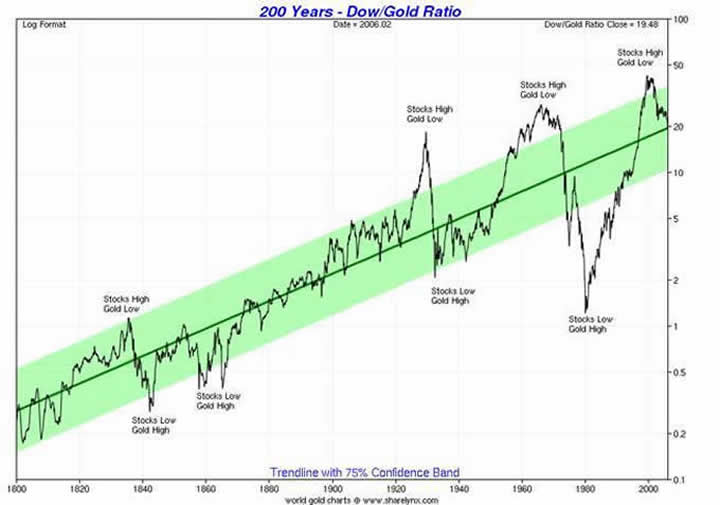

From Jesse (is he still a member?)

When the junior miners start showing these kinds of returns, you might be in a bubble.

We're nowhere near that point yet.

http://jessescrossroadscafe.blogspot.com/2009/11/how-can-you-tell-when-gold-is-in-bubble.html

When the junior miners start showing these kinds of returns, you might be in a bubble.

We're nowhere near that point yet.

http://jessescrossroadscafe.blogspot.com/2009/11/how-can-you-tell-when-gold-is-in-bubble.html

Comment