http://exiledonline.com/manhattans-w...re/#more-23949

Most people know next to nothing about this $20 billion-a-year welfare for the rich program, probably because the billionaires want it that way. Why get the masses worked up? Best to let them think the $200 billion they spent from 1995 through 2006 went to friendly farmers with cute farmhouses, rather than to Chevron or Kenneth Lay. Better to let urban entrepreneurs call themselves backyard farmers and toil away for the locavore movement, than to realize that their rich neighbors are reaping actual “farm” subsidies.

Now, farm subsidies weren’t always this criminal and, until fairly recently, had been doing what New Deal programs were designed to do: help the little guy. But the freemarket “reforms” of the Reagan-Clinton Era warped the welfare, redirecting farm subsidies from the have-nots to the have-mores, bankrupting all but the biggest farmers and depositing farm subsides into the bank accounts of the rich.

There’s no need to go to Iowa to see this welfare-for-the-rich in action. You can see it on the Upper East Side, where billionaire elites collect huge welfare checks from the government just for being rich, while a few blocks away, in one of the poorest, most ghettoized districts in the United States, the city’s black population is being purged from food stamp rolls for smoking some dope. Because, as Mayor Rudy Giuliani once wisely said, “As soon as they stop being dependent on the government, they’re moving in a much healthier direction.”

Norman B. Champ Jr: Wall Street Welfare PrinceBut brutal freemarket ideas don’t apply to members of Manhattan’s genteel farmer class, even billionaires like Norman B. Champ III, who received nearly a half-million dollars in welfare payments for poor farmers, despite the fact that he lives in a multimillion dollar co-op at 828 Park Avenue. From 1995 to 2006, he raked in a total of $405,807 in dairy, corn and soy subsidies via his stake in the Champ family’s dairy farm in Missouri, his home state. Handout-for-handout, even Reagan’s mythic Cadillac-driving Chicago welfare queen and her $150,000 welfare scam got nothing on Champ, who could buy a Lamborghini and still have money left over to reupholster his private jet.

Norman B. Champ III, 47, was born into a wealthy, upper-crust Missouri family and lived a privileged life (the Champs had a Missouri village named after them in their honor: the Village of Champ). He graduated summa cum laude from Princeton University, went to England for a masters in war studies from King’s College and earned a law degree—cum laude, of course—from Harvard, after which he finally settled down at Chilton Investment Company, a multi-billion dollar hedge fund. He had added three titles to his name—Executive Vice President, General Counsel, Chief Compliance Officer—by the time the markets crashed. He lost no time jumping ship to a cushy government job with the Securities and Exchange Commission, coming on board in January 2010 to start a new life as a financial regulator at the SEC’s New York Inspections and Examinations Division. He now leads a team of 100 hardworking investigators in a crusade to crack down on the shady dealings of his hedge-fund buddies.

An upper-crust billionaire type who lives in one of the nation’s wealthiest ZIP codes and collects welfare meant for struggling farmers? Whatta champ!

He might not be what most of us expect a welfare queen to look like, but that’s only because we have been duped by the whole poverty thing, convinced that the crumbs we throw the needy are a huge burden on our budget. So we look for any way to cut them off. For those who want to observe a real subsidy queen in his natural habitat, there’s no better place than Park Avenue. I am not trying to be ironic here. The people are literally welfare queens: They live where queens live and take money from the poor like queens do.

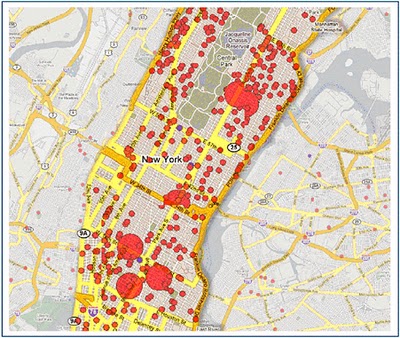

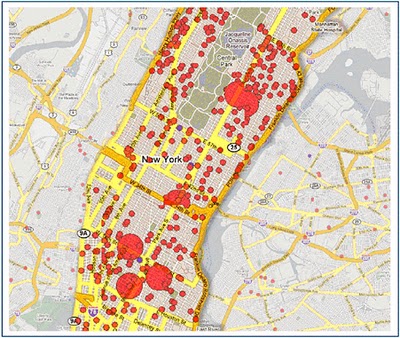

Map to the Subsidy Stars

Billionaires Leonard Lauder, Mark Rockefeller and his dad, David Rockefeller, are just a few of the more famous names exploiting their salt-of-the-earth legal status. Over the past decade, however, millions of dollars in corn, dairy, peanuts, cotton, soy and livestock subsidy payments from the federal government have gone to countless rich rank-and-file Manhattanites few people have ever heard of: It’s all right there in the farm subsidy database maintained by the Environmental Working Group. William Lesse Castleberry, a tax attorney who oversees leveraged buyouts, received $133,680 in cotton subsidies through an Arkansas farm. Mary W. Heller, a photographer with a studio on East 74th Street, got $143,783 via a farm in Kansas for growing wheat and sorghum. William Philip Walsh, who recently purchased a $2.9 million luxury condo with interior design done by Armani, was paid $212,463 to not farm his land. Phyllis A. Joyner, a 77-year old peanut farmer with a swanky Greenwich Village apartment and over $7 million worth of beautiful land in rural Virginia, received $239,624 for her peanut crops.

They’re not your typical crusty overalls wearing farmers. But then, the small family farmers we picture in our heads, who live on their land with their family and rise with the rooster to milk the cows, aren’t around much these days (except maybe in Brooklyn backyard imaginations). And if they are, they probably aren’t receiving any assistance from the federal government anyway, says Ken Cook, president of the Environmental Working Group. “American taxpayers have been writing farm subsidy checks to wealthy absentee land owners, state prison systems, universities, public corporations, and very large, well-heeled farm business operations without the government so much as asking the beneficiaries if they need our money,” explained Cook in 2007, when his organization published a database of farm subsidy recipients from USDA records.

It wasn’t meant to be this way. Farm subsidies first began as part of the New Deal and were designed to help small, family farms struggling through the Great Depression. These days, this well-intentioned program exists only in name. Successive deregulation and various other freemarket “reforms” have turned farm subsidies into just another welfare-for-the-rich program, bypassing the very farmers it was designed to help and depositing billions in taxpayer money straight into the bank accounts of corporations and wealthy Americans.

Here’s what the New Deal program looks like today, after Reaganism had a couple of go’s at it: From 1995 to 2006, the federal government spent about $200 billion on agricultural subsidies, 75 percent of which ended up in the bank accounts of the richest top 10 percent of farmers. It’s welfare in reverse, taking from the many and giving it to the wealthy. And the richer you are, the more assistance you deserve.

You can see this logic at work in Manhattan, where the fattest farm subsidy checks are mailed to the richest zip codes. Like the $825,346.56 addressed to Kent M. Klineman at ZIP code 10020, one of Manhattan’s wealthiest, with an average income of more than $500,000: 10 times higher than the rest of America. In fact, Klineman, who got the cash from 1995 to 2006 for growing wheat and sunflowers and raising livestock on a South Dakota cattlebreeding ranch called Eagle Pass Ranch, just might be the most subsidized farmer in Manhattan. But you probably wouldn’t have caught this 77-year-old Harvard Law School grad (this alma mater appears quite often among Manhattan’s subsidy queens) at the ranch, shoveling and trucking manure and inseminating the sows. Judging by SEC records, Klineman is more of a wheeling and dealing finance type, running venture capital companies, private investment funds and assorted dubious finance companies. Also keep in mind that in 1974, Klineman was among 13 people indicted on various fraud charges in a 100-million Madoff-style Ponzi scheme that involved selling millionaires and movie stars fraudulent shares in an oil-drilling outfit called Home-Stake Production Co., by promising astronomical returns, which were paid out not from profits but from money put in by the newest round of sucker investors. Liza Minnelli, Barbra Streisand, Bob Dylan, Barbara Walters and Mike Nichols, among others, were purportedly bilked for hundreds of thousands of dollars. But it wasn’t just naďve Hollywood entertainers that were scammed. The heads of some of America’s biggest corporations, including the president of American Express, the chairman of General Electric, and the chairman of Pepsi, were all caught up in the scam. In the end, the scam’s ringleader—Robert S. Trippett— got away with a scolding and a small fine, while charges against Klineman were eventually dropped.

But in the mid-90s, Klineman was implicated in another securities swindle, this time a mini version of an Enron stock pump-and-dump operation, which involved some two-bit computer company called EIS International. Whatever scam they were running, a shareholder class action lawsuit against Klineman and his partners alleged that Klineman, who EIS’s company’s Treasurer and Director, intentionally disseminated misleading information to investors the the aim of inflating the company’s stock and then cashed out just before the whole scam imploded, making over $1 million in the process. A settlement was reached nearly a decade later, forcing Klineman and two of his business buddies to fork over $3.9 million (plus a million or so in fees) to the scammed shareholders.

Like Carlito, Klineman “never convicted on no dope.” But even if he was slapped with a felony or two, there would be no reason for him to panic. His sweet $69,000 a year farm subsidy would continue unaffected, regardless of his criminal history. That’s nice, because if Klineman was a food stamp pawn living in Harlem, or any other ghetto in America, he’d have to deal with a harsh Clinton-era welfare reform that introduced poor people to the “one strike you’re out” law that forbids states to provide food stamps or cash-assistance to anyone with a single drug-related felony conviction, permanently—as in for life. “No one, including pregnant women or people participating in drug treatment, is exempt from the ban.” New York was kind enough to begin the lifetime exclusion only after the second conviction.

“What, you think you like me? You ain’t like me motherfucker, you a punk.”Farmers have come to expect preferential treatment from the government. While the rest of us are constantly slapped with new laws, regulations, taxes and fees, farmers have been left to do their own thing because they are too fragile to be squeezed for cash like the off-farm masses. Aside from being exempt from things like zoning laws (a farmer’s property is taxed at a fraction of its market value), they get tax breaks, tax credits, tax abatements and all sorts of other perks that shrink their overall tax exposure to just about nothing, regardless of their wealth. So not only do they milk taxpayers for billions in subsidies, they do not even contribute their fair share.

Subsidies and tax breaks? That’s free money times two. Naturally, the rich have been exploiting America’s kindly treatment of its farmers from day one, widening loopholes, relaxing restrictions and turning farms into personal tax havens and petty cash machines that allowed them to give less, while taking more.

Even a Capitalist Hall of Fame family like the Rockefellers, known for their generous charities and contributions to culture, turn out to receive government welfare.

Mark F. Rockefeller, a fourth-generation industrialist, probably had taxes on his mind when he purchased roughly 5,000 acres of farmland in Swan Valley, Idaho, and started receiving subsidy checks at his capitalist lair in the Rockefeller Plaza. Starting in 2001, the federal government has been giving him $54,500 a year to not farm his land. That’s right: The government gives your money to a member of the ultimate capitalist clan, which has a combined worth of more than $200 billion, to just laze around, not work and let his fields weed over. It’s what they call a “conservation payment” program, in which the government pays farmers to convert their land into something natural, like wetlands or whatever other eco-friendly habitat might be appropriate for the environment.

It worked out well for Rockefeller. By some strange coincidence, his farmland happened to be right next to an upscale fly-fishing resort he opened up with his wife in 1999. The place, called South Fork Lodge, plays host to groups of rich, middle aged men who pay $1,000 a day to fish in elegance and beauty with a personal fly-fishing guide. According to its website, “South Fork Lodge rests on a dramatic bend of eastern Idaho’s world famous South Fork of the Snake River in scenic Swan Valley. As you prepare to spend your day on one of the most scenic and majestic fly-fishing rivers in America, you will marvel at the breathtaking views from your room or the Lodge patio.”

What their guests probably don’t know is that they’ll be paying for some of those views twice: once to South Fork Lodge and once to Mark F. Rockefeller himself.

Rockefeller gets double the welfare by gaming the generous tax breaks built into agricultural land. It appears that instead of having South Fork Lodge own the land surrounding the resort and suffer the full force of a normal property tax rate, Rockefeller has had the business buy up just enough property to house the hotel’s various structures, while he purchased all the open space the resort needed—riverfront real estate for fly-fishing, outdoor activities and background scenery—in his own name and dedicated it to farming.

It’s win-win for Rockefeller’s business, allowing South Fork Lodge to offer commercial services on land for which he pays almost no taxes. The lodge charges $1,700 per night for its outdoor safari type quarters, complete with servants and a personal chef, which they offer to guests who want to rough it in a “gorgeous wilderness retreat nestled in the cottonwoods and aspens of the South Fork of the Snake River Canyon Section.”

A tax free slice of Rockefeller heavenTwo of Rockefeller’s spinoff businesses— which provide guided fly-fishing trips—also exploit the tax-free property, using it for private boat-launches, riverfront access and camping. If you were wondering why wealthy guys like him would go all the way out to places like Idaho for a lousy couple of grand in subsidies, do the math: He’s making a fortune off the land. Rockefeller pays a pitiful property tax of roughly $10 per acre, something like 1/60th of what it should be. Adding up the 5,000 acres or so, he gets a massive tax break of $500,000 or more.

But rich subsidy queens don’t need to travel far to filch their fair share of taxpayer wealth; they can do it right where they live and work.

Failed dot-com entrepreneur Craig Winn lives in Albemarle, Va., and paid $1,000 in taxes on a $3.5 million estate by converting its 50 acres into conserved farmland. All his rich neighbors, including pop culture hacks Dave Matthews and John Grisham, enrolled their land in the tax saver program, too. Hell, even Walt Disney World became a farmer by putting some cows to pasture on its land in Orlando to shave millions off its tax bill. Hewlett-Packard opened up a Christmas tree farm on its massive Houston campus, which saved it (and cost Houston) half a million dollars a year in taxes.

No wonder America is starting to feel like a third-world country. Fighting two wars and bailing out banks is enough without having the rich plundering our country right out from under us. It’s not just property taxes, either. In the past decade, two-thirds of corporations doing business on U.S. soil paid no income taxes. The rich aren’t just not paying their fair share, they’re not paying anything at all.

This article was first published in the New York Press.

Wall Street bankers and retired hedge fund billionaires have been talking about fiscal responsibility and deficit reduction, preparing the masses for austerity measures and cuts in social services—which we are told are regrettable, of course, but necessary nonetheless. Well, here is the perfect welfare program for the bailout queens to show off their fiscally conservative chops: Let’s see them cut federal farm subsidies, which funnel billions of dollars to the richest Americans, including notables like Ted Turner, David Letterman, Scottie Pippen, Paris Hilton’s grandpa, Charles Schwab, Microsoft billionaire Paul Allen and just about every single one of Sam Walton’s degenerate heirs.Most people know next to nothing about this $20 billion-a-year welfare for the rich program, probably because the billionaires want it that way. Why get the masses worked up? Best to let them think the $200 billion they spent from 1995 through 2006 went to friendly farmers with cute farmhouses, rather than to Chevron or Kenneth Lay. Better to let urban entrepreneurs call themselves backyard farmers and toil away for the locavore movement, than to realize that their rich neighbors are reaping actual “farm” subsidies.

Now, farm subsidies weren’t always this criminal and, until fairly recently, had been doing what New Deal programs were designed to do: help the little guy. But the freemarket “reforms” of the Reagan-Clinton Era warped the welfare, redirecting farm subsidies from the have-nots to the have-mores, bankrupting all but the biggest farmers and depositing farm subsides into the bank accounts of the rich.

There’s no need to go to Iowa to see this welfare-for-the-rich in action. You can see it on the Upper East Side, where billionaire elites collect huge welfare checks from the government just for being rich, while a few blocks away, in one of the poorest, most ghettoized districts in the United States, the city’s black population is being purged from food stamp rolls for smoking some dope. Because, as Mayor Rudy Giuliani once wisely said, “As soon as they stop being dependent on the government, they’re moving in a much healthier direction.”

Norman B. Champ Jr: Wall Street Welfare Prince

Norman B. Champ III, 47, was born into a wealthy, upper-crust Missouri family and lived a privileged life (the Champs had a Missouri village named after them in their honor: the Village of Champ). He graduated summa cum laude from Princeton University, went to England for a masters in war studies from King’s College and earned a law degree—cum laude, of course—from Harvard, after which he finally settled down at Chilton Investment Company, a multi-billion dollar hedge fund. He had added three titles to his name—Executive Vice President, General Counsel, Chief Compliance Officer—by the time the markets crashed. He lost no time jumping ship to a cushy government job with the Securities and Exchange Commission, coming on board in January 2010 to start a new life as a financial regulator at the SEC’s New York Inspections and Examinations Division. He now leads a team of 100 hardworking investigators in a crusade to crack down on the shady dealings of his hedge-fund buddies.

An upper-crust billionaire type who lives in one of the nation’s wealthiest ZIP codes and collects welfare meant for struggling farmers? Whatta champ!

He might not be what most of us expect a welfare queen to look like, but that’s only because we have been duped by the whole poverty thing, convinced that the crumbs we throw the needy are a huge burden on our budget. So we look for any way to cut them off. For those who want to observe a real subsidy queen in his natural habitat, there’s no better place than Park Avenue. I am not trying to be ironic here. The people are literally welfare queens: They live where queens live and take money from the poor like queens do.

Map to the Subsidy Stars

They’re not your typical crusty overalls wearing farmers. But then, the small family farmers we picture in our heads, who live on their land with their family and rise with the rooster to milk the cows, aren’t around much these days (except maybe in Brooklyn backyard imaginations). And if they are, they probably aren’t receiving any assistance from the federal government anyway, says Ken Cook, president of the Environmental Working Group. “American taxpayers have been writing farm subsidy checks to wealthy absentee land owners, state prison systems, universities, public corporations, and very large, well-heeled farm business operations without the government so much as asking the beneficiaries if they need our money,” explained Cook in 2007, when his organization published a database of farm subsidy recipients from USDA records.

It wasn’t meant to be this way. Farm subsidies first began as part of the New Deal and were designed to help small, family farms struggling through the Great Depression. These days, this well-intentioned program exists only in name. Successive deregulation and various other freemarket “reforms” have turned farm subsidies into just another welfare-for-the-rich program, bypassing the very farmers it was designed to help and depositing billions in taxpayer money straight into the bank accounts of corporations and wealthy Americans.

Here’s what the New Deal program looks like today, after Reaganism had a couple of go’s at it: From 1995 to 2006, the federal government spent about $200 billion on agricultural subsidies, 75 percent of which ended up in the bank accounts of the richest top 10 percent of farmers. It’s welfare in reverse, taking from the many and giving it to the wealthy. And the richer you are, the more assistance you deserve.

You can see this logic at work in Manhattan, where the fattest farm subsidy checks are mailed to the richest zip codes. Like the $825,346.56 addressed to Kent M. Klineman at ZIP code 10020, one of Manhattan’s wealthiest, with an average income of more than $500,000: 10 times higher than the rest of America. In fact, Klineman, who got the cash from 1995 to 2006 for growing wheat and sunflowers and raising livestock on a South Dakota cattlebreeding ranch called Eagle Pass Ranch, just might be the most subsidized farmer in Manhattan. But you probably wouldn’t have caught this 77-year-old Harvard Law School grad (this alma mater appears quite often among Manhattan’s subsidy queens) at the ranch, shoveling and trucking manure and inseminating the sows. Judging by SEC records, Klineman is more of a wheeling and dealing finance type, running venture capital companies, private investment funds and assorted dubious finance companies. Also keep in mind that in 1974, Klineman was among 13 people indicted on various fraud charges in a 100-million Madoff-style Ponzi scheme that involved selling millionaires and movie stars fraudulent shares in an oil-drilling outfit called Home-Stake Production Co., by promising astronomical returns, which were paid out not from profits but from money put in by the newest round of sucker investors. Liza Minnelli, Barbra Streisand, Bob Dylan, Barbara Walters and Mike Nichols, among others, were purportedly bilked for hundreds of thousands of dollars. But it wasn’t just naďve Hollywood entertainers that were scammed. The heads of some of America’s biggest corporations, including the president of American Express, the chairman of General Electric, and the chairman of Pepsi, were all caught up in the scam. In the end, the scam’s ringleader—Robert S. Trippett— got away with a scolding and a small fine, while charges against Klineman were eventually dropped.

But in the mid-90s, Klineman was implicated in another securities swindle, this time a mini version of an Enron stock pump-and-dump operation, which involved some two-bit computer company called EIS International. Whatever scam they were running, a shareholder class action lawsuit against Klineman and his partners alleged that Klineman, who EIS’s company’s Treasurer and Director, intentionally disseminated misleading information to investors the the aim of inflating the company’s stock and then cashed out just before the whole scam imploded, making over $1 million in the process. A settlement was reached nearly a decade later, forcing Klineman and two of his business buddies to fork over $3.9 million (plus a million or so in fees) to the scammed shareholders.

Like Carlito, Klineman “never convicted on no dope.” But even if he was slapped with a felony or two, there would be no reason for him to panic. His sweet $69,000 a year farm subsidy would continue unaffected, regardless of his criminal history. That’s nice, because if Klineman was a food stamp pawn living in Harlem, or any other ghetto in America, he’d have to deal with a harsh Clinton-era welfare reform that introduced poor people to the “one strike you’re out” law that forbids states to provide food stamps or cash-assistance to anyone with a single drug-related felony conviction, permanently—as in for life. “No one, including pregnant women or people participating in drug treatment, is exempt from the ban.” New York was kind enough to begin the lifetime exclusion only after the second conviction.

“What, you think you like me? You ain’t like me motherfucker, you a punk.”

Subsidies and tax breaks? That’s free money times two. Naturally, the rich have been exploiting America’s kindly treatment of its farmers from day one, widening loopholes, relaxing restrictions and turning farms into personal tax havens and petty cash machines that allowed them to give less, while taking more.

Even a Capitalist Hall of Fame family like the Rockefellers, known for their generous charities and contributions to culture, turn out to receive government welfare.

Mark F. Rockefeller, a fourth-generation industrialist, probably had taxes on his mind when he purchased roughly 5,000 acres of farmland in Swan Valley, Idaho, and started receiving subsidy checks at his capitalist lair in the Rockefeller Plaza. Starting in 2001, the federal government has been giving him $54,500 a year to not farm his land. That’s right: The government gives your money to a member of the ultimate capitalist clan, which has a combined worth of more than $200 billion, to just laze around, not work and let his fields weed over. It’s what they call a “conservation payment” program, in which the government pays farmers to convert their land into something natural, like wetlands or whatever other eco-friendly habitat might be appropriate for the environment.

It worked out well for Rockefeller. By some strange coincidence, his farmland happened to be right next to an upscale fly-fishing resort he opened up with his wife in 1999. The place, called South Fork Lodge, plays host to groups of rich, middle aged men who pay $1,000 a day to fish in elegance and beauty with a personal fly-fishing guide. According to its website, “South Fork Lodge rests on a dramatic bend of eastern Idaho’s world famous South Fork of the Snake River in scenic Swan Valley. As you prepare to spend your day on one of the most scenic and majestic fly-fishing rivers in America, you will marvel at the breathtaking views from your room or the Lodge patio.”

What their guests probably don’t know is that they’ll be paying for some of those views twice: once to South Fork Lodge and once to Mark F. Rockefeller himself.

Rockefeller gets double the welfare by gaming the generous tax breaks built into agricultural land. It appears that instead of having South Fork Lodge own the land surrounding the resort and suffer the full force of a normal property tax rate, Rockefeller has had the business buy up just enough property to house the hotel’s various structures, while he purchased all the open space the resort needed—riverfront real estate for fly-fishing, outdoor activities and background scenery—in his own name and dedicated it to farming.

It’s win-win for Rockefeller’s business, allowing South Fork Lodge to offer commercial services on land for which he pays almost no taxes. The lodge charges $1,700 per night for its outdoor safari type quarters, complete with servants and a personal chef, which they offer to guests who want to rough it in a “gorgeous wilderness retreat nestled in the cottonwoods and aspens of the South Fork of the Snake River Canyon Section.”

A tax free slice of Rockefeller heaven

But rich subsidy queens don’t need to travel far to filch their fair share of taxpayer wealth; they can do it right where they live and work.

Failed dot-com entrepreneur Craig Winn lives in Albemarle, Va., and paid $1,000 in taxes on a $3.5 million estate by converting its 50 acres into conserved farmland. All his rich neighbors, including pop culture hacks Dave Matthews and John Grisham, enrolled their land in the tax saver program, too. Hell, even Walt Disney World became a farmer by putting some cows to pasture on its land in Orlando to shave millions off its tax bill. Hewlett-Packard opened up a Christmas tree farm on its massive Houston campus, which saved it (and cost Houston) half a million dollars a year in taxes.

No wonder America is starting to feel like a third-world country. Fighting two wars and bailing out banks is enough without having the rich plundering our country right out from under us. It’s not just property taxes, either. In the past decade, two-thirds of corporations doing business on U.S. soil paid no income taxes. The rich aren’t just not paying their fair share, they’re not paying anything at all.

Comment