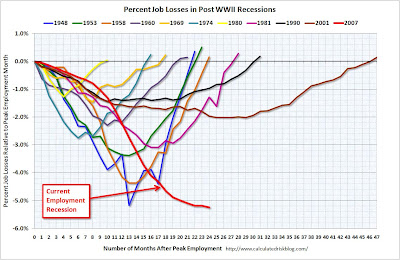

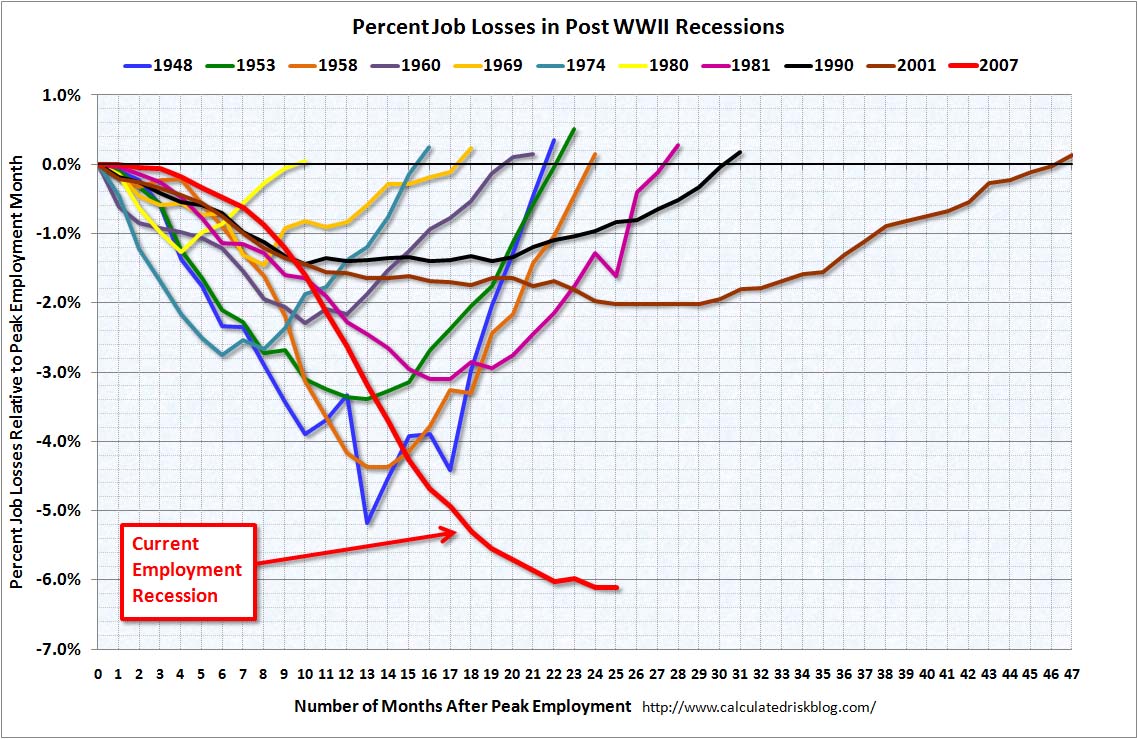

Jesse was wrong, but only because he expected a repeat and not a rhyme...

http://finance.yahoo.com/news/Econom...n&asset=&ccode=

Note the 929,000 'discouraged' workers...

This can mean several things:

1) Unemployment is so bad that even the normal machinations aren't working

2) Some other play is in motion: a minor 'double dip' to allow more ridiculous TARP-like or 'health reform' bills to be passed.

http://finance.yahoo.com/news/Econom...n&asset=&ccode=

Note the 929,000 'discouraged' workers...

WASHINGTON (Reuters) - U.S. employers unexpectedly cut 85,000 jobs in December, cooling optimism on the labor market's recovery and keeping pressure on President Barack Obama to find ways to spur job growth.

The Labor Department said on Friday that November payrolls were revised to show the economy actually added 4,000 jobs rather than losing 11,000 as initially reported, breaking a streak of consecutive losses that dates back to December 2007.

With revisions to October, however, the economy lost 1,000 more jobs than previously estimated over the two months.

The unemployment rate was unchanged at 10 percent in December, but that reflected a surprisingly large number of people leaving the labor force.

Analysts polled by Reuters had expected nonfarm payrolls to hold steady last month, with the jobless rate edging up to 10.1 percent.

"The economy continues to take three steps forward and two steps back. I wouldn't read too much into it beyond the fact that this will be a slow employment recovery. Directionally, the economy is on a mend," said David Katz, chief investment officer at Matrix Asset Advisors in New York.

U.S. stock opened marginally lower, while the dollar fell against the euro and government bond prices erased losses as the report dashed hopes among some that the economy was now generating jobs.

U.S. short-term interest rate futures pared losses as investors bet that the weak labor market would keep inflation tame and encourage the Federal Reserve to leave interest rates near zero for a long time.

Euro-zone unemployment jumped to an 11-year high in November, and is likely to rise more in the coming year.

"The American economy is clearly not going to burst out of the gate with growth and job creation but it will perform better than its major competitors in Europe and Japan," said Joseph Trevisani, chief market analyst at FX Solutions in Ridgewood, New Jersey.

POLITICAL PRESSURES MOUNTS

High unemployment is one of the toughest domestic challenges facing Obama. The administration's success in getting people back to work will shape prospects for Obama's political future.

Obama's popularity has steadily fallen, knocking his approval ratings down to around 50 percent. This could dim the election prospects for his Democratic Party in the November congressional elections. Obama is scheduled to make a statement on the economy at 2:40 p.m. EST.

"We're going to have to work harder to create more jobs," U.S. Labor Secretary Hilda Solis told Bloomberg TV. "The president will outline more tax credits for small business because they are the engine of growth."

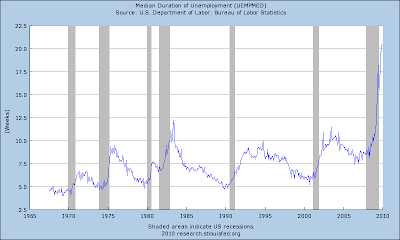

Unemployment remains the Achilles heel of the economic recovery, which started in the third quarter of 2009 following the worst recession in 70 years. Creating jobs is critical to sustaining the economic recovery when government stimulus fades.

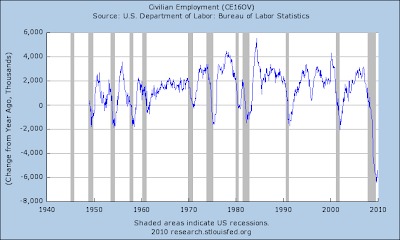

For the whole of 2009, the economy shed 4.2 million jobs, according to the Labor Department's survey of employers.

The department's survey of households offered an even gloomier assessment of the job market, showing that 661,000 people left the work force last month.

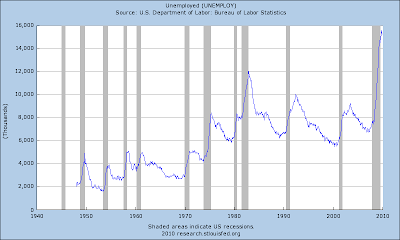

The report showed there were 929,000 "discouraged workers" who had given up looking for a job, up from 642,000 a year earlier. Chris Rupkey, an economist with Bank of Tokyo-Mitsubishi, called the rise in discouraged workers "a simply astonishing number that borders on the frightening."

"If they were still looking for work and counted as the unemployed, the unemployment rate would have been 10.5 percent," he said. "This clearly isn't your father's recession. It is looking more like your great-grandfathers. Brother, can you spare a dime?"

The broadest measure of unemployment, which includes discouraged workers and those working part-time for economic reasons, rose to 17.3 percent from 17.2 percent in the prior month.

Still, the payrolls report, which is viewed by most economists as the more reliable gauge of the labor market's health, suggested a broad trend toward improvement was still intact.

Professional and business services added 50,000 positions, while education and health services increased payrolls by 35,000.

Temporary help employment rose 47,000, continuing an upward trend that shows a reluctance among employers to hire full-time workers but that suggests they may need to soon.

Manufacturing payrolls fell 27,000 after dropping 35,000 in November. The construction sector lost 53,000 jobs, while the service-providing sector shed only 4,000 workers.

The average workweek was unchanged at 33.2 hours, while average hourly earnings increased by $18.80 from $18.77 in November.

The state of the job market is among the key factors that will determine the timing of the Fed's first interest rate increase since cutting benchmark overnight borrowing costs to near zero percent in December 2008. The U.S. central bank has vowed to keep rates low for an extended period.

The Labor Department said on Friday that November payrolls were revised to show the economy actually added 4,000 jobs rather than losing 11,000 as initially reported, breaking a streak of consecutive losses that dates back to December 2007.

With revisions to October, however, the economy lost 1,000 more jobs than previously estimated over the two months.

The unemployment rate was unchanged at 10 percent in December, but that reflected a surprisingly large number of people leaving the labor force.

Analysts polled by Reuters had expected nonfarm payrolls to hold steady last month, with the jobless rate edging up to 10.1 percent.

"The economy continues to take three steps forward and two steps back. I wouldn't read too much into it beyond the fact that this will be a slow employment recovery. Directionally, the economy is on a mend," said David Katz, chief investment officer at Matrix Asset Advisors in New York.

U.S. stock opened marginally lower, while the dollar fell against the euro and government bond prices erased losses as the report dashed hopes among some that the economy was now generating jobs.

U.S. short-term interest rate futures pared losses as investors bet that the weak labor market would keep inflation tame and encourage the Federal Reserve to leave interest rates near zero for a long time.

Euro-zone unemployment jumped to an 11-year high in November, and is likely to rise more in the coming year.

"The American economy is clearly not going to burst out of the gate with growth and job creation but it will perform better than its major competitors in Europe and Japan," said Joseph Trevisani, chief market analyst at FX Solutions in Ridgewood, New Jersey.

POLITICAL PRESSURES MOUNTS

High unemployment is one of the toughest domestic challenges facing Obama. The administration's success in getting people back to work will shape prospects for Obama's political future.

Obama's popularity has steadily fallen, knocking his approval ratings down to around 50 percent. This could dim the election prospects for his Democratic Party in the November congressional elections. Obama is scheduled to make a statement on the economy at 2:40 p.m. EST.

"We're going to have to work harder to create more jobs," U.S. Labor Secretary Hilda Solis told Bloomberg TV. "The president will outline more tax credits for small business because they are the engine of growth."

Unemployment remains the Achilles heel of the economic recovery, which started in the third quarter of 2009 following the worst recession in 70 years. Creating jobs is critical to sustaining the economic recovery when government stimulus fades.

For the whole of 2009, the economy shed 4.2 million jobs, according to the Labor Department's survey of employers.

The department's survey of households offered an even gloomier assessment of the job market, showing that 661,000 people left the work force last month.

The report showed there were 929,000 "discouraged workers" who had given up looking for a job, up from 642,000 a year earlier. Chris Rupkey, an economist with Bank of Tokyo-Mitsubishi, called the rise in discouraged workers "a simply astonishing number that borders on the frightening."

"If they were still looking for work and counted as the unemployed, the unemployment rate would have been 10.5 percent," he said. "This clearly isn't your father's recession. It is looking more like your great-grandfathers. Brother, can you spare a dime?"

The broadest measure of unemployment, which includes discouraged workers and those working part-time for economic reasons, rose to 17.3 percent from 17.2 percent in the prior month.

Still, the payrolls report, which is viewed by most economists as the more reliable gauge of the labor market's health, suggested a broad trend toward improvement was still intact.

Professional and business services added 50,000 positions, while education and health services increased payrolls by 35,000.

Temporary help employment rose 47,000, continuing an upward trend that shows a reluctance among employers to hire full-time workers but that suggests they may need to soon.

Manufacturing payrolls fell 27,000 after dropping 35,000 in November. The construction sector lost 53,000 jobs, while the service-providing sector shed only 4,000 workers.

The average workweek was unchanged at 33.2 hours, while average hourly earnings increased by $18.80 from $18.77 in November.

The state of the job market is among the key factors that will determine the timing of the Fed's first interest rate increase since cutting benchmark overnight borrowing costs to near zero percent in December 2008. The U.S. central bank has vowed to keep rates low for an extended period.

1) Unemployment is so bad that even the normal machinations aren't working

2) Some other play is in motion: a minor 'double dip' to allow more ridiculous TARP-like or 'health reform' bills to be passed.

with a few million dollars in your matress are you going to put them to work?

with a few million dollars in your matress are you going to put them to work?

Comment