California Bubbly: Riding the Wave

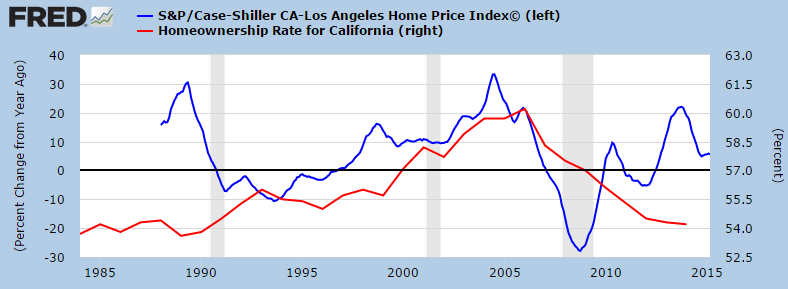

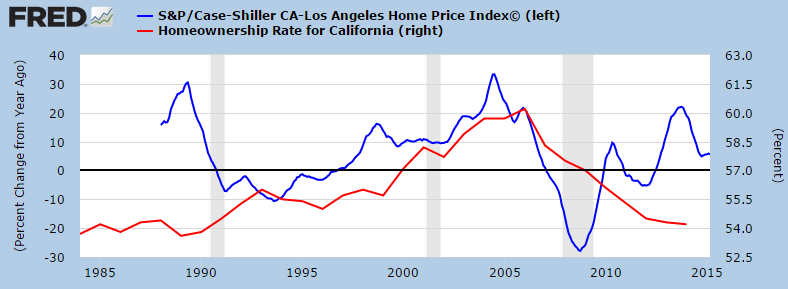

One thing to understand about California housing is that boom and busts are central to the market. It is fascinating from a psychological standpoint that today, many think that California housing is a simple and safe bet. Casually, they forget the massive destruction that occurred only a few years ago and the echoes of the impact are still around: low inventory, massive Federal Reserve intervention, and a shift to investors buying homes. Looking to buy? Gear up for a sizable down payment and maximum leverage on a low interest rate. Also, it is easy to forget that 1,000,000+ Californians lost their homes via foreclosure and many today are still underwater even with the recent boom in home prices. Even with the trend to higher prices, people have the choice to buy or rent. Unlike stocks, most households have to make the analysis of buying or renting. In spite of rising prices and the meme that home values will only go up, the homeownership rate in California has plummeted. The state is seeing a wave of households opting to rent. This trend started in 2005, while home prices held a plateau up until 2007.

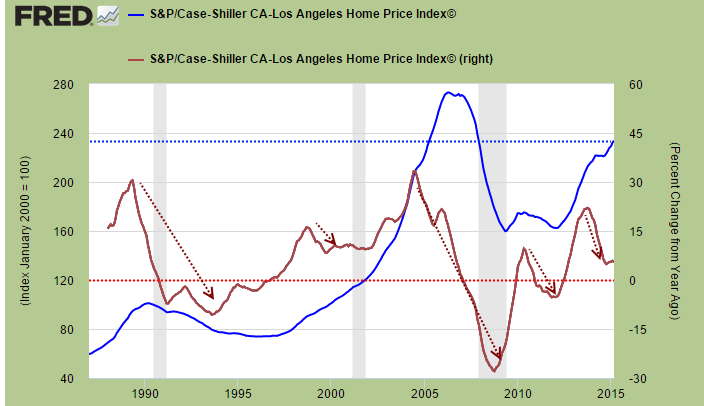

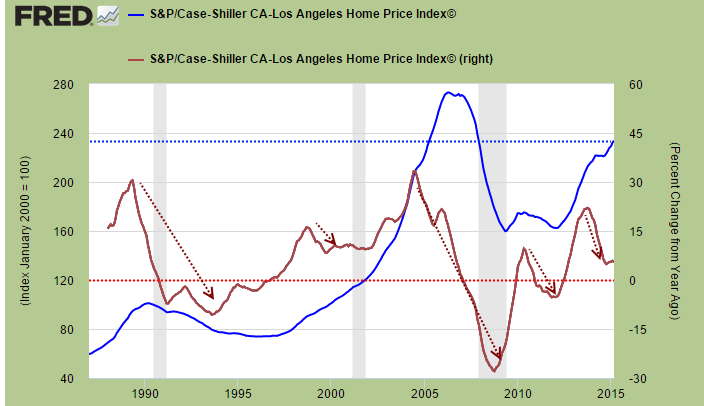

In housing, trends reverse slowly. Take a look at 30 years of housing data for the LA/OC markets.30 years of trends in the LA/OC marketThe boom and bust cycle is simply part of the California market. We’ve had a nice boom driven by investors and low inventory recently. But investors (those with big wallets) have pulled out dramatically early in 2014. Yet momentum is shifting but the question is, what will come about this change? People also forget that the stock market is on a six-year tear and California, especially the Bay Area has a deep connection between the two. Stocks are up and real estate follows. It is interesting to see that the stock market this year is also unsure of what it wants to do.It might be helpful to look at the Case-Shiller Index for the L.A. market. The index also pulls in OC data so it is a nice overview of a very big market. Here is data going back 30 years:

The blue line is the Case-Shiller Index with no adjustments. You can see the recent big bounce up. The red line shows momentum changes in the form of year-over-year changes. You can see that the trend is definitely heading lower. Of course, these changes happen over years. For those in the market looking at a $700,000 crap shack, you are really betting against the above chart. It is interesting that many in California will look at the stock market as some kind of risky proposition, even when placing a $50,000 bet. Yet some see no problem buying a $700,000 home requiring a $140,000 down payment to get down to a modest monthly mortgage payment. A small 10 percent correction (see chart above) would wipe out a nice chunk of change. Those going in with low down payments might be in a position where equity is at par (or below given selling costs).More to the point, price-to-income ratios are incredibly out of whack. It is interesting to see the justifications today for why prices are high. There is a reason why the LA/OC market is the most overpriced in terms of housing. Not New York. Not San Francisco. Not Chicago. It is the LA/OC region and you know why? Because relative to the other areas, incomes here are simply not that high. This is also a reason why we see more booms and busts here. Take New York City:

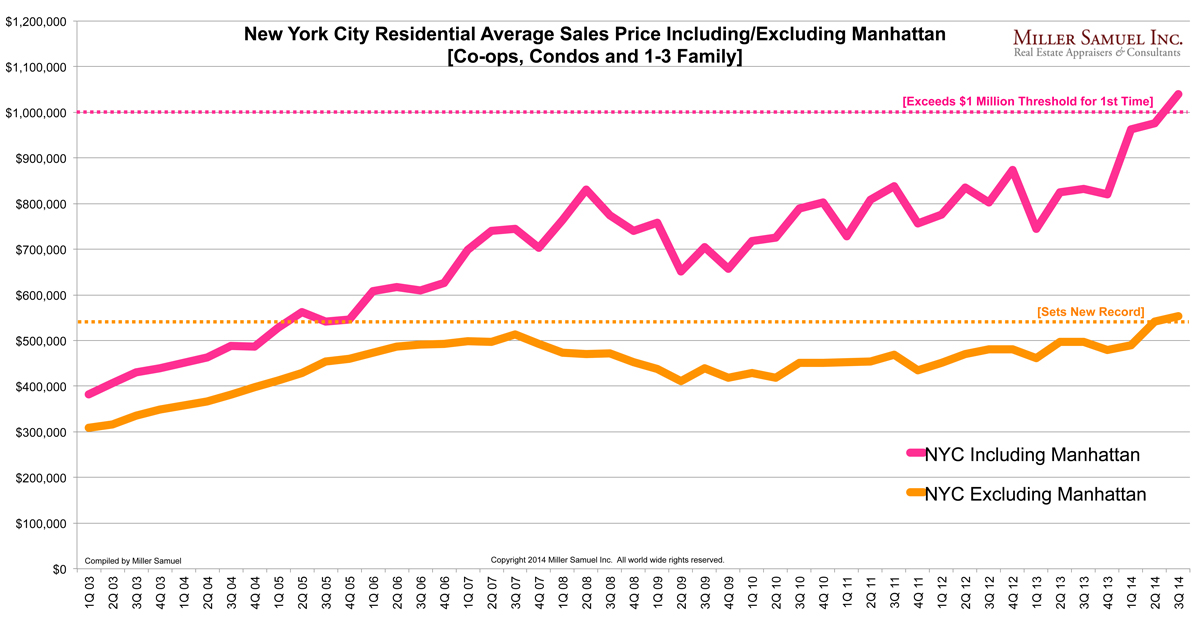

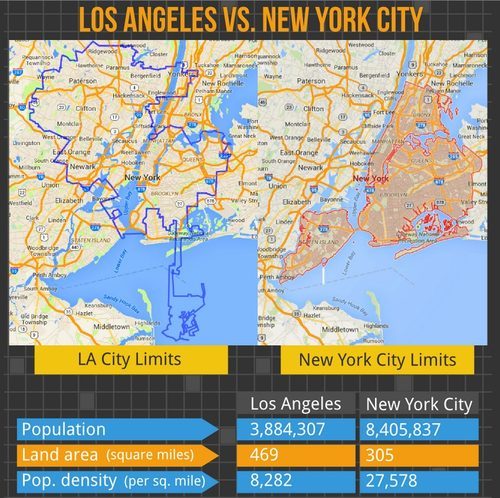

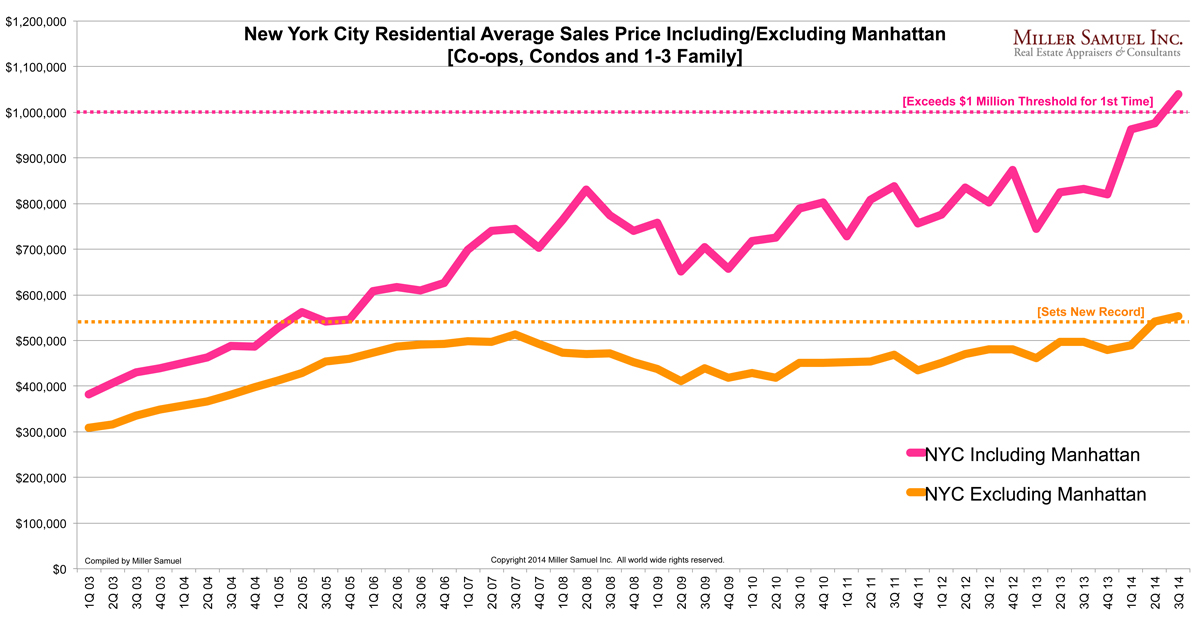

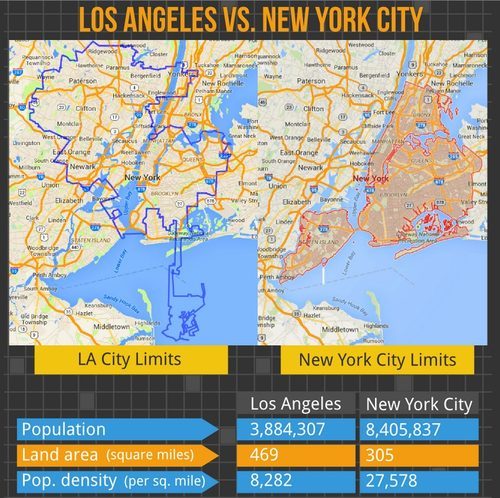

You notice how prices didn’t take a massive hit like the LA/OC area. You know why? Because unlike New York City, the LA/OC market is one giant urban sprawl that isn’t land locked. That is a massively important point to note. Also, incomes in NYC are simply better than in L.A. and Orange County. Forget about population density:

And that is merely for L.A. the city. L.A. County has 10,000,000 people and many are looking to buy in L.A. County cities, not L.A. With that said, the homeownership trend for California has been moving lower over the last decade:

Simply put, this means more renting households and fewer buyers. This young group of future buyers is unlikely to materialize, at least with current incomes. We’ve already highlighted that 2.3 million adult Californians are living at home with their parents. Wages are simply not keeping up with price gains or even rent increases. The last boom was driven by low Fed rates, hot investor money, and a lack of inventory (you notice how higher incomes or booming sales are not driving prices up).But if you want to buy, here is a nice and bright home in Highland Park:

6071 Roy St,Los Angeles, CA 900423 beds, 1 bath 1,231 square feetThis place sold for $90,000 in 1986 (the current tax assessment is $165,228). The current list price is $599,000 (in other words, $600,000). Just think, you’ll enjoy this bright colored home and you’ll have the privilege of paying property taxes 3.5 times higher than the current Prop 13 rate. This is a perfect hipster/Taco Tuesday home (make sure you get $120,000 for a nice down payment).

In 2011 the Zestimate on this place was $366,000. Now you “need” to pay $240,000 more but for what? So how do you justify a $240,000 (a 65% jump) price move in a mere 3 years. For the privilege of living in Highland Park. And they say real estate isn’t a speculative market. Look at the historical data here and you will find out that California is all about boom and bust. The LA/OC market is the epitome of this.

One thing to understand about California housing is that boom and busts are central to the market. It is fascinating from a psychological standpoint that today, many think that California housing is a simple and safe bet. Casually, they forget the massive destruction that occurred only a few years ago and the echoes of the impact are still around: low inventory, massive Federal Reserve intervention, and a shift to investors buying homes. Looking to buy? Gear up for a sizable down payment and maximum leverage on a low interest rate. Also, it is easy to forget that 1,000,000+ Californians lost their homes via foreclosure and many today are still underwater even with the recent boom in home prices. Even with the trend to higher prices, people have the choice to buy or rent. Unlike stocks, most households have to make the analysis of buying or renting. In spite of rising prices and the meme that home values will only go up, the homeownership rate in California has plummeted. The state is seeing a wave of households opting to rent. This trend started in 2005, while home prices held a plateau up until 2007.

In housing, trends reverse slowly. Take a look at 30 years of housing data for the LA/OC markets.30 years of trends in the LA/OC marketThe boom and bust cycle is simply part of the California market. We’ve had a nice boom driven by investors and low inventory recently. But investors (those with big wallets) have pulled out dramatically early in 2014. Yet momentum is shifting but the question is, what will come about this change? People also forget that the stock market is on a six-year tear and California, especially the Bay Area has a deep connection between the two. Stocks are up and real estate follows. It is interesting to see that the stock market this year is also unsure of what it wants to do.It might be helpful to look at the Case-Shiller Index for the L.A. market. The index also pulls in OC data so it is a nice overview of a very big market. Here is data going back 30 years:

The blue line is the Case-Shiller Index with no adjustments. You can see the recent big bounce up. The red line shows momentum changes in the form of year-over-year changes. You can see that the trend is definitely heading lower. Of course, these changes happen over years. For those in the market looking at a $700,000 crap shack, you are really betting against the above chart. It is interesting that many in California will look at the stock market as some kind of risky proposition, even when placing a $50,000 bet. Yet some see no problem buying a $700,000 home requiring a $140,000 down payment to get down to a modest monthly mortgage payment. A small 10 percent correction (see chart above) would wipe out a nice chunk of change. Those going in with low down payments might be in a position where equity is at par (or below given selling costs).More to the point, price-to-income ratios are incredibly out of whack. It is interesting to see the justifications today for why prices are high. There is a reason why the LA/OC market is the most overpriced in terms of housing. Not New York. Not San Francisco. Not Chicago. It is the LA/OC region and you know why? Because relative to the other areas, incomes here are simply not that high. This is also a reason why we see more booms and busts here. Take New York City:

You notice how prices didn’t take a massive hit like the LA/OC area. You know why? Because unlike New York City, the LA/OC market is one giant urban sprawl that isn’t land locked. That is a massively important point to note. Also, incomes in NYC are simply better than in L.A. and Orange County. Forget about population density:

And that is merely for L.A. the city. L.A. County has 10,000,000 people and many are looking to buy in L.A. County cities, not L.A. With that said, the homeownership trend for California has been moving lower over the last decade:

Simply put, this means more renting households and fewer buyers. This young group of future buyers is unlikely to materialize, at least with current incomes. We’ve already highlighted that 2.3 million adult Californians are living at home with their parents. Wages are simply not keeping up with price gains or even rent increases. The last boom was driven by low Fed rates, hot investor money, and a lack of inventory (you notice how higher incomes or booming sales are not driving prices up).But if you want to buy, here is a nice and bright home in Highland Park:

6071 Roy St,Los Angeles, CA 900423 beds, 1 bath 1,231 square feetThis place sold for $90,000 in 1986 (the current tax assessment is $165,228). The current list price is $599,000 (in other words, $600,000). Just think, you’ll enjoy this bright colored home and you’ll have the privilege of paying property taxes 3.5 times higher than the current Prop 13 rate. This is a perfect hipster/Taco Tuesday home (make sure you get $120,000 for a nice down payment).

In 2011 the Zestimate on this place was $366,000. Now you “need” to pay $240,000 more but for what? So how do you justify a $240,000 (a 65% jump) price move in a mere 3 years. For the privilege of living in Highland Park. And they say real estate isn’t a speculative market. Look at the historical data here and you will find out that California is all about boom and bust. The LA/OC market is the epitome of this.

Comment