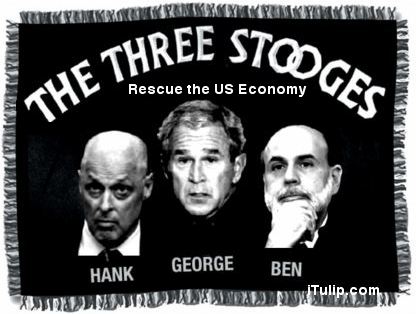

Yes, I know the FHA isn't technically in this article. But really, when the three stooges backstop almost all US mortgages, what's a few different federal agencies that all contain F's and H's between friends.

Enjoy your coffee!

http://triangle.bizjournals.com/tria...ml?t=printable

Enjoy your coffee!

Friday, October 2, 2009, 2:47pm EDT

Fannie Mae, Freddie Mac mortgage delinquencies still rising

Triangle Business Journal - by Jeff Clabaugh Washington Business Journal

A quarterly report from the agency that oversees Fannie Mae and Freddie Mac shows delinquencies on mortgages backed by the two rose 21 percent in the second quarter.

The Federal Housing Finance Agency says another 80,100 loans became more than 60 days delinquent in May, reaching more than 1.3 million, up from 1.1 million in the first quarter. Curtailment of income continues to be the largest reason for delinquency, the FHFA says, growing from 34 percent in January to 40 percent in May.

Foreclosures also continue to rise, up 5 percent from April to May.

Even as delinquencies and foreclosures rise, loan modifications are slowing. FHFA says completed loan modifications fell for the second consecutive month in May. Modification completions are slowed by Fannie Mae and Freddie Macís implementation of a new modification program that requires a three-month trial period for a borrower to demonstrate ability to make the modified payments.

The top five reasons for mortgage delinquency are a reduction in household income, excessive obligations, unemployment, illness and marital difficulties.

Fannie Mae, Freddie Mac mortgage delinquencies still rising

Triangle Business Journal - by Jeff Clabaugh Washington Business Journal

A quarterly report from the agency that oversees Fannie Mae and Freddie Mac shows delinquencies on mortgages backed by the two rose 21 percent in the second quarter.

The Federal Housing Finance Agency says another 80,100 loans became more than 60 days delinquent in May, reaching more than 1.3 million, up from 1.1 million in the first quarter. Curtailment of income continues to be the largest reason for delinquency, the FHFA says, growing from 34 percent in January to 40 percent in May.

Foreclosures also continue to rise, up 5 percent from April to May.

Even as delinquencies and foreclosures rise, loan modifications are slowing. FHFA says completed loan modifications fell for the second consecutive month in May. Modification completions are slowed by Fannie Mae and Freddie Macís implementation of a new modification program that requires a three-month trial period for a borrower to demonstrate ability to make the modified payments.

The top five reasons for mortgage delinquency are a reduction in household income, excessive obligations, unemployment, illness and marital difficulties.

Comment