The Only Certain Bet in this Market is paying Down Debt. Credit Card Rates Rise as Other Interest Rates Drop. $866 Billion in Revolving Debt Still Remains.

The global economy remains on unstable footing as we see debt problems slam the European markets with Greece in the current spotlight. Yet the problem of debt is not unique to Greece itself and it is fascinating that the world is only focusing on one country. The average American over the past four decades has taken on so much debt that household debt outstanding is now equivalent to the U.S. annual GDP. The biggest amount of debt is with mortgage debt. Yet with mortgage debt you are securing the mortgage to ideally a property that will reflect the amount of debt linked to the home. Part of the housing bubble problem stems from the hyper inflated values of homes and now we are seeing the ramifications of this with millions of homes being foreclosed on. But another large part of this bubble was around the usage of credit cards that hit their apex during this crisis:

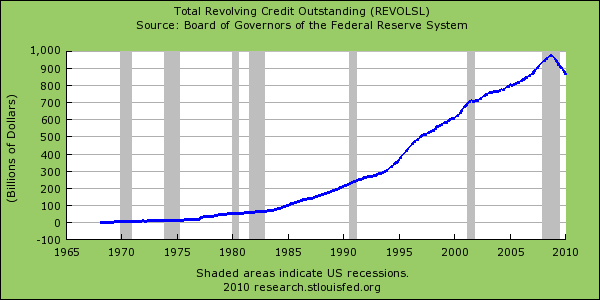

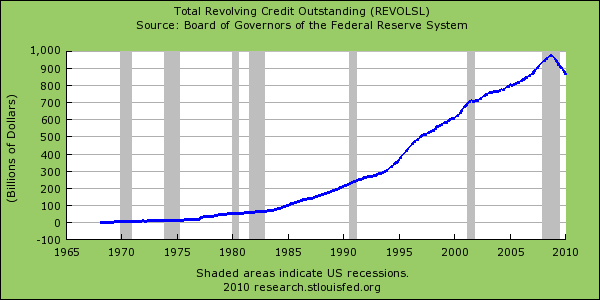

For nearly four decades Americansí love affair with credit cards grew unabated. The amount of credit card debt outstanding hit an apex in 2007 at the height of the bubble reaching $975 billion in debt (to put this in perspective Greeceís GDP is $367 billion and their current deficit is 12.7 percent of economic output). Unlike mortgage debt or even auto debt, there is nothing securing credit card debt. This can be someone going to a club and buying $300 in drinks for friends or taking a trip to Antigua and spending thousands and charging it up on easy plastic. It can also be in the form of consumer goods consumption like buying a new television set or additional appliances. Yet for the first time since data on revolving debt has been kept we have now seen it contract on a yearly basis. And part of this contraction stems from the Great Recession but also more people are paying down extremely expensive debt:

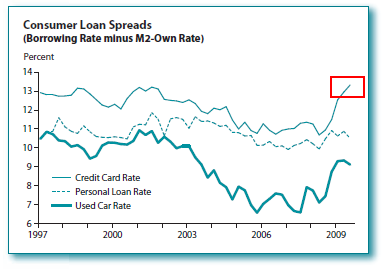

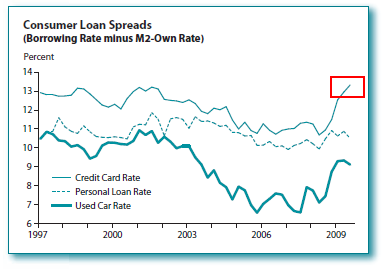

The above data comes from an interesting article from the St. Louis Federal Reserve. The author William T. Gavin examines the low interest rate and its impact on consumers.

.

.

.

.

.

.

In this current environment it would seem that the best course of action is paying down high interest debt and more importantly, not spending beyond what you can reasonably afford. Unfortunately many Americans are now realizing that they do not have access to the same lending window banks have with their central bank. The bailouts were largely a method of shoring up the troubled assets within banks, not a bailout to help the balance sheet of average Americans. If banks had any faith in their customers you would see lending pick up once again. But this Great Recession has created a smaller number of quality borrowers. Or to be more accurate, there werenít many quality borrowers to begin with over the past decade but that didnít stop banks from making loans earlier in the decade. Once banks gained consciousness they slammed shut the door and they went into survival mode primarily by focusing on government support to keep them solvent.

.

.

.

.

.

For nearly four decades Americansí love affair with credit cards grew unabated. The amount of credit card debt outstanding hit an apex in 2007 at the height of the bubble reaching $975 billion in debt (to put this in perspective Greeceís GDP is $367 billion and their current deficit is 12.7 percent of economic output). Unlike mortgage debt or even auto debt, there is nothing securing credit card debt. This can be someone going to a club and buying $300 in drinks for friends or taking a trip to Antigua and spending thousands and charging it up on easy plastic. It can also be in the form of consumer goods consumption like buying a new television set or additional appliances. Yet for the first time since data on revolving debt has been kept we have now seen it contract on a yearly basis. And part of this contraction stems from the Great Recession but also more people are paying down extremely expensive debt:

The above data comes from an interesting article from the St. Louis Federal Reserve. The author William T. Gavin examines the low interest rate and its impact on consumers.

.

.

.

.

.

.

In this current environment it would seem that the best course of action is paying down high interest debt and more importantly, not spending beyond what you can reasonably afford. Unfortunately many Americans are now realizing that they do not have access to the same lending window banks have with their central bank. The bailouts were largely a method of shoring up the troubled assets within banks, not a bailout to help the balance sheet of average Americans. If banks had any faith in their customers you would see lending pick up once again. But this Great Recession has created a smaller number of quality borrowers. Or to be more accurate, there werenít many quality borrowers to begin with over the past decade but that didnít stop banks from making loans earlier in the decade. Once banks gained consciousness they slammed shut the door and they went into survival mode primarily by focusing on government support to keep them solvent.

.

.

.

.

.

Comment