1.81 pct), gold (+1.91 pct), silver (+2.77 pct) and gold stocks ($XAU +4.19 pct) far out-performed.....

The point I am making here is that, like other things, this equity market is being pulled up by inflation, but the true inflation beneficiaries are beating the paper-backed equities and currencies hands-down....

If you don’t believe that, look at the worst two sectors this week: consumer cyclicals (where XLY is the major ETF) [economy] and Financials (where XLF is the major ETF) [interest-sensitive].

And where the seams are coming apart, and which is the area of interest to seek the driver that will take down this roaring Bull, look at the Financials over the past month. They are the worst of the ten sectors of the market, with XLF being down -2.2 pct. Ugly. Yet, most traders think this market is on a screaming run higher....

I think we are quickly reaching – over the next eight to twelve weeks – the cycle peak for stocks. We, some time ago, reached the peak for bonds. What is left is for commodity prices to spike to their final cycle high. That will complete the cycle.....

Rising interest rates will kill (and have been killing) many home-owners, small banks, and fund managers who are loaded up with debt...

Traders can still protect their assets by eliminating debt, buying puts, writing calls or just plain selling the stocks, and as an absolute minimum raising their protective stops across the equity portfolio.

++++++++++++++++++++++++++++++++++++++++++++++++++ +++++++++++

now, my own thoughts:

the market seems to be suffering from mood swings: 1 day the dji is down 148 because of worries about credit, then, 2 days later, it's up over 200 on the euphoric news that some retailers aren't doing as badly as feared.

bill cara's week in review, extracted above, suggests an 8-12 week blow-off before a smash up in the fall. it seems plausible to me, but i remember having exactly the same expectation a year ago at this time.

i think there's a chance that richard russell is right when he says that this is the beginning of a speculative blowout that won't end until the public is pulled back in. if so,we've got not weeks but years to go before the top.

but i've got trouble reconciling that with the subprime/alt-a/overleveraged-prime credit problems, which seem to be undermining the u.s. economy in several ways: by killing house prices and so closing the housing ATM; by blowing up over-leveraged hedge funds and forcing a repricing on assets held in cdo's and mbs's, which in turn may force investment funds to sell other kinds of holdings in order to meet margin calls and reduce over-all risk exposure. meanwhile the hit to consumption by cutting off HELOC's [home equity lines of credit] is reinforced by increasing food and energy prices which drain consumer buying power. add to this the massive numbers of mortgages in the process of resetting and it's hard to avoid the idea of a consumer-led recession. or at least a consumer-led banana. [Alfred Kahn, one of Jimmy Carter’s economic advisers, was once rebuked by the president for scaring people by talking of looming recession. Mr Kahn, in his next speech, substituted the word banana for recession. here i mean a slowdown, call-it-what-you-will.]

so if russell is right we could have a correction but not a bear market, and that means that somehow the game keeps going. how?

if the fed lowers rates, it would support housing and consumption by lowering the rates on arm's and other floating rate credit, but i think that must mean the dollar plunges, and the cost of oil and food goes higher. i can imagine the stock market rising in this scenario, as u.s. assets will look very cheap compared to overseas assets. note that in euro terms the dow is still 40% below its peak in '01. as finster likes to point out, rising stocks can instead be viewed as cheaper dollars.

as i think about it, this scenario looks a lot like the present. the fed hasn't lowered rates, but credit has been plentiful, the dollar is dropping, oil and food are rising and the stock market is rising as an alternative to cash.

on the other hand, if the fed raises rates, it can support the dollar but at the cost of driving a stake through the now irregularly beating heart of the housing market. long rates might come down some, and fixed rate mortgages get a bit cheaper, but still tighter lending standards are likely to accompany higher short rates.

if the present looks like a fed-lowers-rates scenario, that appears to be changing at the margin. the key is the availability of credit. in housing we see not only the disappearance of "affordability products" like liar loans and neg-am option arms, but we also hear that financing for lbo's/pe-deals is becoming a little tighter. covenant-lite is harder to come by, and buyers are turning to banks for bridge loans that they hadn't needed to use in the recent past. this is all the spawn of the slow motion subprime-etc-etc debacle.

i can imagine the fed holding rates just where they are until they are absolutely forced to make a shift. it's your choice whether you want to see this as deer-in-the-headlights, frozen with fear non-functioning, or as stalwart, hold-the-course courage that they've got it right. either way, we'd see the credit markets slowly turning off the flow of pe buyouts and removing this prop from equities. on the other hand, you've got the sovereign investment funds and other potential foreign buyers who can move into u.s. assets, and if the market can just keep going a while, at some point you've got individual investors who swore off the market in 2002 eventually being sucked, or suckered, back in, say in 2008 or '09.

avoiding a serious recession and avoiding more than a "correction" in equities depends on the economy becoming somewhat less dependent on consumption and somewhat more successful in exporting, while [especially asian] other economies pick up the pace of their own consumption. can this handoff be made without severe disruption in the interim?

i think the answer depends on your definition of "severe."

were the events of 1997-98 -- the "asian contagion," the russian default and the ltcm episode -- "severe"? they certainly seemed severe at the time, and the fed thought the global financial structure could topple if ltcm wasn't "handled" carefully.

but in retrospect the equity sell-off in 1998 was just "the pause that refreshes" for the 1990's bull market. the dji dropped from just over 9000 to just under 8000, about 11%. the s&p dropped from about 1200 to about 1000, about 17%. i.e. we had "a correction" of over 10% and under 20%. the nasdaq dropped harder, about 25% from 2000 to 1500. but of course the naz went on to star in the last act.

commentators have been comparing our current circumstances to 1987 and 1999. stock market analysts are driven, i have noticed, to find historical parallels. and in detail: is it the "spring of '87" or the "summer of 1999"? or, god forbid, the summer of 1929? we look to the past for guidance and stuggle to find the right historical epoch as a repository for our fears and hopes.

i'd like to nominate 1997, but upside-down, inside-out and in slow motion.

if you recall, the 1997 "asian contagion" started with a speculative attack against the over-valued thai baht.

[from a paper on the thai crisis @ http://www.columbia.edu/cu/thai/html...cial97_98.html ]

Thailand had had persistent current account deficit ranging from -5.08 to -8.10 % of GDP [from 1990-96] lowest among the other nations for most of the time in the sample [of asian countries]. This negative sum largely came from the country’s balance of trade deficit. The value of its imports had widely exceeded its export value.

does this high current account deficit arising from a high trade deficit remind you of the recent multi-year experience of another country you know?

from the paper on thailand:

"This high volume of imports could be expected as the country had had a high GDP growth rate [5.52 to 8.94% in the years 1990-96]."

that sure doesn't fit.

from the paper on thailand:

"However, the number could look better if Thai people had been more prudent in spending and could be more competitive exporters. During the boom period, the economy was in a bubble. Thai people had had an expectation of a long run economic growth of their country; thus, their consumption had become quite excessive especially in imported commodities and luxuries."

thais had been the recipients of a lot of foreign credit, much of which had been invested in real estate- commercial buildings, luxury condos, golf courses and the like. i.e. the credit was invested in things that didn't generate foreign income. that's starting to sound familiar again, isn't it? we've got the real estate boom, the consumption boom and, in addition, a black hole for money in the form of the war[s] in the middle east.

but the baht was pegged to the dollar, and the foreign debt was denominated in dollars. speculators saw that the baht was overvalued and began selling it. eventually, thailand was forced to devalue.

of course, the u.s. isn't thailand. as owner of the world's reserve currency, the u.s. gets to take on its debt in u.s. dollars. thailand couldn't print dollars to pay back its debts. we can. big difference.

and russia defaulted around the same time because oil was so cheap. oil is no longer cheap. another big difference.

and ltcm could threaten the world's financial system because it had huge leverage supporting huge positions which, although usually uncorrelated, became correlated in a crisis. no difference. there's now huge leverage supporting huge positions, and just about everything still gets correlated in a crisis. so big similarity.

nobody outside thailand cared all that much about the fate of the baht, at least at first. the baht's problems were contained to thailand, it was thought. [like the problems in the credit system are "contained" to a sliver of subprime - right.] the baht represented a little problem on the financial system's "periphery."

central banks all around the world care about the fate of the u.s. dollar: the dollar is at the center of the financial system. they all know that a dollar crisis will be contained only to the immediate planet.

so how about 1997-98 inside-out, upside-down and in slo-mo? i don't think it's coming, i think it's here.

we already have a dollar crisis, but it's playing out in slow motion and no one wants to talk about it too loudly for fear of frightening the flock. overwhelming foreign debt caused a quick devaluation of the baht. overwhelming foreign debt is causing a slow devaluation of the u.s. dollar.

russia was pressured by cheap oil killing its income stream. the u.s. is pressured by expensive oil killing it on the expense side of the ledger.

ltcm was hit by its leveraged bets suddenly becoming correlated as they all went south together. this is what is in the process of playing out in the credit markets right now. but slowly, slowly.

so how about a 1998 sized crisis? a consumer banana severe enough to drop markets and scare a lot of people and bust a lot of bonds. but as with ltcm, there will be a rescue. we already see pieces of it in various state funds to help exploited subprime liar buyers, and we'll see more, and on a bigger scale from the feds. and somehow, when the derivatives explode, the fed will remember its role as lender of last resort, and it will liquify the markets. there will be casualties, sure. but then, after the sell-off, the correction, comes the exciting 3rd stage of the bull market, propelled on a tide of liquidity that, compared to today, will be as a tsunami to a ripple. ka-poom indeed.

Comment