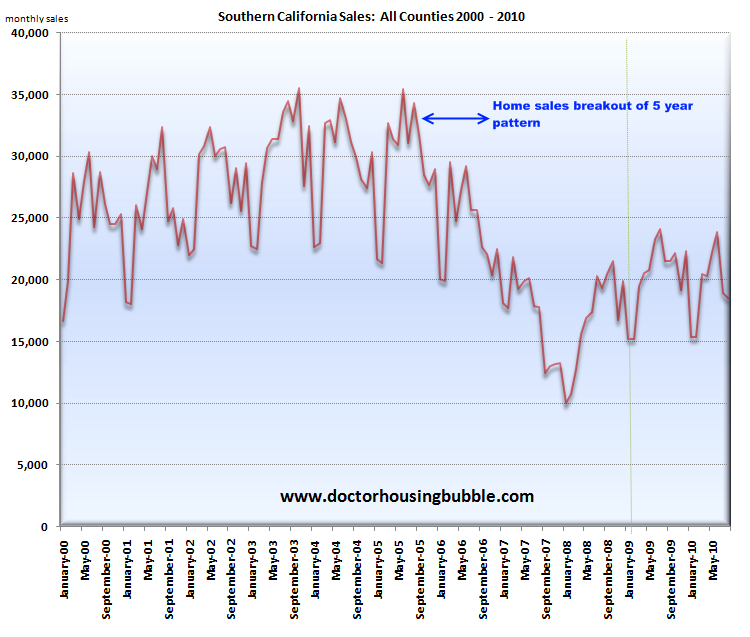

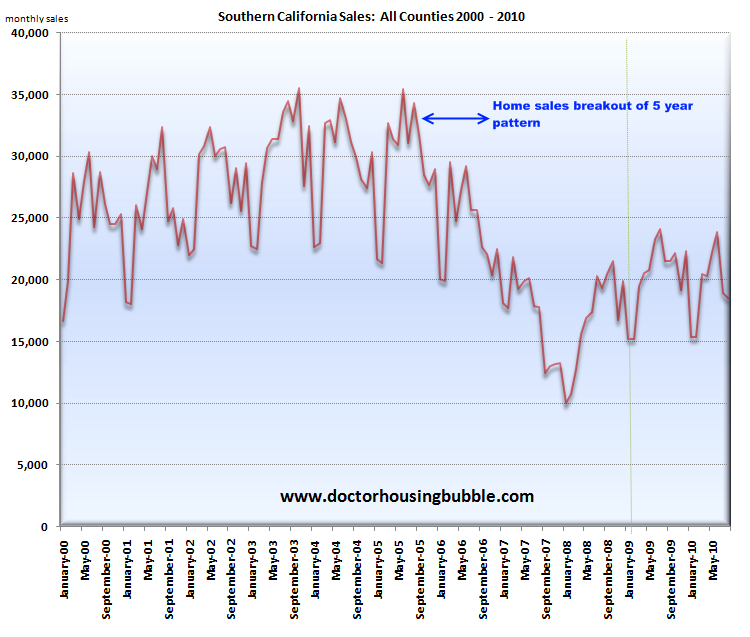

Southern California home sales have collapsed for July and August. These are typically strong sales months. The summer is usually a solid time for sales but the introduction of government intervention, banks stalling, and toxic mortgages lingering on bank balance sheets have thrown a wrench into the typical home sales patterns. This August was the weakest month on record since August 2007, right when the California housing market was first entering the major price correction phase of the bursting bubble. It is interesting that many are blaming the tax credit for this collapse yet the tax credit was an artificial stimulus. It wasnít designed to be permanent since it actually costs taxpayers money and is highly inefficient. The problem with home sales collapsing in Southern California has to do with home prices being too expensive. Back in 2005 and 2006 when we were in the early days of the bubble, we saw the collapse in home sales as a sign that prices will fall later. Is the collapse in home sales a leading indicator that prices are to follow in 2011? Let us examine the trend.

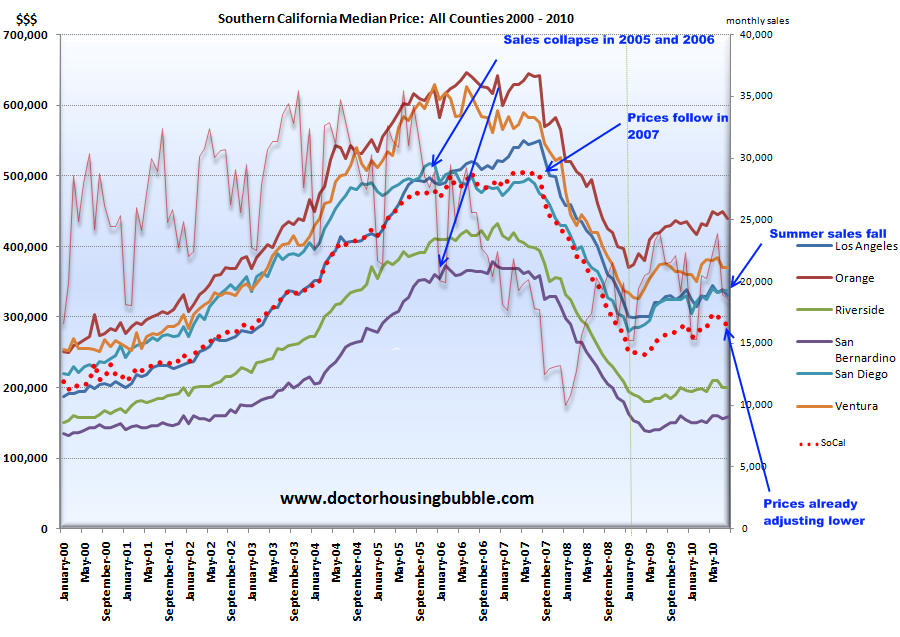

From 2000 to 2005 the home sales pattern for Southern California was rather clear and predictable. Home sales would spike in the spring and summer seasons and this is typical. This was then followed by the slower fall and winter seasons. Yet in late 2005 the winter season took a big hit and the 2006 spring and summer saw no bounce. This set the stage up for the collapse in prices in 2007. The lag from sales to prices was one year. And this makes sense. With fewer sales the market was suddenly building up a large amount of inventory. The toxic mortgage appetite was then gone so financing options were off the table thus reducing the base of potential buyers (i.e., everyone with a pulse to those with verifiable income). It took one full year for prices to suddenly adjust. The collapse in home sales this summer is more than merely the tax credit expiring. The economy is still in bad shape especially in California. With no budget in place and a change in leadership coming soon, it is hard to say what we can expect in the next year. The general sentiment in the market is the public is now completely focused on jobs and everything else is secondary.

Focusing on housing and keeping prices inflated has actually hurt the economy. We have given banks and politicians three years to do it their way and look where we are now. The mission has been simply to focus on keeping home prices inflated but in the end, this is bad policy because people with lower incomes due to the economy can only afford a certain mortgage amount. By keeping prices artificially high, you effectively stifle demand and we are now seeing that. In essence this is a complicated price floor. The tax credit subsidy actually made home prices cheaper but through an expensive mechanism that cost taxpayers billions of dollars. Wouldnít it be simpler to simply let the market adjust prices to what people can currently afford? If we are going to blow billions of dollars why not focus the money on jobs?

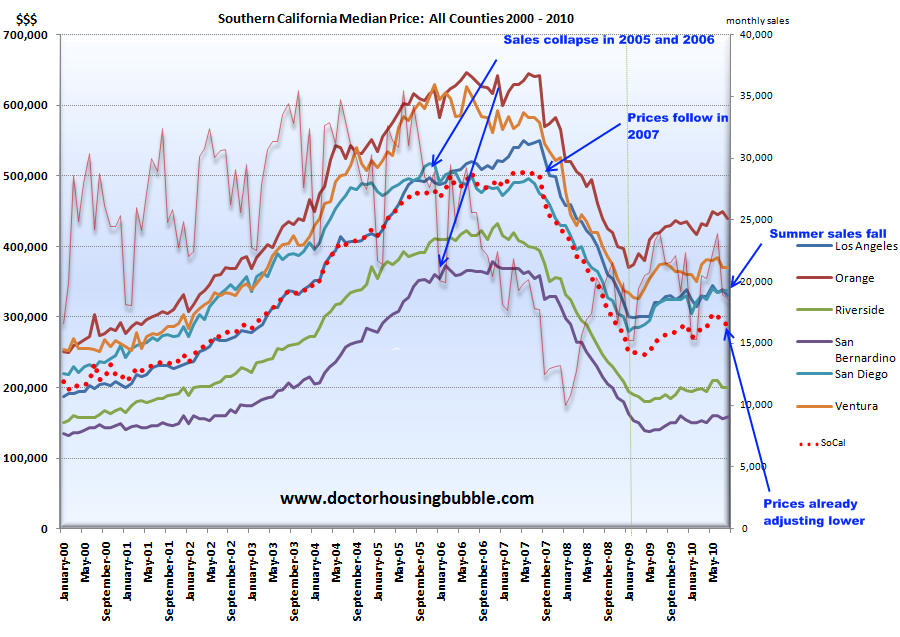

Home prices in Southern California have now fallen for three consecutive months:

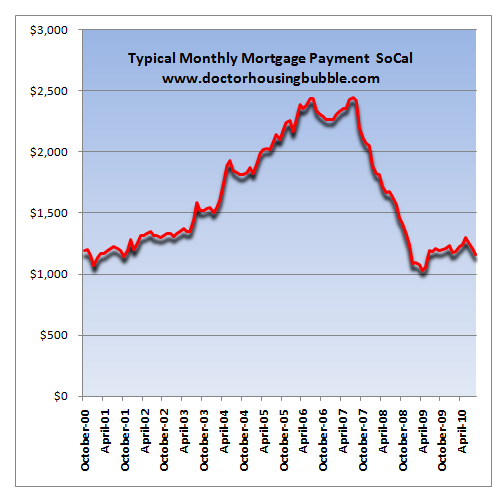

This is actually a departure from the trend back in 2005 and 2006. The lag was much deeper back then. It is also a very different market. Back in 2007 the foreclosure pipeline was only being built up. Now, for over 2 solid years foreclosure resales account for 30 to 50 percent of all monthly sales (last month it was 34.7 percent). So a large portion of the market is being driven by distressed properties. Much of this used to come from toxic mortgagesFHA loansfrom FHA insured loans in Southern California. By looking at the data on FHA loans in California we know that many only go in with the lowest down payment possible and that only requires 3.5 percent of the purchase price. Is it any wonder that FHA defaults are growing exponentially? Even with this easy money, they typical payment Southern California buyers can commit to has consistently dropped: but now we are seeing a good portion of defaults with folks with vanilla 30-year fixed mortgages. still dominate the market. Over 36 percent of sales last month came

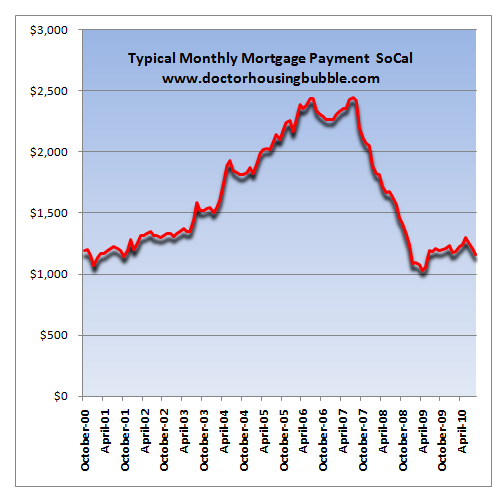

Southern Californians can only commit to so much and the typical mortgage payment last month was $1,158. This is a far cry of the $2,400 peak in 2006. So for the monthly nut, it is already obvious that California home buyers can only afford half of what they could in 2006. The toxic mortgages during that time allowed for additional leverage that is now completely gone. What does the above tell us? That home prices need to come down in many areas.

If you think about what the Fed has done they have rigged the system in every way possible trying to keep prices inflated while keeping the monthly nut low. For example, forcing mortgage rates lower gives more leverage on the monthly nut for buyers but allows banks to keep prices inflated. What use is that? If interest rates go up and there isnít much room on the downside, then when you sell in a few years the new buyer wonít have the leverage that you currently have. In other words, you are buying for the absolute long run right now with very little flexibility. The tax credit? Donít expect that to be an option in a few years. In other words, it is all about the short-term right now and as we are now seeing from actions of 2006 and 2007, those policies did nothing to improve the health of the economy or the housing market unless you believe financial media hype and actually think the economy is good right now.

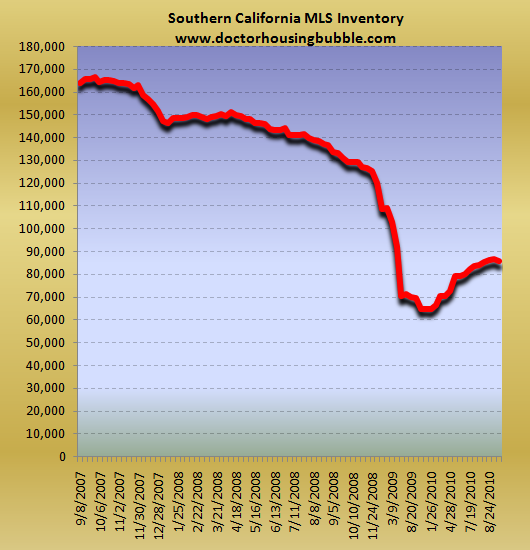

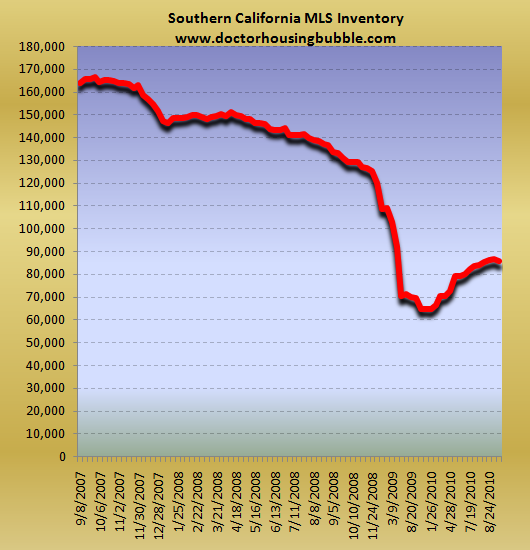

And because of this, supply is now growing:

Even basic economics would tell you that more supply with less demand (because of the economy) would push prices lower. Even Bank of America earlier this year stated they would increase foreclosures by December of 2010:

If we actually practice capitalism and donít have more interventions, prices should go lower because that is what people can afford. Southern California in general is still in a bubble in many areas. When there is a bubble, things usually pop and prices come down.

http://www.doctorhousingbubble.com/c...011/#more-3712

From 2000 to 2005 the home sales pattern for Southern California was rather clear and predictable. Home sales would spike in the spring and summer seasons and this is typical. This was then followed by the slower fall and winter seasons. Yet in late 2005 the winter season took a big hit and the 2006 spring and summer saw no bounce. This set the stage up for the collapse in prices in 2007. The lag from sales to prices was one year. And this makes sense. With fewer sales the market was suddenly building up a large amount of inventory. The toxic mortgage appetite was then gone so financing options were off the table thus reducing the base of potential buyers (i.e., everyone with a pulse to those with verifiable income). It took one full year for prices to suddenly adjust. The collapse in home sales this summer is more than merely the tax credit expiring. The economy is still in bad shape especially in California. With no budget in place and a change in leadership coming soon, it is hard to say what we can expect in the next year. The general sentiment in the market is the public is now completely focused on jobs and everything else is secondary.

Focusing on housing and keeping prices inflated has actually hurt the economy. We have given banks and politicians three years to do it their way and look where we are now. The mission has been simply to focus on keeping home prices inflated but in the end, this is bad policy because people with lower incomes due to the economy can only afford a certain mortgage amount. By keeping prices artificially high, you effectively stifle demand and we are now seeing that. In essence this is a complicated price floor. The tax credit subsidy actually made home prices cheaper but through an expensive mechanism that cost taxpayers billions of dollars. Wouldnít it be simpler to simply let the market adjust prices to what people can currently afford? If we are going to blow billions of dollars why not focus the money on jobs?

Home prices in Southern California have now fallen for three consecutive months:

This is actually a departure from the trend back in 2005 and 2006. The lag was much deeper back then. It is also a very different market. Back in 2007 the foreclosure pipeline was only being built up. Now, for over 2 solid years foreclosure resales account for 30 to 50 percent of all monthly sales (last month it was 34.7 percent). So a large portion of the market is being driven by distressed properties. Much of this used to come from toxic mortgagesFHA loansfrom FHA insured loans in Southern California. By looking at the data on FHA loans in California we know that many only go in with the lowest down payment possible and that only requires 3.5 percent of the purchase price. Is it any wonder that FHA defaults are growing exponentially? Even with this easy money, they typical payment Southern California buyers can commit to has consistently dropped: but now we are seeing a good portion of defaults with folks with vanilla 30-year fixed mortgages. still dominate the market. Over 36 percent of sales last month came

Southern Californians can only commit to so much and the typical mortgage payment last month was $1,158. This is a far cry of the $2,400 peak in 2006. So for the monthly nut, it is already obvious that California home buyers can only afford half of what they could in 2006. The toxic mortgages during that time allowed for additional leverage that is now completely gone. What does the above tell us? That home prices need to come down in many areas.

If you think about what the Fed has done they have rigged the system in every way possible trying to keep prices inflated while keeping the monthly nut low. For example, forcing mortgage rates lower gives more leverage on the monthly nut for buyers but allows banks to keep prices inflated. What use is that? If interest rates go up and there isnít much room on the downside, then when you sell in a few years the new buyer wonít have the leverage that you currently have. In other words, you are buying for the absolute long run right now with very little flexibility. The tax credit? Donít expect that to be an option in a few years. In other words, it is all about the short-term right now and as we are now seeing from actions of 2006 and 2007, those policies did nothing to improve the health of the economy or the housing market unless you believe financial media hype and actually think the economy is good right now.

And because of this, supply is now growing:

Even basic economics would tell you that more supply with less demand (because of the economy) would push prices lower. Even Bank of America earlier this year stated they would increase foreclosures by December of 2010:

ď(IHB) I attended a local Building Industry Association conference on Friday 26 March 2010. The west coast manager of real estate owned, Senior Vice President Ken Gaitan, stated that Bank of America, which currently forecloses on 7,500 homes a month nationally, will increase that number to 45,000 homes per month by December of 2010.

After his surprising statement, two questioners from the audience asked questions to verify the numbers.

Bank of America is projecting a 600% increase in its already large number of monthly foreclosures. Ē

Now Iíve been following shadow inventory for Southern California very carefully for years and right now the amount of shadow inventory is twice the size of the MLS data. Given the current collapse in sales, you wonder if banks will follow through with their own stated goals. Banks are at the root of the problem so donít expect them to do as stated. The government isnít enforcing anything when it comes to streamlining foreclosures so right now, the foreclosure process is basically whatever banks feel like doing which is absolute nonsense since this is the industry that created the toxic mortgage asset bubble in the first place.After his surprising statement, two questioners from the audience asked questions to verify the numbers.

Bank of America is projecting a 600% increase in its already large number of monthly foreclosures. Ē

If we actually practice capitalism and donít have more interventions, prices should go lower because that is what people can afford. Southern California in general is still in a bubble in many areas. When there is a bubble, things usually pop and prices come down.

http://www.doctorhousingbubble.com/c...011/#more-3712

"Housing prices went up last month!" Nothing falls in a straight line... I think it is just hard for some folks to fathom some things, like interest rates could go to 15-18% again.... They have been going down for 30 years.

"Housing prices went up last month!" Nothing falls in a straight line... I think it is just hard for some folks to fathom some things, like interest rates could go to 15-18% again.... They have been going down for 30 years.

Comment