I got this off of Yves Smith today.

Values Have Dropped Only 25% of the Fall Needed to Reach Trend

2009 November 11

tags: property price index, property values, real estate bubble

by Michael David White

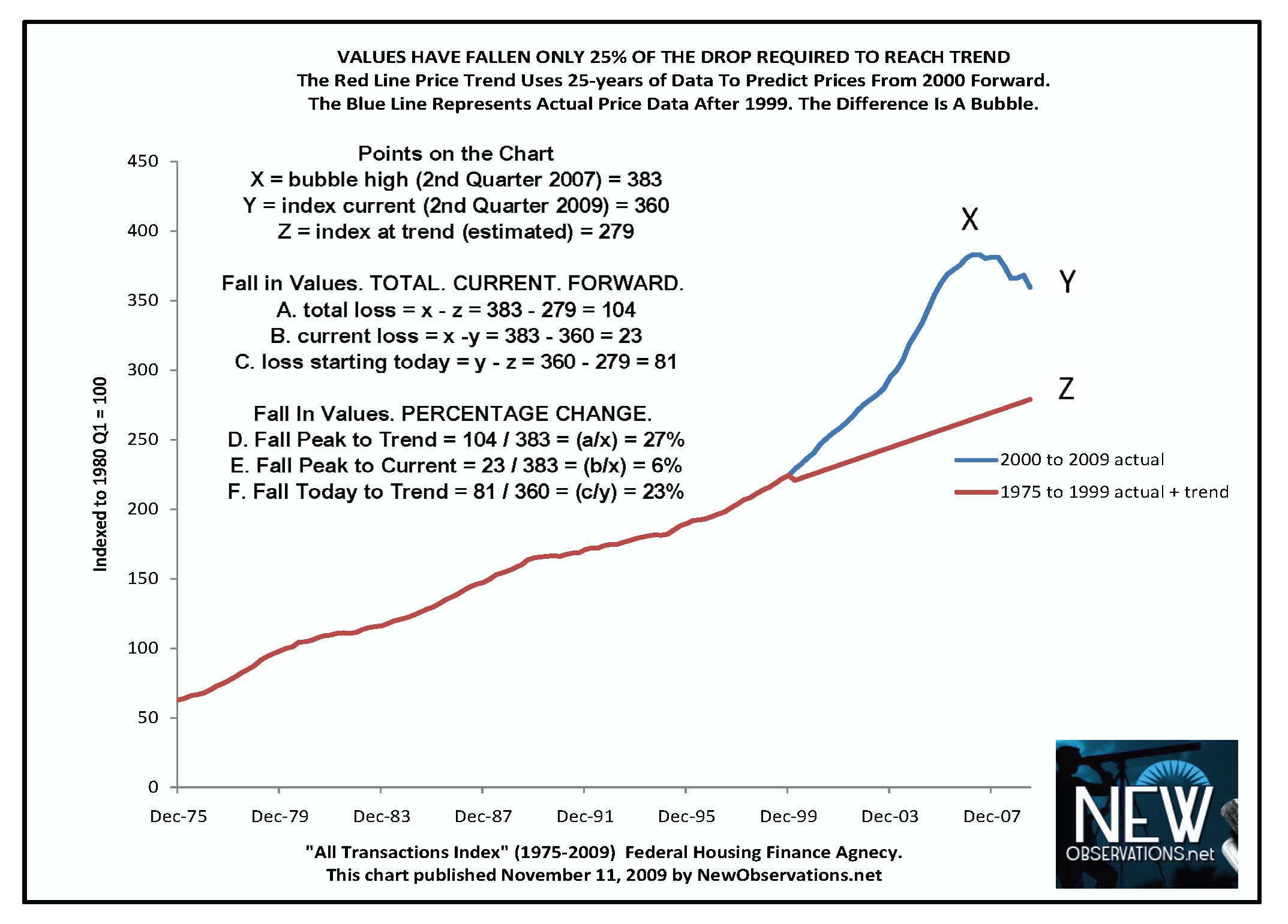

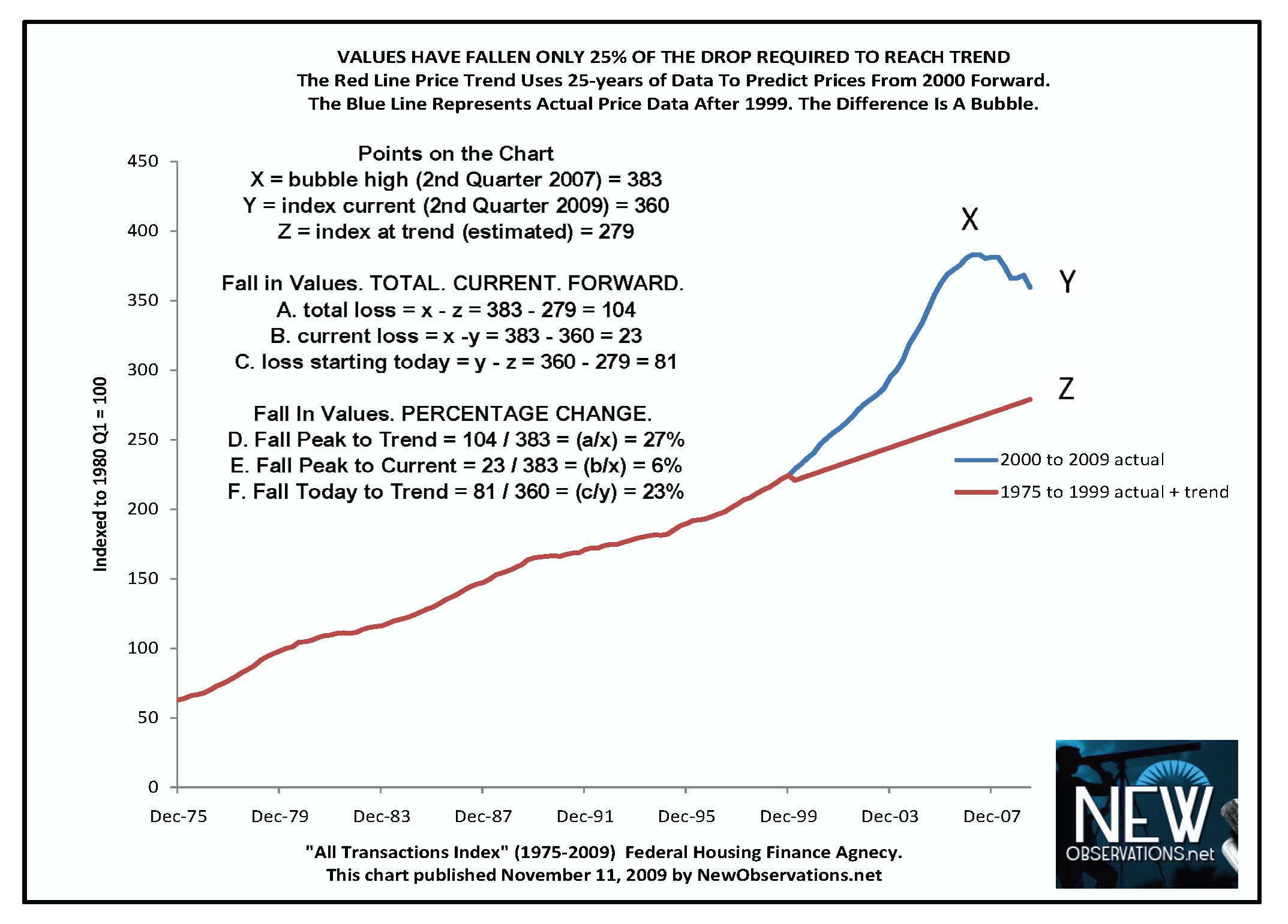

property price index FHFA 1975 to 2009 by NewObservations.netPRICE TRENDS / WAR OF THE WORLDS (Part 4): Property owners nationwide have lost only one dollar for every four dollars they can ultimately expect to lose on their home.

The good news according to the leading data series issued by the United States government is that prices have only fallen 6 percent. If you are a homeowner, you are wealthier than you knew. The bad news is you still have three dollars to lose for every one dollar which has already been lost.

The total projected fall from the Federal Housing Finance Agency (FHFA) “All Transactions Index”, which begins in 1975, shows a peak-to-trend fall of 27%. Since prices are 6% lower by this measure, prices must still fall an additional 23% from today for prices to revert to trend.

The assumption built into these estimates is that prices in the years 1975 to 1999 advanced at a typical rate. A trend line was generated to the present based upon that 25-year period. The chart depicts the divergence of the trend established from 1975 to 1999 and the actual prices recorded from 2000 to 2009.

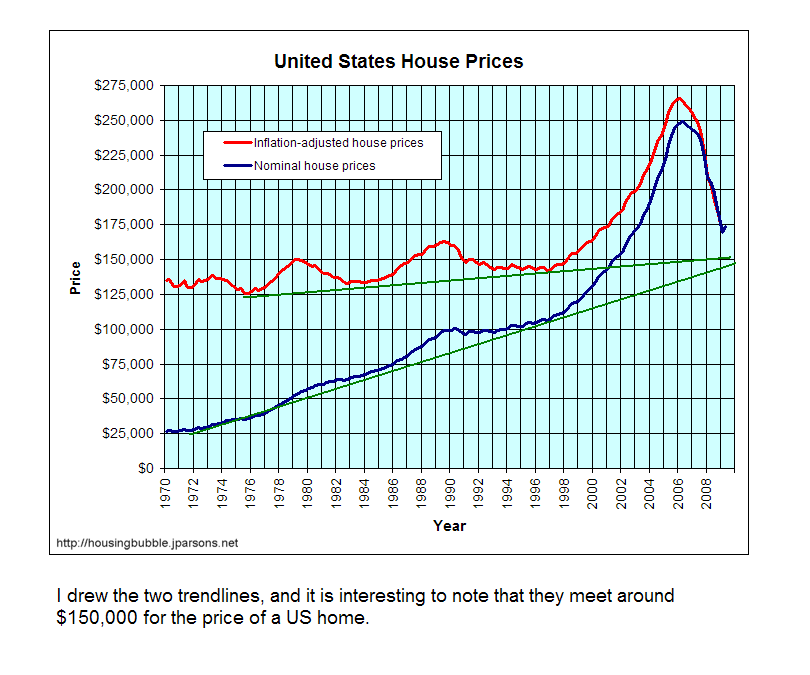

The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% to 60% predicted by Case-Shiller. Based upon the four data sets reviewed in the last few weeks (see summary below), we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. The average of the four indexes projects a total fall of 41% from the bubble high to the trend bottom.

Looking ahead from today, the average of the four indexes predicts that property values will fall 26% from our current price levels.

Please click here to see charts for each of four data sets at “Property Price Index”.

property price index summary of 4 data sets by NewObservations.net

Michael David White is a mortgage broker in Chicago.

2009 November 11

tags: property price index, property values, real estate bubble

by Michael David White

property price index FHFA 1975 to 2009 by NewObservations.netPRICE TRENDS / WAR OF THE WORLDS (Part 4): Property owners nationwide have lost only one dollar for every four dollars they can ultimately expect to lose on their home.

The good news according to the leading data series issued by the United States government is that prices have only fallen 6 percent. If you are a homeowner, you are wealthier than you knew. The bad news is you still have three dollars to lose for every one dollar which has already been lost.

The total projected fall from the Federal Housing Finance Agency (FHFA) “All Transactions Index”, which begins in 1975, shows a peak-to-trend fall of 27%. Since prices are 6% lower by this measure, prices must still fall an additional 23% from today for prices to revert to trend.

The assumption built into these estimates is that prices in the years 1975 to 1999 advanced at a typical rate. A trend line was generated to the present based upon that 25-year period. The chart depicts the divergence of the trend established from 1975 to 1999 and the actual prices recorded from 2000 to 2009.

The FHFA prediction of a total fall of 27% is far less than the total fall of between 49% to 60% predicted by Case-Shiller. Based upon the four data sets reviewed in the last few weeks (see summary below), we can estimate a total fall of between 27% to 60% from the bubble top to the long-term trend. The average of the four indexes projects a total fall of 41% from the bubble high to the trend bottom.

Looking ahead from today, the average of the four indexes predicts that property values will fall 26% from our current price levels.

Please click here to see charts for each of four data sets at “Property Price Index”.

property price index summary of 4 data sets by NewObservations.net

Michael David White is a mortgage broker in Chicago.

Comment