It’s all political now

May 13th, 2010

By David Goldman

Now that the state and the banks have merged in a corporatist alliance, all market news is political news. The market got clobbered today on news that New York State would investigate banks for rigging credit ratings on mortgage-backed securities by providing bad information to the ratings agencies. In my experience, the banks and the ratings agencies had a common purposes, which was to make money. The ratings agencies would advise the banks on how to tweak the portfolios behind Collateralized Debt Obligations so as to squeeze out more incomes. It wasn’t simply a matter of the banks hiring ratings agency experts and gaming the models for their own benefit; the ratings agencies themselves were making most of their money from the CDO market, and volunteered their time and advice to help the banks issue more.

These issues come up because the banks and governments are partners in the attempt to reflate the world economy through deficits comprising a double-digit proportion of GDP in most of the major economies. The banks finance the governments, with money that they borrow from the governments. That’s why many banks showed a profit during every single trading day of the first quarter: with a steep yield curve and nearly zero-cost funding, you have to go out of your way to lose money.

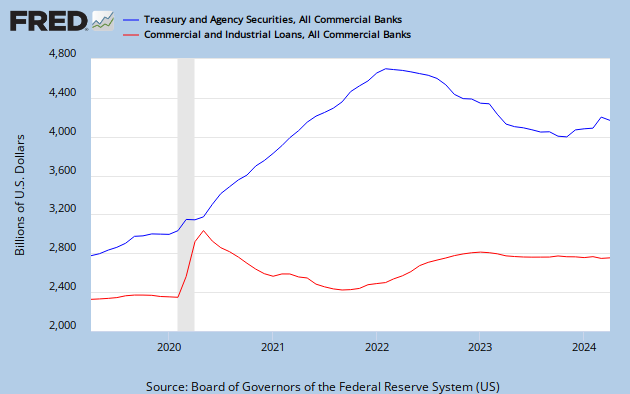

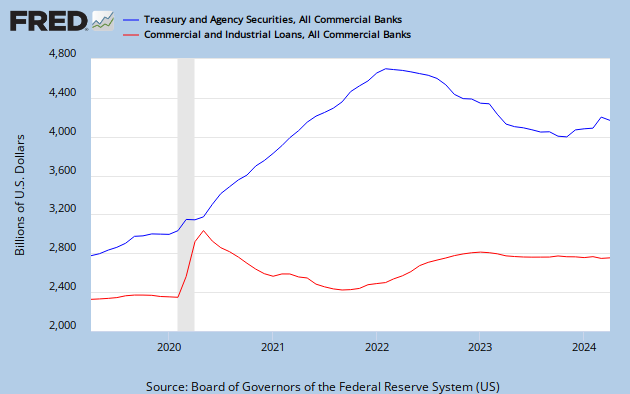

Here’s an update of my favorite data series: the collapse of commercial and industrial lending on the books of major banks and its dollar-for-dollar replacement by holdings of Treasury securities:

The trend shows no sign of abating; when we get the Treasury TIC data for April at the end of this month, we will find out whether foreign banks continue to shovel money into the US Treasury market at the rate of $50 to $60 billion per month.

This symbiosis means that the banking system is in effective government control. As my friend Michael Ledeen–an expert on Italian fascism among many other fields–this is “control without ownership,” or fascism, rather than socialism. Governments and banks will wrangle over the spoils. When the banks look fat the government will use them as a political whipping boy or milk them for taxes; when the banks’ holdings of government securities threaten to topple them, as in Europe last week, the governments will pledge a trillion dollars–and borrow it from the banks.

http://blog.atimes.net/?p=1470

May 13th, 2010

By David Goldman

Now that the state and the banks have merged in a corporatist alliance, all market news is political news. The market got clobbered today on news that New York State would investigate banks for rigging credit ratings on mortgage-backed securities by providing bad information to the ratings agencies. In my experience, the banks and the ratings agencies had a common purposes, which was to make money. The ratings agencies would advise the banks on how to tweak the portfolios behind Collateralized Debt Obligations so as to squeeze out more incomes. It wasn’t simply a matter of the banks hiring ratings agency experts and gaming the models for their own benefit; the ratings agencies themselves were making most of their money from the CDO market, and volunteered their time and advice to help the banks issue more.

These issues come up because the banks and governments are partners in the attempt to reflate the world economy through deficits comprising a double-digit proportion of GDP in most of the major economies. The banks finance the governments, with money that they borrow from the governments. That’s why many banks showed a profit during every single trading day of the first quarter: with a steep yield curve and nearly zero-cost funding, you have to go out of your way to lose money.

Here’s an update of my favorite data series: the collapse of commercial and industrial lending on the books of major banks and its dollar-for-dollar replacement by holdings of Treasury securities:

The trend shows no sign of abating; when we get the Treasury TIC data for April at the end of this month, we will find out whether foreign banks continue to shovel money into the US Treasury market at the rate of $50 to $60 billion per month.

This symbiosis means that the banking system is in effective government control. As my friend Michael Ledeen–an expert on Italian fascism among many other fields–this is “control without ownership,” or fascism, rather than socialism. Governments and banks will wrangle over the spoils. When the banks look fat the government will use them as a political whipping boy or milk them for taxes; when the banks’ holdings of government securities threaten to topple them, as in Europe last week, the governments will pledge a trillion dollars–and borrow it from the banks.

http://blog.atimes.net/?p=1470

Comment