Announcement

Collapse

No announcement yet.

The FED lifts rates!

Collapse

X

-

Re: The FED lifts rates!

Here's my view.Originally posted by Mega View Post

http://www.itulip.com/forums/showpos...2&postcount=20

Comment

-

Re: The FED lifts rates!

Originally posted by WildspitzE View PostHere's my view.

http://www.itulip.com/forums/showpos...2&postcount=20

Very True. I read your Post. The banks are sitting with $1 Trillion reserves. Discount rates for emergency purpose will not hold them. I don't see anyway the reserves can be drained by giving them extra reserves via interest on the reserves.Originally posted by WildspitzEAnd, who cares about the discount rate? I don't think that any bank is borrowing from it at the moment... so if they raise the irrelevant discount rate now, perhaps it will scare the inflationists while we still pump out fiat?

Only an outright reverse-repo to the banks at 100% value(on a 50% devalued asset) can drain. Not a chance. The Banks don't want to buy them at 100% par. They

may be readuy to buy at 50%, then FED can drain only 50% of the $1 Trillion reserves back. Obama is going to win this Nov 2010 election as well as next, I think.

Comment

-

Re: The FED lifts rates!

I'm sure a high enough rate would hold them, but then you have "leaking" reserves. What does it mean if the fed pays 2,3,4,5 % on reserves?

First thought is that then 5% of 1T or 50B of money leaks out with no way to call it back, right? paying interest on the reserves means money is created with no offestting asset at the fed right?

Also the reserves may be there because the banks know that the eye of the huricane is about to pass and they are going to be hit with the eye-wall soon. I think we are in for another wave of arm resets in the spring.

Comment

-

Re: The FED lifts rates!

January's PPI was up 1.4% in 31 days or about 18% per year. So a tightening of 0.25% per year in the discount rate at the Fed to 0.75% per year is a really sick joke. Bernanke is destroying the dollar while making it appear that he is fighting inflation. It is a sick joke. This is exactly what the Fed did in the 1970s to let inflation explode.

After voting to confirm the re-appointment of Bernanke to the Fed, the Demos deserve to lose in 2010 and 2012.... I just call it the way I see it.

And spending in Washington is out of control because money is too cheap. Again, this gets back to Bernanke's absurd monetary experiment with zero interest rates. ( Spending has no cost. )Last edited by Starving Steve; February 18, 2010, 11:07 PM.

Comment

-

Re: The FED lifts rates!

ppi is stated as an annual rate. so 1.4% really means prices in jan moved .116%

However all in not as rosy as it seems. here is some more of the report.

The Producer Price Index for Finished Goods rose 1.4 percent in January, seasonally adjusted,

the U.S. Bureau of Labor Statistics reported today. This increase followed a 0.4-percent advance

in December and a 1.5-percent rise in November. In January, at the earlier stages of processing,

prices received by manufacturers of intermediate goods climbed 1.7 percent, and the crude goods

index jumped 9.6 percent. On an unadjusted basis, prices for finished goods moved up 4.6 percent for the 12 months ended January 2010, their third consecutive 12-month increase.

Look at the crude goods number running 9.6 APR I assume this is for stuff like energy, plastics, steel etc. The difference in rates I assume is that finished goods include labor, and other fixed capital costs to produce the good. Maybe that cell phone only has 20% cost in materials. So a 10% increase in raw materials only add 2% to the cost of the phone.

And the discount rate as people are talking about has always existed. I believe this is the rate that the fed charges banks for overnight loans.

This is oppossed to the fed funds rate where one bank can lend to another overnight. In the early times of the panic, banks didn't trust each other, so they would not lend to each other. Thus the fed became the main overnight lender. Lowering the discount rate, made it competive for the banks to go to the fed for a loan.

This different than the interest that the fed pays for banks to keep their reserves parked at the fed.

Comment

-

Re: The FED lifts rates!

Does this affect the alphabet soup lending facilities?

Data from 2008-09-01 are loans to depository institutions for primary, secondary, and seasonal credit, primary dealer and other broker-dealer credit. This category also includes the asset-backed commercial paper money market mutual fund liquidity facility, credit extended to American International Group, Inc., and other credit extensions. Data were modified to include term asset-backed securities loan facility with the release on 2009-03-26.

Comment

-

Re: The FED lifts rates!

The numbers in the graph look different than the numbers I'm familiar with (the data in that graph is up to Jan). In the link I put above (for another thread), bart shows us a graph with discount window borrowing. Those numbers jive with the ones I've seen. The numbers discussed in the WSJ article below are also in line with these... namely that the current borrowing is ~15-20B.Originally posted by D-Mack View PostDoes this affect the alphabet soup lending facilities?

http://online.wsj.com/article/SB1000...googlenews_wsj

"...Fed officials view the economy as recovering, but still weak and thus not strong enough to justify tighter credit conditions more broadly. In the depths of the financial crisis in 2008, Fed discount window loans exceeded $100 billion. As of Wednesday, they were below $15 billion. ..."

If the total borrowing is 15B from banks as I think it is, then this rate is non-material IMO...other than for posturing purposes which may affect other rates & expectations by fooling the fools.

Perhaps the numbers in the graph include the alphabet soup programs? bart would probably be the best person to elucidate on the differences between these numbers.

Regarding your question re: alphabet soup - my understanding is that the discount rate affects only a part of the programs, but the devil is in the details.

I don't think it affects things like TALF as pretty much all of the programs are libor or prime rate based (with the exception of a small business loan program that is fed funds based).

It doesn't affect the massive amounts of "guarantees" out there that artificially reduce the cost of borrowing from anybody.

I think that it does affect the Maiden Lane programs. However, based on my understanding of how these deals work, what this increase affects is the returns to the "equity" in the SPVs. Meaning, it affects the excess spread - or the differential between the rate of the assets that were purchased with the FED loan and the FED loan. However, this is only for existing maiden lane programs, and they're ending so it's irrelevant from a new maiden lane program perspective.

Simple example to explain excess spread: Say I'm a bank w/ 100 of shitty, yet "qualifying", assets that are yielding 5% net of all operational expenses and losses. I create an SPV (whore lane), that gets 90 in debt funding from the FED at the discount rate (let's assume it's 1% at asset purchase time). My SPV buys my 100 of shitty assets at par (at 100), so I (as the seller) get 90 now plus a residual interest security (or "equity") that entitles me to all of the remaining cash flow (produced by the SPV assets) after the FED loan is paid. I've now limited my loss to 10 (the notional on my equity), and can use the 90 to originate non-shitty assets. So, the SPV's assets generate 5 dollars (annualized), the SPV owes 1 dollar (annualized) to the FED, and I (as the equity holder) keep 4. If the discount rate goes up to 1.5% (from 1%), it would reduce the returns to the equity in my example to 3.5. So I went from making 40% on my equity to 35% (3.5/10*100). Oh no! This also doesn't factor in that my 90 are somewhere else generating X% and I've passed on my losses (past 10) to the taxpayer.

This also doesn't factor in that my 90 are somewhere else generating X% and I've passed on my losses (past 10) to the taxpayer.

In the end, all these alphabet soup program end dates will be used for posturing akin to the discount rate. If they end, will this mean that the FED will not be highliy accomodative if it has to support the economy? Hell no. We'll see next Thursday/Friday what it is that they're doing with the monetary base and what the banks are doing (+multipliers).

Comment

-

Re: The FED lifts rates!

Core Prices Fall for the First Time in 27 Years

by David Rosnick

The consumer price index rose 0.2 percent in January as energy prices continue to drive a wedge between the overall and core rates. Energy prices jumped 2.8 percent (a 40 percent annualized rate) in January. The core index of inflation, however, fell 0.1 percent in the month -- the first such fall in 27 years.

With this month's revisions to the seasonal adjustment factors, the overall rate of inflation nevertheless continues to decline. The 2.3 percent annualized rate over the last three months is below the 3.0 percent for the three months ending in October and well below the 3.7 percent for the preceding quarter.

In addition to energy prices, medical care prices grew 0.5 percent in January after December's modest 0.1 percent gain. Over the last three months, medical prices have risen at a 3.8 percent annualized rate, with services -- notably hospitals -- leading the way. The price of hospital services has increased steadily over the last year and now stands 6.8 percent higher than twelve months ago, reflecting greater pressure on the part of state and local budgets.

Also adding to price pressure was a 1.3 percent rise in transportation costs, in large part due to higher fuel prices. A 0.5 percent fall in new vehicle prices was balanced by a 1.5 percent rise in used vehicle prices. In the last six months, the price of new and used motor vehicles has grown at a 6.4 percent annualized rate. Public transportation, despite a 1.8 percent fall in January, has grown at an 11.0 percent annualized rate over the last six months, also in part due to the rise in fuel prices.

Core prices have remained unchanged over the last three months -- a 0.007 percent annualized rate -- after averaging a 1.7 percent annualized rate over the previous two quarters. The main reason for the restraint in core prices is an ongoing drop in shelter prices due to fallout from the bubble-driven oversupply of housing.

Continued falls in shelter prices more than balanced out the rise in commodity prices. Shelter prices fell 0.5 percent in January (2.6 percent annualized since October.) Rent prices held steady and owners' equivalent rent fell 0.1 percent for the third time since September. Owners' equivalent rent fell at a 0.7 percent annualized rate over the last three months.

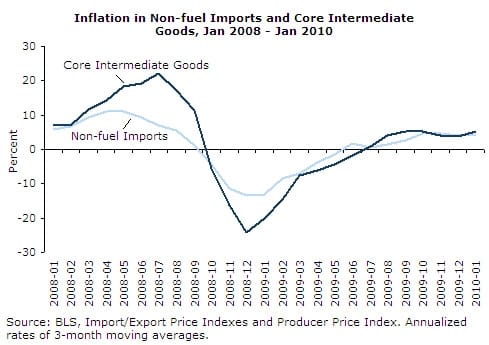

Non-fuel import prices grew 0.4 percent in January and at a 4.0 percent annualized rate over the last three months. The growth in non-fuel import prices has been entirely due to non-fuel industrial supply prices, which grew at a 20 percent annualized rate since October.

Industrial supplies account for less than one-fifth of the non-fuel import price index, yet added 3.1 percentage points to the three-month inflation rate of non-fuel imports. The price of capital and consumer goods, by contrast, fell at a 0.7 percent annualized rate for the three months ending in January.

These higher imported supply costs continue to pressure prices at early stages of production. Driven by price increases for materials used in non-food manufacturing, the price index for intermediate core commodities rose 0.5 percent in January and has now grown at a 5.2 percent annualized rate over the last six months.

With energy and commodity imports the building forces behind inflation, the Federal Reserve would be ill-advised to raise interest rates in response to these price pressures. The real hourly wage of production and non-supervisory workers fell $0.01 again in January, down $0.08 cents over the last year.

David Rosnick is an economist at the Center for Economic and Policy Research in Washington, D.C. He received his Ph.D. in Computer Science from North Carolina State University and his M.A. in Economics from George Washington University. This article was first published by CEPR on 19 February 2010 under a Creative Commons license.

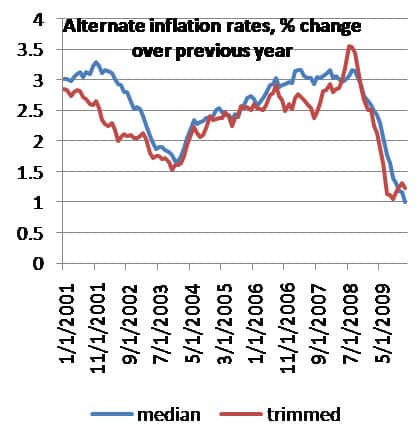

What I find myself looking at these days are the Cleveland Fed "trimmed" inflation measures, which exclude outlying large price movements; the ultimate trim is the median, the rise in the price of the median category. And these indicators tell a story of dramatic disinflation in the face of a week economy:

I find this a scary picture. For one thing, it suggests that deflation may not be too far in the future. But beyond that, there's a growing belief among sensible economists that we need higher, not lower inflation. What we're doing now is moving in the wrong direction, with real interest rates rising even as the nominal rate remains at zero. (DR)

Comment

-

Re: The FED lifts rates!

Like every good trader, the position changes with the wind...Originally posted by phirang View PostI dare the Fed to truly tighten.

I DARE them to.

Originally posted by phirang View PostThe amateurs and pros will already differentiated now:

the amateurs THOUGHT massive debts would kill the dollar.

WRONG

The Fed tightened, the Treasury expanded, and the dollar ripped.

It's going to last a few more months. When the Fed panics again, THEN we get another loosening cycle. Until then - fogettabouit!

Comment

-

Re: The FED lifts rates!

Seems to be the Fed's official position too...Originally posted by FRED View PostThe official iTulip position is that the Fed won't raise rates until unemployment has declined for at least six months, and most likely not for a year.

Fed’s Bernanke to Assure Congress Higher Rates Not Imminent

Feb. 20 (Bloomberg) -- Federal Reserve Chairman Ben S. Bernanke will probably assure Congress that the central bank is mindful of the lack of job growth in the U.S. and an increase in the benchmark interest rate isn’t imminent after the Fed’s decision to raise the cost of direct loans to banks...

...New York Fed President William Dudley indicated yesterday that policy makers need to focus now on maintaining growth rather than fighting inflation, citing a smaller-than-forecast increase in the consumer-price index for January reported by the Labor Department...

...“Monetary policy is about the economy,” Dudley, a voting member of the rate-setting Federal Open Market Committee, told reporters after a speech in San Juan, Puerto Rico. “We need to see solid growth and job creation.”

Consumer prices rose 0.2 percent in January from December, and so-called core prices unexpectedly fell 0.1 percent. The report “showed there’s no inflation pressure,” Dudley said. “So our focus needs to be on growth and jobs.” ...

...“He is going to say it over and over again,” Harris said. “Fed tightening doesn’t happen until there is real healing in the job market, and the job market hasn’t even turned positive.”...

Comment

Comment