Re: Dow tops 9000 as home sales rise

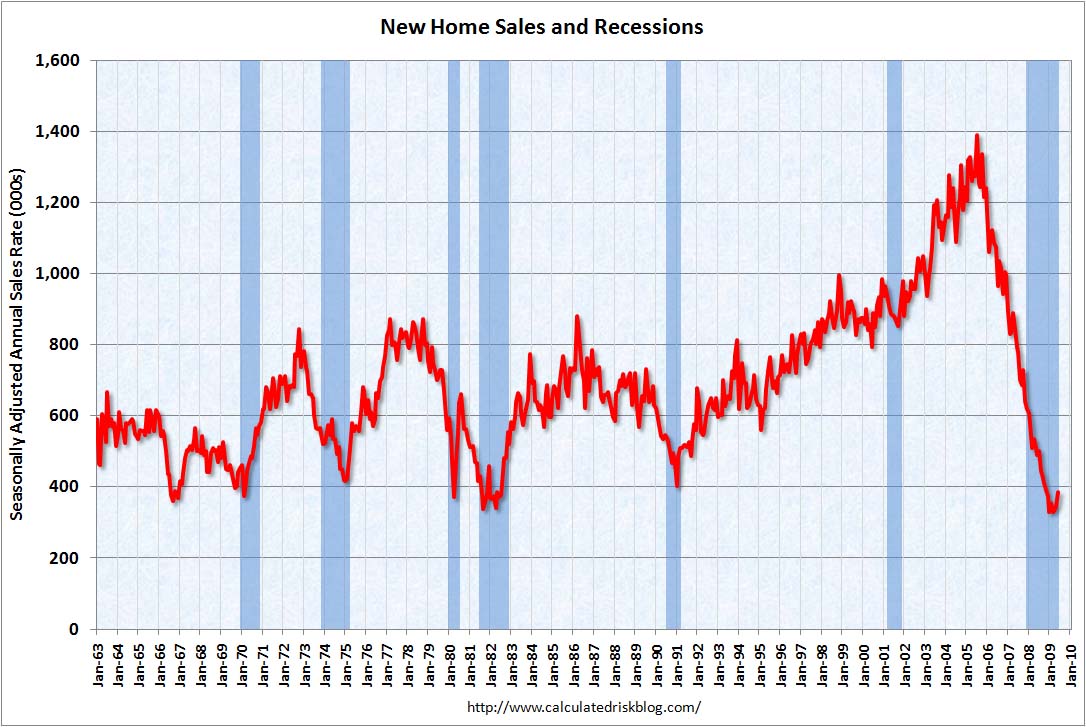

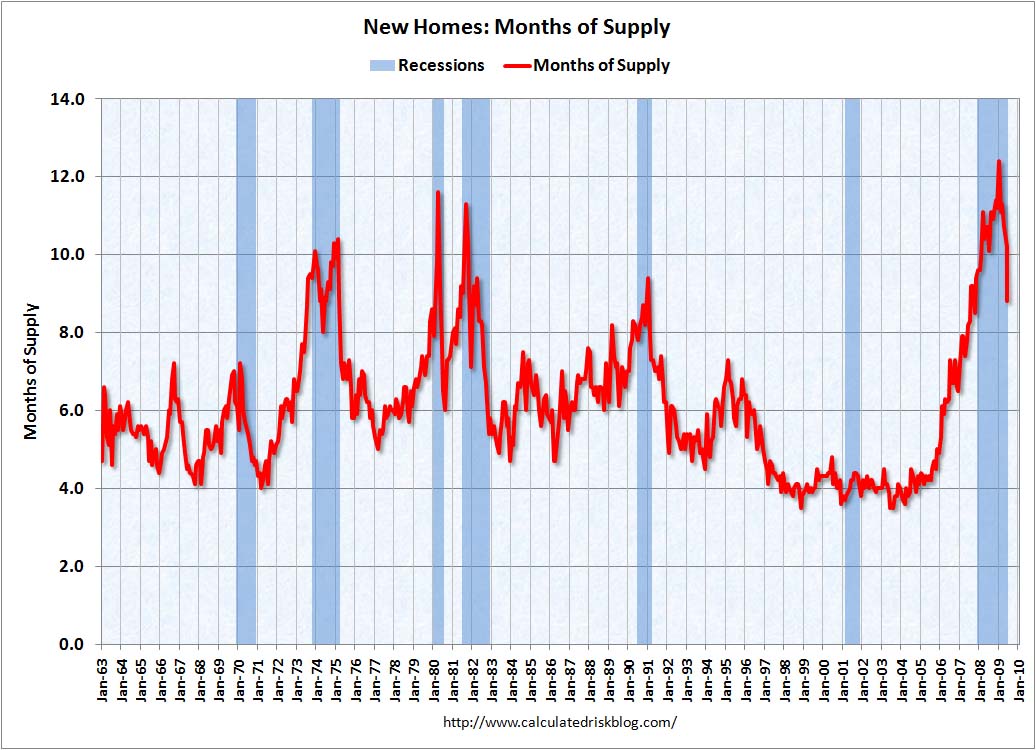

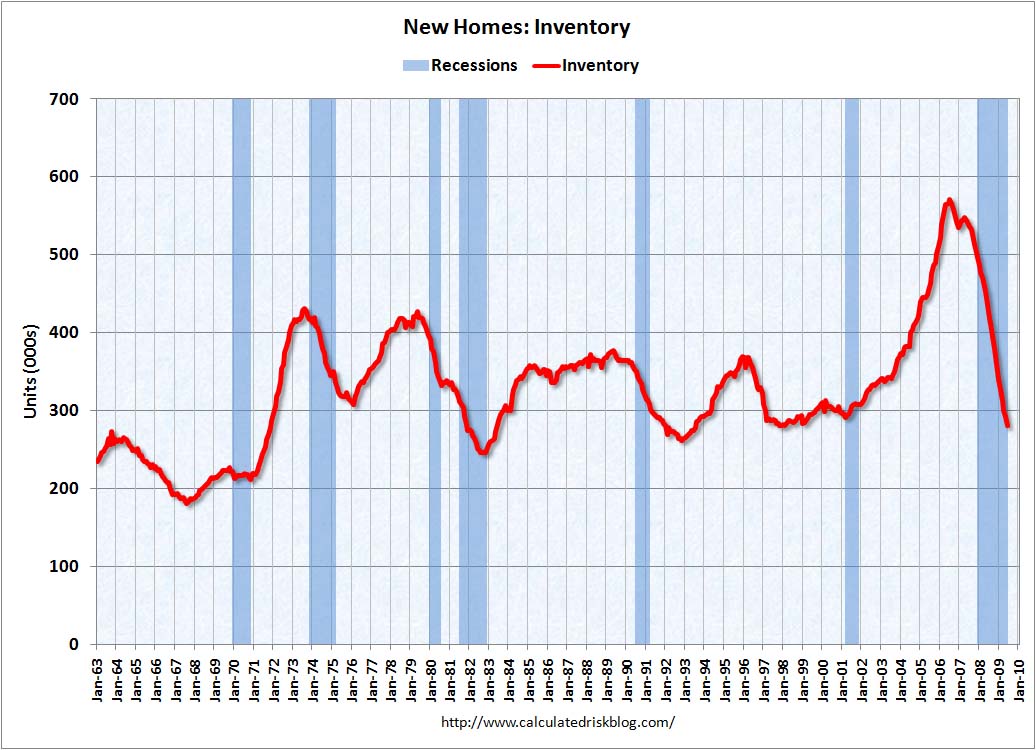

It's all an impressive graph.

However, I think you are coming on to my side, I can sort of feel it in my gut. Today, what was it, 28 % rise in supower? (SPWRA)

It's possible the "green shots" or whatever to call it will begin slow, and maybe it will fizzle out, and you need another stimulus package for the economy to gain traction. However, you have guys like Soros, Faber, Rogers, all saying that the low in march will hold, even nobody believed me here when I was calling it at the time, here. So it is no suprise people think the housing market have much faller to fall.

Itullip is using charts, using the real dow, that are faulty, cause they don't resonate with the Q value, or the Dow/ Gold ratio. That gives a false impression to how much the dow should fall. That is a chart that give a false impression, on the front page of the site.

Since 2005 (in the seventies the similar time is 1972), you have had an inflationary housing bust, culuminating in a crash not that far from 1974, and now there are set to be more inflation, more like the mid to late seventies. Or WW2 era to 1950. I am not really sure how it will turn out, but I think a back-carpet of inflation, will make this a different experience than in the 1990-s.

A option I have been thinking of lately is the WW2-1950 era, is that you can have money printing that will bring the long term interest rates from around 3,5 to around 6 % for the 10 year, etc, and then the stock market will expand to let's say 10-14000 once again. Then, you get a hike in interest rates, that will ensure a boom similar to the 1950-1965 era.

One thing I have kept notice of.

When the nasdaq bubble faded in 2000, housing really started a run that lasted 5 years. In 2005, what basically happened was that China started to adjust their exchange rate. Fertilizer stocks, alternative energy,railroad stocks, gold, all suddenly got very hot.

I think those things, that heated up from 2005, is the current bubble. As western governments, print to compensate for weak private demand, you have stagnant food demand, and demand for commodities from the west. While, these printing, of course leads to a flow of investments into emerging economies, such as BRIC, as people try to protect from this inflation/printing. That then lowers interest rates in these emerging economies, more dollars all around these countries, that then have a further boom in consumer credit, fueling a further demand for food, etc, causing a squeeze..That's why fertilizers will boom, even demand in the west will be stagnant (or sticky). I think the fed will deal with inflation when it becomes a very obvious problem. However, I don't think they will attempt to kill it before the dow / gold ratio is between 2 and 1.

It's all an impressive graph.

However, I think you are coming on to my side, I can sort of feel it in my gut. Today, what was it, 28 % rise in supower? (SPWRA)

It's possible the "green shots" or whatever to call it will begin slow, and maybe it will fizzle out, and you need another stimulus package for the economy to gain traction. However, you have guys like Soros, Faber, Rogers, all saying that the low in march will hold, even nobody believed me here when I was calling it at the time, here. So it is no suprise people think the housing market have much faller to fall.

Itullip is using charts, using the real dow, that are faulty, cause they don't resonate with the Q value, or the Dow/ Gold ratio. That gives a false impression to how much the dow should fall. That is a chart that give a false impression, on the front page of the site.

Since 2005 (in the seventies the similar time is 1972), you have had an inflationary housing bust, culuminating in a crash not that far from 1974, and now there are set to be more inflation, more like the mid to late seventies. Or WW2 era to 1950. I am not really sure how it will turn out, but I think a back-carpet of inflation, will make this a different experience than in the 1990-s.

A option I have been thinking of lately is the WW2-1950 era, is that you can have money printing that will bring the long term interest rates from around 3,5 to around 6 % for the 10 year, etc, and then the stock market will expand to let's say 10-14000 once again. Then, you get a hike in interest rates, that will ensure a boom similar to the 1950-1965 era.

One thing I have kept notice of.

When the nasdaq bubble faded in 2000, housing really started a run that lasted 5 years. In 2005, what basically happened was that China started to adjust their exchange rate. Fertilizer stocks, alternative energy,railroad stocks, gold, all suddenly got very hot.

I think those things, that heated up from 2005, is the current bubble. As western governments, print to compensate for weak private demand, you have stagnant food demand, and demand for commodities from the west. While, these printing, of course leads to a flow of investments into emerging economies, such as BRIC, as people try to protect from this inflation/printing. That then lowers interest rates in these emerging economies, more dollars all around these countries, that then have a further boom in consumer credit, fueling a further demand for food, etc, causing a squeeze..That's why fertilizers will boom, even demand in the west will be stagnant (or sticky). I think the fed will deal with inflation when it becomes a very obvious problem. However, I don't think they will attempt to kill it before the dow / gold ratio is between 2 and 1.

Comment