Re: 1997 ?!

bart,

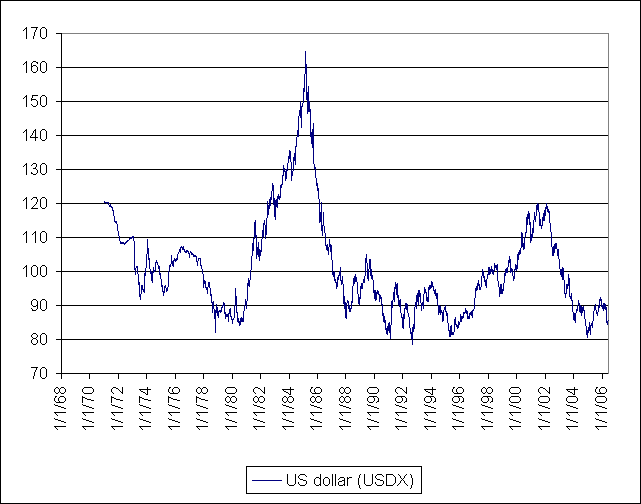

the biggest factor in your model is the currency "deviation from trend." what kind of currency and/or gold moves would it take to make those lines shoot up to say .60 or .70?

Originally posted by bart

View Post

the biggest factor in your model is the currency "deviation from trend." what kind of currency and/or gold moves would it take to make those lines shoot up to say .60 or .70?

Comment