http://www.zerohedge.com/article/gre...chris-martenso

After a day of bashin zero hedge for the crumby CEF scare, here is a more sensible piece by Chris Martenson.

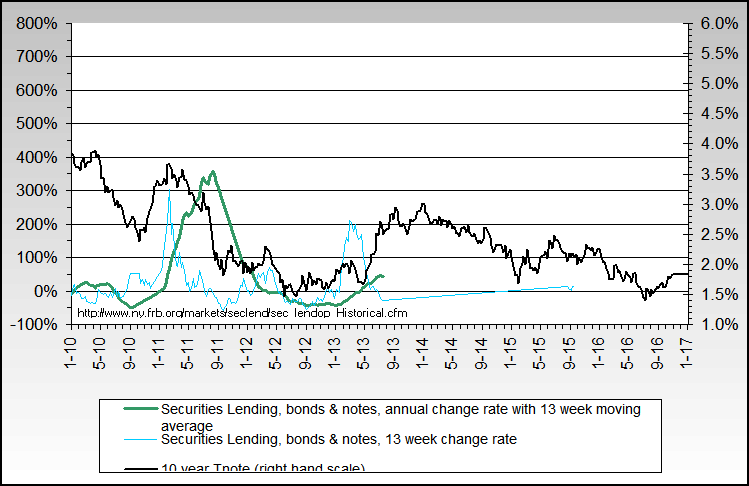

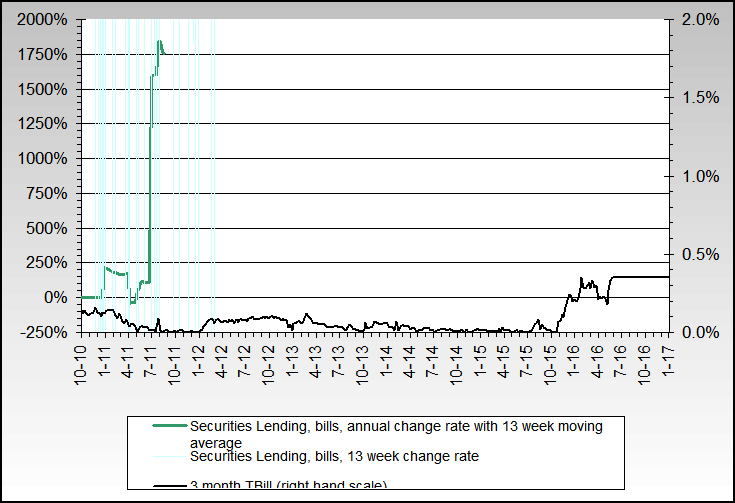

Basically the take down of treasuries by foreingers, is not lining up with the fed's custodial account and TIC data. Chris suggests that perhaps the Fed is funnelling money to other CB's to buy treasuries.

Well written, makes sense.

After a day of bashin zero hedge for the crumby CEF scare, here is a more sensible piece by Chris Martenson.

Basically the take down of treasuries by foreingers, is not lining up with the fed's custodial account and TIC data. Chris suggests that perhaps the Fed is funnelling money to other CB's to buy treasuries.

Well written, makes sense.

Comment