Announcement

Collapse

No announcement yet.

This looks Bad, VERY BAD!!!!

Collapse

X

-

Re: This looks Bad, VERY BAD!!!!

Not looks Mega, but is very bad.Originally posted by MegaThis looks Bad, VERY BAD!!!!

Like I said before, God help us. Through the course of history, this has always ended in a major war, as the victims of Usury seek relief from their debts.Originally posted by hayekvindicated View PostIts the Great Depression Mark II. The scale of this collapse is mind boggling.

Comment

-

Re: This looks Bad, VERY BAD!!!!

Nice find Mega.

Maybe investing in this HyperInflation Hedge Fund (Bloomberg) might not be a bad idea ;-)

Too bad I don't have a few extra million to spare. Their 2008, 234% gains are impressive. They're betting Hyperinflation to begin 2011.

AdeptusWarning: Network Engineer talking economics!

Comment

-

Re: This looks Bad, VERY BAD!!!!

QuestionOriginally posted by Adeptus View PostNice find Mega.

Maybe investing in this HyperInflation Hedge Fund (Bloomberg) might not be a bad idea ;-)

Too bad I don't have a few extra million to spare. Their 2008, 234% gains are impressive. They're betting Hyperinflation to begin 2011.

Adeptus

I know this topic has been discussed here oft, so please excuse my ignorance on these matters, but based on the figures on this report, it seems to my untutored eye, that this type of credit destruction can only lead to massive deflation, how can they turn this into inflation unless Bernanke literally climbs into his helicopter and starts the money drops?

A massive KA (until all inventories depleted) followed by massive POOM when shortages kick in?Last edited by Diarmuid; June 16, 2009, 09:17 AM."that each simple substance has relations which express all the others"

Comment

-

Re: This looks Bad, VERY BAD!!!!

Diarmuid, EJ said that government can always inflate...always.Originally posted by Diarmuid View PostQuestion

I know this topic has been discussed here oft, so please excuse my ignorance on these matters, but based on the figures on this report, it seems to my untutored eye, that this type of credit destruction can only lead to massive deflation, how can they turn this into inflation unless Bernanke literally climbs into his helicopter and starts the money drops?

A massive KA (until all inventories depleted) followed by massive POOM when shortages kick in?

The more dire the situation, the more they will print i.e. add "zeros" to an entry in a computer somewhere. Here let me try: XYX, 000,000,000,000,000,000.00 ... wow that was fast! and easy!

If they wish, they can send all of us stimulus checks for $10K, then $100K, then $1MM etc. (they prefer sending trillions to banks tho - so forget that).

In the end; Inflation guaranteed! Savers and fixed income earners wiped out, but who cares about them right? Lets bail out the overindebted participants (especially the government).

Comment

-

Thanks Largo, I do not doubt they can add zeros to a computer terminal somewhere and add as much money as they like to the base money supply , and I do not doubt they can eventually induce inflation as EJ suggests, I suppose the problem as I see it is the mechanism for getting this money in to the wider economy while such severe credit destruction is taking place and in such circumstances I think it is difficult to tell how long each phase takes. Also how do they perdict and account for the unknowns when pumping money into such a complex system as the economy (while imploding*) e.g one possible - the bullwhip effect, of course I suppose this process is impacting on other processes and they in turn are acting on the bullwhip process and so forth and so forth.Originally posted by LargoWinch View PostDiarmuid, EJ said that government can always inflate...always.

The more dire the situation, the more they will print i.e. add "zeros" to an entry in a computer somewhere. Here let me try: XYX, 000,000,000,000,000,000.00 ... wow that was fast! and easy!

If they wish, they can send all of us stimulus checks for $10K, then $100K, then $1MM etc. (they prefer sending trillions to banks tho - so forget that).

In the end; Inflation guaranteed! Savers and fixed income earners wiped out, but who cares about them right? Lets bail out the overindebted participants (especially the government).

"If they wish, they can send all of us stimulus checks for $10K, then $100K, then $1MM etc. (they prefer sending trillions to banks tho - so forget that)."

I think this suggestion goes against the eleventh commandment - the usury commandment so I dont see this happening - there is no way the usurests are leting their fish off the hook, to do so is relinquish power over them, (especially if a few of them can learn from experience.)

The Bullwhip Effect

An unmanaged supply chain is not inherently stable. Demand variability increases as one moves up the supply chain away from the retail customer, and small changes in consumer demand can result in large variations in orders placed upstream. Eventually, the network can oscillate in very large swings as each organization in the supply chain seeks to solve the problem from its own perspective. This phenomenon is known as the bullwhip effect and has been observed across most industries, resulting in increased cost and poorer service.Last edited by Diarmuid; June 16, 2009, 10:15 AM."that each simple substance has relations which express all the others"

Comment

-

Re: This looks Bad, VERY BAD!!!!

[quote=Diarmuid;104635]...the problem as I see it is the mechanism for getting this money in to the wider economy while such severe credit destruction is taking place and in such circumstances I think it is difficult to tell how long each phase takes. Also how do they perdict and account for the unknowns when pumping money into such a complex system as the economy (while imploding*) ...

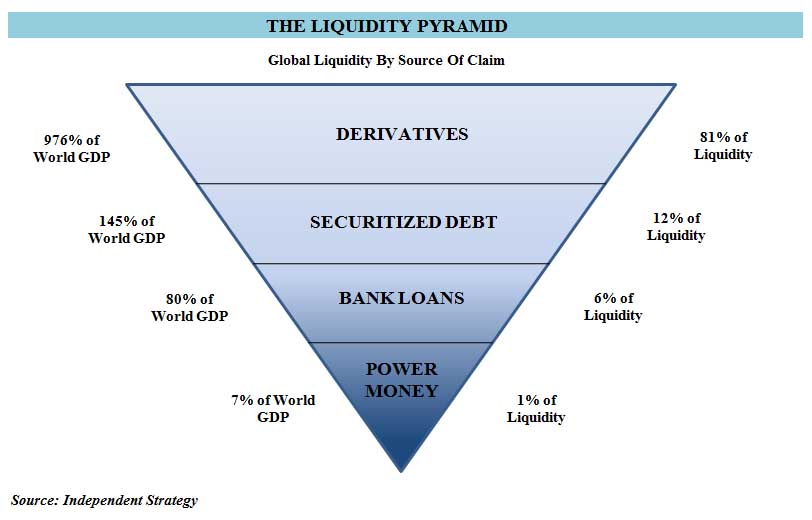

I agree re unpredictability...they control 1% of liquidity, and look at what's coming crashing down...

Comment

-

Re: This looks Bad, VERY BAD!!!!

All the various programs, i.e., TARP, TALF,'Build America' bonds, Iraq,etc.,

are attempts to offset the collapse in private sector debt/credit levels with new government(direct or indirect) debt/credit. If it doesn't work, then maybe they'll try the literal printing press/Zimbabwe-Weimar approach.

Or maybe not. Then it's 1932-or 1843?-again.

Comment

-

Re: This looks Bad, VERY BAD!!!!

Too much "sky is falling" in the article.

Back in Jan. the Fed said they would buy up to 1/2 trillion in MBS', how much did they actually buy?

$14T in lost wealth was mostly housing and security assets. It's bad, but a lot of it is paper losses and it certainly isn't going to translate to a dollar for dollar decline in consumer spending.

Things are bad, very bad, but this is over the top.

Comment

-

Re: This looks Bad, VERY BAD!!!!

IMO, in a true hyperinflation, that fund will collapse as all the people who bet against them will fail to pay . . .Originally posted by Adeptus View PostNice find Mega.

Maybe investing in this HyperInflation Hedge Fund (Bloomberg) might not be a bad idea ;-)

Too bad I don't have a few extra million to spare. Their 2008, 234% gains are impressive. They're betting Hyperinflation to begin 2011.

Adeptus

and all the fund's investors will lose everything.raja

Boycott Big Banks • Vote Out Incumbents

Comment

-

Re: This looks Bad, VERY BAD!!!!

That is my general take, as well. A true hyperinflation -- as opposed to a period of very high inflation -- is not an investment opportunity. On the other hand, I would expect hyperinflation to be localized within a national economy inasmuch as it is a phenomenon of the national currency. That suggests that a fund betting on hyperinflation which invests outside the national economy where hyperinflation is expected might actually do okay. For instance, if you were a Zimbabwean hedge fund manager prior to the hyperinflation there, and simply invested all your money in US Treasury bonds held in Switzerland, your clients probably would have come out ahead. The main danger, as you point out, is betting on hyperinflation inside the national economy that is about to go down. Given the prominence of the dollar and the US economy, it may be harder to find quality investments that are truly outside the path of destruction. Also, given the potential difficulty keeping hold of and using any external investment gains realized during a hyperinflationary scenario, I think the best strategy if one plans to invest for hyperinflation outside the US is to also live outside the US. That being the case, you would not really have made a "profit" from the hyperinflation -- you would merely have side-stepped it and avoided the loss.Originally posted by raja View PostIMO, in a true hyperinflation, that fund will collapse as all the people who bet against them will fail to pay . . .

and all the fund's investors will lose everything.

Comment

-

Re: This looks Bad, VERY BAD!!!!

I think key shortages are already kicking in.Originally posted by Diarmuid View PostQuestion

...it seems to my untutored eye, that this type of credit destruction can only lead to massive deflation, how can they turn this into inflation unless Bernanke literally climbs into his helicopter and starts the money drops?

A massive KA (until all inventories depleted) followed by massive POOM when shortages kick in?

I'm watching the retest of the natural gas breakout closely.

Comment

Comment