http://www.bloomberg.com/apps/news?p...d=allDMOrP8m3M

Mortgage Holders Owing More Than Homes Are Worth Rise to 23%

By Brian Louis

May 10 (Bloomberg) -- More than a fifth of U.S. mortgage holders owed more than their homes were worth in the first quarter as repossessions climbed to a record, according to Zillow.com.

Twenty-three percent of owners of mortgaged homes were underwater during the period, up from 21 percent in the previous three months, the Seattle-based property data provider said today in a report. More than one in 1,000 homes were repossessed by lenders in March, the highest rate in Zillow data dating back to 2000.

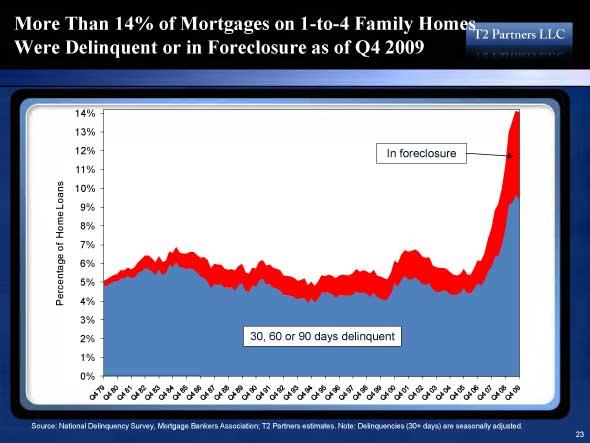

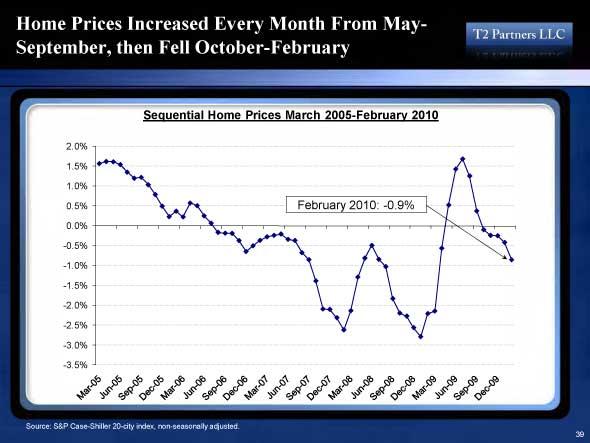

Underwater homes are more likely to be lost to foreclosure because their owners have a harder time refinancing or selling when they fall behind on loan payments. U.S. home values dropped 3.8 percent in the first quarter from a year earlier, the 13th straight period of year-over-year declines, Zillow said.

“Having a lot of underwater homeowners will add to the downward pressure on house prices,” said Celia Chen, senior director at Moody’s Economy.com in West Chester, Pennsylvania. “We do expect that home prices will fall a bit more.”

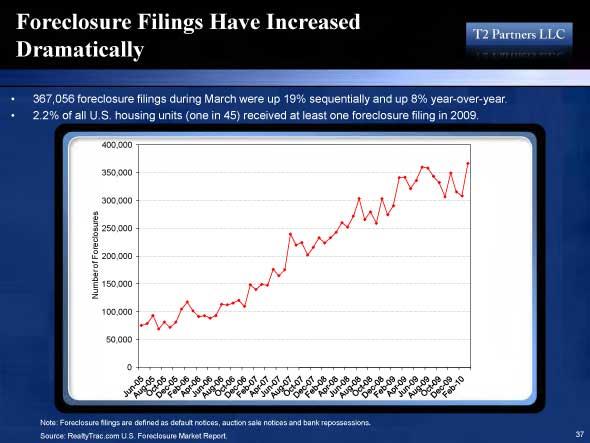

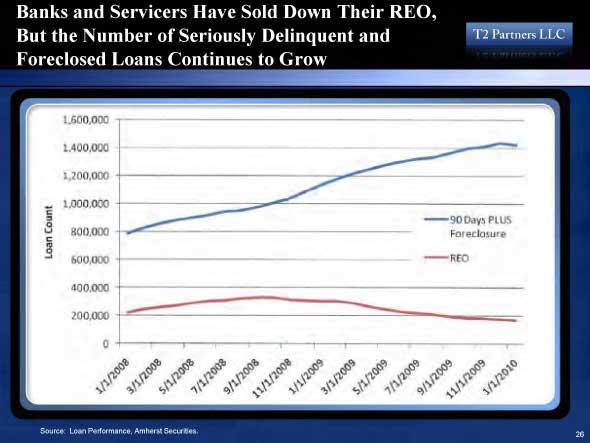

Bank repossessions in the U.S. rose 35 percent in the first quarter from a year earlier to a record 257,944, according to RealtyTrac Inc., an Irvine, California-based company.

Sales of foreclosed properties by banks accounted for more than a fifth of all U.S. home sales in March, Zillow said. They made up 66 percent and 62 percent of transactions, respectively, in the metropolitan areas of Merced and Modesto in California.

About 32 percent of homes sold in the U.S. in March went for less than their sellers paid for them, Zillow said.

The closely held company uses data from public records going back to 1996. Its mortgage figures come from information filed with individual counties.

By Brian Louis

May 10 (Bloomberg) -- More than a fifth of U.S. mortgage holders owed more than their homes were worth in the first quarter as repossessions climbed to a record, according to Zillow.com.

Twenty-three percent of owners of mortgaged homes were underwater during the period, up from 21 percent in the previous three months, the Seattle-based property data provider said today in a report. More than one in 1,000 homes were repossessed by lenders in March, the highest rate in Zillow data dating back to 2000.

Underwater homes are more likely to be lost to foreclosure because their owners have a harder time refinancing or selling when they fall behind on loan payments. U.S. home values dropped 3.8 percent in the first quarter from a year earlier, the 13th straight period of year-over-year declines, Zillow said.

“Having a lot of underwater homeowners will add to the downward pressure on house prices,” said Celia Chen, senior director at Moody’s Economy.com in West Chester, Pennsylvania. “We do expect that home prices will fall a bit more.”

Bank repossessions in the U.S. rose 35 percent in the first quarter from a year earlier to a record 257,944, according to RealtyTrac Inc., an Irvine, California-based company.

Sales of foreclosed properties by banks accounted for more than a fifth of all U.S. home sales in March, Zillow said. They made up 66 percent and 62 percent of transactions, respectively, in the metropolitan areas of Merced and Modesto in California.

About 32 percent of homes sold in the U.S. in March went for less than their sellers paid for them, Zillow said.

The closely held company uses data from public records going back to 1996. Its mortgage figures come from information filed with individual counties.

Comment