Announcement

Collapse

No announcement yet.

"Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

Collapse

X

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

In September of 2008 we finally knew we'd hit the end of the credit binge - even the entertainers in Washington realized the gig was up. Forty years after it had first been measured in the US, revolving credit was almost 1000X larger. Unfortunately for us, the economy had not grown quite as fast.Originally posted by Camtender View PostBig jump from June..........

Even with government stimulus, the US economy is functioning at a mid 90s level. We can expect credit to throttle back to that level as well. An overall 50% decrease in revolving credit would not be surprising.

First the demise of the stock market ATM, then the housing ATM, then the credit card ATM. Life in the US is not getting easier.

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

Quoting a one-month decrease of slightly less than 1% as being a 10.4% change "at an annual rate" strikes me as the kind of statistics fluffing one would expect from the Fed when rates are improving. Perhaps they forgot to edit their spreadsheet to just show the one month rate, as would sound nicer in these declining times.Most folks are good; a few aren't.

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

Cow - This is huge - no, this is enormous. Credit card debt has been measured for 40 years. Using the rolling 12 month period we've been talking about, (ending in July), here's a few more metrics:Originally posted by ThePythonicCow View PostQuoting a one-month decrease of slightly less than 1% as being a 10.4% change "at an annual rate" strikes me as the kind of statistics fluffing one would expect from the Fed when rates are improving. Perhaps they forgot to edit their spreadsheet to just show the one month rate, as would sound nicer in these declining times.

- YOY aggregate revolving debt has never fallen before.

- There has never been a YOY increase in revolving debt as great as this decrease

- Revolving debt did not start falling until last October so it's likely to continue at an even greater rate of descent moving forward

- It's fallen almost $70B - How much of this was simply written off?

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

To add a bit more to this analysis, we should look at non-revolving credit and all credit.

- Non-revolving credit and all credit has fallen 4 times during the same period, ('75, '91, '92 and the current period).

- The current period, -$34B so far is the greatest credit contraction in the last 40 years.

- The current aggregate YOY credit contraction is over $100B.

- The last month available, July '09, suffered the largest contraction of all months in 40 years.

- The next 7 worst months for credit contraction occurred in the last 9 months.

At a minimum we can say that the economy is not likely to grow while credit is being destroyed at this rate.

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

That Year-over-year (YOY) consumer debt has fallen for the first time in decades is huge, yes.Originally posted by santafe2 View PostCow - This is huge - no, this is enormous. Credit card debt has been measured for 40 years. Using the rolling 12 month period we've been talking about, (ending in July), here's a few more metrics:

- YOY aggregate revolving debt has never fallen before.

The above "percent change at annual rate" numbers were (if I read correctly) multiplying the one month change by twelve which is just fluffing up numbers (even when, as in this case, they probably would rather not fluff them.)Most folks are good; a few aren't.

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

Got it, you're right. They use the current month X12. But since the current month is the worst since records have been kept on this stuff...the worst is not likely behind us.Originally posted by ThePythonicCow View PostThe above "percent change at annual rate" numbers were (if I read correctly) multiplying the one month change by twelve which is just fluffing up numbers (even when, as in this case, they probably would rather not fluff them.)

Revolving credit has been falling steadily since last September but non-revolving credit was fairly flat until April this year and has since then begun a real contraction. The credit contraction appears to be gaining momentum.

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

They could, I suppose, take a page from calculus and make the time slice infinitely small. But I doubt that would be as informative as the y-o-y change and an annualized rate [provided, of course, that the annualized rate can be compared with the annualized numbers from the same period/month in prior years to highlight seasonality or other such factors].Originally posted by ThePythonicCow View PostThat Year-over-year (YOY) consumer debt has fallen for the first time in decades is huge, yes.

The above "percent change at annual rate" numbers were (if I read correctly) multiplying the one month change by twelve which is just fluffing up numbers (even when, as in this case, they probably would rather not fluff them.)

There is nothing more magical about a month [or a week or a day] compared to a year. Consistency in how the data is recorded and reported is much more important, non?Last edited by GRG55; September 09, 2009, 10:53 AM.

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

I agree that this is big (and bad), but the charts below may give a little more perspective.Originally posted by santafe2 View PostCow - This is huge - no, this is enormous. Credit card debt has been measured for 40 years. Using the rolling 12 month period we've been talking about, (ending in July), here's a few more metrics:

- YOY aggregate revolving debt has never fallen before.

- There has never been a YOY increase in revolving debt as great as this decrease

- Revolving debt did not start falling until last October so it's likely to continue at an even greater rate of descent moving forward

- It's fallen almost $70B - How much of this was simply written off?

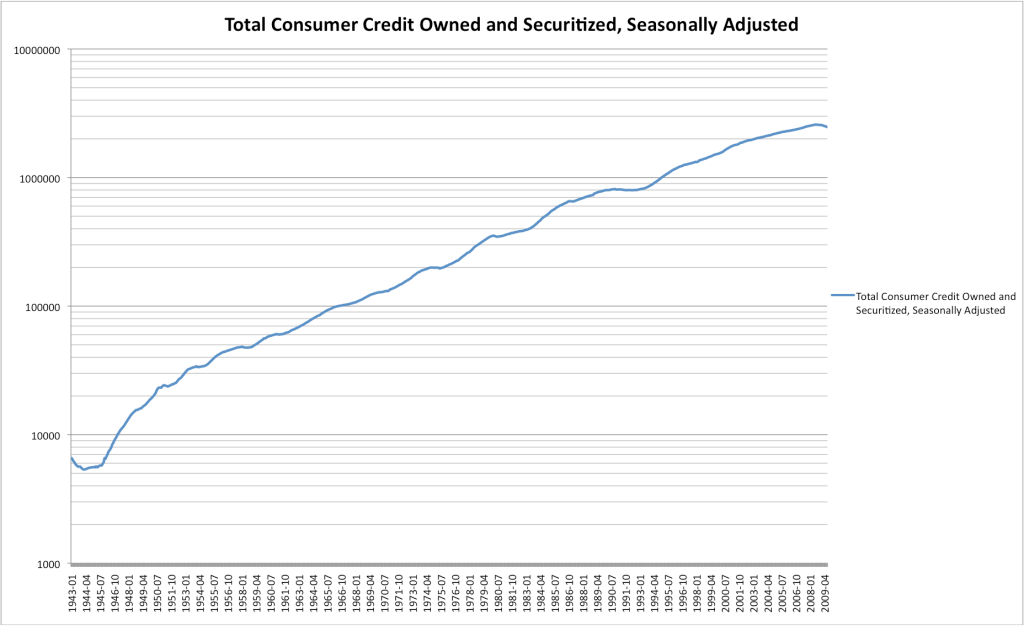

The chart above plots total consumer credit since 1943 in log scale. The current dip appears similar to 1991, but more severe.

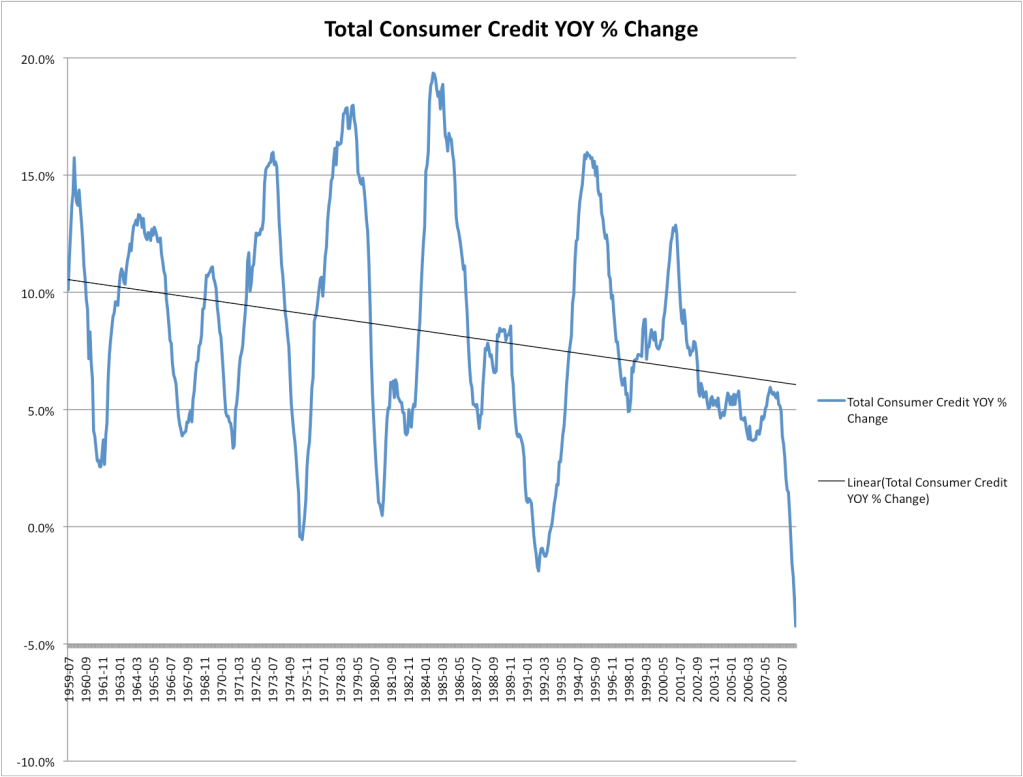

This chart tracks YOY% change for the past 50 years. As you can see, there are fairly regular cycles of expansion and, er, dis-expansion about every 5 years. In addition, the long term trendline has been trending down from 10% in the 1960s to 6% today.

Here are a couple of comparisons and contrasts I see between the 1983-95 period and the 1998-2009 period, with projections for 2010.

'83-'84 - Expanding economy, rising stock market, credit growth rises to peak

'85-'87 - Credit growth slows as stock market doubles. Credit growth bottoms with 10/87 stock market crash

'88-'89 - Credit growth increases but barely crosses above trendline

'90-'92 - S&L crisis, oil price surge, gulf war, recession. Credit growth goes negative for 15 months.

'93-'95 - Credit growth surges with post-recession expansion, strong dollar and rising stocks

'98-'00 - Expanding economy, rising stock market, credit growth rises to peak

'01-'02 - Credit growth slows and bottoms with stock market, but not nearly as low as normal cycles due to housing bubble

'03-'07 - Credit grows slightly during housing bubble, does not cross trendline

2008 - Financial crisis, oil price surge, gulf wars, recession. Credit growth contracts.

2009 - Credit growth goes negative.

2010? - As recession drags on and stocks again crash, credit growth languishes in negative or zero territory for 30 months through mid-2011, supported mainly by government programs.

2011? - Credit growth surges with post-recession expansion, weak dollar, inflation and rising stocks.

-Jimmy

Comment

-

Re: "Consumer credit decreased at an annual rate of 10-1/2 percent in July 2009"

Jimmy - The difference is that this drop in credit is almost 5X larger than 91 AND the last reported month was the largest decline ever. Let's put this into perspective, if we consider only July, that drop in credit was more than 25% larger than the entire credit pullback during the 90-91 recession and this line is still falling at an accelerating rate. Before it's over - 10X worse/20X? July is not the only month to nearly meet or exceed the entire credit downturn in 91, it is the 4th month to do that.Originally posted by jimmygu3 View PostThe current dip appears similar to 1991, but more severe.

I understand that we should mitigate these most recent numbers by comparing them to overall available credit and/or to GDP in 91 but I stand by my original assessment. This is huge.

Comment

Comment