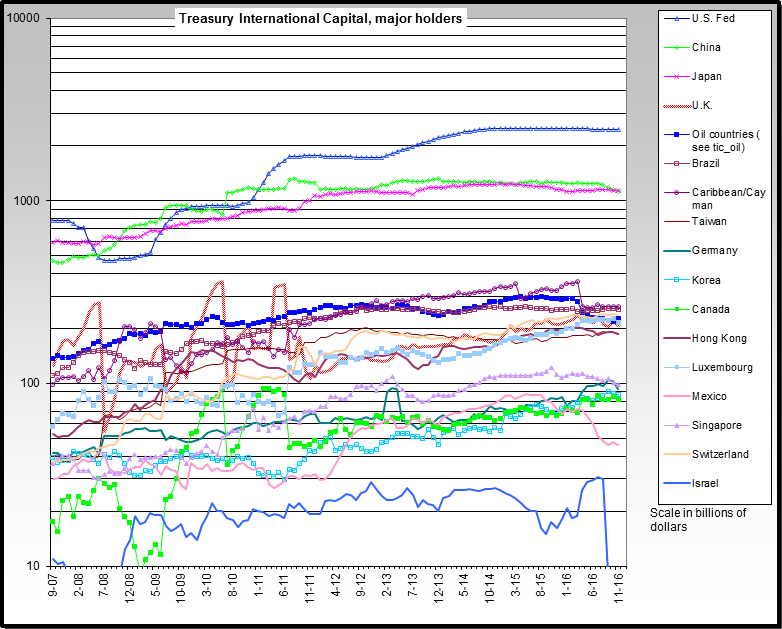

As has been noted on ZeroHedge, China has sold off $34.2B in Treasuries in December.

More interestingly, the net holdings of Foreigners for US Treasuries rose only $16.9B in December 2009, with full Q4 2009 purchases netting $116.6B

The good news: net Treasury issuance was only about $260B in Q4 2009 as opposed to the $350B originally estimated. Thus the foreign coverage rate was not as low as feared - especially since the UK comprised 46%+ of the overall purchases.

But from a deficit funding perspective this is a problem. A $1.5T annual deficit for the foreseeable future does not jibe well with merely $260B of quarterly net Treasury issuance.

Net Treasury issuance for all of 2009: $1.376T

Net Treasury issuance data from:

http://www.sifma.org/research/research.aspx?ID=10806

Previous Q4 2009 net Treasury estimate:

http://www.itulip.com/forums/showthread.php?t=14027

More interestingly, the net holdings of Foreigners for US Treasuries rose only $16.9B in December 2009, with full Q4 2009 purchases netting $116.6B

The good news: net Treasury issuance was only about $260B in Q4 2009 as opposed to the $350B originally estimated. Thus the foreign coverage rate was not as low as feared - especially since the UK comprised 46%+ of the overall purchases.

But from a deficit funding perspective this is a problem. A $1.5T annual deficit for the foreseeable future does not jibe well with merely $260B of quarterly net Treasury issuance.

Net Treasury issuance for all of 2009: $1.376T

| Dec | Nov | Oct | Sep | Aug | Jul | Jun | May | |

| Country | 2009 | 2009 | 2009 | 2009 | 2009 | 2009 | 2009 | 2009 |

| ------ | ------ | ------ | ------ | ------ | ------ | ------ | ------ | |

| Japan | 768.8 | 757.3 | 745.9 | 751 | 730.6 | 723.9 | 711.2 | 677.2 |

| China, Mainland | 755.4 | 789.6 | 798.9 | 798.9 | 797.1 | 800.5 | 776.4 | 801.5 |

| United Kingdom 2/ | 302.5 | 277.6 | 230.1 | 248.8 | 226.4 | 219.4 | 213.4 | 163.7 |

| Oil Exporters 3/ | 186.8 | 187.7 | 188.4 | 185.3 | 189.2 | 189.3 | 191.2 | 192.9 |

| Carib Bnkng Ctrs 4/ | 184.7 | 179.8 | 170.6 | 173 | 181.3 | 194.5 | 191 | 195.2 |

| Brazil | 160.6 | 157.1 | 156.2 | 144.9 | 137.3 | 138.1 | 139.8 | 127.1 |

| Hong Kong | 152.9 | 146.2 | 142 | 132.2 | 124.7 | 115.3 | 99.8 | 93.2 |

| Russia | 118.5 | 128.1 | 122.5 | 121.8 | 121.6 | 118 | 119.9 | 124.5 |

| Luxembourg | 99.9 | 91.7 | 91 | 99 | 94.4 | 92.2 | 104.3 | 96.2 |

| Taiwan | 79.6 | 78.4 | 78.7 | 78.1 | 75.9 | 77.4 | 77 | 75.7 |

| Switzerland | 76 | 75.8 | 71.5 | 68.9 | 68.2 | 68.1 | 71.5 | 63.7 |

| Germany | 52.7 | 53.6 | 52.9 | 53.7 | 55 | 56.1 | 53.8 | 55.1 |

| Canada | 48.3 | 46.2 | 40.3 | 37.7 | 25.7 | 19.6 | 18.4 | 11 |

| Ireland | 39.3 | 38.8 | 38.3 | 32.7 | 36.6 | 38.7 | 46.3 | 50.6 |

| Korea, South | 39.2 | 39.1 | 42.2 | 38.8 | 38.7 | 37.6 | 36.3 | 37.4 |

| Singapore | 38.1 | 36.4 | 35.2 | 38.3 | 42 | 42.3 | 40.8 | 39.6 |

| France | 37.5 | 47.5 | 36.2 | 32 | 35 | 24.6 | 26 | 25.9 |

| Thailand | 35.4 | 31.7 | 30.1 | 30.1 | 33.5 | 31.4 | 29.7 | 26.8 |

| Mexico | 31.1 | 26.2 | 20.7 | 22.1 | 27.5 | 27.7 | 29.5 | 31.5 |

| Norway | 29.7 | 26.2 | 24.9 | 25.2 | 24.7 | 28.9 | 28.7 | 28.3 |

| India | 29.6 | 31.6 | 32.9 | 35.9 | 38.5 | 38.9 | 39.3 | 38.8 |

| Turkey | 28.3 | 29.6 | 30.4 | 28.2 | 28.7 | 27.3 | 27.5 | 28.8 |

| Egypt | 24.8 | 25.3 | 20.2 | 20.8 | 20.4 | 18.6 | 17.3 | 18.6 |

| Netherlands | 19.8 | 20.3 | 19.8 | 21.3 | 21.4 | 21.5 | 18.9 | 16.4 |

| Sweden | 19.1 | 19.4 | 19.2 | 18.3 | 16.7 | 16.5 | 16.4 | 13 |

| Italy | 18.7 | 19.1 | 19.1 | 17.6 | 16.9 | 17.3 | 16.7 | 16.7 |

| Colombia | 15.8 | 15.6 | 16.8 | 16.8 | 16.4 | 14.9 | 11.8 | 12 |

| Israel | 15.3 | 16.6 | 16 | 18.3 | 17.7 | 17 | 18.1 | 19 |

| Belgium | 15.2 | 15.3 | 14.7 | 15 | 15.6 | 15.7 | 15.7 | 15.7 |

| Australia | 14.1 | 11.5 | 10.5 | 10.1 | 10.2 | 9.8 | 9.9 | 9 |

| Chile | 12.5 | 12.2 | 12.5 | 12.9 | 13 | 13.5 | 14.3 | 14.7 |

| Philippines | 12.2 | 12.2 | 11.9 | 11.8 | 12.4 | 11.4 | 11.6 | 11.8 |

| Malaysia | 11 | 11.1 | 11 | 11 | 11.2 | 11.9 | 11.7 | 12.3 |

| All Other | 140.7 | 142.3 | 146.4 | 146.7 | 148.5 | 149.7 | 147.5 | 148.6 |

| Grand Total | 3614 | 3597.1 | 3498.1 | 3497.4 | 3453.1 | 3427.5 | 3382.1 | 3292.6 |

| Of which: | ||||||||

| For. Official | 2374.2 | 2404.6 | 2384.8 | 2369.4 | 2360 | 2346.1 | 2295.7 | 2287.5 |

| Treasury Bills | 534.3 | 586.6 | 598 | 597.7 | 607.3 | 606.6 | 571.9 | 586.2 |

| T-Bonds & Notes | 1839.9 | 1818 | 1786.8 | 1771.7 | 1752.7 | 1739.5 | 1723.8 | 1701.3 |

http://www.sifma.org/research/research.aspx?ID=10806

Previous Q4 2009 net Treasury estimate:

http://www.itulip.com/forums/showthread.php?t=14027

Comment