If it was, was it an unplanned meeting engagement?

http://globaleconomicanalysis.blogsp...onnection.html

Euro Rallies, Paring Slump, as G-7 Meets on Greece; Pound Drops

May 7 (Bloomberg) -- The euro rose against the dollar and the yen, paring the biggest weekly declines since October 2008, as the Group of Seven nations prepared to discuss the Greek debt crisis and the German government voted on the bailout package.

The euro snapped four days of losses versus the dollar after the Japanese Finance Minister Naoto Kan said European members will probably update the Group of Seven on Greece during a conference call today. The pound tumbled to a 13-month low versus the dollar as the U.K. parliamentary election failed to produce an outright winner, fanning concern the next government will struggle to reduce the budget deficit.

“Some market participants hope that policy makers will soon get their act together and deal with the worsening situation,” said John Hydeskov, a currency analyst at Danske Bank A/S in Copenhagen. “But the markets are still very vulnerable to any bad news about the euro.”

The euro climbed 1.2 percent to $1.2771 as of 7:12 a.m. in New York, paring its decline this week to 3.9 percent, the biggest weekly drop since October 2008, the month following the collapse of Lehman Brothers Holdings Inc. The 16-nation currency jumped 3.2 percent to 118.12 yen, paring its drop in the five days to 5.7 percent. The dollar advanced 2.1 percent to 92.49 yen. The pound declined 1 percent to $1.4680, trading as low as $1.4476, the weakest level since April 2009.

Euro members are unlikely to be asked to take specific policy action such as currency intervention to shore up markets, Kan said at a press conference in Tokyo. The Bank of Japan said today it will pump 2 trillion yen ($22 billion) into the financial system in an effort to maintain orderly markets.

http://www.bloomberg.com/apps/news?p...iG2hVeI&pos=5#

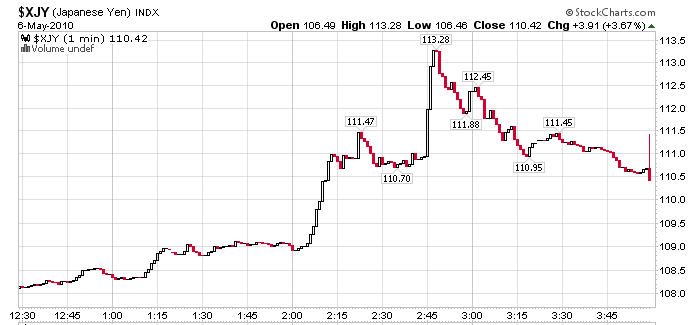

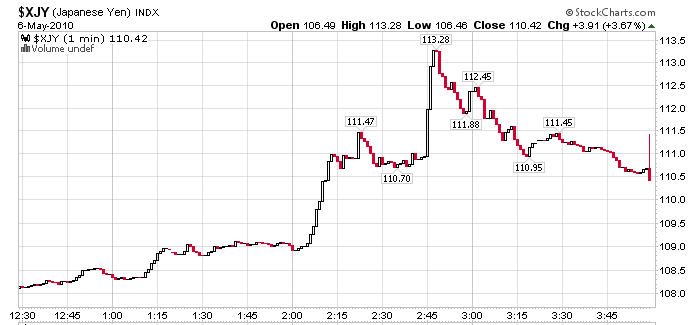

Inquiring minds are digging deeper into the mysteries of Thursday's stock market plunge starting with an intraday chart of the Yen.

The Yen rose 4 cents in an hour vs. the US dollar. Wow.

Now let's invert the chart and overlay a chart of the S&P 500 on top of it.

Please consider the following chart courtesy of "OMI" who emailed me late afternoon.

Now let's invert the chart and overlay a chart of the S&P 500 on top of it.

Please consider the following chart courtesy of "OMI" who emailed me late afternoon.

45 minutes before US equities went into a waterfall dive, the Yen went into a skyrocket rally vs. the US dollar (inverted on the above chart).

The Yen and the stock market magically stabilized at exactly the same time, right at the equity bottom.

The Yen and the stock market magically stabilized at exactly the same time, right at the equity bottom.

Euro Rallies, Paring Slump, as G-7 Meets on Greece; Pound Drops

May 7 (Bloomberg) -- The euro rose against the dollar and the yen, paring the biggest weekly declines since October 2008, as the Group of Seven nations prepared to discuss the Greek debt crisis and the German government voted on the bailout package.

The euro snapped four days of losses versus the dollar after the Japanese Finance Minister Naoto Kan said European members will probably update the Group of Seven on Greece during a conference call today. The pound tumbled to a 13-month low versus the dollar as the U.K. parliamentary election failed to produce an outright winner, fanning concern the next government will struggle to reduce the budget deficit.

“Some market participants hope that policy makers will soon get their act together and deal with the worsening situation,” said John Hydeskov, a currency analyst at Danske Bank A/S in Copenhagen. “But the markets are still very vulnerable to any bad news about the euro.”

The euro climbed 1.2 percent to $1.2771 as of 7:12 a.m. in New York, paring its decline this week to 3.9 percent, the biggest weekly drop since October 2008, the month following the collapse of Lehman Brothers Holdings Inc. The 16-nation currency jumped 3.2 percent to 118.12 yen, paring its drop in the five days to 5.7 percent. The dollar advanced 2.1 percent to 92.49 yen. The pound declined 1 percent to $1.4680, trading as low as $1.4476, the weakest level since April 2009.

Euro members are unlikely to be asked to take specific policy action such as currency intervention to shore up markets, Kan said at a press conference in Tokyo. The Bank of Japan said today it will pump 2 trillion yen ($22 billion) into the financial system in an effort to maintain orderly markets.

http://www.bloomberg.com/apps/news?p...iG2hVeI&pos=5#

Comment