Announcement

Collapse

No announcement yet.

M3 nosediving, but prices increasing, Why? - James Turk

Collapse

X

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

I readily confess the inflation/deflation bugaboo is beyond my intellectual powers to grasp. I remain struck by the fact that great minds are arrayed on both sides of the debate. Cracking this conundrum will yield the keys to the city. It is either the $1,000,000 question or the $100 question.

Here, Turk remains attached to hyperinflationist position despite what looks like a prima facie deflationary scenario. Then there's the ba-ba-boom theory or is it ka-poom with its interminable period of hyphenation.

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Inflation and deflation is at best a cunundrum partially because of language, location, charts and graphs, definitions-multiple and confusiionplus divergent micro and macro economic theories.Originally posted by due_indigence View PostI readily confess the inflation/deflation bugaboo is beyond my intellectual powers to grasp. I remain struck by the fact that great minds are arrayed on both sides of the debate. Cracking this conundrum will yield the keys to the city. It is either the $1,000,000 question or the $100 question.

Here, Turk remains attached to hyperinflationist position despite what looks like a prima facie deflationary scenario. Then there's the ba-ba-boom theory or is it ka-poom with its interminable period of hyphenation.

Nevertheless for me the confusing part had been between 2003 to 2009 to observe local/regional and national inflation and deflation occurring simultaneously based on my personal -micro pocketbook. Milk is $4 a gallon and then $2.50 and while milk is going down gas goes from $2.50 to $4.00 a gallon is an example. Oil goes up and gas goes up and everthing moved by truck goes up. Oil goes down and gas goes down and nothing moved by truck goes down - is that inflation/deflation or something else?

I am betting on the something else!

Cindy

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

M3 nosediving, but prices increasing, Why?

Lots of reasons, amongst them being:

- M3 is not the same as total money supply

- The concepts of monetary lags exist - it just plain takes a while for large changes to filter through ( http://www.nowandfutures.com/money_and_lags.html )

- Debt deflation as a concept exists, and total credit is shrinking

- Total money supply in the entire world is a missing factor

- Price directions are also affected by supply & demand, and relative GDP

- CPI lags money supply growth

- Velocity (the speed with which money travels through an economy), which is a factor of total money supply, is slow and still dropping

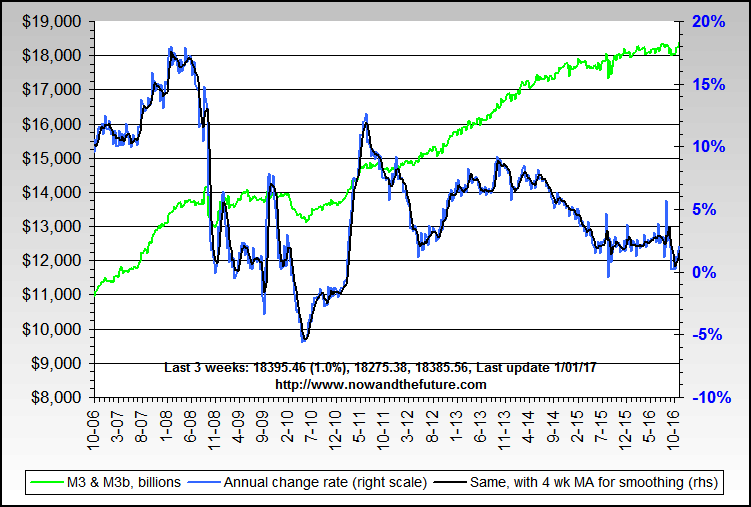

Here's my M3 reconstruction, which showed the shrinking as early as last October, if one was watching it:

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Bart, so do you think that Turk is talking his book then when he poses these possibilities?Originally posted by bart View PostM3 nosediving, but prices increasing, Why?

Lots of reasons, amongst them being:

- M3 is not the same as total money supply

- The concepts of monetary lags exist - it just plain takes a while for large changes to filter through ( http://www.nowandfutures.com/money_and_lags.html )

- Debt deflation as a concept exists, and total credit is shrinking

- Total money supply in the entire world is a missing factor

- Price directions are also affected by supply & demand, and relative GDP

- CPI lags money supply growth

- Velocity (the speed with which money travels through an economy), which is a factor of total money supply, is slow and still dropping

1) Demand for the dollar is falling – A basic principle of Economics 101 is that price will fall if demand drops more rapidly than supply. This principle is also true for money, the ‘price’ of which is its purchasing power. So even though the quantity of M3 is less than it was one year ago, presumably the demand for dollars has fallen even more. The consequence is that the dollar today purchases less than it did last year. In other words, the price of goods and services is rising.

2) M3 is understated – It is possible that Shadow Stats is not capturing the total amount of dollars in circulation with its M3 estimates. One of the M3 components is eurodollars, which is notoriously difficult to estimate. I emailed John Williams, the proprietor of Shadow Stats, on this point, who acknowledged that there is little good reporting for eurodollars, but he also raised a related point. Given that the dollar is still the world’s primary reserve currency, the global stock of dollars has to be taken into account. Unfortunately, there is no reliable number for the total quantity of dollars outside the U.S.

I also noticed that Steve Saville posted an article on the same subject

http://www.321gold.com/editorials/sa...lle011210.html

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Originally posted by bart View PostM3 nosediving, but prices increasing, Why?

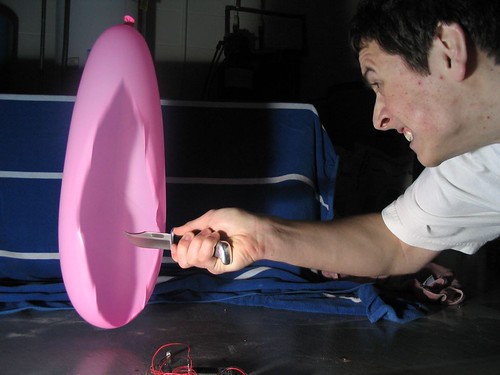

pV = nRT

pV != nRT

On the left side, the Ideal gas law holds for the gas inside balloon. On the right side, the law does not hold.

The "economic law" that prices rise and fall in proportion to money supply is an analogy to the ideal gas law.Most folks are good; a few aren't.

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

To the extent that the ideal gas law applies to real atmospheric gases (which is pretty close), it holds in either case. However, the pressure inside the volume formerly constrained by the balloon will not be the same after it bursts. Changing the boundary conditions doesn't invalidate the law -- it merely invalidates the solution which existed under earlier boundary conditions. ;)Originally posted by ThePythonicCow View PostOn the left side, the Ideal gas law holds for the gas inside balloon. On the right side, the law does not hold.

The "economic law" that prices rise and fall in proportion to money supply is an analogy to the ideal gas law.

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

We're agreeing, sort of. I should have said:Originally posted by ASH View PostTo the extent that the ideal gas law applies to real atmospheric gases (which is pretty close), it holds in either case. However, the pressure inside the volume formerly constrained by the balloon will not be the same after it bursts. Changing the boundary conditions doesn't invalidate the law -- it merely invalidates the solution which existed under earlier boundary conditions. ;)

However my real point is more obscure. I'm saying that regardless of how much a "law" the ideal gas law is, the corresponding theories of money supply and price in economics are at best analogies, not laws. The simple lab physics experiment of turning up the bunsen burner to raise the pressure in a closed rigid container in order to demonstrate the ideal gas law only works in a controlled experiment with carefully constrained variables.On the left side, the Ideal gas law holds for the gas inside balloon. On the right side, the law does not hold inside the balloon (for lack of a good definition of "inside" if no other reason.)

There is no such rigid container, no such reproducible lab experiment, no such controls, no such constraint in economics. Moreover, I doubt that even if there were, this analogy (more money correlates to higher prices as more gas molecules correlates to higher pressure) would hold in all cases, all else equal. Sometimes the lab student overheats the rigid container and it blows up. Ouch.

The economic system has severe non-linearities. Money is not an ideal gas.Most folks are good; a few aren't.

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Originally posted by bart View PostM3 nosediving, but prices increasing, Why?

Lots of reasons, amongst them being:

- M3 is not the same as total money supply

- The concepts of monetary lags exist - it just plain takes a while for large changes to filter through ( http://www.nowandfutures.com/money_and_lags.html )

- Debt deflation as a concept exists, and total credit is shrinking

- Total money supply in the entire world is a missing factor

- Price directions are also affected by supply & demand, and relative GDP

- CPI lags money supply growth

- Velocity (the speed with which money travels through an economy), which is a factor of total money supply, is slow and still dropping

One more point. The dollar has been depreciating against imported commodities so one dollar buys less imported goods.

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Originally posted by Charles Mackay View PostBart, so do you think that Turk is talking his book then when he poses these possibilities?

1) Demand for the dollar is falling – A basic principle of Economics 101 is that price will fall if demand drops more rapidly than supply. This principle is also true for money, the ‘price’ of which is its purchasing power. So even though the quantity of M3 is less than it was one year ago, presumably the demand for dollars has fallen even more. The consequence is that the dollar today purchases less than it did last year. In other words, the price of goods and services is rising.

2) M3 is understated – It is possible that Shadow Stats is not capturing the total amount of dollars in circulation with its M3 estimates. One of the M3 components is eurodollars, which is notoriously difficult to estimate. I emailed John Williams, the proprietor of Shadow Stats, on this point, who acknowledged that there is little good reporting for eurodollars, but he also raised a related point. Given that the dollar is still the world’s primary reserve currency, the global stock of dollars has to be taken into account. Unfortunately, there is no reliable number for the total quantity of dollars outside the U.S.

I also noticed that Steve Saville posted an article on the same subject

http://www.321gold.com/editorials/sa...lle011210.html

Turk has always seemed like a straight shooter and quite consistent from here, unlike Mish and a few others that blow with the wind and get "creative" or into dubious or opportunistic mode (Mish actually showed his "creativity" again a few months ago by literally stating that "M3 is useless", and suddenly gives it credence yesterday).

1. As far as dollar demand, I have medium and short term difficulty seeing the actual evidence of demand falling much. Longer term of course, trends in areas like COFER (CB dollar holdings) are pretty much indisputable.

2. For sure - reconstructing something like Eurodollars is fraught with problems, and even statistical issues like margin of error come seriously into play. But shadowstats.com reconstruction and mine are quite close, especially in the change rate area, which adds a lot of credence given that he's a "real" economist that's been doing this stuff for 30+ years.

Also, do keep in mind that I do some significant adjusting and fiddling with the Eurodollar figures. One of the adjustments is based on oil prices - higher oil prices mean more Eurodollars. Another was based on the gigantic swap lines that the Fed did a while back - they peaked at almost $700 billion. There are other adjustments that I do too, one of which is based on "CONfidence", but they're currently proprietary.

I will say this - average Eurodollars as a percent of M3 averaged about 2.9% from 1980 to early 2006 when it was discontinued with a high of 5.1% in February 2006, and per my work hit a peak of well over 6.5% in March of 2009. It's back to about 4.5% now... for what its worth.

As far as Steve Saville's article - good stuff! I've been ranting and charting and punting about what total money supply really is for years, and its excellent to see the area covered.

There is no "holy grail" (except for the FDI of course ;) ), just like virtually everything in economics or other social sciences. Making conclusions about what's happening to credit or debt or M3 or velocity or debt deflation or TMS or varying monetary lags or AMS or M2 or whatever is *very* dangerous without knowing as precisely as possible what they are, and a failure to take them all into account is downright idiocy in my opinion.

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

What about the exiting of dollars from expats? This from Bill Bonner's Sovereign Society letter.Originally posted by bart View PostTurk has always seemed like a straight shooter and quite consistent from here, unlike Mish and a few others that blow with the wind and get "creative" or into dubious or opportunistic mode (Mish actually showed his "creativity" again a few months ago by literally stating that "M3 is useless", and suddenly gives it credence yesterday).

1. As far as dollar demand, I have medium and short term difficulty seeing the actual evidence of demand falling much. Longer term of course, trends in areas like COFER (CB dollar holdings) are pretty much indisputable.

2. For sure - reconstructing something like Eurodollars is fraught with problems, and even statistical issues like margin of error come seriously into play. But shadowstats.com reconstruction and mine are quite close, especially in the change rate area, which adds a lot of credence given that he's a "real" economist that's been doing this stuff for 30+ years.

Also, do keep in mind that I do some significant adjusting and fiddling with the Eurodollar figures. One of the adjustments is based on oil prices - higher oil prices mean more Eurodollars. Another was based on the gigantic swap lines that the Fed did a while back - they peaked at almost $700 billion. There are other adjustments that I do too, one of which is based on "CONfidence", but they're currently proprietary.

I will say this - average Eurodollars as a percent of M3 averaged about 2.9% from 1980 to early 2006 when it was discontinued with a high of 5.1% in February 2006, and per my work hit a peak of well over 6.5% in March of 2009. It's back to about 4.5% now... for what its worth.

As far as Steve Saville's article - good stuff! I've been ranting and charting and punting about what total money supply really is for years, and its excellent to see the area covered.

There is no "holy grail" (except for the FDI of course ;) ), just like virtually everything in economics or other social sciences. Making conclusions about what's happening to credit or debt or M3 or velocity or debt deflation or TMS or varying monetary lags or AMS or M2 or whatever is *very* dangerous without knowing as precisely as possible what they are, and a failure to take them all into account is downright idiocy in my opinion.

"Millions of Americans are leaving (or planning to leave) the country. According to Zogby Research, a massive and silent migration is underway. Families are packing their bags…kids… pets and deciding to go offshore at the rate of 54-per minute! (Some seeking a full-time residence… others a part-time tropical vacation home where they can live like royalty for $20,000 a year.)

When someone takes a million dollars offshore and buys property and foreign currency with it how does that change the money supply ?

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Is this really happening?Originally posted by Charles Mackay View Post"Millions of Americans are leaving (or planning to leave) the country. According to Zogby Research, a massive and silent migration is underway. Families are packing their bags…kids… pets and deciding to go offshore at the rate of 54-per minute! (Some seeking a full-time residence… others a part-time tropical vacation home where they can live like royalty for $20,000 a year.)

Comment

-

Re: M3 nosediving, but prices increasing, Why? - James Turk

Originally posted by Charles Mackay View PostWhat about the exiting of dollars from expats? This from Bill Bonner's Sovereign Society letter.

"Millions of Americans are leaving (or planning to leave) the country. According to Zogby Research, a massive and silent migration is underway. Families are packing their bags…kids… pets and deciding to go offshore at the rate of 54-per minute! (Some seeking a full-time residence… others a part-time tropical vacation home where they can live like royalty for $20,000 a year.)

When someone takes a million dollars offshore and buys property and foreign currency with it how does that change the money supply ?

Sure, it's a factor but keep in mind that the planet is pretty well globalized so any money taken out of the US just stays part of global money supply. Plus, the IRS has their fingers in the pie these days for 10(?) years after one expatriates.

There are also folk that emigrate in every day too, but even more than that, the US is quite the tax haven for much of the rest of the world - the laws are quite different for non-residents. Also, many foreigners do actually invest in various assets in the US currently, even real estate. TIC flows show the raw data and the US isn't an awful place to invest, especially with dollar hedging and it still is the #1 flight currency.

Then there's the missing data from Bonner & Zogby of how much of their total money do those expats move completely out of the country, and the hedging element in your quote "of deciding to go offshore" - how many actually go through with it being my point. Lots of folk I know have talked about it but only one has moved.

Its easy to hedge dollar exposure, not so easy or inexpensive to put together trusts etc. to cover one's posterior, and move an entire family to a country with perhaps a very different culture, let alone language, etc.

Don't get me wrong, the dollar is in a long term decline just like every fiat currency, but expats are a very small monetary factor in my opinion... and Bonner is in the business of selling a newsletter, etc. too.

Comment

Comment