From ZH, looks like SS will have no cushion at the end of this year! (As in the trust fund will be gone!)

(see I TOLD you we are going to do an Argentina)

http://www.zerohedge.com/article/ss-...ar-results-ugh

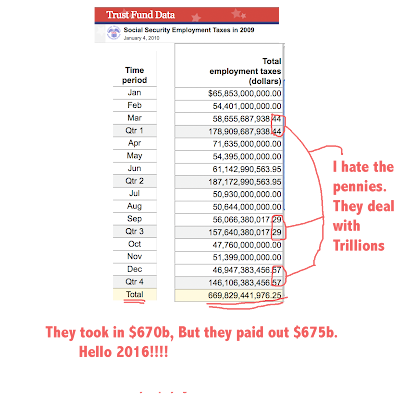

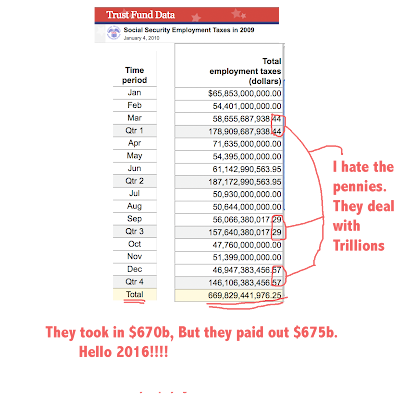

Now look at the reports released today. Total tax receipts were less than the disbursements. This was not supposed to happen until 2016. It happened last year.

There was a $100 billion surplus for the year. But compare that to the $190 Billion surplus in 2007. We have lost $90 Billion in just two years. But this number should be much higher than the 07 surplus. It was assumed that the Fund would have larger and larger surpluses for years to come. The 2008 Trustee Report (signed by then Chairman Hank Paulson) provided a set of Intermediate Assumptions for the Fund's surpluses looking forward. As you can see we missed the 2009 target of a $220b surplus by a cool $120 billion. As of 12/31/09 the funds assets are behind that 08 schedule by $155 billion.

(see I TOLD you we are going to do an Argentina)

http://www.zerohedge.com/article/ss-...ar-results-ugh

Now look at the reports released today. Total tax receipts were less than the disbursements. This was not supposed to happen until 2016. It happened last year.

There was a $100 billion surplus for the year. But compare that to the $190 Billion surplus in 2007. We have lost $90 Billion in just two years. But this number should be much higher than the 07 surplus. It was assumed that the Fund would have larger and larger surpluses for years to come. The 2008 Trustee Report (signed by then Chairman Hank Paulson) provided a set of Intermediate Assumptions for the Fund's surpluses looking forward. As you can see we missed the 2009 target of a $220b surplus by a cool $120 billion. As of 12/31/09 the funds assets are behind that 08 schedule by $155 billion.

,) government expenses up (again, either way you measure it,) and hence government fiat money destined to become worth quite a bit less. Is that what you're referring to?

,) government expenses up (again, either way you measure it,) and hence government fiat money destined to become worth quite a bit less. Is that what you're referring to?

Comment