Not precisely news, but an interesting perspective:

http://www.theoildrum.com/node/6226

Peak Oil: Looking for the Wrong Symptoms?

Posted by Gail the Actuary on February 18, 2010 - 9:56am

Topic: Economics/Finance

If I were to ask 10 random people what they would expect would be a sign of the arrival of “peak oil”, I would expect that all 10 would say “high oil prices”.

Let me tell you what I think the symptoms of the arrival of peak oil are

1. Higher default rates on loans

2. Recession

Furthermore, I expect that as the supply of oil declines over time, these symptoms will get worse and worse—even though people may call the cause of the decline in oil use “Peak Demand” rather than “Peak Supply”.

Let’s think about what happens when oil prices try to increase. From the perspective of a consumer who is already spending pretty much all of his income, it seems to me the result is something like this:

What happens is that many of the consumer’s most necessary purchases tend to be closely tied to the price of oil—things like food and gasoline, and home heating oil. If the price of these necessities goes up, the consumer is likely to cut back on something else. One possibility is to cut back on non-essential purchases—not go out to a restaurant, or not buy a new car or higher priced home. Another possibility, if the consumer is really pressed, is to default on some of the consumer’s promised debt repayments. (The increase in the cost of food and gasoline doesn’t have to be as exaggerated as shown in the diagram for this effect to take place.)

What effect would cutbacks in discretionary spending and loan defaults have? It seems to me that they would look a whole lot like the recession and debt defaults that we have been seeing recently.

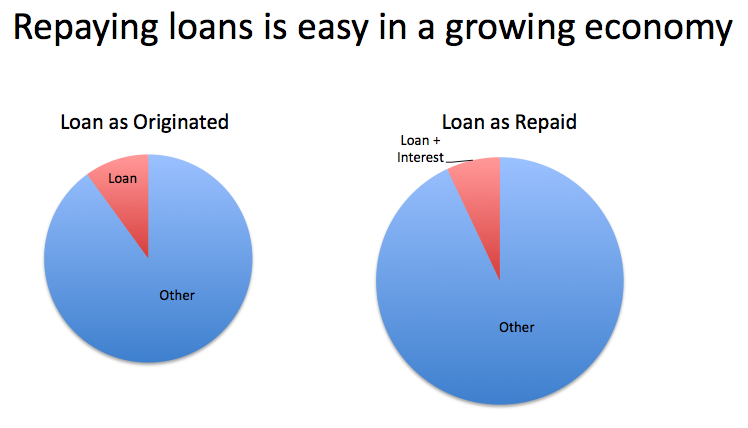

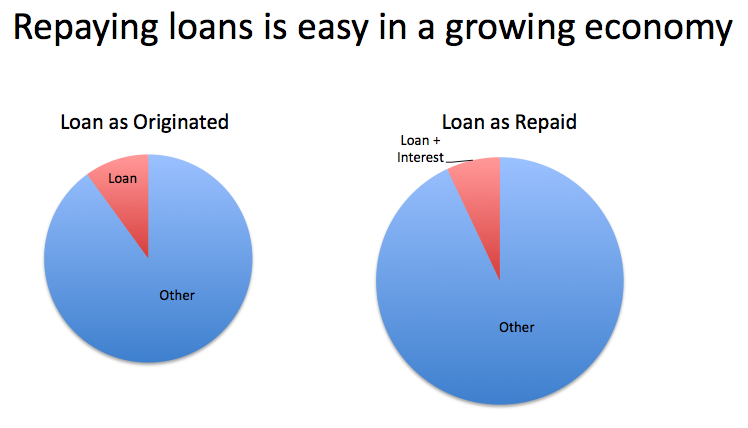

It is possible to look at the debt repayment issue another way as well:

As long as resource extraction is growing rapidly, it is easy for economies to grow, because raw materials needed for growth are present in greater and greater quantities. But when oil—a necessity for nearly all resource extraction and for transportation—is present in lesser and lesser quantities, it is difficult for economies to grow. Without economic growth, it is much more difficult to repay debt with interest, because the interest payment must come from somewhere. Economic growth helps provide the necessary margin for these interest payments.

The period we have recently lived through—from1950 to 2005—was a period of growth in world oil supplies and in the availability of other types of resources using oil for extraction. Economies in general tended to grow, and economists came to believe that economic growth could continue forever.

But since 2005, oil production has been flat. In fact, oil production in 2009 was down over the 2005 to 2008 period. This lack of growth in oil supplies led to a run up of oil prices (from $42 in January 2005 to $147 in July 2008, before a drop in prices, and another run up in prices), and has made it more difficult for economies to grow. During the time prices were rising, we have seen increasing disruption of the types expected by higher oil prices—loan defaults and recessionary impacts.

The defaults on loans caused by the higher oil prices have had a feedback impact through the system. When there are loan defaults, banks and other institutions making loans find their balance sheets impaired. This tends to restrict their willingness to make new loans. Without ready access to credit, customers cannot make purchases such as new cars. (Of course, people who have lost their jobs because of recession cannot get credit either.) This lack of access to credit tends to hold down oil prices—through the mechanism we recognize as reduced demand.

One thing that people tend to overlook is the fact that the historic price of oil back when most of our infrastructure was built was quite low--$20 a barrel or less. So even the prices we are seeing now—in the $70 barrel range—are quite high by historical standards. Prices don’t have to be extremely high to have recessionary impacts and to cause debt defaults.

I expect that oil prices in the future will increase (to the extent they do) in a saw tooth fashion, with a rise to a peak, before additional credit restrictions cause a drop in demand, to a new lower level. Meanwhile, our leaders will trot around the world, to Davos and other places, looking vainly for the cause of our current financial problems. If peak oil problems don’t look like they expect, they must not be there!

http://www.theoildrum.com/node/6226

Peak Oil: Looking for the Wrong Symptoms?

Posted by Gail the Actuary on February 18, 2010 - 9:56am

Topic: Economics/Finance

If I were to ask 10 random people what they would expect would be a sign of the arrival of “peak oil”, I would expect that all 10 would say “high oil prices”.

Let me tell you what I think the symptoms of the arrival of peak oil are

1. Higher default rates on loans

2. Recession

Furthermore, I expect that as the supply of oil declines over time, these symptoms will get worse and worse—even though people may call the cause of the decline in oil use “Peak Demand” rather than “Peak Supply”.

Let’s think about what happens when oil prices try to increase. From the perspective of a consumer who is already spending pretty much all of his income, it seems to me the result is something like this:

What happens is that many of the consumer’s most necessary purchases tend to be closely tied to the price of oil—things like food and gasoline, and home heating oil. If the price of these necessities goes up, the consumer is likely to cut back on something else. One possibility is to cut back on non-essential purchases—not go out to a restaurant, or not buy a new car or higher priced home. Another possibility, if the consumer is really pressed, is to default on some of the consumer’s promised debt repayments. (The increase in the cost of food and gasoline doesn’t have to be as exaggerated as shown in the diagram for this effect to take place.)

What effect would cutbacks in discretionary spending and loan defaults have? It seems to me that they would look a whole lot like the recession and debt defaults that we have been seeing recently.

It is possible to look at the debt repayment issue another way as well:

As long as resource extraction is growing rapidly, it is easy for economies to grow, because raw materials needed for growth are present in greater and greater quantities. But when oil—a necessity for nearly all resource extraction and for transportation—is present in lesser and lesser quantities, it is difficult for economies to grow. Without economic growth, it is much more difficult to repay debt with interest, because the interest payment must come from somewhere. Economic growth helps provide the necessary margin for these interest payments.

The period we have recently lived through—from1950 to 2005—was a period of growth in world oil supplies and in the availability of other types of resources using oil for extraction. Economies in general tended to grow, and economists came to believe that economic growth could continue forever.

But since 2005, oil production has been flat. In fact, oil production in 2009 was down over the 2005 to 2008 period. This lack of growth in oil supplies led to a run up of oil prices (from $42 in January 2005 to $147 in July 2008, before a drop in prices, and another run up in prices), and has made it more difficult for economies to grow. During the time prices were rising, we have seen increasing disruption of the types expected by higher oil prices—loan defaults and recessionary impacts.

The defaults on loans caused by the higher oil prices have had a feedback impact through the system. When there are loan defaults, banks and other institutions making loans find their balance sheets impaired. This tends to restrict their willingness to make new loans. Without ready access to credit, customers cannot make purchases such as new cars. (Of course, people who have lost their jobs because of recession cannot get credit either.) This lack of access to credit tends to hold down oil prices—through the mechanism we recognize as reduced demand.

One thing that people tend to overlook is the fact that the historic price of oil back when most of our infrastructure was built was quite low--$20 a barrel or less. So even the prices we are seeing now—in the $70 barrel range—are quite high by historical standards. Prices don’t have to be extremely high to have recessionary impacts and to cause debt defaults.

I expect that oil prices in the future will increase (to the extent they do) in a saw tooth fashion, with a rise to a peak, before additional credit restrictions cause a drop in demand, to a new lower level. Meanwhile, our leaders will trot around the world, to Davos and other places, looking vainly for the cause of our current financial problems. If peak oil problems don’t look like they expect, they must not be there!

Comment