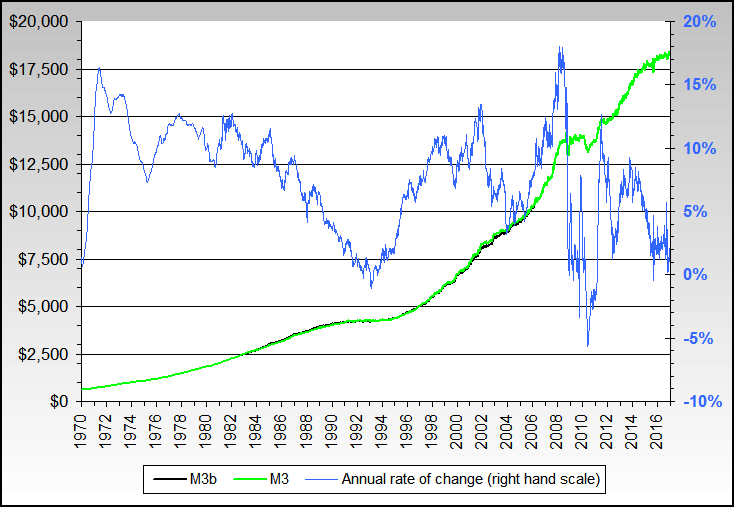

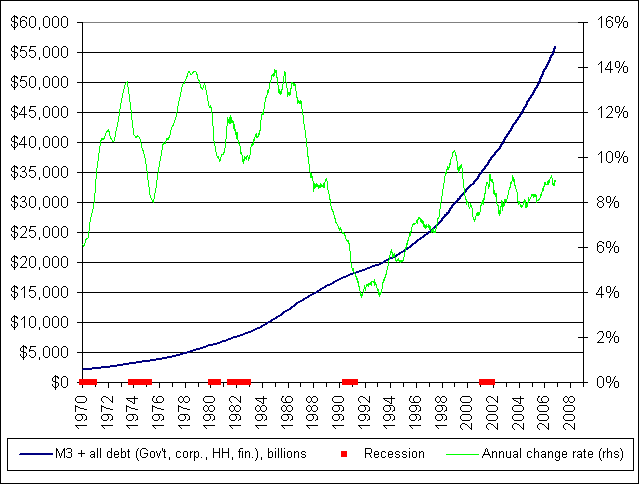

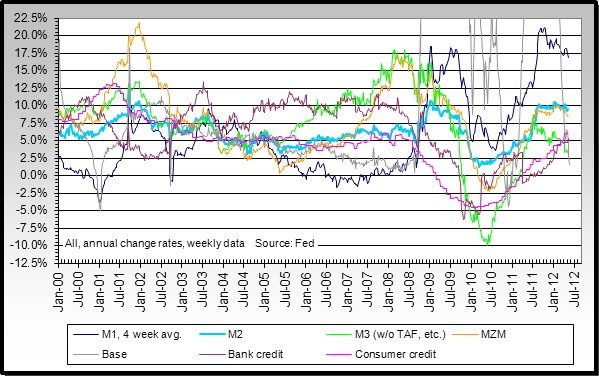

Just to be clear: my definition of "true deflation" is a prolonged dip of growth in the money supply by various measures below zero (money supply contraction in other words.)

Any government except one run by a king-for-life is going to be concerned about the effects of deflation, so concerned that it will stop deflation no matter what cost, pretty much.

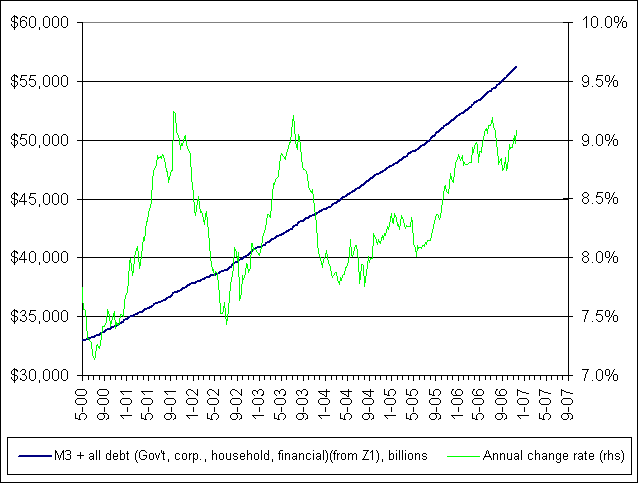

That's because the monied classes build their wealth with debt. And the government itself is usually the biggest debtor. So there is nothing but incentives to inflate and nothing but disincentives to deflate.

And indeed, it seems to me that the last deflation that we encountered was 1929-1933. As soon as the US got off the domestic gold standard, deflation ended.

Even in Japan, there hasn't been true deflation 1990 to the present. Only a little dip in the money supply below zero, not long enough to really qualify as a true deflation.

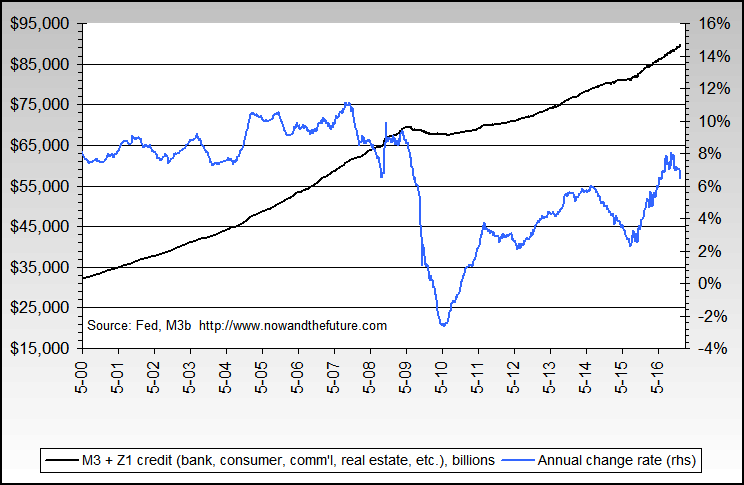

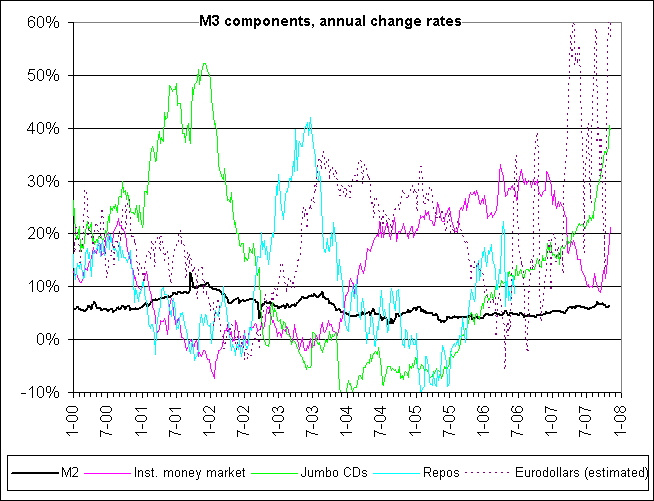

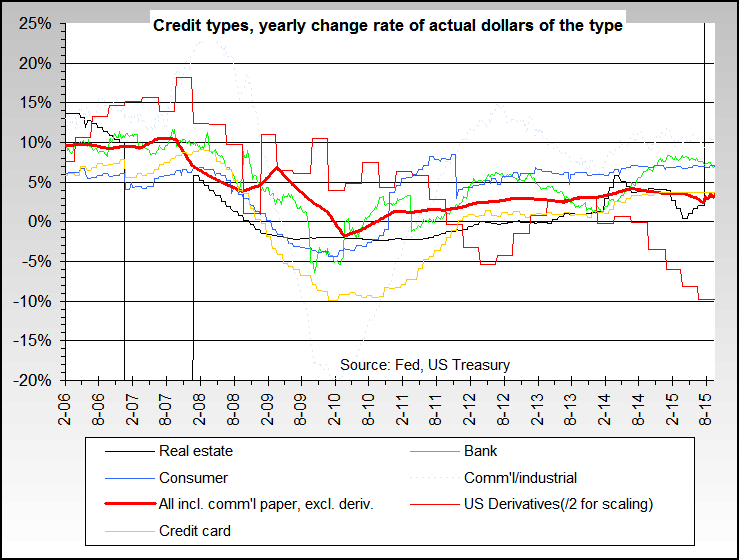

The arguments that the deflationists make is that you can't make people borrow money, and it is through borrowing that the money supply grows.

But it is also true that there are many fiscal and political means to preventing a contraction of the money supply even if people aren't borrowing. Again I would point out Japan's experience.

For these reasons, my belief is that true deflation won't happen until there is complete and utter collapse of the current money system. Therefore, true deflation is not worth seriously considering as an investor.

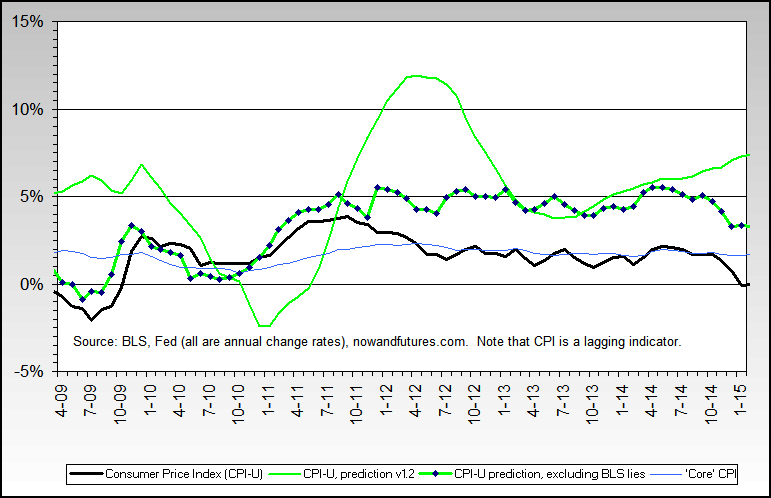

Yes, there may be "disinflation". There probably will be, a la ka-POOM, but there will not be deflation. We can continue banking on inflation when we make our investments.

Any government except one run by a king-for-life is going to be concerned about the effects of deflation, so concerned that it will stop deflation no matter what cost, pretty much.

That's because the monied classes build their wealth with debt. And the government itself is usually the biggest debtor. So there is nothing but incentives to inflate and nothing but disincentives to deflate.

And indeed, it seems to me that the last deflation that we encountered was 1929-1933. As soon as the US got off the domestic gold standard, deflation ended.

Even in Japan, there hasn't been true deflation 1990 to the present. Only a little dip in the money supply below zero, not long enough to really qualify as a true deflation.

The arguments that the deflationists make is that you can't make people borrow money, and it is through borrowing that the money supply grows.

But it is also true that there are many fiscal and political means to preventing a contraction of the money supply even if people aren't borrowing. Again I would point out Japan's experience.

For these reasons, my belief is that true deflation won't happen until there is complete and utter collapse of the current money system. Therefore, true deflation is not worth seriously considering as an investor.

Yes, there may be "disinflation". There probably will be, a la ka-POOM, but there will not be deflation. We can continue banking on inflation when we make our investments.

Comment