http://www.doctorhousingbubble.com/o...erw/#more-3815

A nice summary excerpted from the 2010 US Census

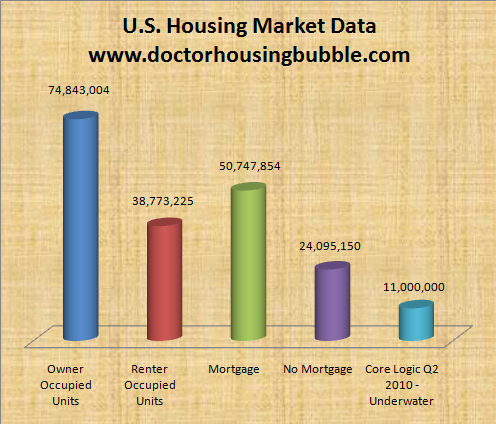

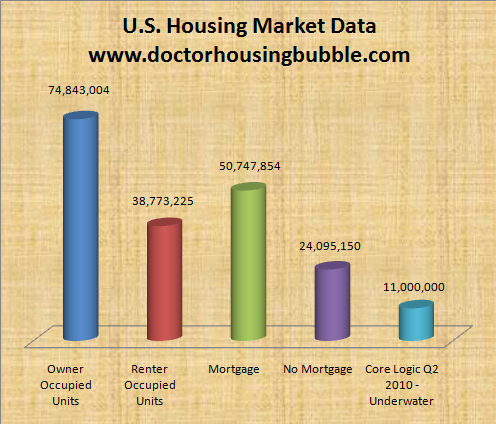

As mentioned previously, there are about 110 million US households. The actual number is apparently 113616229

Of these, 74843004 'own' their places of residence. And of these, 50747854 have mortgages - the 2/3rds mentioned numerous times.

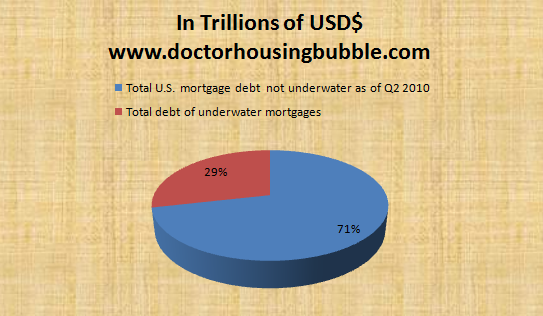

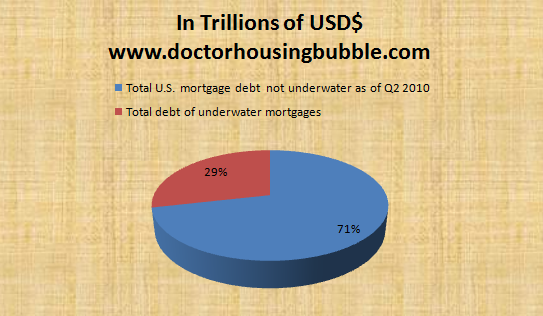

Of those 50M odd households, the total amount of negative equity (and the overall pie) - is startling: $2.9 trillion in negative equity mortgages

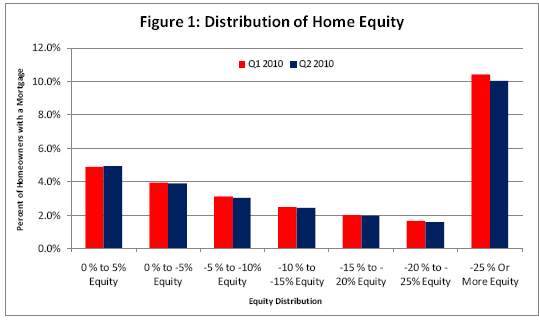

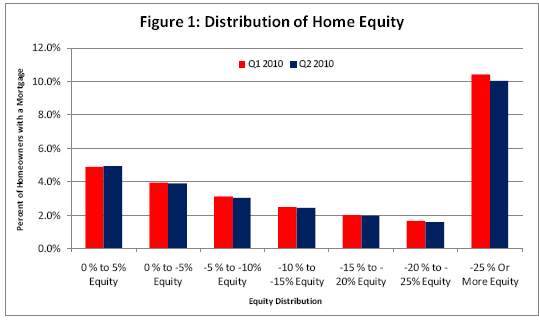

The distribution of negative equity is also fairly startling:

Note this doesn't take into account the costs of selling a home - typically a 6% commission paid for by seller. Shift all the x-axis labels by 6% to compensate.

So over 1 million homes/households are 30% or greater negative equity. I think it is safe to say these aren't going to move or sell anytime soon and are virtually guaranteed to default at some point.

Another nearly 1 million homes/households are 10% to 30% underwater - similar to above, but slightly higher chances of not defaulting. Say snowball in Sahara as opposed to Hell.

So there are about 2 million homes/households getting a temporary free ride before getting booted onto the street. Alternatively, the sovereign wealth funds/pension funds/whatever investors are going to eat some large part of $2.9 trillion in losses.

EJ's proposal to remove this excess negative equity has its merits, but of course the process of doing so swells the US government debt by another multiple trillion - and also doesn't fix the ongoing labor competitiveness issues.

A nice summary excerpted from the 2010 US Census

As mentioned previously, there are about 110 million US households. The actual number is apparently 113616229

Of these, 74843004 'own' their places of residence. And of these, 50747854 have mortgages - the 2/3rds mentioned numerous times.

Of those 50M odd households, the total amount of negative equity (and the overall pie) - is startling: $2.9 trillion in negative equity mortgages

The distribution of negative equity is also fairly startling:

Note this doesn't take into account the costs of selling a home - typically a 6% commission paid for by seller. Shift all the x-axis labels by 6% to compensate.

So over 1 million homes/households are 30% or greater negative equity. I think it is safe to say these aren't going to move or sell anytime soon and are virtually guaranteed to default at some point.

Another nearly 1 million homes/households are 10% to 30% underwater - similar to above, but slightly higher chances of not defaulting. Say snowball in Sahara as opposed to Hell.

So there are about 2 million homes/households getting a temporary free ride before getting booted onto the street. Alternatively, the sovereign wealth funds/pension funds/whatever investors are going to eat some large part of $2.9 trillion in losses.

EJ's proposal to remove this excess negative equity has its merits, but of course the process of doing so swells the US government debt by another multiple trillion - and also doesn't fix the ongoing labor competitiveness issues.

Comment