Announcement

Collapse

No announcement yet.

Load up the Heleocopter, Ben is back!

Collapse

X

-

Re: Load up the Heleocopter, Ben is back!

keep an eye out for this.... latest contraction has been partly a trial balloon imo.

http://research.stlouisfed.org/publi...usfd/page3.pdf

Comment

-

Re: Load up the Heleocopter, Ben is back!

hmm very interesting, valleys are Jan 09, June 09, now Jan 10.

All had stocks down soon afterward. Based on this can we expect

another run up. Thanks for the chart.

I got stopped out on almost all my stock postions this week. Made a profit, but obviously not as big if I would have jumped out a few weeks ago. I am nervous about Japan, and Europe. Can the jump in AMB compensate for chaos there?

Comment

-

Re: Load up the Heleocopter, Ben is back!

It was too tempting for a person like me that loves tacky puns.Originally posted by WildspitzE View PostLOL. nice subtle point bart...

Hope charliebrown has a good sense of humor.

Comment

-

Re: Load up the Heleocopter, Ben is back!

If I only knew...Originally posted by WildspitzE View PostLOL. Given that you're always looking across the data field, any thoughts that you would be willing to share re: mild money supply tightening as of late? and, it's effects on what's going on?

My best guess is that the Fed saw inflation coming on stronger a few months ago or more and is trying to back off (and as almost always is a day late and a dollar short, as the old saying goes), and is also trying its best to affect CONfidence in the dollar while it walks an even sharper razor blade.

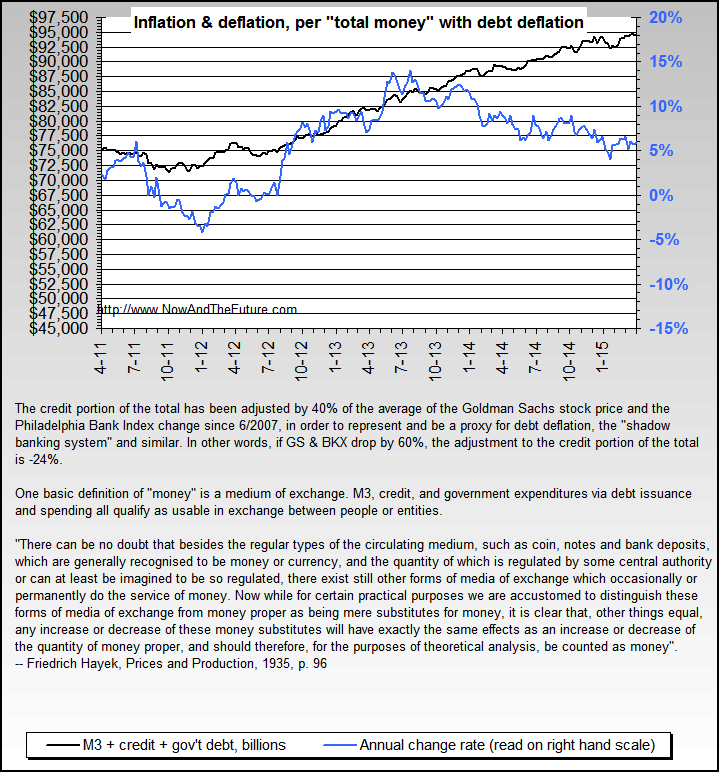

The chart that best reflects my current view of total money supply is this one, but it doesn't as of yet have velocity as a discrete element... and I've been mulling over how to add it for almost a year, with little certainty. :confused:

It also doesn't include the concept of monetary lags.

And here's my current best shot at velocity:

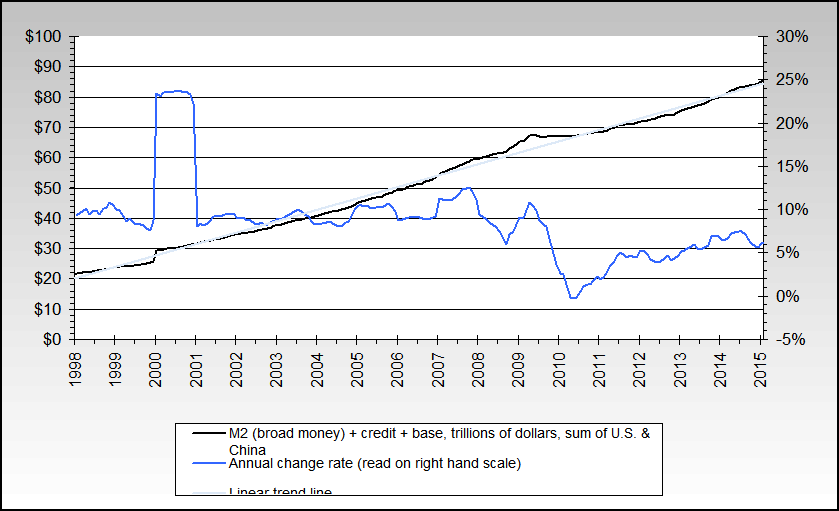

And here's a bonus - a previously unpublished picture of China plus the US - M2/broad money plus credit plus monetary base:

Last edited by bart; January 29, 2010, 10:58 PM.

Last edited by bart; January 29, 2010, 10:58 PM.

Comment

-

Re: Load up the Heleocopter, Ben is back!

I hear you. In search of commentary re: the [covert] tightening efforts, I stumbled on a piece by gary north. I find that often times he is the only one or one of the few ones out there specifically addressing the monetary base, and multipliers/velocity (from a purely austrian perspective).

If you stumble on to others please pass them along.

Anyway, his take is:

"Why is the FED deflating? I offer these suggestions.

1. It is testing the waters to see if unwinding will cause a crisis: a secondary recession.

2. It is giving itself some wiggle room in case commercial banks begin to lend, which threatens to let M1's expansion force up consumer prices.

3. It is providing visible confirmation for a an announced policy that it cannot follow without creating a true depression.

4. It has begun to unwind, as promised.

....

There has been a recent period of monetary sobriety. The FED can reverse this at any time. For as long as it lasts, however, the economy will be faced with deflationary pressures. This is healthy, but not for incumbent politicians. They will demand action on the part of the FED to get the economy moving upward again. All the FED can do at that point is inflate. At some point, it will. But, for now, it has adopted a policy of preliminary unwinding.

Let us hope that this continues. But let us be realistic: it won't."

BTW --- That last chart, US + China is wicked! When is that going on your website? If only I could believe Chinese #s.

Comment

-

Re: Load up the Heleocopter, Ben is back!

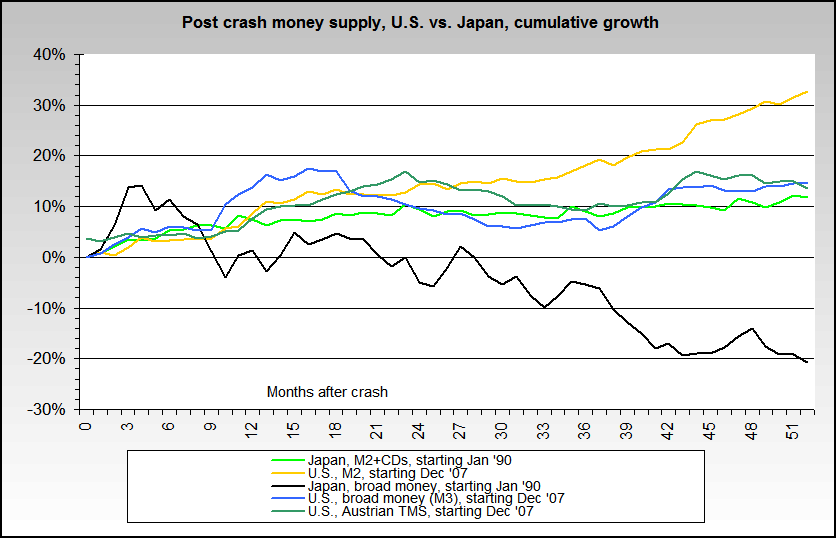

My contention is that we are in a Depression. Meaning a period of many years with very tough economic times.

The reason isn't the credit bubble bursting. It's the government's reaction to that. Exactly why Japan has had two decades of very poor growth.

The government's "jobs" program steals jobs. The bailouts steals from wage earners and savers. What this country needs is DEFLATION and what it will get is INFLATION.

There is a well known delay between the money supply and what it does, and prices and what they do.

We are going to experience price increases in food, energy and other "real" things people need, while wages fall in terms of real buying power due to global competition and the lack of a real recovery in the USA.

This is baked in the cake because of the vast increase in the money supply we have ALREADY experienced.

So any "deflation" by the Fed right now is not relevant to the next 18 or 24 months anyway.

And we are starting to experience the next downleg in the Depression.

Comment

-

Re: Load up the Heleocopter, Ben is back!

Wilco.Originally posted by WildspitzE View PostI hear you. In search of commentary re: the [covert] tightening efforts, I stumbled on a piece by gary north. I find that often times he is the only one or one of the few ones out there specifically addressing the monetary base, and multipliers/velocity (from a purely austrian perspective).

If you stumble on to others please pass them along.

Cool, works for me although I'd add a few more like CONfidence.Originally posted by WildspitzE View PostAnyway, his take is:

"Why is the FED deflating? I offer these suggestions.

1. It is testing the waters to see if unwinding will cause a crisis: a secondary recession.

2. It is giving itself some wiggle room in case commercial banks begin to lend, which threatens to let M1's expansion force up consumer prices.

3. It is providing visible confirmation for a an announced policy that it cannot follow without creating a true depression.

4. It has begun to unwind, as promised.

....

There has been a recent period of monetary sobriety. The FED can reverse this at any time. For as long as it lasts, however, the economy will be faced with deflationary pressures. This is healthy, but not for incumbent politicians. They will demand action on the part of the FED to get the economy moving upward again. All the FED can do at that point is inflate. At some point, it will. But, for now, it has adopted a policy of preliminary unwinding.

Let us hope that this continues. But let us be realistic: it won't."

Good reminder, thanks - I just added it to my confidence/sentiment page, my current "catch-all".Originally posted by WildspitzE View PostBTW --- That last chart, US + China is wicked! When is that going on your website? If only I could believe Chinese #s.

Comment

-

Re: Load up the Helicopter, Ben is back!

I might quibble on calling what we have now a depression, only because I define a depression as GDP dropping over 10% - but we're close enough for horseshoes... as my granpappy used to say. ;)Originally posted by grapejelly View PostMy contention is that we are in a Depression. Meaning a period of many years with very tough economic times.

The reason isn't the credit bubble bursting. It's the government's reaction to that. Exactly why Japan has had two decades of very poor growth.

And here's my version of Japan since the 90s vs. the US since late 2007:

This is baked in the cake because of the vast increase in the money supply we have ALREADY experienced.

I think you know this (but just in case), monetary lags affect different items and markets at different times, and they also vary in the actual time lag amount depending on other factors like velocity.Originally posted by grapejelly View Post...

So any "deflation" by the Fed right now is not relevant to the next 18 or 24 months anyway.

And we are starting to experience the next downleg in the Depression.

The last week or so sure has shown how fast Fed & Treasury monetary actions can hit the stock market.

Comment

-

Re: Load up the Heleocopter, Ben is back!

yes bart charliebrown is LOL too.

I feel like an action hero. the bomb has detonated and somehow I can out run the fire ball. I'm almost all the way out of the market now, got singed but made 10-15% on most of my postions. I was up 25% but did not pull the trigger fast enough. I thought I heard the sound of a "chopper" I will wait for some

stability before buying back in, and my postion is not going to be nearly as large going forward.

Comment

Comment