http://finance.yahoo.com/tech-ticker...KF,xlf,jpm,fas

Oh boy!

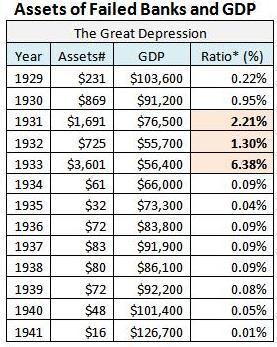

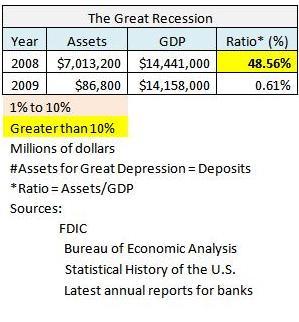

The failure of some of the nation's largest banks in 2008, including Washington Mutual, Wachovia and IndyMac, and scores of smaller banks this year came at a price. The Federal Deposit Insurance Corporation's fund that insures the country's deposits now stands at $10.4 billion, down from $45.2 billion the prior year.

Jim Bianco, president of Bianco Research in Chicago doesn't believe depositors need worry, because the government has the power of the printing press to make good on FDIC insurance. But he is troubled. "As a taxpayer you should be concerned because this could be another potential drag and possibly a significant drag on the U.S. Treasury and bloat the already record federal deficit," he says, echoing a Wall Street Journal editorial on Tuesday, suggesting the FDIC may be the next entity in need of a bailout.

...

Jim Bianco, president of Bianco Research in Chicago doesn't believe depositors need worry, because the government has the power of the printing press to make good on FDIC insurance. But he is troubled. "As a taxpayer you should be concerned because this could be another potential drag and possibly a significant drag on the U.S. Treasury and bloat the already record federal deficit," he says, echoing a Wall Street Journal editorial on Tuesday, suggesting the FDIC may be the next entity in need of a bailout.

...

Comment