This has been touched on before but this article highlights the disconnect:

http://anecdotaleconomics.blogspot.c...sales-tax.html

http://anecdotaleconomics.blogspot.c...sales-tax.html

Well, now we know why there is such a substantial disconnect between growing retail sales and falling state sales tax collections: the Census Bureau Retail and Food Service Sales report theorizers now must be incorporating the value of bartered goods and services, like healthcare for chickens, in light of the growing talk of creating a Value-Added Tax (VAT) on consumption. (Shhh...not 'til after the November elections.)

Bartered goods and services ARE, of course, taxable at the federal and state levels, but probably not being reported by, nor income/sales taxes remitted by, tax-rules-challenged goods and services traders, nor perhaps by doctors and hospitals which currently accept poultry in exchange for treatment. At least not yet.

The retail consumer is back, and she* is in the mood to shop, we reliably are told. The Census Bureau reported March 2010 Advance Retail and Food Service Sales improved 7.6 percent from a year ago, and for 1Q2010 are 5.5 percent above 1Q2009. Good news, it's a "V"-shaped recovery, the green shoots of last spring have blossomed and The Great Recession ended in August 2009...now borrow some money and buy something.

It's certainly a better quarterly performance than the last one. For 4Q2009, the Bureau reported retail sales advanced 1.9 percent (but fell 6.2 percent for the full year over compared with 2008).

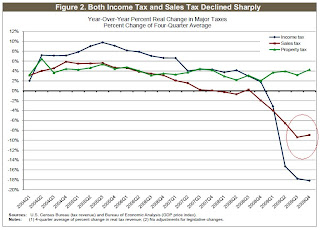

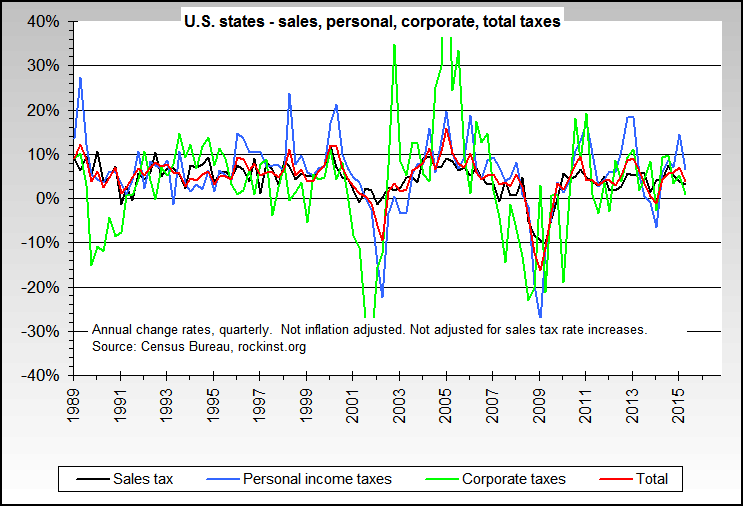

So why do state sales tax revenues tell a different, disconnected story? In the Nelson A. Rockefeller Institute of Government's April 2010 State Revenue Report, which chronicles the woeful status of state tax collections, concludes that sales tax collections fell almost 9.0 percent in 2009, a statistically significant 2.8 percent more than the reported decline in retail and food service salesmade up estimated by the Census Bureau.

In the October-December 2009 quarter, state sales tax collections were 5.3 percent below 4Q2008 according to the Rockefeller report based on (irony alert...) Census Bureau data, but, as noted above, some other guessers in the Census Bureau theorized the retail sector improved by 1.9 percent for a whopping 7.2 percent disconnect.

Ah, but state sales tax collections should lag Census Bureau reporting by a month, right, as retailers generally are required to remit their sales taxes collected to their respective state tax authority before the end of the next month.

Adjusting for the timing difference, by looking at September-November 2009 retail sales (+2.2 percent compared with September-November 2008), and the disconnect widens to 7.5 percent.

The Census Bureau says Retail and Food Service Sales are improving, but state sales tax revenues tell a much different story (in the absence of massive, fraudulent under-reporting of sales by retailers in order to pay less tax to the states, which, given states' desperate need for revenue, is highly unlikely).

It's a significant disconnect between theory (Census Bureau) and reality (actual sales tax collections), much as the similar, significant disconnect between the Employment Situation reported by the Bureau of Labor Statistics (theory), which appears to be masking the true extent of unemployment in America with all those marginally attached and discouraged workers, and the meaningful decline in actual payroll tax withholdings (reality), as reported by the Treasury Department in its Daily Treasury Statements (again assuming the absence of massive, fraudulent under-payment of payroll withholding taxes to the Treasury by a majority of the nation's employers, which, again, given the federal government's desperate need for revenue, seems highly unlikely). Trim Tabs (subscription required) has reported extensively on this Employment/DTS disconnect.

Brace yourself for new bartered goods and services tax reporting and collection rules, especiallyif when a Value-Added Tax (VAT) is proposed in early January 2011. Won't that do wonders for the consumer economy?

*(Yes, "she," an unfortunate, sexist reality as retail analysts estimate, and retailers know, 80 percent of consumption purchases are made by women.)

Posted by Keith Hazelton, The Anecdotal Economist at 11:43 AM

Bartered goods and services ARE, of course, taxable at the federal and state levels, but probably not being reported by, nor income/sales taxes remitted by, tax-rules-challenged goods and services traders, nor perhaps by doctors and hospitals which currently accept poultry in exchange for treatment. At least not yet.

The retail consumer is back, and she* is in the mood to shop, we reliably are told. The Census Bureau reported March 2010 Advance Retail and Food Service Sales improved 7.6 percent from a year ago, and for 1Q2010 are 5.5 percent above 1Q2009. Good news, it's a "V"-shaped recovery, the green shoots of last spring have blossomed and The Great Recession ended in August 2009...now borrow some money and buy something.

It's certainly a better quarterly performance than the last one. For 4Q2009, the Bureau reported retail sales advanced 1.9 percent (but fell 6.2 percent for the full year over compared with 2008).

So why do state sales tax revenues tell a different, disconnected story? In the Nelson A. Rockefeller Institute of Government's April 2010 State Revenue Report, which chronicles the woeful status of state tax collections, concludes that sales tax collections fell almost 9.0 percent in 2009, a statistically significant 2.8 percent more than the reported decline in retail and food service sales

In the October-December 2009 quarter, state sales tax collections were 5.3 percent below 4Q2008 according to the Rockefeller report based on (irony alert...) Census Bureau data, but, as noted above, some other guessers in the Census Bureau theorized the retail sector improved by 1.9 percent for a whopping 7.2 percent disconnect.

Ah, but state sales tax collections should lag Census Bureau reporting by a month, right, as retailers generally are required to remit their sales taxes collected to their respective state tax authority before the end of the next month.

Adjusting for the timing difference, by looking at September-November 2009 retail sales (+2.2 percent compared with September-November 2008), and the disconnect widens to 7.5 percent.

The Census Bureau says Retail and Food Service Sales are improving, but state sales tax revenues tell a much different story (in the absence of massive, fraudulent under-reporting of sales by retailers in order to pay less tax to the states, which, given states' desperate need for revenue, is highly unlikely).

It's a significant disconnect between theory (Census Bureau) and reality (actual sales tax collections), much as the similar, significant disconnect between the Employment Situation reported by the Bureau of Labor Statistics (theory), which appears to be masking the true extent of unemployment in America with all those marginally attached and discouraged workers, and the meaningful decline in actual payroll tax withholdings (reality), as reported by the Treasury Department in its Daily Treasury Statements (again assuming the absence of massive, fraudulent under-payment of payroll withholding taxes to the Treasury by a majority of the nation's employers, which, again, given the federal government's desperate need for revenue, seems highly unlikely). Trim Tabs (subscription required) has reported extensively on this Employment/DTS disconnect.

Brace yourself for new bartered goods and services tax reporting and collection rules, especially

*(Yes, "she," an unfortunate, sexist reality as retail analysts estimate, and retailers know, 80 percent of consumption purchases are made by women.)

Posted by Keith Hazelton, The Anecdotal Economist at 11:43 AM

Comment