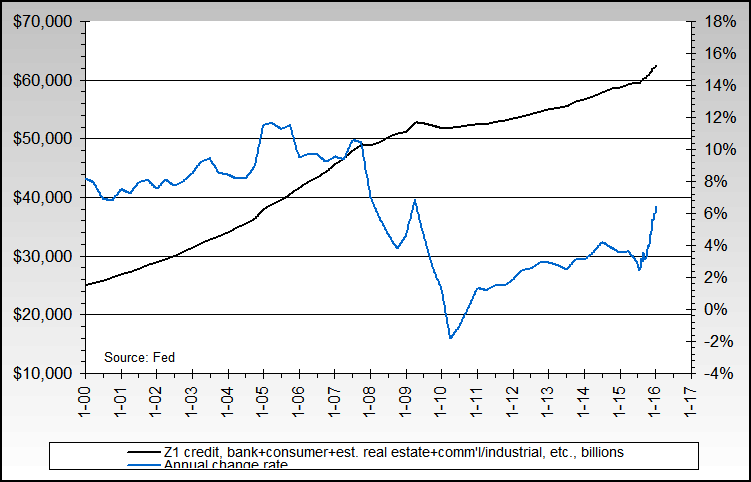

After reading this little known press release ( http://www.federalreserve.gov/releases/h6/20060316 ) a few weeks ago, I started to wonder… and the surprising result is that (except for the Eurodollars element of M3), the data is still available with which to reconstruct M3.

* The formula used has over five nines (.9999946 – 1.0 being perfect) correlation to the original data back going back to 1980, and is taken directly from the Federal Reserve’s definition of M3.

* There is only one missing element that is apparently no longer available (Eurodollars) and I've applied an adjustment to generate it. Its only about 3% of total M3 so should not have a material effect on the total

* The data sources are M2, Institutional Money Market and two weekly reports from the Fed – H.8 and H.4.1.

* Not surprisingly, the growth rate has continued up since the last official report in early March

* I’ll leave it up to the reader on why M3 was discontinued but wish to point out this quote: The last duty of a central banker is to tell the public the truth. -- Alan Blinder, Vice Chairman of the Federal Reserve, on PBS’s Nightly Business Report in 1994

[image]http://www.nowandfutures.com/images/m3b.png[/image]

* The formula used has over five nines (.9999946 – 1.0 being perfect) correlation to the original data back going back to 1980, and is taken directly from the Federal Reserve’s definition of M3.

* There is only one missing element that is apparently no longer available (Eurodollars) and I've applied an adjustment to generate it. Its only about 3% of total M3 so should not have a material effect on the total

* The data sources are M2, Institutional Money Market and two weekly reports from the Fed – H.8 and H.4.1.

* Not surprisingly, the growth rate has continued up since the last official report in early March

* I’ll leave it up to the reader on why M3 was discontinued but wish to point out this quote: The last duty of a central banker is to tell the public the truth. -- Alan Blinder, Vice Chairman of the Federal Reserve, on PBS’s Nightly Business Report in 1994

[image]http://www.nowandfutures.com/images/m3b.png[/image]

.png)

Comment