since reading Flow5's post led me to this -

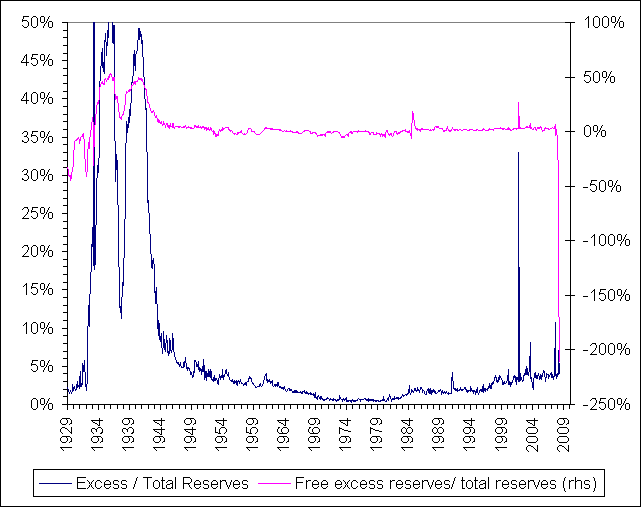

based on the de minimis reserve requirements, are banks fully extended?

That is to say, could they lend much more money TODAY without

1. more reserves

OR

2. further loosening of reserve requirements

or are their loan books maxed out for the existing combinations of reserve requirements and reserves?

Or is there any way of knowing this?

this is I think a crucial question to ask when figuring out whether the system could survive a perturbation without much external aid.

based on the de minimis reserve requirements, are banks fully extended?

That is to say, could they lend much more money TODAY without

1. more reserves

OR

2. further loosening of reserve requirements

or are their loan books maxed out for the existing combinations of reserve requirements and reserves?

Or is there any way of knowing this?

this is I think a crucial question to ask when figuring out whether the system could survive a perturbation without much external aid.

Comment