http://www.mybudget360.com/the-ultim...llion-is-that/

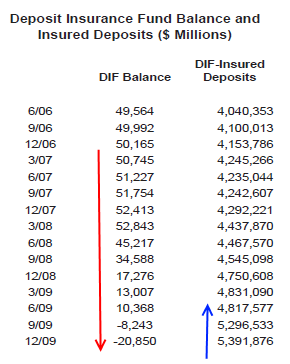

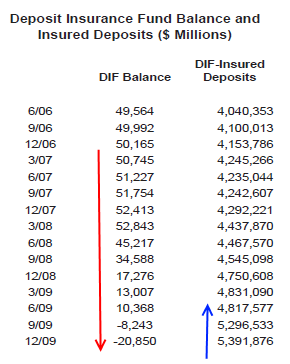

The FDIC is running the biggest confidence game in the country. The FDIC is now protecting through the Deposit Insurance Fund (DIF) some $5.3 trillion in deposits in banks across the country. All of this is secured by an insurance fund that is now in the negative by $20.8 billion. In the middle of this financial crisis we allowed the government to suddenly up the deposit insurance coverage from $100,000 to $250,000 which on face value seems fantastic. I mean every average American wants their money to be covered so upping it to $250,000 seems fantastic even though most middle class Americans have nothing close to that and are merely trying to pay their bills from one month to another. But what if people suddenly pulled their money out of banks similar to what occurred with IndyMac Bank in California? Think this can’t happen again? One of the too big to fail banks seems to think this might be coming down the pipeline. Some interesting information on Citigroup:

I’ve seen a few people dismiss the current negative DIF fund by saying “the FDIC is flush with cash.” Really? Let us examine that part of the equation. From the latest FDIC quarterly bank report:

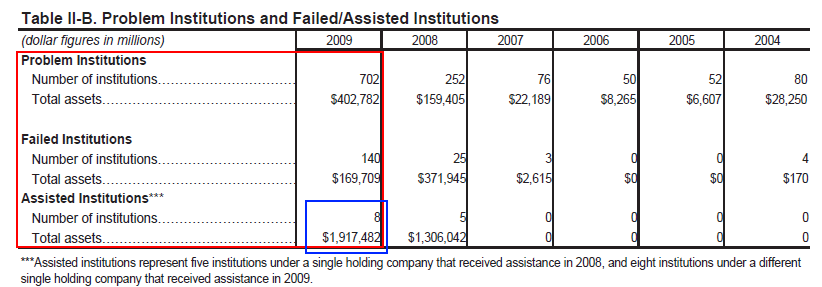

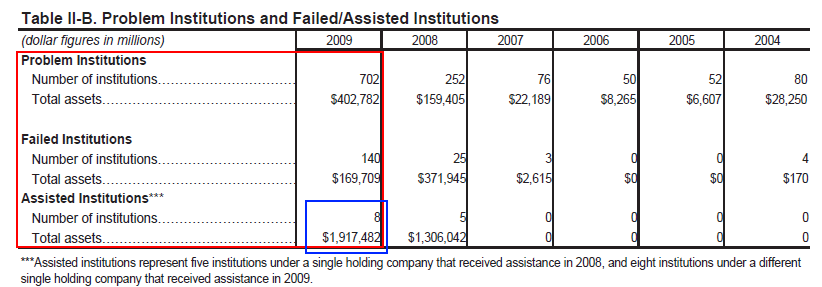

You know if the FDIC is saying 702 we know it is much higher. I still stand by my prediction that this crisis will bring down at least 1,000 banks when all is said and done. I love how the FDIC lists “assisted institutions” as 8 with total assets of nearly $2 trillion. I wonder who those could be?

The bottom line is, we are playing a very big game of confidence here. Gallup just ran a poll showing that 19.9 percent of Americans are underemployed. That number is getting really close to the 25 percent rate of the Great Depression but with part-time employment. That does a number on the psyche of average Americans.

The FDIC is running the biggest confidence game in the country. The FDIC is now protecting through the Deposit Insurance Fund (DIF) some $5.3 trillion in deposits in banks across the country. All of this is secured by an insurance fund that is now in the negative by $20.8 billion. In the middle of this financial crisis we allowed the government to suddenly up the deposit insurance coverage from $100,000 to $250,000 which on face value seems fantastic. I mean every average American wants their money to be covered so upping it to $250,000 seems fantastic even though most middle class Americans have nothing close to that and are merely trying to pay their bills from one month to another. But what if people suddenly pulled their money out of banks similar to what occurred with IndyMac Bank in California? Think this can’t happen again? One of the too big to fail banks seems to think this might be coming down the pipeline. Some interesting information on Citigroup:

“(Prison Planet) A new advisory being sent by America’s third largest bank to its account holders has stoked fears that major financial institutions could be preparing for old fashioned bank runs if the economy takes a turn for the worse.

Originally reported by John Carney over at the Business Insider website, Citigroup is sending the following information to customers along with their bank statements.

“Effective April 1, 2010, we reserve the right to require (7) days advance notice before permitting a withdrawal from all checking accounts. While we do not currently exercise this right and have not exercised it in the past, we are required by law to notify you of this change.”

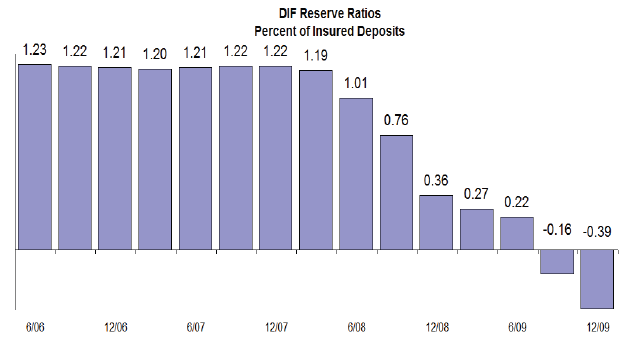

In other words, let us assume many clients decide to withdraw all their funds in a short period of time because people suddenly realize that $250,000 is actually being supported by pure faith. In addition, average Americans realize that -$20.8 billion will certainly not cover $5.3 trillion in actual deposits that can be redeemed at any given time! That is the psychology of our current banking system. As long as people believe the wizard behind the curtain can back up the deposits then all is fine. This worked as long as assets actually had values that banks claimed were true. We know that game is over. In fact, that is why the entire banking system has received roughly $13 trillion in bailouts and backstops. It really is this fragile. This is how the deposit insurance fund looks like:

Source: FDIC

So you would think that people would at least try to diversify their investments since even a minor bank run would cause major damage. But instead, people have increased their deposits at these banks at a rapid pace:

And I can’t blame them. What choice is there? Gamble in the Wall Street rigged casino or put it in the bank. If we go back to December of 2007 when the crisis started, DIF-Insured deposits have shot up by $1.1 trillion and the actual fund has gone negative because of all the additional bank failures. This psychology really does remind me of the mania surrounding the housing bubble boom. What if, hypothetically, people decide that one of the too big to fail is suddenly not that big at all, and Americans start withdrawing funds to some other institution. Worse yet, they take their funds out and put them in a non-DIF insured institution. Then what? Or maybe people want the actual cash. This is what is so troubling. Just go to any local store and see how much actual cash is being exchanged. It is all electronic debits and credits. Insured to $250,000? On what? Clearly the U.S. Treasury would step in at this point and flat out start printing money but what use would that be since the dollars you are being paid with would quickly devalue (even more).Originally reported by John Carney over at the Business Insider website, Citigroup is sending the following information to customers along with their bank statements.

“Effective April 1, 2010, we reserve the right to require (7) days advance notice before permitting a withdrawal from all checking accounts. While we do not currently exercise this right and have not exercised it in the past, we are required by law to notify you of this change.”

In other words, let us assume many clients decide to withdraw all their funds in a short period of time because people suddenly realize that $250,000 is actually being supported by pure faith. In addition, average Americans realize that -$20.8 billion will certainly not cover $5.3 trillion in actual deposits that can be redeemed at any given time! That is the psychology of our current banking system. As long as people believe the wizard behind the curtain can back up the deposits then all is fine. This worked as long as assets actually had values that banks claimed were true. We know that game is over. In fact, that is why the entire banking system has received roughly $13 trillion in bailouts and backstops. It really is this fragile. This is how the deposit insurance fund looks like:

Source: FDIC

So you would think that people would at least try to diversify their investments since even a minor bank run would cause major damage. But instead, people have increased their deposits at these banks at a rapid pace:

I’ve seen a few people dismiss the current negative DIF fund by saying “the FDIC is flush with cash.” Really? Let us examine that part of the equation. From the latest FDIC quarterly bank report:

“In June 2008, before the number of bank and thrift failures began to rise significantly, total assets held by the DIF were approximately $56 billion and consisted almost entirely of cash and marketable securities (i.e. liquid assets). As the crisis has unfolded, liquid assets of the DIF have been to protect depositors of failed institutions and were exchanged for less liquid claims against assets of failed institutions. As of September 30, 2009, although total assets had increased to almost $63 billion, cash and marketable securities had fallen to approximately $23 billion.”

Did you get that? The FDIC “cash” went from roughly $56 billion in June of 2008 to $23 billion in September of 2009. And supposedly, they now have “assets” of $63 billion but how much of this is crap mortgages from failed banks like WaMu and IndyMac? In reality, the FDIC at this point only had $23 billion to back up $5.3 trillion. But in December of 2009 the FDIC took the radical step to front-load prepaid assessments:“To provide the FDIC with the funds needed to carry on with the task of resolving failed institutions in 2010 and beyond, but without accelerating the impact of assessments on the industry’s earnings and capital, the FDIC approved a measure to require insured institutions to prepay 13 quarters worth of deposit insurance premiums. These prepayments—about $46 billion—were collected on December 30, 2009. Cash and marketable securities stood at $66 billion on December 31, 2009.”

Now don’t you feel better? The FDIC took in 13 quarters of prepaid deposit insurance premiums and we now have a combined total of cash and marketable securities of $66 billion. In other words, one too big to fail going down and good luck with that $250,000 backup really being worth what you would actually think. This is what surprises me here. We all know things are actually getting worse with the banking system yet we keep piling on the risk. In fact, the FDIC has even upped the number of troubled banks on their list:

You know if the FDIC is saying 702 we know it is much higher. I still stand by my prediction that this crisis will bring down at least 1,000 banks when all is said and done. I love how the FDIC lists “assisted institutions” as 8 with total assets of nearly $2 trillion. I wonder who those could be?

The bottom line is, we are playing a very big game of confidence here. Gallup just ran a poll showing that 19.9 percent of Americans are underemployed. That number is getting really close to the 25 percent rate of the Great Depression but with part-time employment. That does a number on the psyche of average Americans.

Comment