from rugged individualism

to

We Deliver

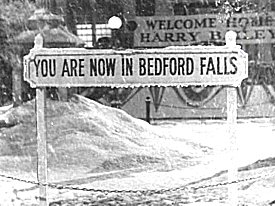

Hollywood and the White House

A Marriage made in Heaven

Why aren't the stressed -- and the not-so-stressed -- feeling better?

For starters, it just doesn't feel much like a recovery to many people.

Unemployment is stubbornly high -- 9.9 percent. The jobless face fierce competition for work. Those with a job are watching their paychecks shrink.

A growing number of people are at risk of falling into foreclosure, and only those with the most stellar credit probably can get a new loan. AP-GfK polls show that only 20 percent say the economy is good, compared with 15 percent last year.

Cynthia Bryant, 73, feels stress from her bills -- much of that heartburn related to medical expenses.

"I need a different car. I can't afford it. I have to watch every penny that comes in," says Bryant, who worked as a purchasing agent for a computer company before she retired. Bryant, who lives in a Denver suburb, gets by on a fixed-income that hasn't budged, although her expenses -- rent, groceries and other basics-- have risen.

Ken Goldstein, economist at the Conference Board, a research group that keeps close tabs on consumers, says it's people's individual circumstances -- more so than their sentiment about the economy -- that shape their confidence and their stress over debt. "It's about what happens to me -- my house, my car, my job," he says.

Christina Standridge, 33, of Milwaukee, says she's stressed about her debts, including car payments.

Laid off twice in the past two years, Standridge has watched her income drop. She worries about losing her current job as an administrative assistant for a company that designs and builds waste water control systems.

Standridge and her husband, who works at a factory fixing machines, have one daughter. The family is watching the pennies. "We're trying to spend less and pay off the bills," she says. "We're cutting corners wherever we can. We're trying to do things that are relatively cheap," she adds, such as having a backyard barbecue rather than going out to eat or to the movies. "Bills gotta be paid," she says.

http://finance.yahoo.com/news/Poll-f...html?x=0&.v=11

to

We Deliver

Hollywood and the White House

A Marriage made in Heaven

Why aren't the stressed -- and the not-so-stressed -- feeling better?

For starters, it just doesn't feel much like a recovery to many people.

Unemployment is stubbornly high -- 9.9 percent. The jobless face fierce competition for work. Those with a job are watching their paychecks shrink.

A growing number of people are at risk of falling into foreclosure, and only those with the most stellar credit probably can get a new loan. AP-GfK polls show that only 20 percent say the economy is good, compared with 15 percent last year.

Cynthia Bryant, 73, feels stress from her bills -- much of that heartburn related to medical expenses.

"I need a different car. I can't afford it. I have to watch every penny that comes in," says Bryant, who worked as a purchasing agent for a computer company before she retired. Bryant, who lives in a Denver suburb, gets by on a fixed-income that hasn't budged, although her expenses -- rent, groceries and other basics-- have risen.

Ken Goldstein, economist at the Conference Board, a research group that keeps close tabs on consumers, says it's people's individual circumstances -- more so than their sentiment about the economy -- that shape their confidence and their stress over debt. "It's about what happens to me -- my house, my car, my job," he says.

Christina Standridge, 33, of Milwaukee, says she's stressed about her debts, including car payments.

Laid off twice in the past two years, Standridge has watched her income drop. She worries about losing her current job as an administrative assistant for a company that designs and builds waste water control systems.

Standridge and her husband, who works at a factory fixing machines, have one daughter. The family is watching the pennies. "We're trying to spend less and pay off the bills," she says. "We're cutting corners wherever we can. We're trying to do things that are relatively cheap," she adds, such as having a backyard barbecue rather than going out to eat or to the movies. "Bills gotta be paid," she says.

http://finance.yahoo.com/news/Poll-f...html?x=0&.v=11