The Foreclosure Spiral

The Next Housing Crisis

By MIKE WHITNEY

Did the Federal Reserve collude with the big banks to hold millions of houses off the market until the Fed finished adding $1.25 trillion to the banks reserves? Did the Fed do this to make it appear that its bond purchasing plan (quantitative easing) was stabilizing prices when, in fact, it was the reduction in supply that stopped prices from plunging? It sure looks that way. This is from Bloomberg News:

What's so impressive about Bernanke's trillion dollar sleight-of-hand operation is its simplicity. We're just talking "supply and demand" here, not rocket science. The banks agreed to cut supply (by temporarily stockpiling homes) while the Fed loaded them up with a cold trillion-plus in reserves. Meanwhile, John Q. Public assumed (incorrectly) that Bernanke's program stabilized prices. It's a very ingenious deception.

Readers may remember that quantitative easing (QE) was promoted as a way to increase lending to consumers and to keep interest rates on mortgages low. But that was all public relations hype. Consumer lending contracted in the last year while interest rates on the 30-year mortgage have fallen since Bernanke's QE program ended at the end of March.

So what does it all mean? It means the public was snookered yet again. It also means that housing prices will fall further as banks dump more inventory on the market. How far prices drop will depend on how quickly the banks clear their shadow inventory which, in turn, depends on agreements they've made with the Fed and the other banks. Housing inventory is being released in drips and drabs according to an unknown plan. Some would call it price-fixing. Here's an excerpt from an article in the Wall Street Journal that says that there's a 9-year backlog of distressed homes:

Now that the government's homebuyer credits, subsidies and incentives have ended, demand for housing is drying up fast. The Mortgage Bankers Association (MBA) reports that new mortgage purchase applications have tumbled nearly 40 per cent to their lowest level since April of 1997. Sales are in freefall. Prices have already slipped 30 percent from their peak in 2006. Another 10 percent could be the straw that breaks the camel’s back, as Whitney Tilson explains in a recent article titled "The Housing Non Recovery". Here's an excerpt:

http://www.counterpunch.org/whitney06152010.html

The Next Housing Crisis

By MIKE WHITNEY

Did the Federal Reserve collude with the big banks to hold millions of houses off the market until the Fed finished adding $1.25 trillion to the banks reserves? Did the Fed do this to make it appear that its bond purchasing plan (quantitative easing) was stabilizing prices when, in fact, it was the reduction in supply that stopped prices from plunging? It sure looks that way. This is from Bloomberg News:

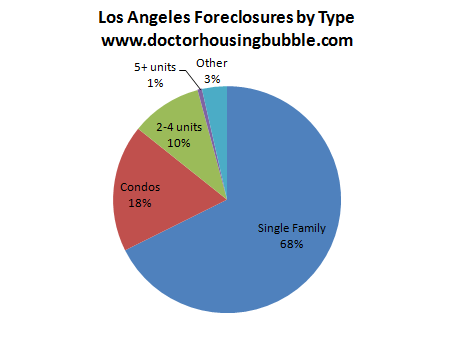

"U.S. home foreclosures reached a record for the second consecutive month in May, with increases in every state, as lenders stepped up property seizures, according to RealtyTrac.Inc.

“Bank repossessions climbed 44 per cent from May 2009 to 93,777, the Irvine, California-based data company said today in a statement. Foreclosure filings, including default and auction notices, rose about 1 per cent to 322,920. One out of every 400 U.S. households received a filing." (Bloomberg)

Inventory steadily declined during the period the Fed was exchanging cash-for-trash (toxic assets and non performing loans for reserves) with the banks. Now inventories have begun to rise again as the banks get back to business as usual, in other words, throwing people out of their homes. The sudden uptick in repossessions and property seizures coincides perfectly with the ending of the Fed's giant "no bankster left behind" program. Clearly, there must have been a quid pro quo.“Bank repossessions climbed 44 per cent from May 2009 to 93,777, the Irvine, California-based data company said today in a statement. Foreclosure filings, including default and auction notices, rose about 1 per cent to 322,920. One out of every 400 U.S. households received a filing." (Bloomberg)

What's so impressive about Bernanke's trillion dollar sleight-of-hand operation is its simplicity. We're just talking "supply and demand" here, not rocket science. The banks agreed to cut supply (by temporarily stockpiling homes) while the Fed loaded them up with a cold trillion-plus in reserves. Meanwhile, John Q. Public assumed (incorrectly) that Bernanke's program stabilized prices. It's a very ingenious deception.

Readers may remember that quantitative easing (QE) was promoted as a way to increase lending to consumers and to keep interest rates on mortgages low. But that was all public relations hype. Consumer lending contracted in the last year while interest rates on the 30-year mortgage have fallen since Bernanke's QE program ended at the end of March.

So what does it all mean? It means the public was snookered yet again. It also means that housing prices will fall further as banks dump more inventory on the market. How far prices drop will depend on how quickly the banks clear their shadow inventory which, in turn, depends on agreements they've made with the Fed and the other banks. Housing inventory is being released in drips and drabs according to an unknown plan. Some would call it price-fixing. Here's an excerpt from an article in the Wall Street Journal that says that there's a 9-year backlog of distressed homes:

"How much should we worry about a new leg down in the housing market? If the number of foreclosed homes piling up at banks is any indication, there’s ample reason for concern. As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20 per cent from a year earlier....

“Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That “shadow inventory” was up 30 per cent from a year earlier. Based on the rate at which banks have been selling those foreclosed homes over the past few months, all that inventory, real and shadow, would take 103 months to unload. That’s nearly nine years. Of course, banks could pick up the pace of sales, but the added supply of distressed homes would weigh heavily on prices — and thus boost their losses." ("Number of the Week: 103 Months to Clear Housing Inventory" Mark Whitehouse, Wall Street Journal)

Here's a clip from Housing Wire with a slightly different perspective:“Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That “shadow inventory” was up 30 per cent from a year earlier. Based on the rate at which banks have been selling those foreclosed homes over the past few months, all that inventory, real and shadow, would take 103 months to unload. That’s nearly nine years. Of course, banks could pick up the pace of sales, but the added supply of distressed homes would weigh heavily on prices — and thus boost their losses." ("Number of the Week: 103 Months to Clear Housing Inventory" Mark Whitehouse, Wall Street Journal)

"The amount of REO property held by the banks is also known as the “shadow inventory” of foreclosures. According to Morgan Stanley, it would take 47 months for the market to clear the roughly 7.5m first-lien mortgages in danger or already in foreclosure." ("Foreclosed Properties Held by Banks Up 12.4 per cent in Q110: SNL Financial," Jon Prior, Housingwire.com)

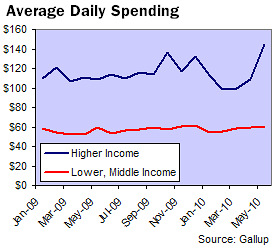

No matter how you look at it, housing will be in a funk for the next 5 to 10 years. There's just too much product and too few buyers. Austerity measures by the Obama team will only put more pressure on sales and prices. Now that the government's homebuyer credits, subsidies and incentives have ended, demand for housing is drying up fast. The Mortgage Bankers Association (MBA) reports that new mortgage purchase applications have tumbled nearly 40 per cent to their lowest level since April of 1997. Sales are in freefall. Prices have already slipped 30 percent from their peak in 2006. Another 10 percent could be the straw that breaks the camel’s back, as Whitney Tilson explains in a recent article titled "The Housing Non Recovery". Here's an excerpt:

"Today about 17.2 per cent of homeowners are underwater. But if home prices drop 10 per cent from here, 27 per cent of homeowners would go underwater. In other words, a 10 per cent drop in home prices would cause a 56 per cent increase in the number of people underwater…which would almost certainly lead to another surge in defaults." ("The Housing Non Recovery", The Daily Reckoning)

This excerpt deserves a second reading. The next 10 per cent plunge in prices will be more painful than the first 30 percent. The market is on a knife's edge and one false move could be deadly. More than 7 million homeowners have already stopped paying their mortgages which means that the inventory-pipeline will be bulging for years to come.http://www.counterpunch.org/whitney06152010.html

Comment