Today's Daily News has that "told you so" quality that begs the question, "Yeh, so what have you done for me lately?" Always vigilant community member jk submitted this report today, noting a fact that is now, nearly a year after the prediction, conforming to the model.

Far-flung exurbs hard hit by housing downturn

Feb 6, 2007 (Patrick Rucker - Reuters)

While the housing downturn has depressed once-thriving real estate markets around the nation, far-flung suburbs of major cities have suffered the most abrupt market correction.

Home construction in these distant exurbs has slowed and prices and sales have fallen more than those of close-in suburban neighbors since a five-year housing boom ended in the summer of 2005.

Average home prices in Loudon County, Virginia, 35 miles outside of Washington, D.C., fell roughly 11 percent in 2006, according to the Northern Virginia Association of Realtors. By contrast, Virginia's Arlington County, which hugs the nation's capital, saw a price decline of only about 2 percent.

Wagner and other local real estate agents say the area's soft market is a hangover, in part, from a building spree and a buying binge among investors priced out of other areas.

The same holds true for California, where exurban housing markets have softened more than those close to urban centers.

Home prices in Los Angeles rose a relatively modest 5.8 percent in December from a year earlier, while sales were down 14.5 percent, the California Association of Realtors said.

AntiSpin: Housing bubble, ending in the summer of 2005? Who could have known? Except anyone who read Dancing, Booze, and Overpriced Houses in June 2005. Home price declines cascading from the exurbs on into the cities? An unknowable process to predict, unless of course you read Housing Bubble Correction Update: Geographic Regions Cascade March 2006.

Let's take a quick recap of the cascade theory.

The dynamic that drove prices outward was the need for workers in the cities and later the suburbs to escape high real estate prices, to move to where real estate was relatively cheaper and the cost of living lower, but still within an “affordable” commute. As homebuyers traveled farther from metro areas, they encountered lower real estate prices. At the extreme top of the market in late 2004 and early 2005, some home owners who bought property in the mid 1990s in market bubble areas before a housing bubble reached their region, sold their property at a huge profit, purchased equivalent property in size and quality in a rural area, and retired on the profit with perhaps a low wage retirement job. For example, home owners from Boston and nearby suburban towns, as well as from new York and Connecticut, sold their homes and purchased homes in Amherst and surrounding towns, 90 minutes from Boston and have retired using the profit on the transaction. However, most rural homebuyers who purchased at the top of the rural market in mid 2005 did so to have a chance to buy an affordable home. Of course, as more and more homebuyers searched farther away from metropolitan areas, prices increased in outlying areas as well until property values in rural areas reached historical peaks and experienced bubbles of their own.

Living in rural areas and working either in the suburbs or metropolitan areas increased commute time and expense, but this was affordable with gasoline under $1.50 per gallon as it was before hurricane Katrina. But combined increases in gasoline, heating oil, natural gas and propane prices plus higher interest payment on ARMs combined in mid 2005 to pushed many household budgets past the tipping point for those living in homes purchased in rural areas at or near the top of rural market housing bubbles.

Housing bubbles are driven by the same psychological factors that drive all late stage asset bubbles, the popular assumption that prices only rise. A steady drumbeat of negative press today, as evidence mounts that the boom is over, reinforces the negative price expectations, but nothing gets the fear juices flowing like watching home prices collapse in a neighboring town, or watching one’s neighbor lose his or her home.

This change in psychology will start to cause housing bubbles around suburban then metro areas to decline in a reversal of the process that drove prices from metropolitan markets outward to suburban and rural markets. The trigger, it should be remembered, was rising gasoline and energy prices and their impact on rural homeowners who purchased at the top of the market.

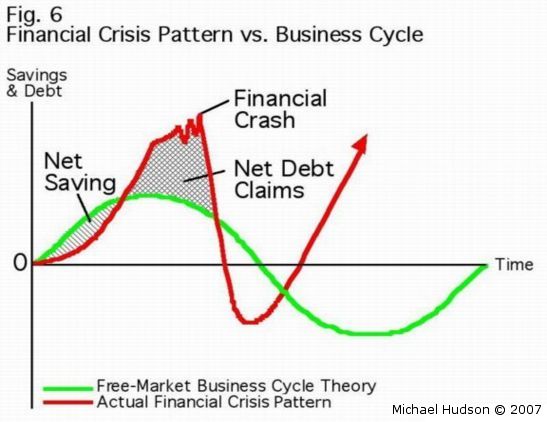

That concludes the "told you so" portion of today's show. Now what? As we see from the brain twister Saving, Asset-Price Inflation, and Debt-Induced Deflation submitted by Dr. Hudson, the credit-based asset inflation economy reaches its absolute limit when the total carrying costs of debt exceed total current income available to pay it. Dr. Hudson shows a debt crisis cycle that looks like the picture to the left. To me, the crisis that Dr. Hudson depicts is as predictable as the end of the housing bubble in mid 2005 and the cascading of prices of homes downward in a reversal of the process that took them up. The only real questions are: When? (no one knows) and, What will result, deflation or inflation? The question of this final outcome has been debated on the Web for at least eight years, and in various books for a decade before that. Later this week, I use with his generous permission research by Dr. Farrokh Langdana, Ph.D., Professor, Finance/Economics, Director, Rutgers Executive MBA Program (USA), in his book of Macroeconomic Policy Demystifying Monetary and Fiscal Policy to support my contention that a period of high inflation is theoretically possible. The chapter in question is "Long Term Interest Rates, the Yield Curve, and Hyperinflation." Then we can get into the range of possible policy options, including a major inflation, assigning an approximate probability to each.

to support my contention that a period of high inflation is theoretically possible. The chapter in question is "Long Term Interest Rates, the Yield Curve, and Hyperinflation." Then we can get into the range of possible policy options, including a major inflation, assigning an approximate probability to each.

Far-flung exurbs hard hit by housing downturn

Feb 6, 2007 (Patrick Rucker - Reuters)

While the housing downturn has depressed once-thriving real estate markets around the nation, far-flung suburbs of major cities have suffered the most abrupt market correction.

Home construction in these distant exurbs has slowed and prices and sales have fallen more than those of close-in suburban neighbors since a five-year housing boom ended in the summer of 2005.

Average home prices in Loudon County, Virginia, 35 miles outside of Washington, D.C., fell roughly 11 percent in 2006, according to the Northern Virginia Association of Realtors. By contrast, Virginia's Arlington County, which hugs the nation's capital, saw a price decline of only about 2 percent.

Wagner and other local real estate agents say the area's soft market is a hangover, in part, from a building spree and a buying binge among investors priced out of other areas.

The same holds true for California, where exurban housing markets have softened more than those close to urban centers.

Home prices in Los Angeles rose a relatively modest 5.8 percent in December from a year earlier, while sales were down 14.5 percent, the California Association of Realtors said.

AntiSpin: Housing bubble, ending in the summer of 2005? Who could have known? Except anyone who read Dancing, Booze, and Overpriced Houses in June 2005. Home price declines cascading from the exurbs on into the cities? An unknowable process to predict, unless of course you read Housing Bubble Correction Update: Geographic Regions Cascade March 2006.

Let's take a quick recap of the cascade theory.

|

Living in rural areas and working either in the suburbs or metropolitan areas increased commute time and expense, but this was affordable with gasoline under $1.50 per gallon as it was before hurricane Katrina. But combined increases in gasoline, heating oil, natural gas and propane prices plus higher interest payment on ARMs combined in mid 2005 to pushed many household budgets past the tipping point for those living in homes purchased in rural areas at or near the top of rural market housing bubbles.

Housing bubbles are driven by the same psychological factors that drive all late stage asset bubbles, the popular assumption that prices only rise. A steady drumbeat of negative press today, as evidence mounts that the boom is over, reinforces the negative price expectations, but nothing gets the fear juices flowing like watching home prices collapse in a neighboring town, or watching one’s neighbor lose his or her home.

This change in psychology will start to cause housing bubbles around suburban then metro areas to decline in a reversal of the process that drove prices from metropolitan markets outward to suburban and rural markets. The trigger, it should be remembered, was rising gasoline and energy prices and their impact on rural homeowners who purchased at the top of the market.

|

Comment