Re: In Home-Lending Push, Banks Misjudged Risk

I'll remind everyone of the underlying reason for the success of these predictions: it is in understanding the "economy" as a Finance Economy, and in the analysis of its rise and fall as a process, not an event. It is a mistake to expect that the press will notice a fall in housing prices one quarter and that we'll see a recession at the same time. If you look back at the predictions, such as a call in the top of the housing market in June 2005, I also said a year was to pass before expectations of declining prices start to influence consumption, and perhaps another year after price declines are widely experienced before meaningful changes in actual consumer purchase decisions result, and then some time after that, recession. Barring any unexpected events that hammer consumer confidence and cause a recession to start sooner, that puts us into Q4 2007, more or less, as I explain in the Recession 2007 series.

At the risk of presenting information prematurely, I'm working on an analysis that helps our readers understand the evolution of the process that started with the peak in housing prices 2005 and, simultaneously, of foreign purchases of net issuance of U.S. financial assets. According to our best estimates, the dual process of real estate price and foreign lending declines will continue into 2010 to 2015. With respect to government policy decisions to preserve elements of the savings/creditor class from the costs of the failure of leveraged bets, there appear to be five warning signs or symptoms of an impending inflation via monetization of debt:

1) The central bank lessens the bond market's visibility into operations, such as by discontinuing long running reports of monetary aggregates. The elimination of M3 last year falls into that category. The purpose is to create uncertainty, making it difficult for the bond market to know which way to bet on the direction of the inflation risk premium. The result is that while confusion reins, the bond markets tread water. This presumably buys time for the Fed and Treasury to hit the road to make their last ditch sales pitch to Asia and "friendly" oil producers, to sell more bonds.

2) The discontinuance or reformulation of long standing of inflation indexes and measures. This can take the form of outright lying, as occurred under the Nixon administration. The practice of changing inflation measures and indexes, especially the CPI, has been ongoing since the Nixon administration, so is hard to correlate short term changes with the start of an inflation. Again, this keeps the bond market guessing. The purpose is not to try to trick the bond market into seeing less inflation than exists, but rather to present data that confronts the bond market with a wide range of plausible data for interpretation. The bond market has to guess, for example, whether future inflation is likely to be 2% or 4%, with an even distribution of probabilities between the two extremes.

3) Anecdotal evidence of net savers, especially high net worth, diversifying assets overseas. I see this as a trend over the past several years and accelerating now.

4) Introduction of new ways to avoid monetizing debt, such as: An Insider Spills the Beans on Offshore Banking Centers

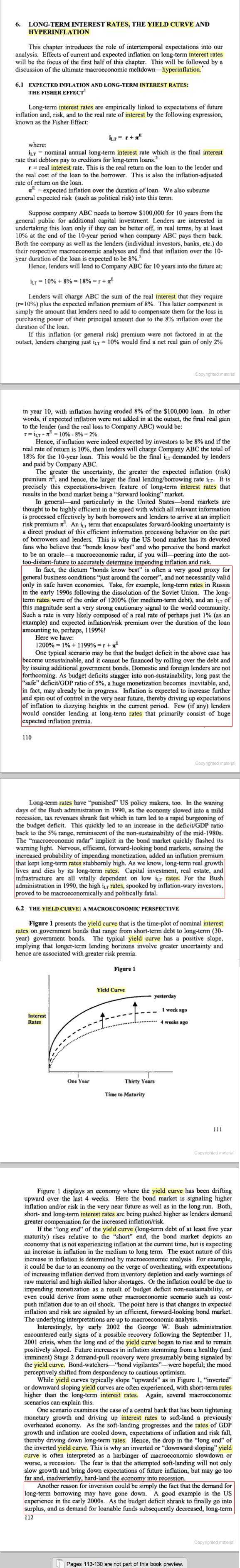

5) Inverted yield curve. This can, of course, have other meanings, but in the presence of these other conditions can mean that the bond markets smell an imminent monetization, as explained here.

Keep in mind is that you are witnessing a slow, long term process, not a sudden event, like the crash in a stock market. When a stock market crashes, everyone's portfolio is marked to market the next quarter. When housing bubbles deflate, millions of home owners only mark to market when they either try to sell or refi. One at a time, gradually. That means no post NASDAQ crash type "Ka" event, but a more gradual deflation. The loss in confidence of foreign lenders is also gradual, although sudden crisis-like events are quite possible, such as Charles de Gualle's demand for his country's gold in 1968. Even then, the general policy response didn't occur until three years later, in 1971.

If you are looking for employment to drop off a cliff tomorrow, because the housing and foreign investment in the U.S. bubbles are deflating, you will be disappointed. The process doesn't work that way. Expect to experience the process the way you experience the condition of the fence deteriorating in your front yard. For years you see it every day when you come home, but do not notice. Only after you go away on a trip for a while and return do you may notice that the paint has peeled off and the fence isn't looking so good. To understand such a gradual process as I am describing, even though it is likely to be punctuated with crises, you need to "go away" from it in your mind and "see" what the economy looked like ten years ago, then five, and imagine what it might look like in five or ten. As I mentioned before, we are developing "peeling paint" indicators that help us detect these gradual otherwise imperceptible changes as the process continues.

I'll remind everyone of the underlying reason for the success of these predictions: it is in understanding the "economy" as a Finance Economy, and in the analysis of its rise and fall as a process, not an event. It is a mistake to expect that the press will notice a fall in housing prices one quarter and that we'll see a recession at the same time. If you look back at the predictions, such as a call in the top of the housing market in June 2005, I also said a year was to pass before expectations of declining prices start to influence consumption, and perhaps another year after price declines are widely experienced before meaningful changes in actual consumer purchase decisions result, and then some time after that, recession. Barring any unexpected events that hammer consumer confidence and cause a recession to start sooner, that puts us into Q4 2007, more or less, as I explain in the Recession 2007 series.

At the risk of presenting information prematurely, I'm working on an analysis that helps our readers understand the evolution of the process that started with the peak in housing prices 2005 and, simultaneously, of foreign purchases of net issuance of U.S. financial assets. According to our best estimates, the dual process of real estate price and foreign lending declines will continue into 2010 to 2015. With respect to government policy decisions to preserve elements of the savings/creditor class from the costs of the failure of leveraged bets, there appear to be five warning signs or symptoms of an impending inflation via monetization of debt:

1) The central bank lessens the bond market's visibility into operations, such as by discontinuing long running reports of monetary aggregates. The elimination of M3 last year falls into that category. The purpose is to create uncertainty, making it difficult for the bond market to know which way to bet on the direction of the inflation risk premium. The result is that while confusion reins, the bond markets tread water. This presumably buys time for the Fed and Treasury to hit the road to make their last ditch sales pitch to Asia and "friendly" oil producers, to sell more bonds.

2) The discontinuance or reformulation of long standing of inflation indexes and measures. This can take the form of outright lying, as occurred under the Nixon administration. The practice of changing inflation measures and indexes, especially the CPI, has been ongoing since the Nixon administration, so is hard to correlate short term changes with the start of an inflation. Again, this keeps the bond market guessing. The purpose is not to try to trick the bond market into seeing less inflation than exists, but rather to present data that confronts the bond market with a wide range of plausible data for interpretation. The bond market has to guess, for example, whether future inflation is likely to be 2% or 4%, with an even distribution of probabilities between the two extremes.

3) Anecdotal evidence of net savers, especially high net worth, diversifying assets overseas. I see this as a trend over the past several years and accelerating now.

4) Introduction of new ways to avoid monetizing debt, such as: An Insider Spills the Beans on Offshore Banking Centers

5) Inverted yield curve. This can, of course, have other meanings, but in the presence of these other conditions can mean that the bond markets smell an imminent monetization, as explained here.

Keep in mind is that you are witnessing a slow, long term process, not a sudden event, like the crash in a stock market. When a stock market crashes, everyone's portfolio is marked to market the next quarter. When housing bubbles deflate, millions of home owners only mark to market when they either try to sell or refi. One at a time, gradually. That means no post NASDAQ crash type "Ka" event, but a more gradual deflation. The loss in confidence of foreign lenders is also gradual, although sudden crisis-like events are quite possible, such as Charles de Gualle's demand for his country's gold in 1968. Even then, the general policy response didn't occur until three years later, in 1971.

If you are looking for employment to drop off a cliff tomorrow, because the housing and foreign investment in the U.S. bubbles are deflating, you will be disappointed. The process doesn't work that way. Expect to experience the process the way you experience the condition of the fence deteriorating in your front yard. For years you see it every day when you come home, but do not notice. Only after you go away on a trip for a while and return do you may notice that the paint has peeled off and the fence isn't looking so good. To understand such a gradual process as I am describing, even though it is likely to be punctuated with crises, you need to "go away" from it in your mind and "see" what the economy looked like ten years ago, then five, and imagine what it might look like in five or ten. As I mentioned before, we are developing "peeling paint" indicators that help us detect these gradual otherwise imperceptible changes as the process continues.

Comment