Re: Load up the Heleocopter, Ben is back!

You've obviously been reading my thoughts.( ) Thanks for putting them on paper.

) Thanks for putting them on paper.

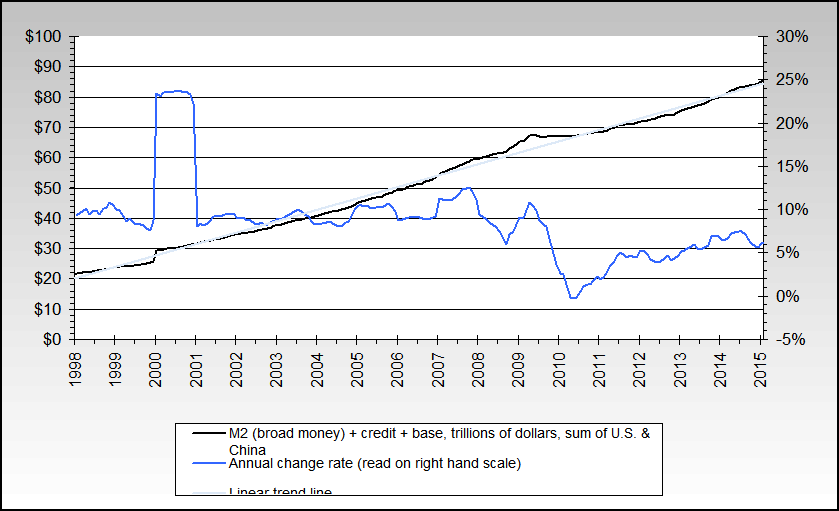

I also believe we're in a Depression, or a Balance Sheet Recession in some areas of Washingtonspeak. It's not your Daddy's Recession which was an Inventory Recession intentionally caused by Fed tightening. This one is a result of several factors, one of which is MISH's term "Peak Credit".

He's actually right about some things.

Originally posted by grapejelly

View Post

) Thanks for putting them on paper.

) Thanks for putting them on paper.I also believe we're in a Depression, or a Balance Sheet Recession in some areas of Washingtonspeak. It's not your Daddy's Recession which was an Inventory Recession intentionally caused by Fed tightening. This one is a result of several factors, one of which is MISH's term "Peak Credit".

He's actually right about some things.

Comment