http://maxkeiser.com/2009/10/03/ote2...anet-tavakoli/

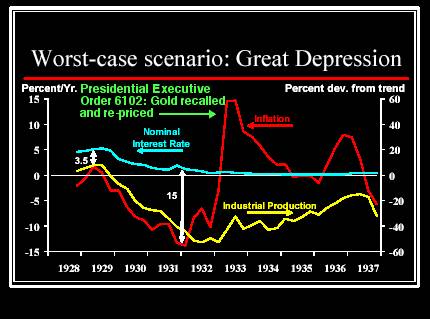

- Money printing NOT working

- Falling prices killing income

- GDP adjusted for deflation is -2.1%

- Consumer debt load the error of inflationists

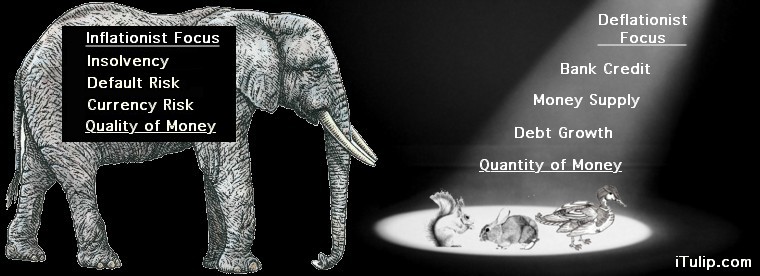

Has Itulip got it wrong, has the slow kill of the delfation process fooled Itulips thinking ....

Hey you gotta listen to the dark side !

I am just reporting whats out there !

- Money printing NOT working

- Falling prices killing income

- GDP adjusted for deflation is -2.1%

- Consumer debt load the error of inflationists

Has Itulip got it wrong, has the slow kill of the delfation process fooled Itulips thinking ....

Hey you gotta listen to the dark side !

I am just reporting whats out there !

Comment