http://jessescrossroadscafe.blogspot...arket-and.html

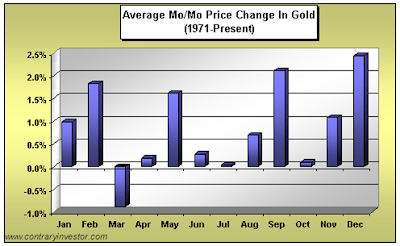

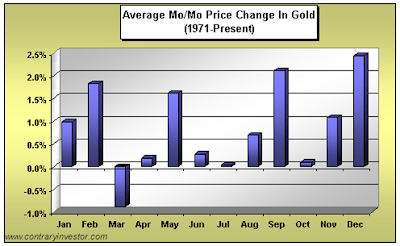

1. Seasonality

2. Continuing Risks in the Financial System

3. Moral Hazard: Tipping Point In Confidence From Over a Decade of Monetary and Regulatory Policy Errors

4. Blowback from Banking Frauds on the Rest of World

5. A Failure in Political Leadership to Deliver Essential Reforms

1. Seasonality

2. Continuing Risks in the Financial System

3. Moral Hazard: Tipping Point In Confidence From Over a Decade of Monetary and Regulatory Policy Errors

4. Blowback from Banking Frauds on the Rest of World

5. A Failure in Political Leadership to Deliver Essential Reforms

Comment