State and Local Budget Crisis Black Swan – California paying out $100 Million per Day in Unemployment Insurance. Detroit’s Shrinking Population Crushes Revenues. The Employment Situation at a Micro Level.

One stunning statistic that hit this week regards California’s unemployment insurance claims being paid out. California is paying out some $100 million per day in unemployment benefits. I’m not sure if I would call it a “benefit” but more as a buffer to get by. In reality if we really want to get a pulse on what Americans are facing in terms of the recession unemployment claims and benefits are a good place to start. The unemployment rate as we all know can be fudged in many ways. If you work 10 hours at Wal-Mart but want full-time work then you are counted as employed in terms of the headline rate. This isn’t a big deal when a small part of the country is working part-time for economic reasons but this group is enormous (9 million to be exact). The headline rate is 9.7 percent but add in this group and we are up to 16.9 percent. And people seeking unemployment rarely fudge numbers because they need the money and they have to report their status every two weeks to continue receiving claims.

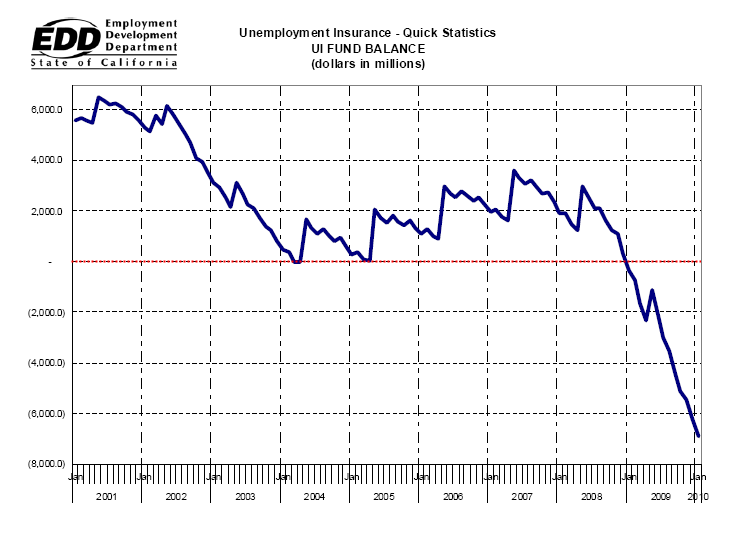

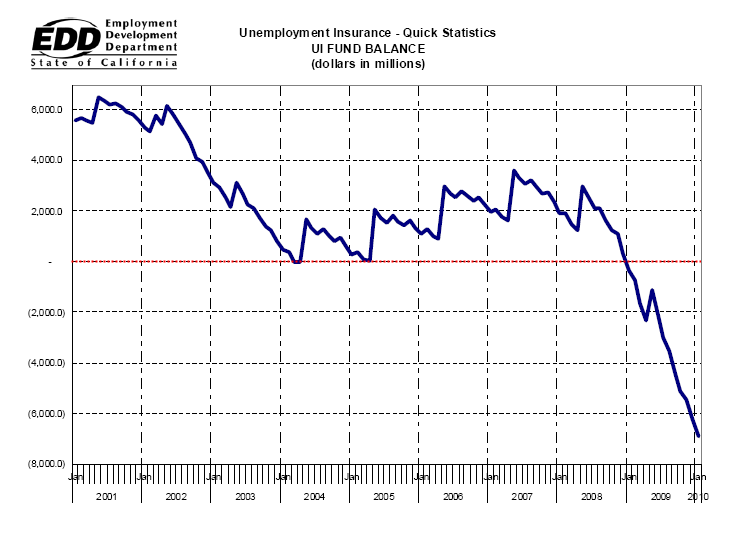

If we look at California for example, the numbers show anything but a recovery:

Source: California EDD

Even with 99 weeks of unemployment insurance between federal and state, extensions, and other emergency support programs we have a sizeable number of people reaching the end of their rope. This shows how pervasive and deep this economic crisis has hit average Americans. I tend to look at unemployment insurance payouts as a good measure to see how quickly the economy actually recovers. After all, if after two weeks you find a job, you would expect that less would be coming out of the fund when it comes to renewing your benefits. So it is very sensitive to market changes in the employment market. We have so many market indicators from consumer confidence to home sales but in terms of employment, I’d be following the unemployment insurance payouts very closely to see when things actually take a turn.

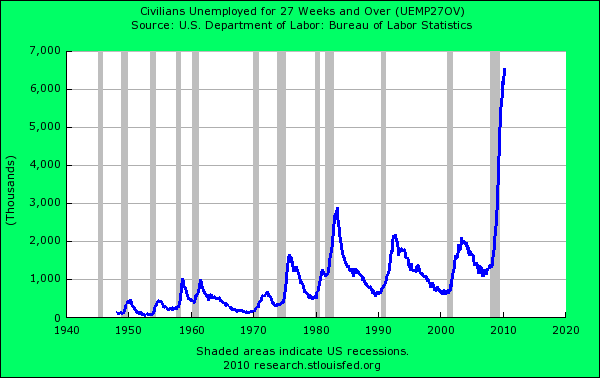

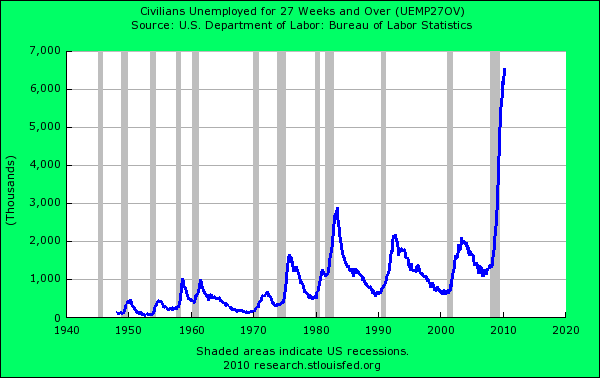

And one unique aspect (there are many) about this recession is the length of time people have been out of work:

Of the 15 million officially unemployed people, nearly 7 million have been unemployed for 27 weeks or more. The problem when people remain without work this long is that they typically will be shifting into other industries. Think of a mortgage broker that now needs to retool for another industry that is hiring (i.e., health care). Congress is currently debating whether to extend unemployment benefits but the fact that we are even having this debate with 99 weeks of unemployment insurance in some states is troubling in itself.

In many places like Los Angeles and Detroit, you are seeing massive deficits in their budget but for different reasons. California relied heavily on the housing bubble. States that really built an entire tax collecting expectation around real estate are being harmed deeply:

.

.

.

.

.

.

If we look at California for example, the numbers show anything but a recovery:

Source: California EDD

Even with 99 weeks of unemployment insurance between federal and state, extensions, and other emergency support programs we have a sizeable number of people reaching the end of their rope. This shows how pervasive and deep this economic crisis has hit average Americans. I tend to look at unemployment insurance payouts as a good measure to see how quickly the economy actually recovers. After all, if after two weeks you find a job, you would expect that less would be coming out of the fund when it comes to renewing your benefits. So it is very sensitive to market changes in the employment market. We have so many market indicators from consumer confidence to home sales but in terms of employment, I’d be following the unemployment insurance payouts very closely to see when things actually take a turn.

And one unique aspect (there are many) about this recession is the length of time people have been out of work:

Of the 15 million officially unemployed people, nearly 7 million have been unemployed for 27 weeks or more. The problem when people remain without work this long is that they typically will be shifting into other industries. Think of a mortgage broker that now needs to retool for another industry that is hiring (i.e., health care). Congress is currently debating whether to extend unemployment benefits but the fact that we are even having this debate with 99 weeks of unemployment insurance in some states is troubling in itself.

In many places like Los Angeles and Detroit, you are seeing massive deficits in their budget but for different reasons. California relied heavily on the housing bubble. States that really built an entire tax collecting expectation around real estate are being harmed deeply:

.

.

.

.

.

.

Comment