For release at 5:00 p.m. EDT

The results of a comprehensive, forward-looking assessment of the financial conditions of the nation's 19 largest bank holding companies (BHCs) by the federal bank supervisory agencies were released on Thursday.

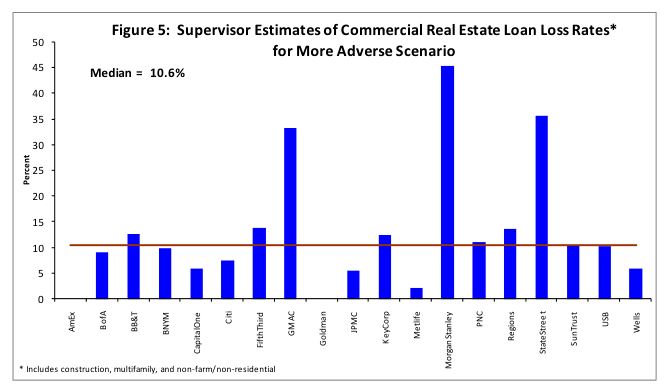

The exercise--conducted by the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation--was conducted so that supervisors could determine the capital buffers sufficient for the 19 BHCs to withstand losses and sustain lending--even if the economic downturn is more severe than is currently anticipated. In a detailed summary of the results of the Supervisory Capital Assessment Program (SCAP), the supervisors identified the potential losses, resources available to absorb losses, and resulting capital buffer needed for the 19 participating BHCs.

The SCAP is a complement to the Treasury's Capital Assistance Program (CAP), which makes capital available to financial institutions as a bridge to private capital in the future. Together, these programs play a critical role in ensuring that the U.S. banking sector will be in a position of strength.

Statement by Chairman Ben S. Bernanke

Overview of Results (333 KB PDF)

Related information

The results of a comprehensive, forward-looking assessment of the financial conditions of the nation's 19 largest bank holding companies (BHCs) by the federal bank supervisory agencies were released on Thursday.

The exercise--conducted by the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation--was conducted so that supervisors could determine the capital buffers sufficient for the 19 BHCs to withstand losses and sustain lending--even if the economic downturn is more severe than is currently anticipated. In a detailed summary of the results of the Supervisory Capital Assessment Program (SCAP), the supervisors identified the potential losses, resources available to absorb losses, and resulting capital buffer needed for the 19 participating BHCs.

The SCAP is a complement to the Treasury's Capital Assistance Program (CAP), which makes capital available to financial institutions as a bridge to private capital in the future. Together, these programs play a critical role in ensuring that the U.S. banking sector will be in a position of strength.

Statement by Chairman Ben S. Bernanke

Overview of Results (333 KB PDF)

Related information

- Joint statement by Federal Reserve, Treasury, FDIC, and OCC on Treasury Capital Assistance Program and Supervisory Capital Assessment Program (May 6, 2009)

- The Supervisory Capital Assessment Program: Design Summary (287 KB PDF)

- Agencies to Begin Forward-Looking Economic Assessments (February 25, 2009)

Comment