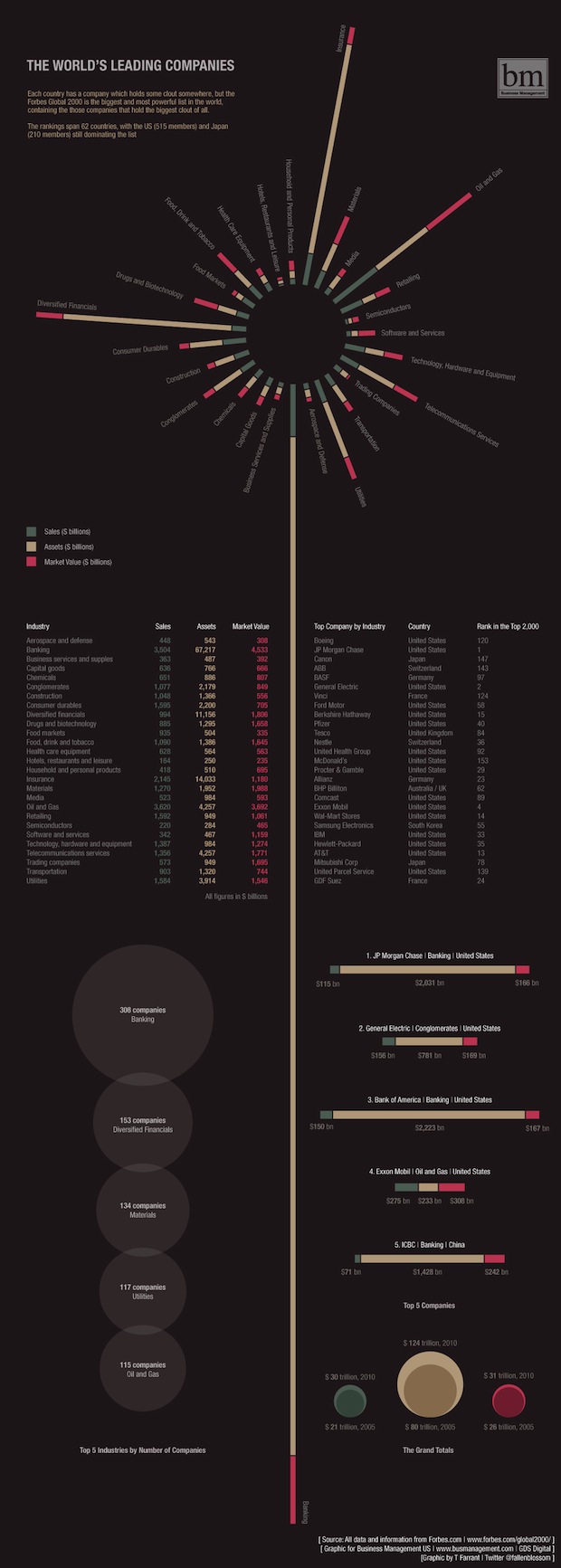

Infographic: Banking Gone Wild

BY Cliff Kuang

Fri May 7, 2010

A graph of the 2000 largest companies in the world reveals the crazy size of the banking sector. Talk about too big to fail.

This elegant chart, created by Tiffany Farrant for GDS Digital (the second from her today, we know; we can't help it), started as merely a visualization of the Forbes 2,000, which lists the 2,000 largest companies in the world. And it does it's job with tremendous efficiency--it's pretty interesting to see, roughly, how big chemicals companies and media companies and transportation are, relatively to each other.

But then, one single thing leaps off the page: The GINORMOUS size of the banking industry--followed by insurance, "diversified financials," and...drum roll please!...oil and gas:

It makes sense that banking is so much larger than all of the other industries--after all, it's where all the other companies, as well as governments, go to salt their money away.

But in light of that, it makes the recent revelations about Wall Street's penchant for unregulated derivatives, "proprietary trading," and venal sales practices pretty chilling. How is it that the biggest part of our corporate landscape is also allowed to have the least oversight of the risks it they take on? We'd give up stunning infographics like this to see that change.

Original Article

The world's leading companies

By Mary Queen | 05/04/10 - 15:15

http://www.busmanagement.com/news/th...ing-companies/

Full Sized Image

http://www.busmanagement.com/media/m...gCompanies.jpg

BY Cliff Kuang

Fri May 7, 2010

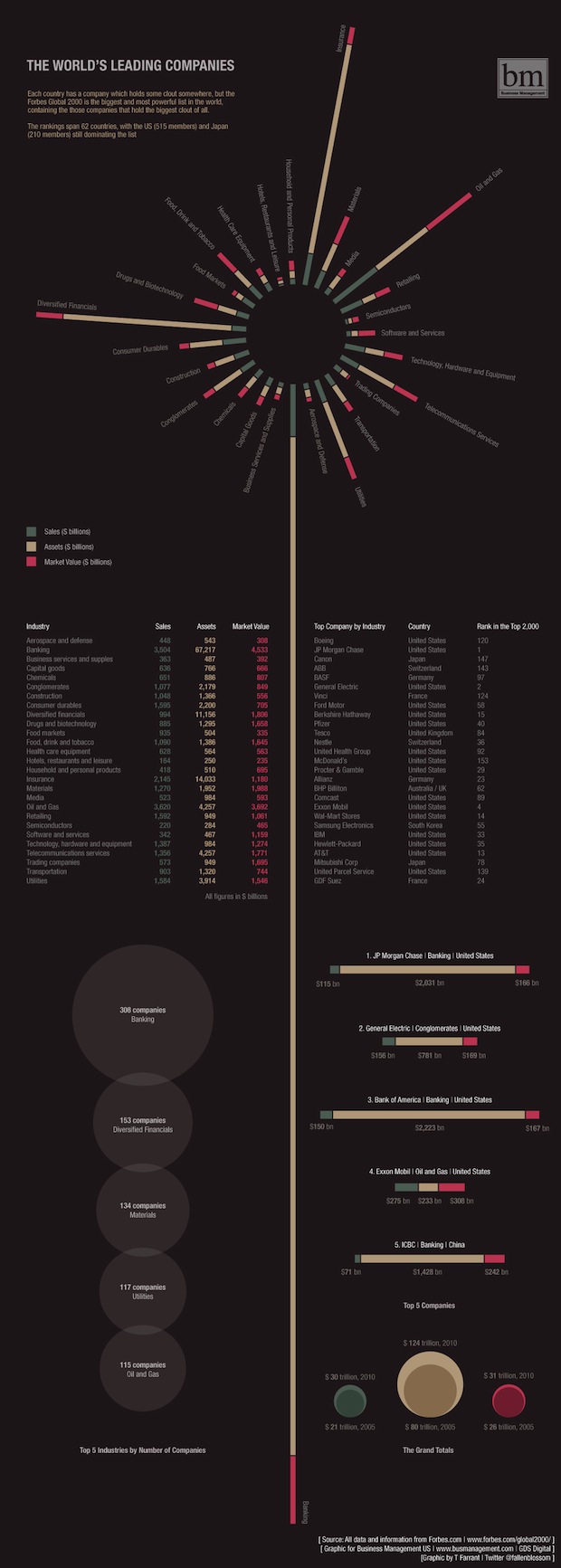

A graph of the 2000 largest companies in the world reveals the crazy size of the banking sector. Talk about too big to fail.

This elegant chart, created by Tiffany Farrant for GDS Digital (the second from her today, we know; we can't help it), started as merely a visualization of the Forbes 2,000, which lists the 2,000 largest companies in the world. And it does it's job with tremendous efficiency--it's pretty interesting to see, roughly, how big chemicals companies and media companies and transportation are, relatively to each other.

But then, one single thing leaps off the page: The GINORMOUS size of the banking industry--followed by insurance, "diversified financials," and...drum roll please!...oil and gas:

It makes sense that banking is so much larger than all of the other industries--after all, it's where all the other companies, as well as governments, go to salt their money away.

But in light of that, it makes the recent revelations about Wall Street's penchant for unregulated derivatives, "proprietary trading," and venal sales practices pretty chilling. How is it that the biggest part of our corporate landscape is also allowed to have the least oversight of the risks it they take on? We'd give up stunning infographics like this to see that change.

Original Article

The world's leading companies

By Mary Queen | 05/04/10 - 15:15

http://www.busmanagement.com/news/th...ing-companies/

Full Sized Image

http://www.busmanagement.com/media/m...gCompanies.jpg

Comment